XRP futures merchants are positioning for a possible price decline, as proven by key on-chain metrics from CryptoQuant.

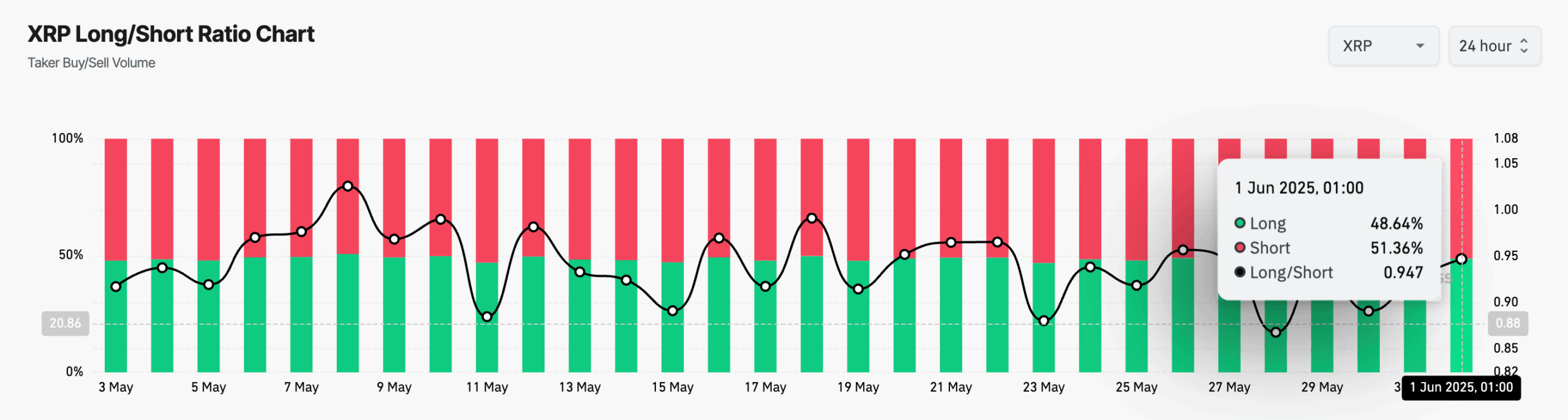

For the previous two weeks, XRP’s taker purchase/promote ratio has remained beneath 1. As of June 1, 2025, it stands at 0.92, that means promote orders proceed to outweigh purchase orders within the token’s futures market.

A taker purchase/promote ratio beneath 1 suggests elevated sell-side strain. This metric compares the quantity of aggressive purchase orders (taker buys) in opposition to aggressive promote orders (taker sells). When the ratio stays underneath 1 for an prolonged interval, it typically alerts that merchants are closing lengthy positions or getting into shorts.

One other bearish indicator is XRP’s lengthy/brief ratio, presently at 0.94. This reveals that extra merchants are holding brief positions, anticipating the price to fall.

The information factors to constant promote strain from derivatives merchants, aligning with current adverse momentum throughout the XRP market.

Since Might 8, 2025, XRP’s lengthy/brief ratio has persistently remained beneath 1, in accordance with Coinglass. The newest studying on June 1 reveals a ratio of 0.947, with 51.36% of positions brief and solely 48.64% lengthy. This implies extra futures merchants are betting on a decline than an increase.

The sustained imbalance alerts that bearish sentiment isn’t restricted to transient volatility spikes. As an alternative, it displays a broader market outlook the place merchants count on XRP to fall additional. The development has continued for almost a month, exhibiting that brief positions proceed to dominate futures exercise.

This extended strain aligns with the weakening price chart and confirms that merchants haven’t shifted towards a bullish stance.

