About Ethena Labs, Ethena Protocol, ENA Token

Ethena Labs and Ethena Protocols

Ethena Labs has launched a complicated DeFi protocol on the Ethereum blockchain: Ethena Protocol. This strategic alternative underpins its core tenets of decentralization and censorship resistance, essential for operational integrity.

At Ethena’s coronary heart are two main digital belongings: USDe, an artificial greenback stablecoin pegged 1:1 to the US greenback, and ENA, its native governance token. These tokens kind the important framework for a secure medium of change and decentralized protocol evolution.

Ethena’s mission is to ship a crypto-native, scalable, and censorship-resistant different to present stablecoins and standard banking. This goals to democratize entry to secure, clear cash for DeFi and CeFi contributors, resolving monetary exclusion and vulnerabilities tied to centralized intermediaries.

The protocol’s idea attracts important inspiration from BitMEX founder Arthur Hayes’s “Luna Brothers, Inc.” weblog put up. This emerged throughout Terra’s UST/LUNA collapse in 2022. Hayes’s proposed decentralized stablecoin mannequin, designed for excessive market volatility, served as Ethena’s architectural blueprint. This historic context highlights Ethena’s design philosophy, prioritizing resilience and stability.

Formally unveiled by Man Younger in July 2023, Ethena’s speedy progress since then demonstrates robust market demand for its distinctive providing.

For extra: The Rise of Stablecoins: 2025 Market Replace and Key Statistics

Understanding the ENA Token

The ENA token serves because the native governance token of the Ethena protocol, which is constructed on the Ethereum blockchain. Its main operate is to empower holders to take part within the decentralized governance of the protocol, permitting them to vote on vital choices akin to threat administration frameworks, asset composition, and future protocol upgrades.

The full provide of ENA tokens is capped at 15 billion, with a circulating provide of roughly 6 billion ENA as of latest knowledge. Staking ENA may also provide rewards, aligning incentives with the protocol’s success.

ENA token data. Supply: Coingecko

Ethena’s Distinctive Worth Proposition in DeFi: USDe

Ethena carves a definite area of interest in DeFi with its progressive USDe stablecoin. Its core uniqueness lies in a crypto-native answer for sustaining its peg, utilizing a complicated delta-neutral hedging technique inside the crypto ecosystem. This mitigates centralization dangers and presents a really unbiased digital greenback.

A key differentiator is USDe’s inherent yield-generating functionality. sUSDe holders can earn engaging returns (e.g., round 10% APY), organically derived from ETH staking rewards and derivatives market funding charges. This makes USDe a compelling crypto-native financial savings account.

Ethena’s design additionally emphasizes capital effectivity and scalability. Its 1:1 collateral ratio for minting USDe makes it extra environment friendly than over-collateralized stablecoins, enabling speedy scaling. Moreover, Ethena prioritizes censorship resistance and transparency by way of on-chain verifiability and Proof of Reserves reviews.

Lastly, USDe is very composable, guaranteeing seamless integration throughout numerous DeFi and CeFi platforms, increasing its utility inside the broader crypto ecosystem.

