Toncoin (TON) surged over 13% in 24 hours, peaking at $3.394 on Might 29. Quantity rose to 452.77K on OKX, confirming heavy curiosity. The TON/USDT pair broke above the 50-period EMA at $3.127 on the 4-hour chart, signaling a robust technical shift.

Telegram’s $1.5B Bond Sale Triggers Shopping for Frenzy

On Might 28, Satoshi Membership posted on X that Telegram goals to boost $1.5 billion via a brand new bond providing. In line with the replace, main monetary gamers like BlackRock, Citadel, and Mubadala are more likely to take part. Although Telegram formally handed Toncoin’s improvement to the group, the shut ties between the 2 nonetheless impression TON’s market efficiency.

The Wall Road Journal confirmed the bond plan. The brand new bonds can have a five-year maturity and yield 9%, and Telegram will use the funds to refinance its 2021 bond. BlackRock and Mubadala are already bondholders and are anticipated to reinvest on this spherical.

Technical Breakout Confirms Bullish Shift in Toncoin

In the meantime, chart information shared by CryptoBull_360 on X revealed a bullish breakout from a descending triangle sample. The breakout occurred across the $3.10 degree, breaking the trendline resistance that had held since mid-Might.

Assist on the $2.95–$3.00 zone remained sturdy throughout earlier dips. The price closed above the breakout degree with elevated quantity, confirming sturdy purchaser curiosity. TON now trades almost 10% larger, supported by this technical sample. The 50 EMA degree of 1.45% can be appearing as assist.

Telegram’s xAI Partnership Fuels Toncoin’s Outperformance Over Ethereum

On Might 29, Toncoin gained a significant enhance after Telegram introduced a $300 million partnership with xAI, the synthetic intelligence startup based by Elon Musk. The deal consists of each money and fairness funds and grants Telegram integration rights to xAI’s AI assistant Grok.

Telegram CEO Pavel Durov confirmed the one-year settlement on X, stating that Grok shall be distributed to Telegram’s person base via in-app integration. As a part of the deal, Telegram can even obtain 50% of subscription income from xAI companies bought through its platform.

The information triggered a pointy response out there, serving to Toncoin get away of a descending triangle sample. The token had beforehand traded in a slender vary, capped by a falling trendline. The breakout adopted instantly after Durov’s announcement, confirming the shut tie between Telegram’s strategic strikes and TON’s market trajectory.

This partnership information added to Toncoin’s momentum, additional widening the hole between TON and Ethereum in every day efficiency.

