Arbitrum is a layer 2 (L2) resolution for Ethereum that goals to enhance the community’s scalability and general effectivity. It operates within the background, utilizing rollups to deal with transactions off-chain earlier than finalizing them on-chain. This results in faster execution instances and decrease prices for Ethereum customers. On the coronary heart of the Arbitrum community lies ARB, its native cryptocurrency, which powers the community’s safety and decision-making processes. If you’re optimistic in regards to the challenge’s potential and plan to purchase Arbitrum as a strategic funding, this information will present you how to achieve this.

Methodology

We assessed a number of high platforms that can assist you choose the most effective crypto change for buying Arbitrum (ARB). Our analysis was primarily based on essential components akin to safety, charges, and person expertise. Listed here are our high picks, every with its personal strengths:

OKX

- Wide range: OKX permits buying and selling ARB with a various vary of main crypto and fiat currencies, providing most flexibility.

- Environment friendly trades: Excessive liquidity ensures simple order execution and minimal slippage.

- Consumer-friendly: Appropriate for each rookies and seasoned merchants because of its intuitive interface.

- Safe: Implements sturdy safety features like chilly storage and 2FA to maintain your ARB secure.

- Responsive help: Usually, buyer help is available every time help is required.

- Low charges: Aggressive charges make shopping for ARB extra inexpensive.

Coinbase

- Nice for rookies: The user-friendly interface simplifies shopping for ARB, particularly for newcomers to crypto.

- Safe surroundings: Sturdy regulatory compliance and safety measures guarantee a secure buying and selling expertise.

- Extensive crypto choice: Gives a broad array of cryptocurrencies, together with ARB, for a various portfolio.

- Insured property: Digital property and USD balances are insured, offering extra safety. (Word: Larger charges in comparison with some rivals may have an effect on your ARB buy value.)

- Instructional sources: Gives loads of supplies that can assist you study ARB and different cryptocurrencies.

- A number of fee strategies: Permits purchases utilizing financial institution transfers, debit playing cards, and extra.

Bybit

- Direct ARB pairs: Commerce ARB straight with main cryptocurrencies like BTC and USDT.

- Excessive effectivity: Excessive liquidity ensures clean and swift order execution for ARB trades.

- Superior options: Gives superior buying and selling choices like leveraged buying and selling and derivatives for skilled customers.

- Glorious safety: Protects your ARB funding with chilly storage and superior encryption.

- Round-the-clock help: Gives 24/7 buyer help to help with any points.

For additional perception into BeInCrypto’s verification methodology, comply with this hyperlink.

The place to purchase Arbitrum (ARB)

Earlier than you be taught how to purchase Arbitrum, it’s vital to first choose a suitable crypto change. Listed here are a number of of the highest choices to select from in 2024.

1. OKX

Greatest for low charges and passive earnings alternative

Availability

E.U. and 100+ international locations

Charges

As much as 0.1% for trades, 0 deposit charges

Supported property

BTC, ETH, ARB, DOGE, and most main cash and tokens

In our evaluation, OKX emerged as a high contender primarily because of its capacity to serve new and skilled customers equally nicely. It has a variety of buying and selling pairs to select from and the liquidity for main property is mostly on the upper aspect. Moreover, the change additionally has an honest monitor report when it comes to safety.

- Excessive liquidity

- Aggressive charges

- A variety of buying and selling pairs to select from

- Margin and leveraged buying and selling for advance customers

- Automated buying and selling bots

Cons

- Restricted fiat help

- Does not provide as many instructional sources compared to say, Coinbase

2. Coinbase

Greatest for newbies

Availability

100+ international locations

Price

From 0.00% to 0.40% for maker charges, and 0.05% to 0.60% for taker charges.

Supported property

Almost 400 buying and selling pairs

Coinbase made it to our listing of high exchanges to purchase ARB due to its user-friendly interface, stringent safety, and a large assortment of instructional sources to assist out rookies. Along with commonplace safety features akin to 2FA and complex encryption, the platform additionally gives FDIC-insured USD steadiness and insured digital property. Being one of many high exchanges on the earth, it additionally gives among the highest liquidity throughout property.

- Intuitive interface designed for these new to cryptocurrency.