For extra: A Complete Evaluation of Yield and Cost Stablecoins

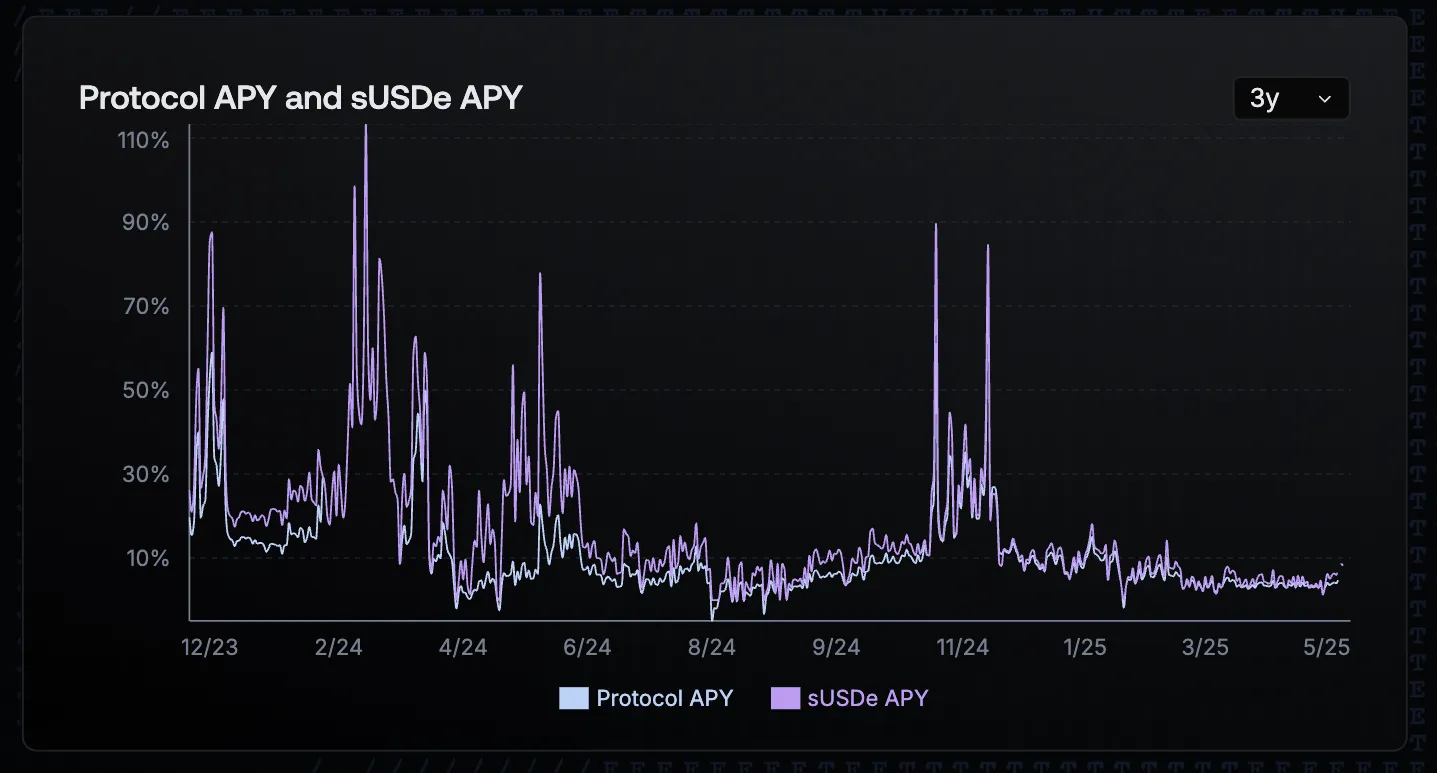

sUSDe APY

Core Mechanics of USDe: The Yield-Bearing Artificial Greenback

Delta-Impartial Technique for Peg Stability

Ethena’s artificial greenback, USDe, uniquely distinguishes itself by sustaining its 1:1 peg to the US greenback by way of an progressive “delta-neutral” technique, basically departing from conventional fiat reserves or easy over-collateralization fashions. This refined method is central to USDe’s design, explicitly aiming to supply stability inside the often-volatile cryptocurrency markets.

The core of this technique entails two main, interconnected elements: collateralization and equal quick positions.

When customers select to mint USDe, they deposit accepted crypto belongings, primarily Ethereum (ETH), staked ETH (stETH), or different liquid staking tokens (LSTs) as collateral.

Concurrently, the Ethena protocol opens corresponding quick positions in derivatives markets, particularly perpetual and deliverable futures contracts, equal to the worth of the deposited collateral.

This pairing of a protracted spot place (the collateral) with a brief derivatives place creates a delta-neutral hedge. The intent is that if the price of the underlying collateral asset (e.g., ETH) drops, the positive aspects from the quick place will offset the loss within the collateral’s worth, thereby sustaining the soundness of USDe’s peg.