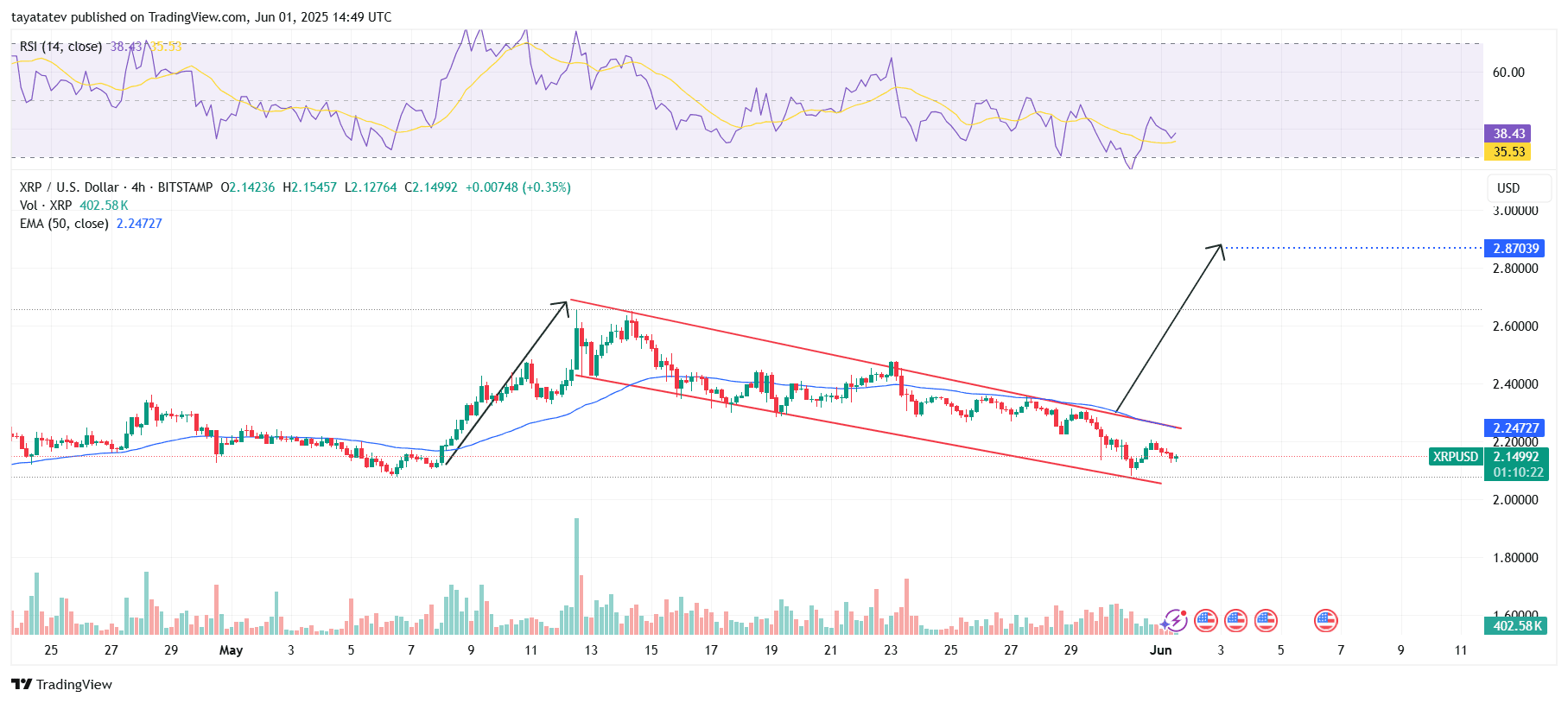

XRP Creates Descending Channel Sample, Eyes 33% Upside if Breakout Confirms

On June 1, 2025, the 4-hour chart for XRP to U.S. Greenback (XRP/USD) on Bitstamp fashioned a descending channel sample.

A descending channel happens when the price strikes between two downward-sloping parallel trendlines, typically signaling managed promoting strain with the potential for a bullish breakout.

XRP presently trades at $2.14992 and sits close to the decrease boundary of the channel. If consumers push the price above the higher pink trendline, this sample would verify. Based mostly on the peak of the earlier upward transfer, XRP might rally by 33% from its present degree to achieve the projected goal of $2.87039.

Proper now, XRP stays beneath the 50-period Exponential Transferring Common (EMA), which stands at $2.24727. This implies short-term bearish momentum. Nevertheless, price motion close to the decrease trendline and a rising Relative Power Index (RSI) from oversold territory point out a potential reversal.

The RSI worth is 38.43, climbing above its sign line at 35.53. This crossover typically hints at rising bullish momentum. Quantity additionally reveals transient surges, suggesting consumers could also be getting into at decrease ranges.

If the breakout confirms and XRP reclaims the EMA, the momentum might flip, with the $2.87039 degree appearing as the subsequent key goal.