- Stringent safety measures and insured USD balances

- Extensive number of cryptocurrencies obtainable, together with ARB.

- Gives useful sources for understanding ARB and the crypto market.

- Helps numerous fee strategies for handy purchases.

Cons

- Charges could also be barely increased in comparison with another platforms.

- Isn’t obtainable in some main markets because of regulatory points

3. Bybit

Availability

160+ international locations

Charges

Beginning at 0.1% for spot buying and selling, 0.02% for perpetual contracts

Supported property

100+ property

Bybit does a fairly stable job of empowering lively and skilled merchants with its superior options. The platform gives a complete suite of buying and selling choices, akin to spot, margin, and futures buying and selling, all with aggressive charges. It additionally facilitates easy accessibility via numerous fiat deposit strategies. Additionally it is one of many best platforms for brand spanking new customers to purchase and commerce crypto, as demonstrated within the “how to buy” part beneath.

- Spot, margin, and futures contracts cater to varied buying and selling methods.

- Gives aggressive buying and selling charges.

- Accepts a number of fiat currencies for handy deposits.

- Gives entry to leveraged tokens and IEO participation.

- Gives 100% proof-of-reserves for verifiable asset safety.

Cons

- Primarily geared in the direction of skilled merchants.

Tips on how to purchase Arbitrum (ARB)

For demonstration, we might be utilizing Bybit, due to its simple and user-friendly interface. The shopping for course of is, by and huge, the identical for many exchanges, albeit with some minor variations right here and there.

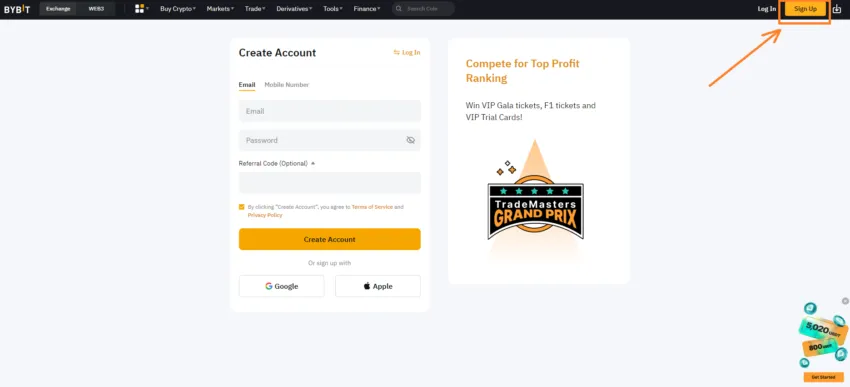

Step 1: Signal-up

In the event you don’t have already got an account on Bybit, it’s time to create one. The method is so simple as it will get. You may sign-up utilizing your e-mail or cell quantity, or you possibly can log in straight utilizing your Google or Apple ID.

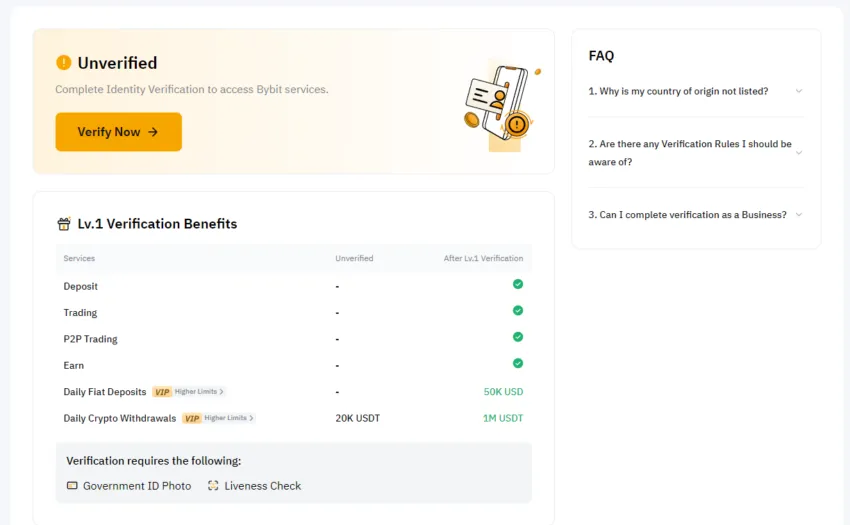

Step 2: Confirm id

Up subsequent, you’ll be prompted to confirm id. You need to bear this necessary KYC course of earlier than with the ability to deposit, purchase, or commerce. Degree-1 verification requires you to submit a government-issued ID (akin to passport, driver’s license, and so forth.) and seem on stay digital camera for liveness verify. Usually, the method doesn’t take greater than quarter-hour, though you could have to attend longer in some instances.

