On Might 30, 2025, the SUI to Tether (SUI/USDT) buying and selling pair on the 4-hour Binance chart created a descending channel sample.

A descending channel seems when a cryptocurrency’s price strikes between two parallel trendlines that slope downward. This sample typically reveals a brief downtrend inside a broader bullish setup and sometimes alerts a attainable reversal if the price breaks above the higher boundary.

The chart reveals that SUI’s price has been transferring decrease since early Might. It bounced between the higher and decrease pink trendlines, forming decrease highs and decrease lows. Throughout this era, the price additionally dropped under the 50-period Exponential Transferring Common, which at the moment stands at $3.6285. That shift under the common indicated weakening short-term momentum.

Regardless of the decline, quantity spikes throughout chosen periods present that patrons have remained lively at decrease ranges. If SUI breaks out above the higher pink trendline of the descending channel, the price may rally sharply. Based mostly on the peak of the sample’s preliminary upward leg, SUI could climb 46% from the present stage of $3.44 to a projected goal close to $5.02.

This attainable transfer would push SUI again above latest resistance zones and restore bullish momentum.

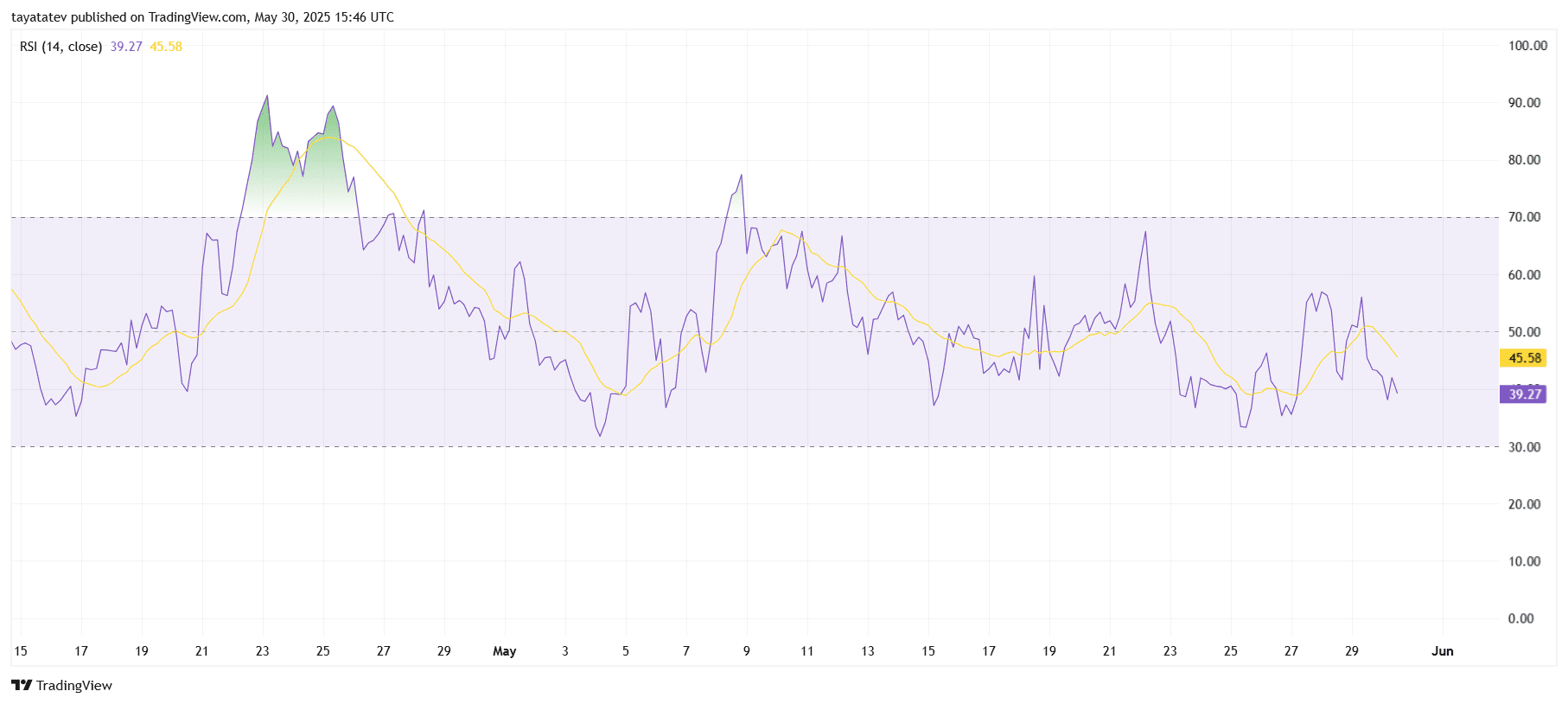

SUI RSI Drops Under Impartial Zone, Signaling Weak Momentum

On Might 30, 2025, the Relative Energy Index (RSI) for SUI/USDT on the 4-hour chart fell to 39.27, in accordance with TradingView.

The RSI (Relative Energy Index) is a momentum indicator that measures the velocity and alter of price actions on a scale from 0 to 100. Values above 70 normally point out overbought circumstances, whereas values under 30 counsel oversold ranges.

Presently, SUI’s RSI has moved under the midpoint of fifty and stays removed from the overbought zone. It additionally trades under its 14-period transferring common, which stands at 45.58. This hole confirms weak shopping for momentum and elevated bearish stress.

The RSI curve has been fluctuating underneath 50 since late Might, reflecting an absence of robust upward momentum. If RSI continues to remain under its transferring common and doesn’t get well towards the impartial 50 zone, the price could battle to achieve power with out a breakout from the descending channel.