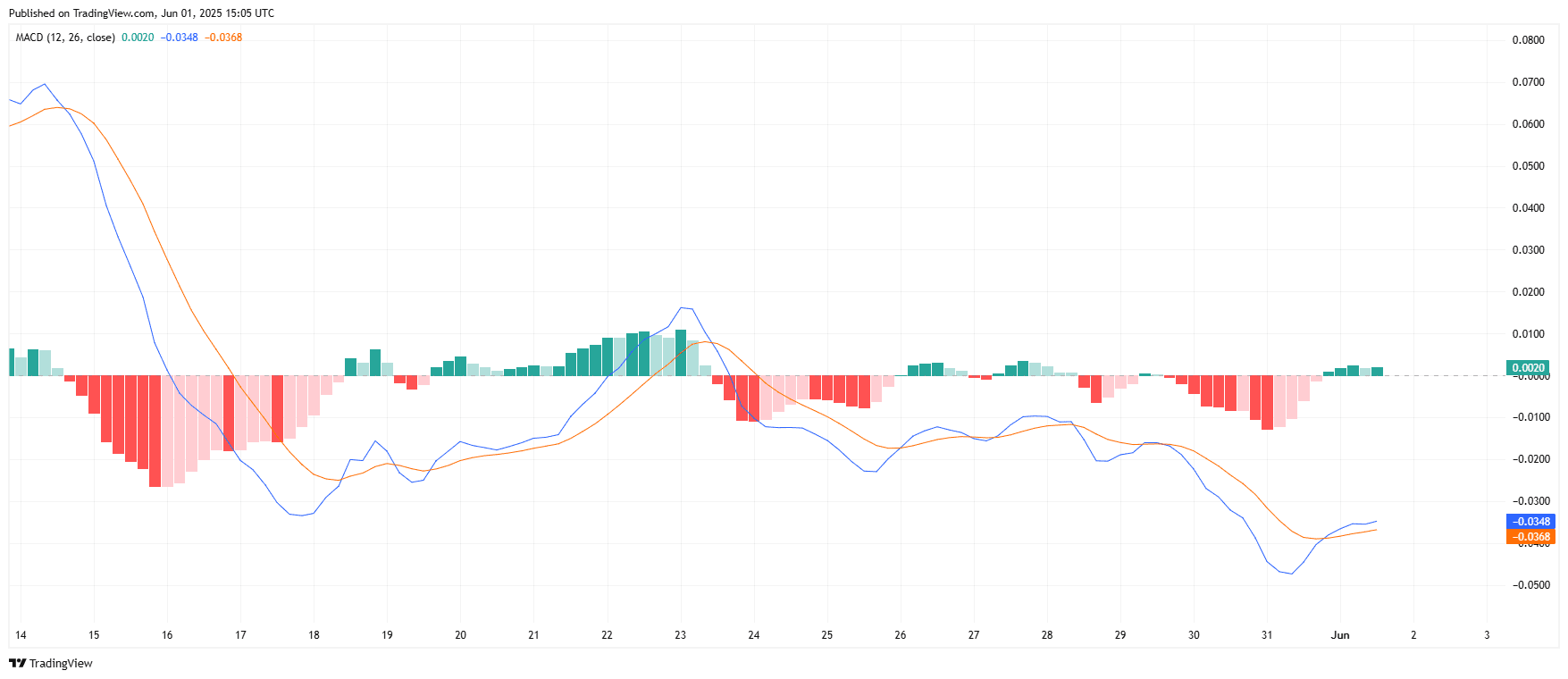

XRP MACD Flashes Early Bullish Sign After Prolonged Downtrend

On June 1, 2025, the Transferring Common Convergence Divergence (MACD) indicator for XRP/USDT confirmed the primary bullish sign up days. The MACD line (blue) now tendencies upward towards the sign line (orange), with a histogram studying of +0.0020—marking a return to optimistic territory after an prolonged pink part.

The MACD line stands at –0.0348, whereas the sign line is at –0.0368. Though each stay in adverse territory, the narrowing hole reveals that promoting momentum is fading. The histogram additionally flipped inexperienced for the primary time since Might 24, indicating that bearish momentum could also be weakening.

If the MACD line crosses above the sign line within the coming periods, it will verify a bullish crossover—usually an indication that upward momentum might observe. This shift aligns with current chart assist ranges and matches the slight restoration seen in quantity and Relative Power Index (RSI) information.

In abstract, the MACD reveals early indicators of a possible development reversal, however affirmation will rely upon the crossover and sustained histogram progress.