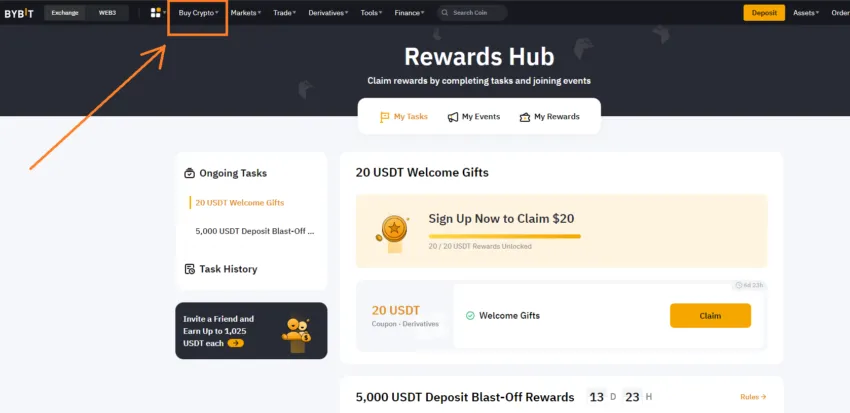

Step 3: Purchase ARB

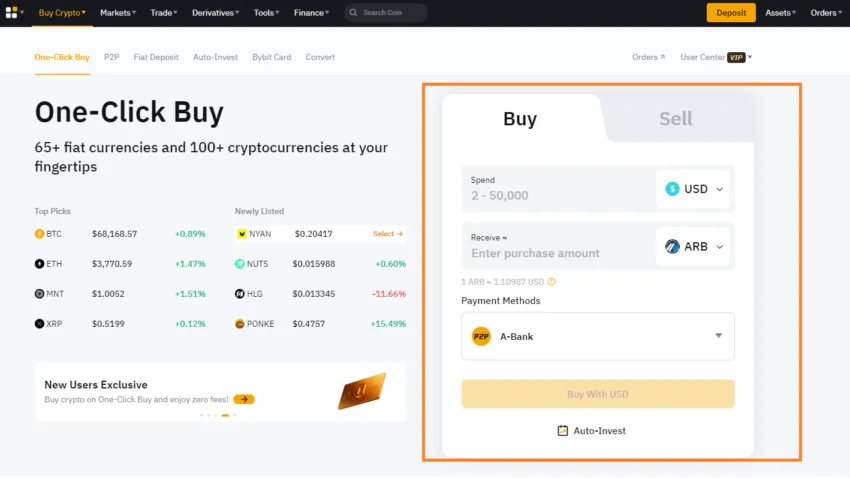

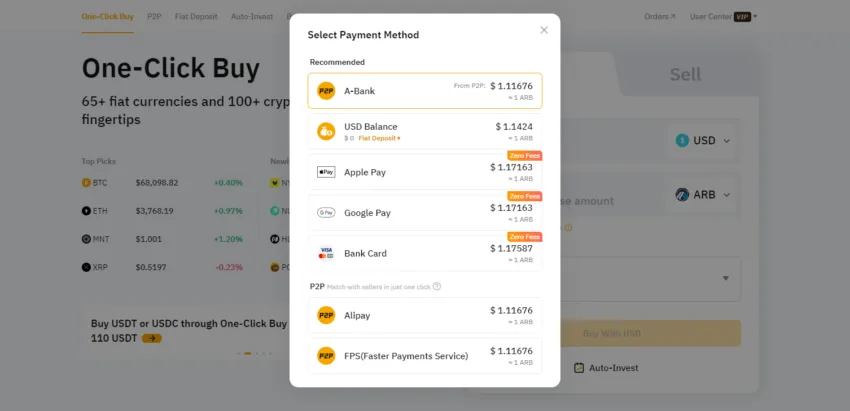

As soon as you’re KYC verified, head over to the “Buy Crypto” menu on the upper-left aspect of the display screen, as proven within the screenshot beneath. Subsequent, select “One-Click Buy” from the drop-down menu.