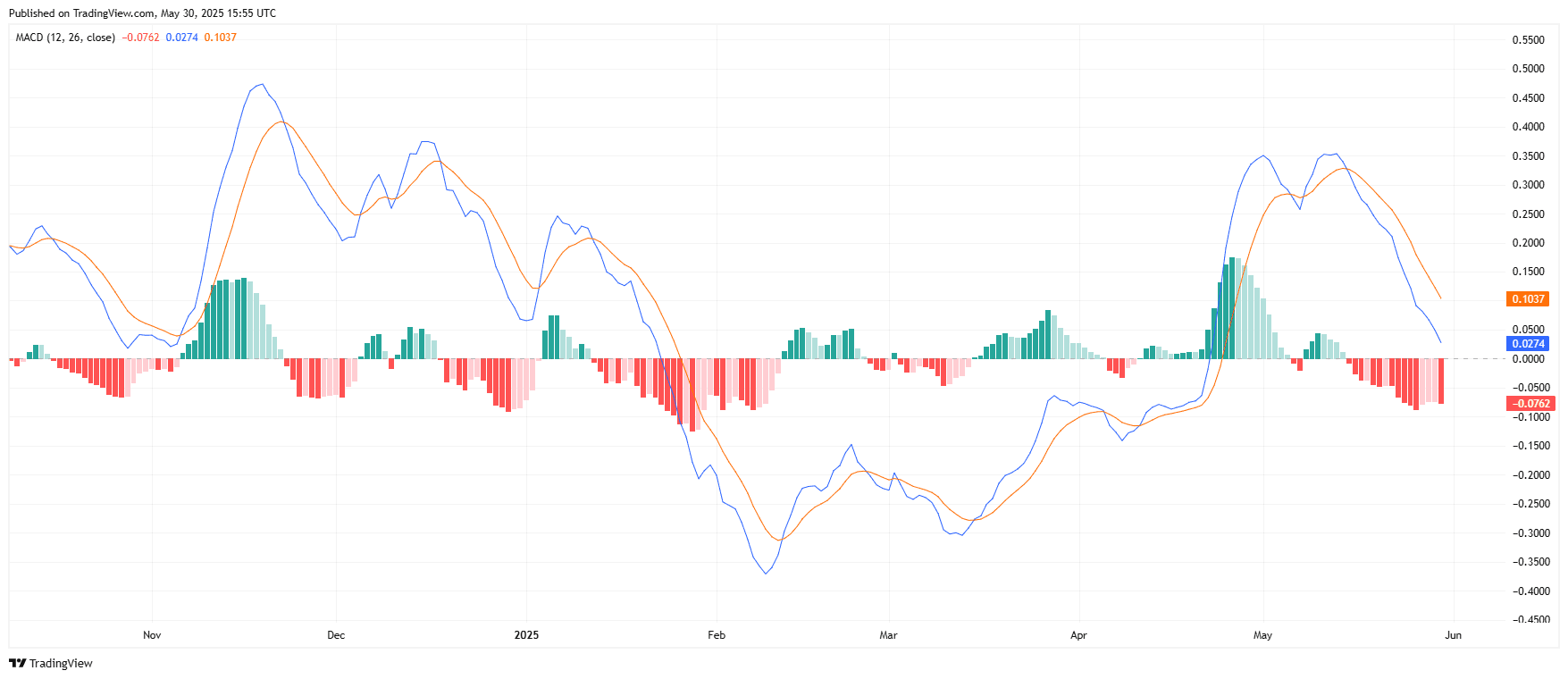

SUI MACD Turns Bearish as Momentum Weakens

The Transferring Common Convergence Divergence (MACD) indicator for SUI/USDT flashed a bearish sign on the every day chart, in accordance with TradingView.

The MACD (Transferring Common Convergence Divergence) measures the connection between two exponential transferring averages—normally the 12-period and 26-period—and helps determine pattern course and momentum power. When the MACD line crosses under the sign line, it typically suggests a possible downtrend.

As of now, the MACD line sits at –0.0762, whereas the sign line stands increased at 0.1037. This crossover under the sign line confirms bearish divergence. On the identical time, the histogram reveals increasing pink bars, reflecting rising detrimental momentum.

The blue MACD line has been trending downward since mid-Might, following SUI’s failed restoration makes an attempt. The present setup signifies continued promoting stress until the MACD line turns again above the sign line.