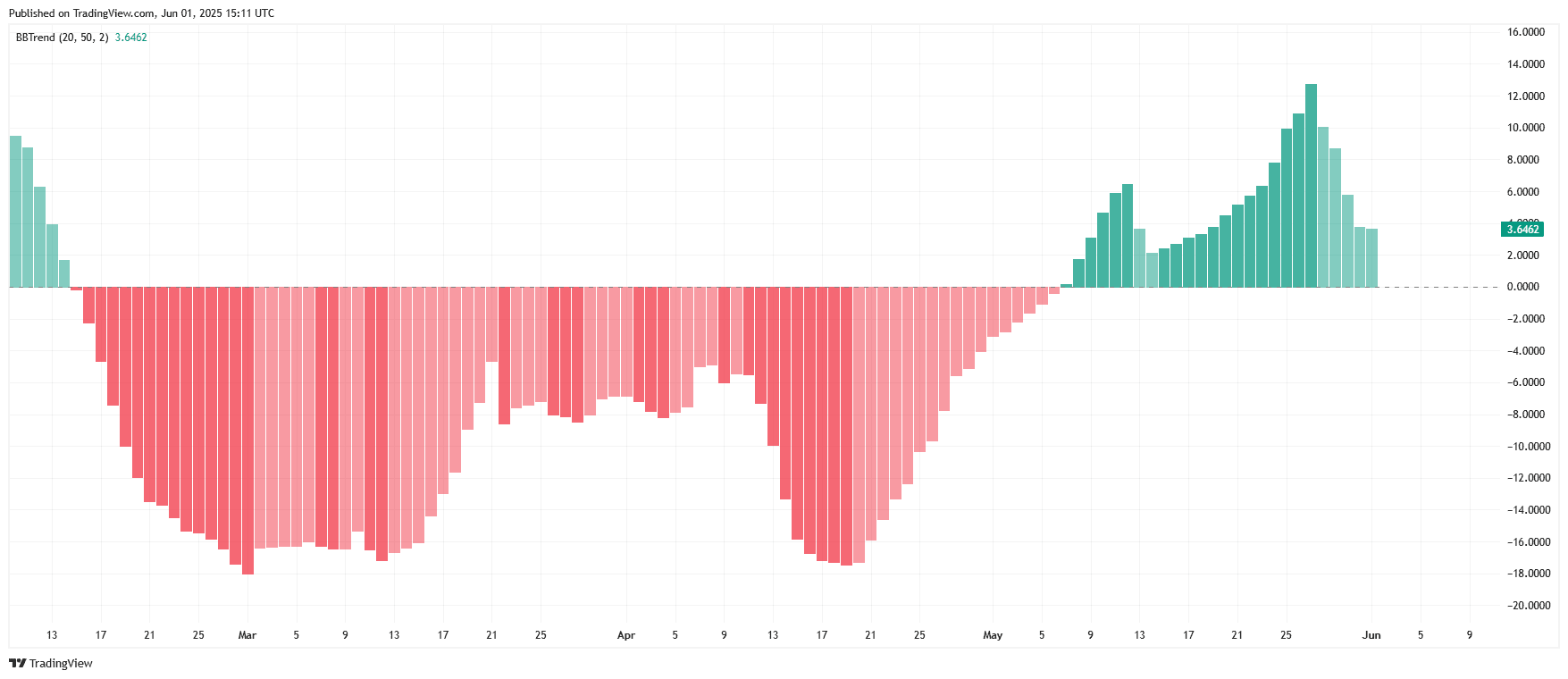

XRP BBTrend Indicator Stays Optimistic Regardless of Pullback

On June 1, 2025, the BBTrend (Bollinger Band Development) indicator for XRP/USDT posted a price of three.6462, remaining in optimistic territory after reaching an area peak close to 14 in late Might.

The BBTrend measures directional power and momentum. Optimistic values, particularly these above 1.0, usually verify the presence of a bullish development. In XRP’s case, the indicator has stayed above zero since early Might, exhibiting that bullish strain persists regardless of current price fluctuations.

Whereas the histogram bars have shortened over the previous few periods, indicating diminished development power, the optimistic slope means that the uptrend continues to be intact. Nevertheless, a continued drop in bar peak could sign weakening momentum forward.

In abstract, XRP’s BBTrend holds above the baseline, supporting a bullish bias, however the present deceleration hints that merchants ought to watch intently for both development resumption or reversal.