Choose your most popular fiat forex within the “Spend” discipline and select Arbitrum (ARB) within the “Receive” discipline. Bybit accepts a spread of fiat deposits together with USD, AUD, EUR, INR, RUB, MXN, HKD, IDR, and lots of extra.

Subsequent, select your fee methodology and click on on the “Buy” button. Observe on-screen directions, and that’s it — congratulations in your first ARB buy!

What’s Arbitrum?

Arbitrum (ARB) is a cutting-edge layer-2 (L2) scaling resolution for Ethereum, designed to spice up the community’s efficiency by dealing with a considerable quantity of transactions off-chain and solely recording the ultimate outcomes again on-chain. Let’s break it down utilizing an instance.

Think about Ethereum’s transaction system as a single pipe via which all transactions should cross. When too many transactions occur directly, the pipe will get clogged, slowing the whole lot down.

That is the place the function of Arbitrum kicks in. As an L2 scaling resolution, Arbitrum provides extra pipes to deal with the overflow. It processes a big quantity of transactions in these extra pipes and solely sends the ultimate outcomes again via the primary pipe.

This sensible method reduces congestion and speeds up transactions whereas reducing down on fuel charges. It does this by utilizing superior rollup expertise that bundles many transactions into one neat bundle earlier than processing.

How Arbitrum works below the hood

Arbitrum operates by bundling a number of transactions collectively and processing them off-chain on the Arbitrum chain. These transactions are compiled into rollup blocks, that are then submitted to the Ethereum major chain. This course of drastically reduces the quantity of knowledge that must be saved on-chain. This, in flip, makes transaction processing extra environment friendly.

Optimistic rollups

Optimistic rollups work on the idea that every one transactions are legitimate except confirmed in any other case. After a rollup block is submitted to Ethereum, there’s a problem interval throughout which validators can examine the transactions. If a validator finds an incorrect transaction, they’ll problem a problem. This triggers a fraud-proof mechanism to establish and proper the fraudulent transaction.

Validators are incentivized to behave truthfully as a result of dishonest habits can result in penalties, which matches a great distance in making certain transactions are precisely verified.

Arbitrum Digital Machine (AVM)

Arbitrum deploys its customized execution surroundings referred to as the Arbitrum Digital Machine (AVM). The AVM executes sensible contracts in a way just like the Ethereum Digital Machine (EVM) — the one distinction is that it operates natively on the Arbitrum chain.

This setup permits for clean interplay between sensible contracts on each the Arbitrum and Ethereum layers. It’s value mentioning right here that the system’s safety relies upon squarely on the idea that a minimum of one validator stays trustworthy.

So, what occurs if a validator is discovered to be concerned in questionable actions? Properly, the community has its personal deterrence — validators stake tokens as collateral, which could be confiscated if they’re discovered to be dishonest.