Conversely, if the collateral’s price will increase, the loss on the quick place is balanced by the elevated worth of the collateral. This mechanism ensures the online worth of the backing belongings stays secure relative to the US greenback, no matter market fluctuations within the underlying crypto belongings.

Supply: Ethena Labs

A vital component within the operationalization of this technique is the important position of Off-Change Settlement (OES) suppliers and custodians. These entities are liable for holding the deposited belongings in custody, whereas centralized exchanges (CEXs) handle the by-product positions.

This important separation of custody from buying and selling ensures that Ethena retains full management and possession of the collateral belongings, even when an change experiences an idiosyncratic occasion.

As an illustration, Ethena companions with main custodial platforms like Copper, CEFFU, and Cobo, which ceaselessly make use of authorized constructions, akin to bankruptcy-remote trusts, to legally defend consumer funds within the occasion of the custodian’s failure.

Moreover, Ethena implements frequent revenue and loss (PnL) settlements, occurring in cycles between 8 to 24 hours relying on the custodian, to reduce counterparty threat publicity to CEXs.

The protocol additionally permits customers to confirm the existence of each protocol collateral and Ethena’s derivatives positions by way of direct learn entry to custodial pockets APIs and change sub-account APIs, together with third-party attestations of collateral on a month-to-month foundation, actively selling transparency.

Ethena Delta Impartial mannequin. Supply: Ethena

USDe Yield Era Mechanisms

Ethena’s USDe is designed as a yield-generating asset, considerably enhancing its enchantment as a crypto-native financial savings instrument. Its engaging yields, typically exceeding 30% APY, stem from two main sources.

The primary supply is staking rewards from ETH. A portion of USDe’s collateral consists of staked Ethereum (stETH) or different liquid staking tokens. These belongings generate a foundational yield, usually round 3-4% yearly, from taking part in Ethereum’s Proof-of-Stake consensus.

The second, and sometimes extra substantial, supply is funding charges from derivatives markets. Ethena maintains quick positions in perpetual futures contracts (e.g., ETH, BTC) as a part of its delta-neutral technique.

Supply: Ethena Labs

Traditionally, perpetual futures funding charges are “long-biased,” that means Ethena, as a brief place holder, receives funds. This phenomenon has traditionally supplied a mean yield of roughly 6-7% during the last three years for the quick aspect. Ethena captures these funding charges, making a sustainable, non-inflationary yield tied to actual market forces.

The mix of those staking rewards and derivatives funding charges permits Ethena to supply an “excess return” to its customers. This aggregated yield is handed on to holders of sUSDe, often known as the “Internet Bond.”

sUSDe is a reward-bearing token that accrues worth from Ethena’s underlying delta-neutral place, aiming to be a globally accessible, dollar-denominated financial savings car for Web3 buyers. Customers can stake USDe for sUSDe, taking part in income distribution, with a 7-day unstaking interval.

