On Could 26, 2025, the XRP/US Greenback pair fashioned a bullish flag sample on the 4-hour chart.

A bullish flag sample seems when a pointy price rally is adopted by a downward-sloping consolidation, sometimes between two parallel strains. It usually alerts that the price could proceed rising as soon as the sample confirms.

If the breakout is confirmed, XRP may rally roughly 29% from the present price of $2.34 to the projected goal of $3.01.

At the moment, XRP trades slightly below the 50-period Exponential Transferring Common (EMA), which stands at $2.36. This EMA now acts as dynamic resistance. A breakout above each the EMA and the higher crimson trendline could set off the anticipated continuation.

In the meantime, the Relative Energy Index (RSI), a momentum indicator, sits at 49.13, slightly below the impartial 50 mark. The RSI line curves upward, signaling bettering momentum. If RSI climbs above 50 with robust quantity, it will assist the bullish flag affirmation.

Trading quantity stays average at 305.34K, with no vital spikes but. Nevertheless, any enhance in quantity throughout a breakout may validate the transfer towards $3.01.

In brief, XRP is consolidating inside a bullish flag. If it breaks above the resistance and EMA with robust quantity, a 29% rally towards $3.01 could observe.

XRP-Bitcoin Correlation Drops to 0.4, Elevating Brief-Time period Strain Dangers

On Could 26, 2025, the correlation coefficient between XRP and Bitcoin dropped to 0.40, reaching its lowest degree since February 2025. A correlation coefficient measures the diploma to which two property transfer in relation to one another, the place 1 signifies excellent correlation and 0 signifies no correlation.

A 0.4 studying reveals that XRP is changing into more and more disconnected from Bitcoin’s price motion. Traditionally, this type of divergence has had unfavourable penalties. For instance, the final time the correlation dropped to this degree, XRP’s price fell by 22.33%, as proven within the highlighted inexperienced zone on the chart.

This decoupling comes at a time when Bitcoin has hit a brand new all-time excessive. Usually, altcoins like XRP profit from Bitcoin’s power. Nevertheless, the present divergence suggests XRP could not trip Bitcoin’s upward momentum. This weakening hyperlink may point out lowered investor confidence or shifting capital to different altcoins.

Regardless of this, on-chain knowledge factors to rising investor conviction. The availability of XRP that has remained unmoved for 3–6 months has elevated steadily in Could. This alerts that short-term holders are maturing into mid-term holders, suggesting a extra secure and fewer speculative investor base.

So whereas technical correlation weakens and near-term price danger will increase, holding conduct implies a longer-term confidence amongst XRP traders.

Dormant XRP Provide Hits 12.3 Billion, Indicators Rising Lengthy-Time period Confidence