The Nitro improve

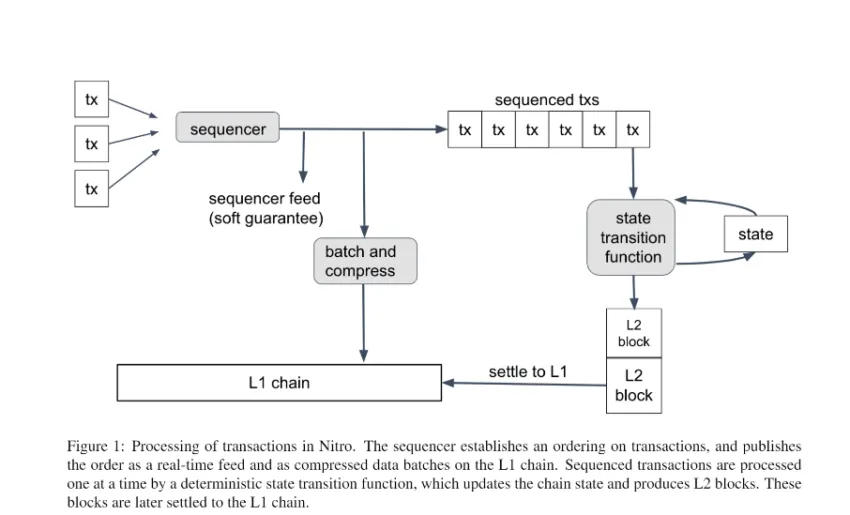

The Nitro improve introduced a big enchancment to Arbitrum’s expertise. It changed the AVM’s customized digital machine with WebAssembly (Wasm), which permits the community to make use of Go code and combine Geth, probably the most broadly used Ethereum implementation.

This structure permits Nitro to make use of Ethereum-like blocks as state checkpoints, which then improves effectivity and reduces the necessity for Wasm compilation solely to dispute instances. Nitro’s design permits native execution of Go code, which is quicker and extra performant, leading to decrease charges for customers.

“Nitro provides higher througput, faster finality, and more efficient dispute resolutions than previous rollups. Nitro achieves these properties through several design principles: separating secuencing of transactions from deterministic execution; combining existing Ethereum emulation software with extensions to enable cross-chain functionalities; compiling separately for execution versus proving, so that execution is fast and proving is structured and machine-independent [……]”

– Nitro whitepaper

Optimistic execution in Nitro

Nitro enhances effectivity via an modern method referred to as (Optimistic)^2 execution. On this system, high-level code (Solidity, Vyper, and so forth.) is initially compiled to EVM bytecode, which is then transpiled to AVM directions by ArbOS.

Nevertheless, in Nitro, the node’s Go code is compiled into Wasm solely when a dispute happens. This enables the widespread case of native execution to be sooner and extra performant, whereas Wasm compilation is reserved for dispute decision, optimizing the system’s general effectivity.

Calldata compression

Arbitrum Nitro additionally helps calldata compression, which considerably reduces the price of posting transaction information on Ethereum. The Nitro structure can incorporate broadly used compression libraries, making certain environment friendly information dealing with and decreasing transaction prices.

This optimization is essential as a result of the majority of an Arbitrum Rollup transaction’s payment covers the price of posting information on Ethereum. By compressing information earlier than posting, Nitro minimizes these prices.

Nearer EVM compatibility

Nitro gives nearer compatibility with the Ethereum Digital Machine (EVM) than its predecessor, the AVM. Gasoline items on L1 and L2 correspond 1:1. This simplifies the deployment and interplay of sensible contracts. Nitro additionally inherits Ethereum’s node functionalities, akin to transaction tracing, out-of-the-box, enhancing compatibility with present instruments and infrastructure.

Simplicity and safety

Nitro’s structure simplifies Arbitrum’s codebase by leveraging Geth’s EVM implementation. This enables ArbOS to give attention to layer-2 particular capabilities, leading to leaner and extra accessible code. This simplicity enhances the system’s safety, thus making it simpler to audit and making certain sturdy implementation that can solely strengthen because the ecosystem grows.

To chop a protracted story brief, Arbitrum’s modern use of Optimistic Rollups and the Nitro improve now supplies a scalable, environment friendly, and safe layer-2 resolution for Ethereum.

What makes Arbitrum distinctive and fashionable

Arbitrum is just not the one layer-2 crypto challenge tackling Ethereum’s limitations, however it’s definitely one of the fashionable ones. After all, a giant chunk of the credit score goes to its Optimistic rollup expertise, however that’s not the one issue driving its recognition. A few of the different components are:

- Full compatibility with Ethereum: The Arbitrum Digital Machine (AVM) is totally suitable with the Ethereum Digital Machine (EVM). This implies builders can write sensible contracts for Ethereum and deploy applications written in fashionable languages on Arbitrum with minimal modifications. This compatibility simplifies the creation of DApps on Arbitrum, which then permits simple integration with the Ethereum mainnet.

- Excessive throughput: Arbitrum is designed to deal with excessive throughput and low latency transactions. This makes it very best for numerous use instances akin to gaming, non-fungible tokens (NFTs), and DeFi makes use of. Customers profit from quick transaction speeds and decrease charges when utilizing off-chain purposes constructed on Arbitrum.