Ethena Stableoin in Comparability with Different Stablecoin Fashions

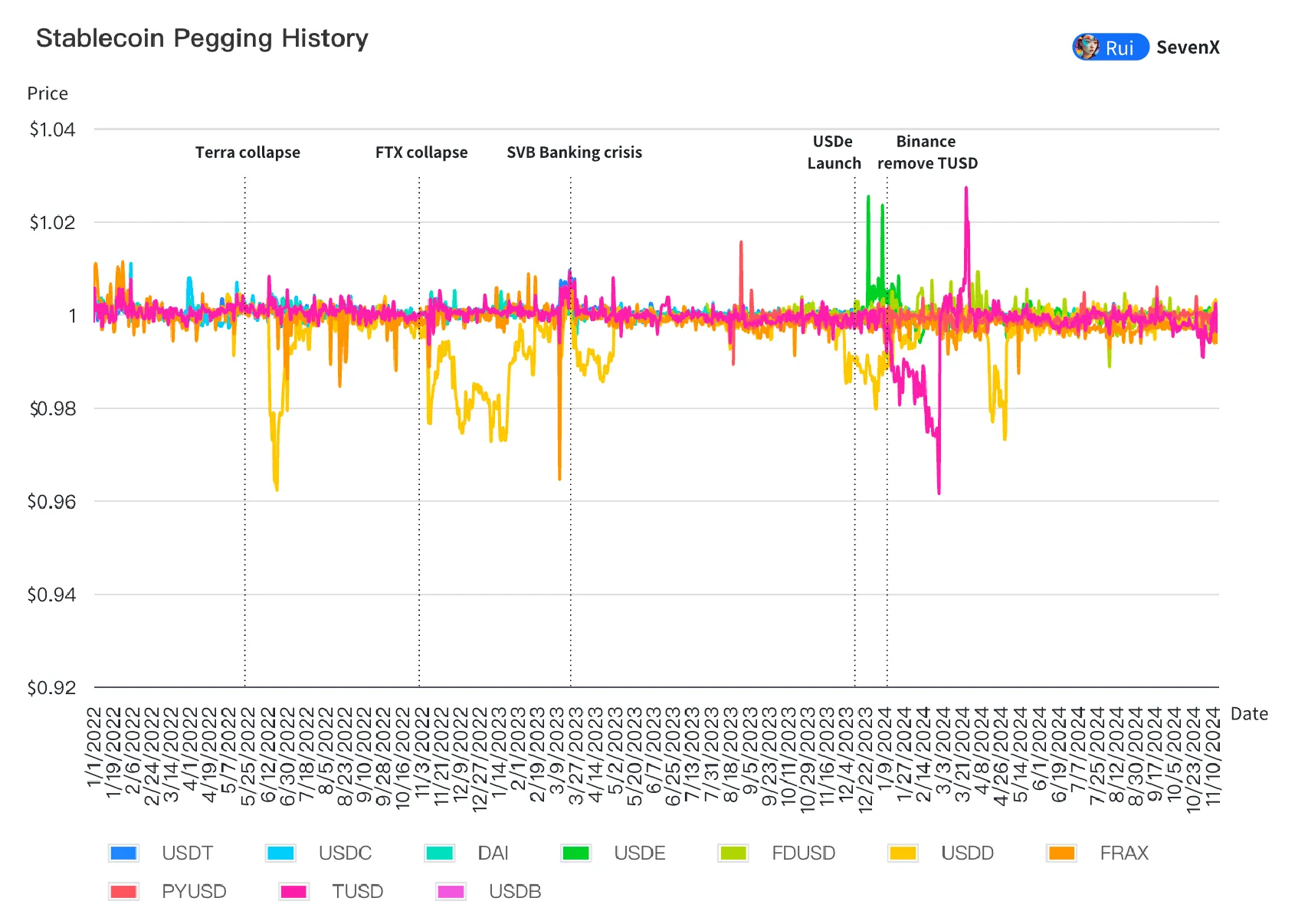

Ethena’s USDe considerably evolves stablecoin design, diverging from conventional fiat-backed, crypto-backed, and algorithmic fashions. Fiat-backed stablecoins like USDT and USDC are commonest, sustaining a 1:1 peg with fiat reserves in centralized banks. They provide stability however carry centralization dangers and depend upon conventional infrastructure.

Crypto-backed stablecoins, akin to DAI, use over-collateralized crypto belongings locked in good contracts, eradicating central financial institution reliance however introducing liquidation dangers attributable to asset volatility.

In distinction, algorithmic stablecoins, infamously exemplified by TerraUSD (UST), tried peg upkeep through token provide changes with no actual backing. UST’s collapse demonstrated the acute fragility of unbacked, sponsored yield fashions, resulting in catastrophic depegging and billions in losses.