XRP Drops Beneath Mid-Band Assist on Bollinger Bands Chart

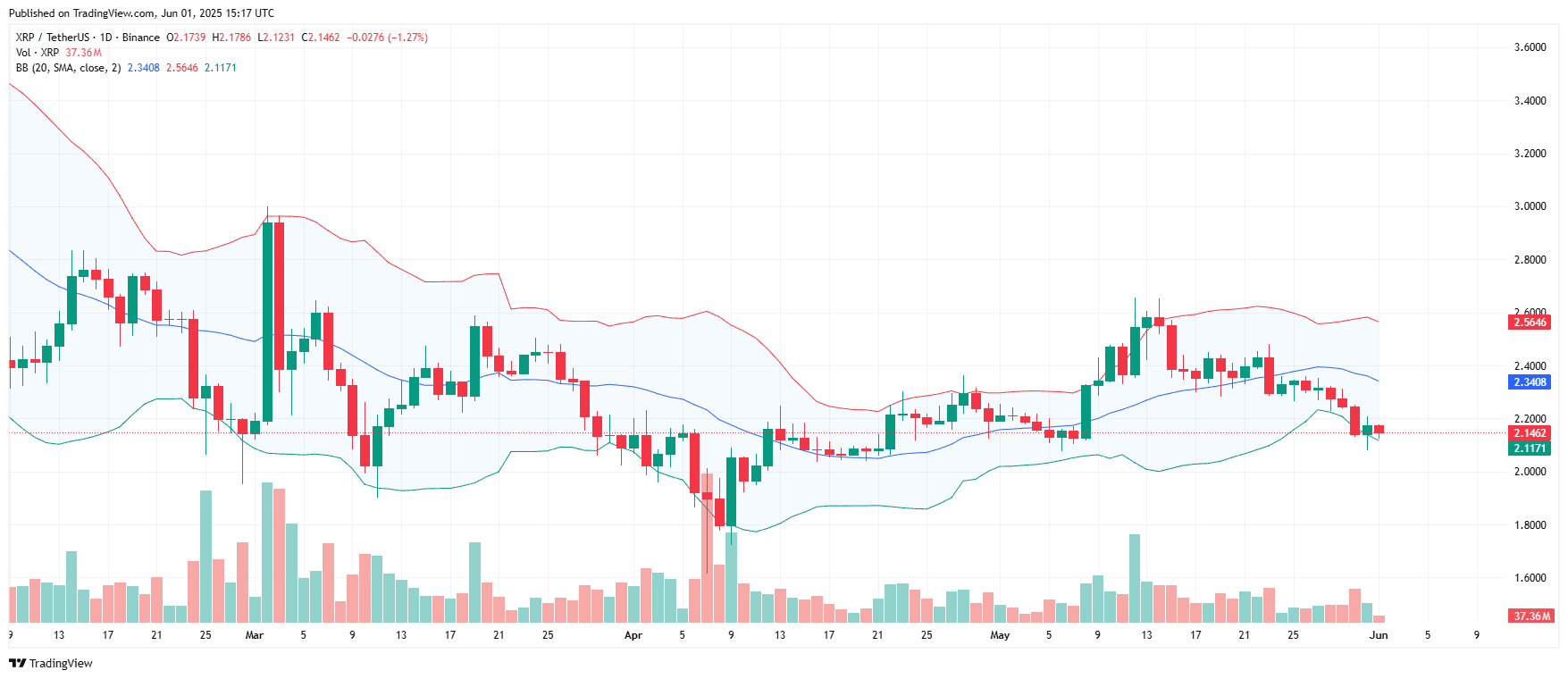

The day by day XRP to Tether (XRP/USDT) chart on Binance confirmed the price falling beneath the center Bollinger Band, which is the 20-day Easy Transferring Common (SMA), presently at $2.3408.

Supply: TradingView

The Bollinger Bands indicator consists of a center SMA line and two outer bands—higher and decrease—set two normal deviations away. These bands assist gauge price volatility and potential reversal zones.

On the time of the chart, XRP trades at $2.1462, with the decrease band sitting at $2.1171 and the higher band at $2.5646. The price now rests close to the decrease Bollinger Band, suggesting it has entered an oversold space.

Quantity stands at 37.36 million, barely elevated through the current decline, which alerts energetic participation within the sell-off.

If XRP holds above the decrease band and bounces, the transfer might act as a short-term assist degree. Nevertheless, failure to reclaim the center band at $2.3408 could maintain bearish momentum intact.