On Could 28, 2025, the SEI/USDT 4-hour chart on Binance created a bearish pennant sample. A bearish pennant kinds after a powerful downward transfer, adopted by temporary consolidation inside two converging trendlines, and sometimes results in additional decline.

If this setup confirms, the SEI token might drop 19% from the present price of $0.2197 to the projected goal of $0.1766.

The sample begins with a steep decline that formed the flagpole round Could 16 to Could 18. After that, the price briefly consolidated inside a purple symmetrical triangle. This formation sometimes represents a continuation of the sooner downtrend.

At the moment, the price trades under the 50-period Exponential Shifting Common (EMA), which sits at $0.2269. This place provides downward strain and acts as dynamic resistance. As well as, the latest breakout try above the triangle failed, pushing SEI again beneath each the higher trendline and the EMA.

Trading quantity stands at 17.55 million, displaying a light improve. A spike in purple quantity bars throughout a breakdown would verify bearish momentum.

The subsequent key assist lies at $0.1766, which additionally matches the projected breakdown goal from the pennant. If SEI closes under the decrease trendline with robust quantity, this drop might happen swiftly.

Till then, merchants and analysts will monitor the price carefully for affirmation.

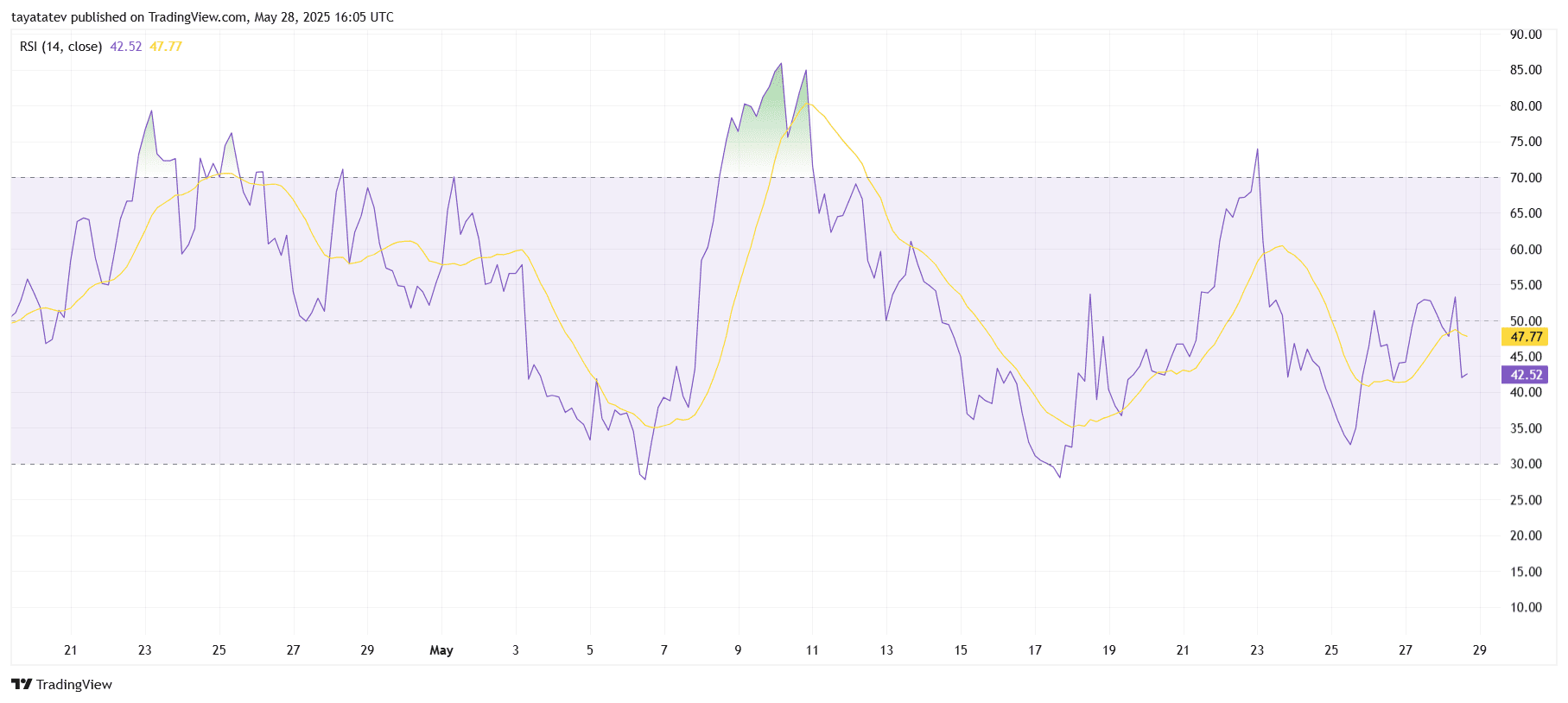

SEI RSI Drops Beneath Sign Line, Reveals Weak Momentum

On Could 28, 2025, the 4-hour Relative Energy Index (RSI) chart for SEI/USDT exhibits a bearish sign. The RSI line (purple) stands at 42.52, whereas the 14-period transferring common (yellow) reads 47.77.

For the reason that RSI has dropped under the 50 mark, it signifies weakening bullish momentum. In truth, the crossover beneath its transferring common confirms short-term bearish strain. This drop follows a failed try to remain above 50, which regularly acts as a mid-point for momentum steadiness.

Furthermore, the RSI has not reached the oversold area but, which begins at 30. Due to this fact, there may be nonetheless room for additional draw back earlier than any technical rebound.

Beforehand, the RSI peaked above 70 in early Could, signaling an overbought situation. Nonetheless, it rapidly reversed, and the present downtrend continues to mirror broader promoting exercise.

If this development holds, it could additional assist the breakdown potential seen on the primary price chart.

SEI Hits Document TVL as ETF Curiosity and GIGA Launch Construct Momentum

On Could 28, 2025, Sei reached a brand new all-time excessive in Complete Worth Locked (TVL), signaling robust engagement throughout its ecosystem. This development comes as Canary Capital reportedly filed for an ETF based mostly on SEI efficiency, reflecting rising institutional curiosity.

In the meantime, Sei prepares for the upcoming GIGA token launch, which might drive further traction. The protocol continues to develop its presence in decentralized finance by securing person belief and rising liquidity.

Collectively, the ETF transfer and the GIGA rollout have strengthened SEI’s narrative within the broader market, whilst its short-term price motion stays beneath bearish strain.