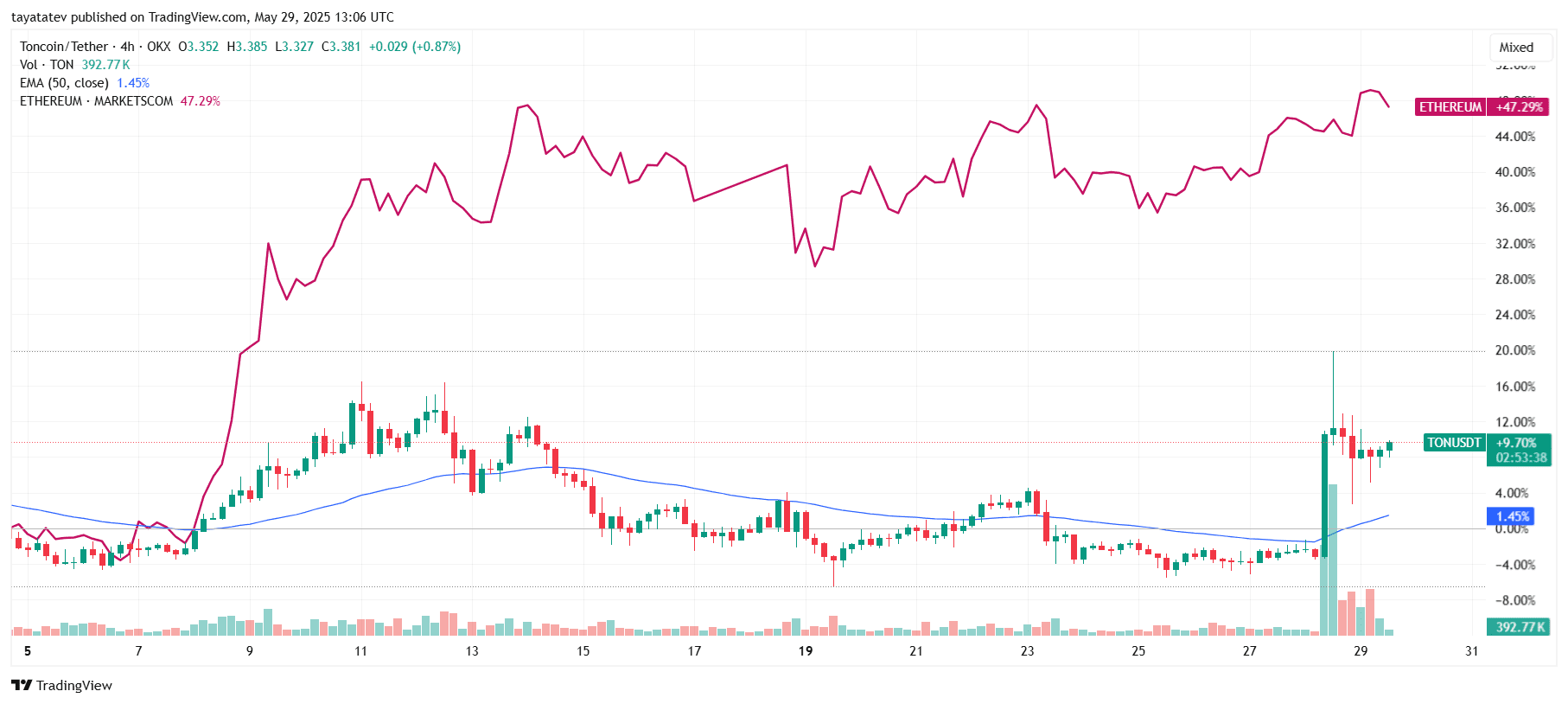

TON Leaves Ethereum Behind in Day by day Positive factors

Toncoin (TON) clearly outpaced Ethereum (ETH) in every day price motion on Might 29. Whereas Ethereum maintained a gentle long-term achieve of 47.29%, the 4-hour chart exhibits TON surging over 9.70% in a single transfer, breaking out with sturdy momentum and quantity.

The chart reveals a pointy vertical spike in TON price, adopted by a short consolidation between $3.30 and $3.38. This transfer got here with a heavy quantity burst, as proven by the inexperienced bars close to the bottom of the breakout. Trading quantity reached 392.77K on OKX, signaling intense market participation and renewed curiosity in TON.

Against this, Ethereum’s efficiency curve on the identical chart stays clean, with none main intraday surges. The pink line monitoring ETH’s relative proportion change exhibits no comparable breakout. As a substitute, it traits step by step upward, reflecting broader market power relatively than event-driven momentum.

TON’s price additionally crossed above its 50-period EMA, marked in blue, and now sits comfortably above the indicator’s 1.45% degree. This bullish cross reinforces the breakout, confirming that the price construction has shifted. In distinction, Ethereum didn’t present any main technical breakout throughout this timeframe.

The divergence highlights that Toncoin’s rally was triggered by direct catalysts, not simply normal market power. The surge adopted Telegram’s $1.5 billion bond announcement, which introduced institutional names like BlackRock and Citadel into focus. This information, mixed with a bullish technical breakout, pushed TON right into a sooner uptrend in comparison with ETH.

Because the market reacted to Telegram’s financing transfer, TON turned the highlight asset of the day—leaving Ethereum behind in short-term efficiency.