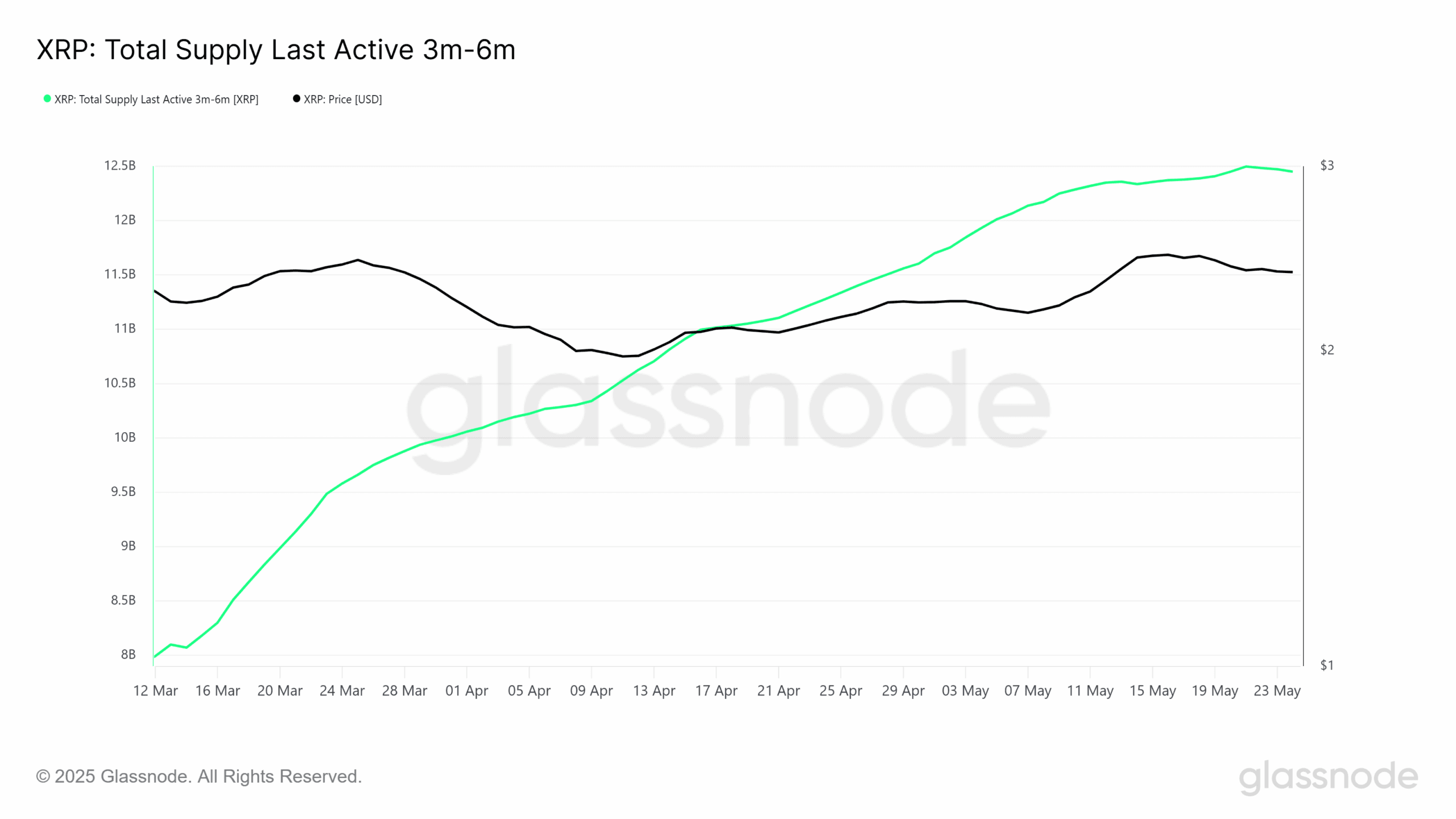

From mid-March to late Could 2025, the full provide of XRP final energetic 3 to six months in the past climbed steadily from 8 billion to 12.3 billion tokens, based on Glassnode knowledge.

This metric tracks cash that haven’t moved for 3 to 6 months, and its enhance means that extra holders are selecting to not promote. These traders are both ready for a greater exit price or signaling long-term confidence in XRP’s outlook.

Whereas XRP’s price (black line) confirmed average volatility throughout this era, the inexperienced line representing dormant provide moved constantly upward. This divergence means that the current sideways or barely bearish price motion has not shaken holders with mid-term conviction.

This sort of conduct usually displays a maturing investor base. When provide stays untouched for months, it reduces short-term circulating provide, doubtlessly limiting sharp selloffs throughout risky intervals.

Analyst Hyperlinks XRP Progress to Ripple-Circle Acquisition Rumors

Kate Younger Ju, a secondary X account related to Ki Younger Ju—the founding father of on-chain analytics platform CryptoQuant—shared new commentary on XRP and Ripple’s potential acquisition plans.

“XRP seems like a group of capital market experts. It has its shortcomings, but its movement is unquestionably sharp,”

the pseudonymous account said.

In the identical put up, the analyst addressed rising hypothesis that Ripple could purchase Circle, the issuer of the USDC stablecoin. Circle has reportedly begun “informal talks” with each Ripple and Coinbase to discover a possible acquisition. The corporate is in search of a valuation of not less than $5 billion, according to its goal for an preliminary public providing (IPO).

In accordance with Ju, a Ripple–Circle deal would mark a strategic shift. He famous that robust demand for stablecoins throughout each crypto and conventional markets may carry institutional consideration to XRP. The analyst added that traders making ready for Circle’s IPO may as a substitute flip to XRP as a proxy wager on the stablecoin market’s progress.

“If Ripple acquires Circle, investors waiting for Circle’s IPO may choose XRP instead,”

he wrote.

MiCA-Regulated Euro Stablecoin EURØP Launches on XRP Ledger

Furthermore, Rippleannounced that Schuman Monetary’s euro-backed stablecoin, EURØP, has formally launched on the XRP Ledger (XRPL), marking the primary full integration of a MiCA-compliant euro stablecoin into the community.

The stablecoin is absolutely backed by euros, redeemable, and usually audited by KPMG. Its reserves are held at main monetary establishments, together with Société Générale, and its issuer is regulated by France’s ACPR (Prudential Supervision and Decision Authority). This aligns EURØP with the European Union’s Markets in Crypto-Property (MiCA) framework.

Ripple emphasised that the launch represents a serious step towards increasing compliant, euro-denominated stablecoin use on one of many world’s most energetic blockchain networks. In accordance with the corporate:

“This marks a major step toward bringing compliant euro-denominated stablecoins into active use on one of the world’s most widely used blockchains.”

Over the previous decade, the XRP Ledger has processed greater than 3.3 billion transactions, supported over six million energetic wallets, and maintained a decentralized community of greater than 200 validators. Ripple described the ledger as “institution-ready”, making it well-suited for the combination of stablecoins like EURØP.

Cassie Craddock, Ripple’s managing director for the UK and Europe, highlighted the broader utility:

“The launch of EURØP on the XRP Ledger demonstrates how stablecoins can meet the high standards set by MiCA while unlocking new possibilities for onchain use cases such as payments and real-world asset tokenization.”

In the meantime, Ripple additionally revealed that Braza Group is increasing digital forex adoption in Latin America. The agency has launched its USDB stablecoin on the XRP Ledger. USDB is pegged to the U.S. greenback and backed by a mixture of U.S. and Brazilian authorities bonds. This additional reveals how the XRPL is changing into a hub for compliant and scalable stablecoin options.

Collectively, EURØP and USDB strengthen the XRP Ledger’s place in international markets by enabling institutional-grade settlement, decentralized finance (DeFi) entry, and real-world asset tokenization, all underneath regulatory readability.