- Decentralized governance: Governance within the Arbitrum community is decentralized and powered by the ARB token. Token holders can take part in decision-making processes, and vote on proposals, payment changes, and different protocol modifications. This ensures that the group has a say within the community’s evolution. This decentralized method makes it a beautiful possibility for individuals who need to purchase Arbitrum.

What’s the ARB token?

ARB is the native crypto on the Arbitrum community. It’s an ERC-20 token, that means it follows a particular set of technical requirements for fungible tokens on the Ethereum blockchain. It establishes a algorithm that builders comply with to create purposes with their very own tokens.

The ARB token is a key participant within the Arbitrum community, although you possibly can’t use it to pay for transaction charges in contrast to another cryptocurrencies. As a substitute, ARB primarily capabilities as a governance token, giving holders a voice in vital selections in regards to the community’s future — as an example, protocol updates and incentive applications.

Moreover, it’s used to reward validators who assist safe the community. This twin function in governance and safety makes ARB a doubtlessly useful asset for individuals who are invested within the Arbitrum ecosystem for the lengthy haul.

ARB tokenomics

ARB has a circulating provide hovering simply below 3 billion out of its complete max provide of 10 billion. With a market cap exceeding $3.2 billion as of early June 2024, ARB is the thirty first largest cryptocurrency.

The ARB token allocation is as follows:

- Buyers maintain a 17.53% stake within the complete ARB provide.

- DAOs throughout the Arbitrum Ecosystem obtain 1.13% of the tokens.

- Particular person wallets obtain a share of 11.62%.

- The DAO Treasury holds the biggest portion, with 42.78%.

- The remaining 26.94% goes to the present and future group, together with advisors.

Try our detailed Arbitrum (ARB) price prediction for a better take a look at the asset’s prospects over the brief, mid, and lengthy haul.

Arbitrum (ARB) vs. different cryptocurrencies

Arbitrum vs. Ethereum

Each Arbitrum and Ethereum serve distinct but complementary roles throughout the blockchain ecosystem. Arbitrum is a layer-2 scaling resolution that enhances Ethereum’s transaction throughput and reduces charges. In distinction, Ethereum is a foundational layer-1 blockchain that helps sensible contracts and decentralized purposes.

Function and performance:

- Arbitrum: Designed to scale Ethereum by processing transactions off-chain and submitting rollup blocks to the Ethereum blockchain.

- Ethereum: A layer-1 platform for constructing and working decentralized purposes.

Scalability:

- Arbitrum: Will increase scalability by dealing with transactions off-chain, thereby considerably boosting throughput.

- Ethereum: Faces scalability challenges because of its on-chain transaction processing, which results in increased charges and slower speeds throughout congestion.

Transaction pace and charges:

- Arbitrum: Gives sooner transaction speeds and decrease charges because of its off-chain processing.

- Ethereum: Usually slower and dearer as a result of all transactions are processed on-chain.

Compatibility:

- Arbitrum: Totally suitable with the Ethereum Digital Machine (EVM), enabling seamless deployment of Ethereum sensible contracts with minimal modifications.

- Ethereum: The native platform for EVM, making certain full compatibility.

Governance:

- Arbitrum: Makes use of decentralized governance via the ARB token. This manner, token holders get a say on protocol modifications.

- Ethereum: Ruled by a mixture of core builders and the broader group, with modifications proposed via Ethereum Enchancment Proposals (EIPs).

Arbitrum vs. Optimism

Arbitrum and Optimism each leverage Optimistic rollups to scale Ethereum, however they differ of their technical implementations and efficiency traits.

Expertise:

- Arbitrum: Makes use of Optimistic rollups with the Arbitrum Digital Machine (AVM), optimized via the Nitro improve which includes WebAssembly (Wasm) and integrates Geth.

- Optimism: Employs Optimistic rollups with the Optimism Digital Machine (OVM).

Efficiency:

- Arbitrum: Recognized for prime throughput and low latency, which makes it appropriate for a variety of purposes akin to gaming, NFTs, and DeFi.

- Optimism: Optimism gives related advantages however could differ in particular efficiency metrics because of completely different implementation particulars.

Charges:

- Arbitrum: Goals to attenuate charges via environment friendly transaction processing and name information compression.