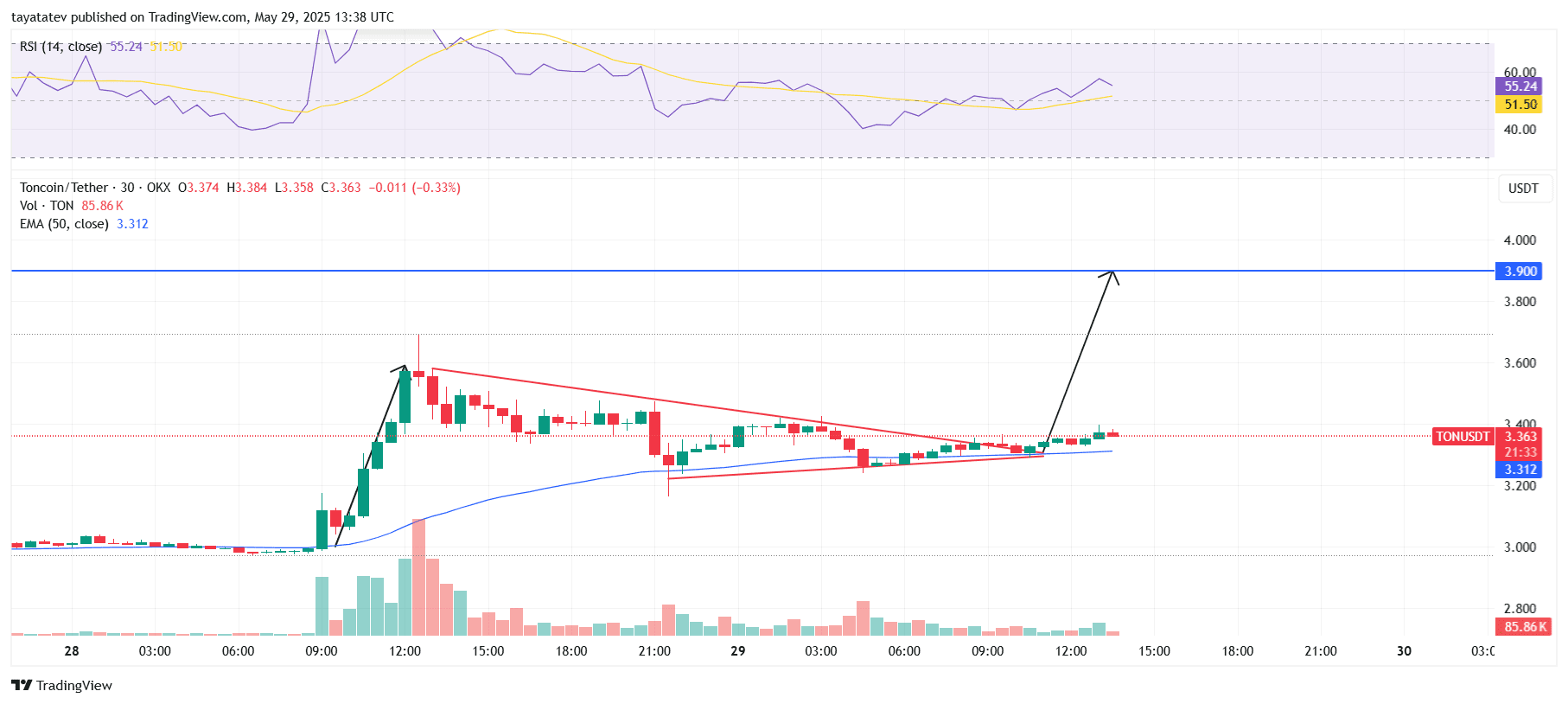

Toncoin Varieties Bullish Pennant, Eyes 16% Rally

On Might 29, 2025, the 30-minute Toncoin (TON/USDT) chart on OKX shaped a bullish pennant sample. This technical formation seems after a robust upward transfer, adopted by a brief consolidation between two converging trendlines. It typically alerts a continuation of the prior uptrend.

The chart exhibits a pointy price enhance early on Might 28, adopted by tightening price motion inside a triangle. This consolidation part formed the pennant. The 50-period Exponential Shifting Common (EMA), proven in blue and presently at $3.312, helps the sample from under.

As of the newest candle, the price of Toncoin sits at $3.363, already up almost 2% from the breakout degree. This early transfer suggests merchants are beginning to act on the breakout sign.

If the bullish pennant confirms with sustained quantity, the anticipated breakout goal would venture an extra 16% rally from the present degree. That might push the price up to round $3.90, as marked on the chart by the blue resistance line.

Quantity is step by step selecting up, and the Relative Power Index (RSI) is at 55.24, barely above impartial, indicating room for extra upward motion with out being overbought. If momentum continues and price holds above each the EMA and the pennant’s higher boundary, additional positive factors seem possible.

The construction, mixed with the prior surge and regular RSI, helps a possible bullish continuation. Merchants will watch carefully for affirmation with a robust inexperienced candle and rising quantity.