Ethena’s USDe presents a definite artificial greenback mannequin. It’s absolutely backed by crypto belongings (ETH, stETH, BTC, liquid stables) and corresponding quick futures positions. This delta-neutral hedging mechanism basically departs from predecessors, aiming for stability with out over-collateralization or reliance on conventional banking techniques.

Stablecoin Pegging Historical past. Supply: ruishang

This distinctive design presents a number of benefits: capital effectivity by way of 1:1 collateralization, superior to DAI’s over-collateralization, permitting better scalability. Its crypto-native nature additionally offers enhanced transparency and censorship resistance, addressing centralization dangers inherent in fiat-backed stablecoins. Crucially, Ethena realized from Terra/UST’s downfall.

In contrast to UST’s unsustainable, sponsored yields, USDe’s yield is organically generated from verifiable sources: ETH staking rewards and constructive funding charges from derivatives markets. This strong, market-driven yield era and absolutely backed, delta-hedged place goals to forestall the same “death spiral” situation, positioning Ethena as a extra resilient try at a decentralized, yield-bearing stablecoin, regardless of its personal complexities.

The Rise of Ethena: Historic Progress and Adoption

Ethena’s trajectory since its formal introduction in July 2023 has been characterised by a unprecedented surge in progress and adoption, shortly establishing it as a big drive within the DeFi ecosystem.

Ethena Key Progress Milestones and Adoption Drivers

Ethena has quickly ascended, reaching a number of notable milestones since its July 2023 launch. USDe skilled explosive market capitalization progress, briefly surpassing DAI between December 2024 and March 2025.