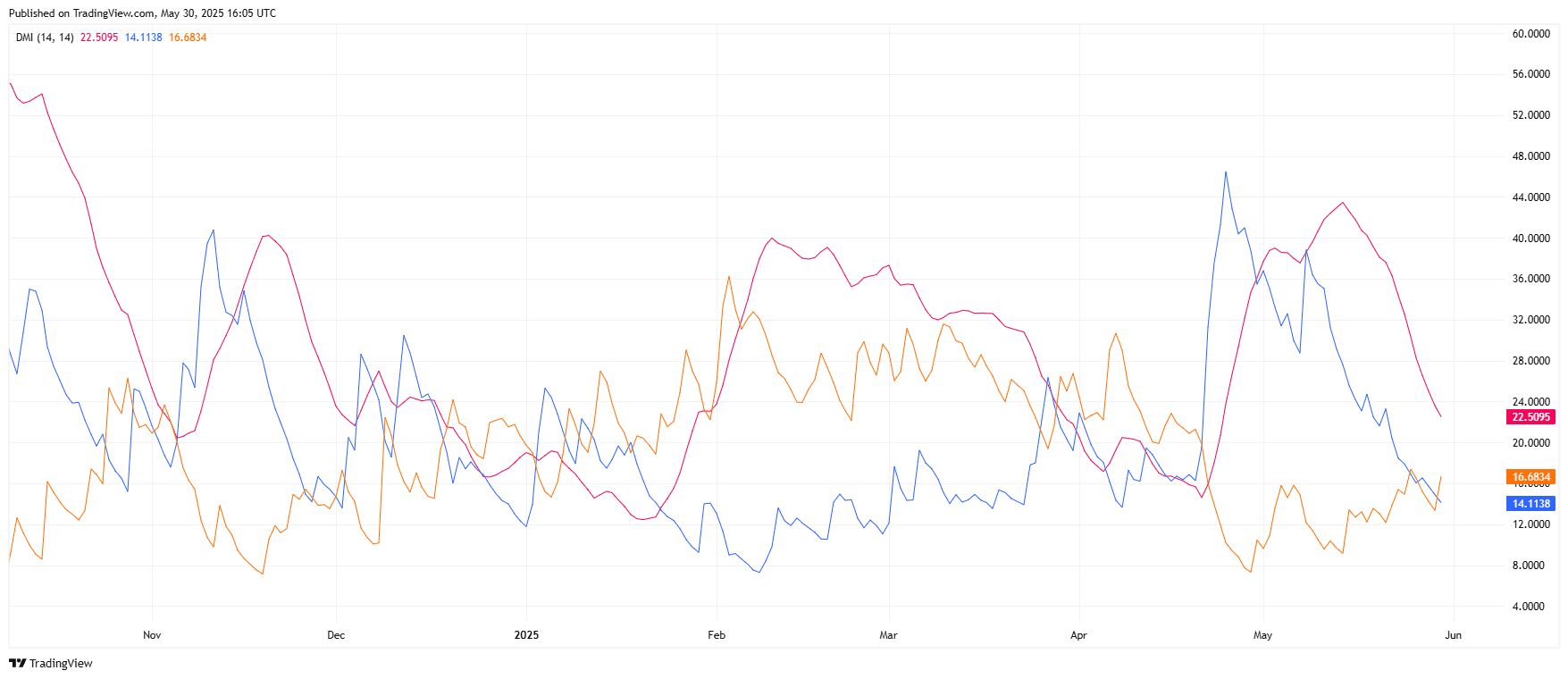

SUI Directional Indicator Confirms Weak Development Energy

On Might 30, 2025, the Directional Motion Index (DMI) for SUI/USDT on the every day chart signaled weakening pattern power, in accordance with TradingView.

The DMI indicator consists of three parts:

– +DI (Optimistic Directional Indicator), which measures upward stress

– –DI (Adverse Directional Indicator), which measures downward stress

– ADX (Common Directional Index), which reveals the general power of the pattern

On the time of the chart, the +DI stands at 14.11, the –DI is increased at 22.50, and the ADX reads 16.68. When the –DI stays above the +DI, it confirms that sellers are in management. In the meantime, an ADX under 20 means that the present pattern—bullish or bearish—lacks robust momentum.

The setup reveals that bearish stress outweighs bullish demand. Nonetheless, the low ADX worth means the pattern stays weak general, with no main directional conviction. This explains the sideways motion in SUI’s price, regardless of forming a descending channel.

Sui Approves $162M Reimbursement Plan After Cetus Exploit

On Might 29, 2025, Sui validators accredited a governance proposal to launch $162 million in frozen funds linked to the latest Cetus exploit. The vote handed with 90.9% in favor, 1.5% abstaining, and seven.2% not taking part, in accordance with Sui’s official governance portal.

The choice adopted a significant safety breach on Might 22, when the decentralized trade Cetus misplaced over $220 million in digital belongings. Shortly after the assault, validators froze $162 million of the compromised funds.

With the proposal now accredited, the frozen belongings will probably be transferred to a multisignature pockets. Sui acknowledged in a put up on X that the funds will probably be held in belief till returned to customers based mostly on Cetus’s official restoration plan.

This transfer has triggered renewed debate about decentralization. Some customers questioned the validators’ potential to freeze onchain belongings, whereas others known as the swift motion needed to guard customers from additional loss.

The vote types a part of a wider restoration technique. Alongside the $162 million, Cetus will use funds from its treasury and draw on an emergency mortgage from the Sui Basis to assist full reimbursement and relaunch operations.

Cetus shared its post-vote roadmap on Might 29. First, Sui validators will execute a series improve to switch the frozen funds. As soon as that’s full, Cetus will deploy a restoration pool improve and start restoring person information.

The protocol goals to finish the total restoration and resume operations inside one week. It additionally confirmed {that a} new compensation contract is underneath improvement. The contract will probably be reviewed by exterior auditors earlier than launch.

After the restart, Cetus plans to return liquidity to all affected suppliers. Customers with unrecovered funds will be capable of declare the remaining balances via the compensation contract as soon as it goes dwell.