- Optimism: Additionally reduces charges however could have completely different value constructions and optimizations.

Compatibility:

- Arbitrum: Extremely EVM-compatible, which implies it might facilitate simple migration and deployment of Ethereum-based purposes.

- Optimism: Equally EVM-compatible. Subsequently it might enable seamless deployment of DApps initially constructed for Ethereum.

Neighborhood and adoption:

- Arbitrum: Has gained vital traction and help from main initiatives and builders.

- Optimism: Additionally broadly adopted however with completely different strengths in group and challenge help.

Arbitrum vs. Polygon

Arbitrum and Polygon each goal to enhance Ethereum’s scalability, however they undertake completely different approaches and provide distinctive advantages.

Layer construction:

- Arbitrum: Features solely as a layer-2 resolution on high of Ethereum, enhancing scalability and decreasing charges.

- Polygon: Operates as a multi-chain system offering each layer-2 scaling options and standalone blockchains.

Expertise:

- Arbitrum: Makes use of Optimistic rollups to course of transactions off-chain.

- Polygon: Employs numerous applied sciences, together with Plasma Chains, zk-rollups, and Optimistic rollups, providing a flexible scaling framework.

Ecosystem:

- Arbitrum: Focuses on enhancing Ethereum’s capabilities with sturdy EVM compatibility.

- Polygon: Gives a broader ecosystem with a number of scaling options and interoperability between completely different blockchains.

Transaction pace and charges:

- Arbitrum: Delivers quick transactions and low charges via off-chain processing

- Polygon: Recognized for terribly low charges and excessive transaction speeds.

Arbitrum vs. Ethereum vs. Optimism vs. Polygon: A fast comparability

| Characteristic | Arbitrum | Ethereum | Optimism | Polygon |

|---|---|---|---|---|

| Function and performance | Layer-2 scaling resolution for Ethereum | Layer-1 blockchain for sensible contracts and Dapps | Layer-2 scaling resolution for Ethereum | Multi-chain system with each L2 scaling and standalone blockchains |

| Scalability | Excessive scalability via Optimistic rollups | Restricted scalability, faces congestion points | Excessive scalability via Optimistic rollups | Excessive scalability via numerous applied sciences |

| Transaction pace and charges | Quick transactions, low charges | Slower transactions, increased charges throughout congestion | Quick transactions, diminished charges | Extraordinarily low charges, excessive transaction speeds |

| Compatibility | Totally suitable with EVM | Native EVM platform | Totally suitable with EVM | Helps EVM and different blockchains |

| Governance | Decentralized through ARB token | Mixture of core builders and group (EIPs) | Decentralized governance | Decentralized governance through MATIC token |

| Expertise | Optimistic rollups, Nitro improve with Wasm and Geth | On-chain processing, EVM | Optimistic rollups, OVM | Plasma Chains, zk-rollups, Optimistic rollups |

| Ecosystem | Centered on Ethereum enhancement, sturdy EVM compatibility | Major blockchain for DApps and sensible contracts | EVM compatibility, helps Ethereum DApps | Broad ecosystem, interoperability between blockchains |

| Efficiency | Excessive throughput, low latency | Efficiency varies, slower below heavy load | Excessive throughput, low latency | Excessive throughput, versatile efficiency |

Must you purchase Arbitrum in 2024?

Provided that ARB is likely one of the largest cryptocurrencies by market cap and stands as a number one layer-2 resolution for Ethereum, it definitely deserves consideration as an funding possibility. Nevertheless, the crypto market’s infamous volatility implies that ARB is just not proof against price swings. Subsequently, it’s essential to totally examine ARB and consider its future potential earlier than making any funding selections. In the event you resolve to purchase Arbitrum, guarantee you’ve got a transparent understanding of the dangers concerned.

Incessantly requested questions

Disclaimer

According to the Belief Mission tips, the academic content material on this web site is obtainable in good religion and for basic info functions solely. BeInCrypto prioritizes offering high-quality info, taking the time to research and create informative content material for readers. Whereas companions could reward the corporate with commissions for placements in articles, these commissions don’t affect the unbiased, trustworthy, and useful content material creation course of. Any motion taken by the reader primarily based on this info is strictly at their very own threat. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.