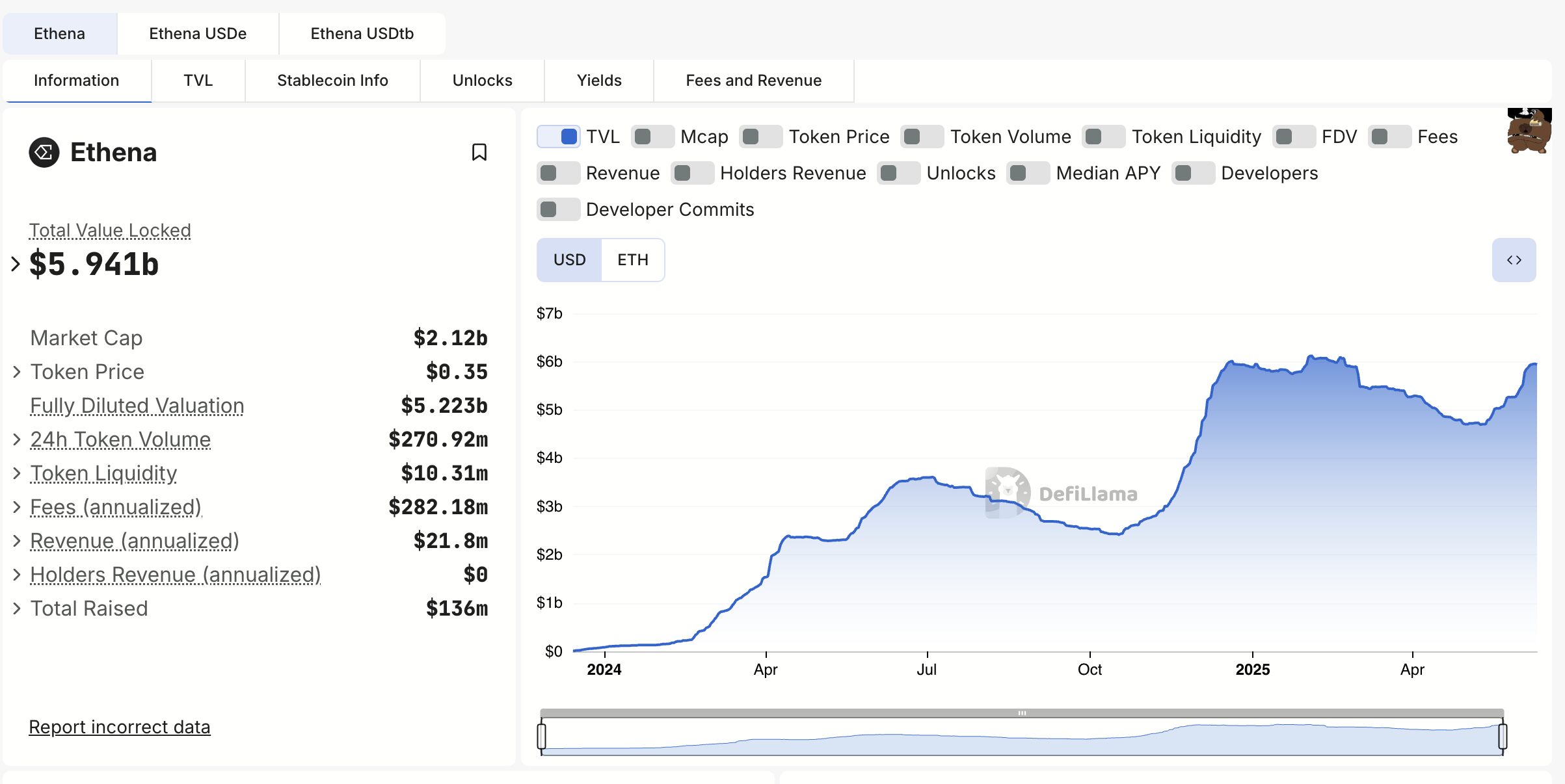

As of early June 2025, USDe’s market cap stands between roughly $5.46 billion and $5.88 billion, solidifying its place because the third-largest stablecoin globally, behind USDT and USDC. This speedy growth underscores robust investor urge for food within the yield-bearing stablecoin sector, which itself soared to over $11 billion by Could 2025, from $1.5 billion in early 2024.

Supply: DefiLlama

Accompanying this, Ethena’s Whole Worth Locked (TVL) elevated considerably, exceeding $6.3 billion earlier than settling at $5.935 billion in early June 2025, rating it amongst prime DeFi protocols and indicating strong consumer confidence.

Ethena additionally shortly surpassed the $100 million income mark in simply 251 days, showcasing its environment friendly yield era from staking rewards and futures spreads, with annualized charges reported at $282.12 million. The protocol’s ecosystem boasts over 682,000 customers throughout 24 chains, highlighting widespread accessibility and rising adoption.

Elements Contributing to Fast Adoption

Ethena’s speedy adoption is pushed by a number of key components.

- Firstly, its engaging yields are a significant draw, with sUSDe providing aggressive annual returns that may typically exceed 30% APY, typically settling round 7%-10% APY.

- Secondly, its crypto-native design and censorship resistance align strongly with DeFi ideas, offering transparency and independence from conventional banking.

- Thirdly, strategic partnerships, notably with Telegram (tsUSDe) providing up to 10% yield, considerably develop its consumer base and mainstream attain.

- Lastly, Ethena’s capital effectivity, permitting 1:1 collateralization for USDe minting, permits efficient scaling and attracts substantial liquidity, solidifying its market match.

Dangers and Challenges to Ethena’s Stability and Sustainability

Ethena’s progressive design faces inherent dangers. Its delta-neutral technique is weak to market volatility. Adverse funding charges can deplete its reserve fund. S&P International rated USDe’s peg stability as “weak.”

Operationally, Ethena depends on CEXs, posing counterparty threat. Custodial dangers exist with OES suppliers. Good contract vulnerabilities are additionally attainable regardless of audits.

Regulatory challenges are important. Germany’s BaFin ordered Ethena’s German entity to stop operations below MiCAR. This compelled a transfer to the British Virgin Islands. Regulatory stress on artificial stablecoins is rising globally.

To succeed, Ethena should improve threat administration. It must diversify yield sources. Strengthening its reserve fund is essential. Navigating these complexities and demonstrating stability will outline its future in DeFi.