Spot Bitcoin ETFs and Ethereum ETFs are experiencing file inflows, reflecting rising institutional confidence in cryptocurrencies as Bitcoin surpasses $106,000 and Ethereum beneficial properties momentum, pushed by world adoption and market dynamics.

Spot Bitcoin ETFs hit $109 billion AUM

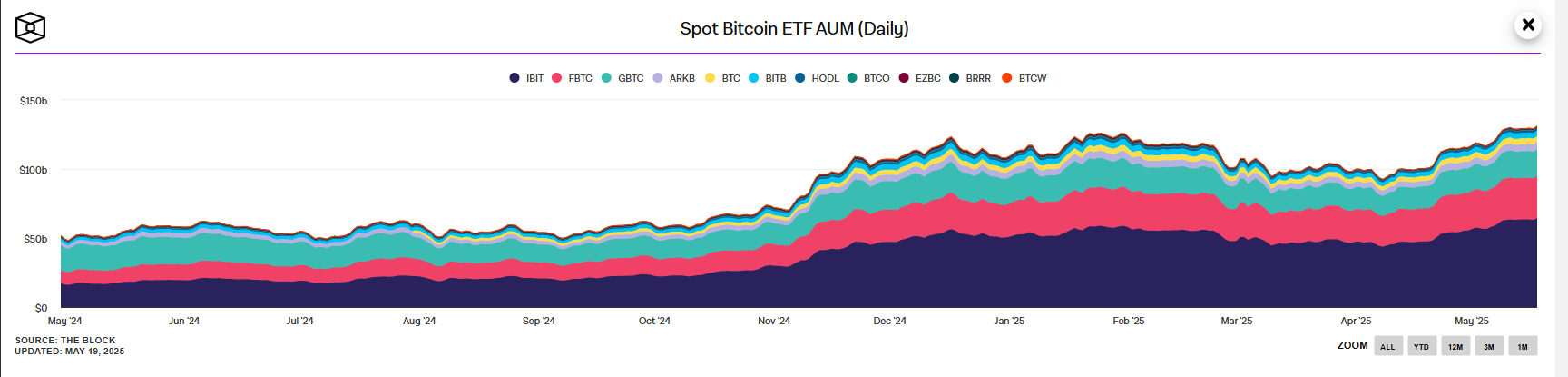

The cryptocurrency market is witnessing a historic surge in institutional funding, with U.S. spot Bitcoin exchange-traded funds (ETFs) reaching a exceptional $109 billion in belongings beneath administration (AUM) as of late April 2025.

Supply: The Block

This milestone underscores the accelerating tempo of institutional adoption globally, with Bitcoin ETFs reaching all-time excessive with over $41 billion in inflows since their launch in early 2024.

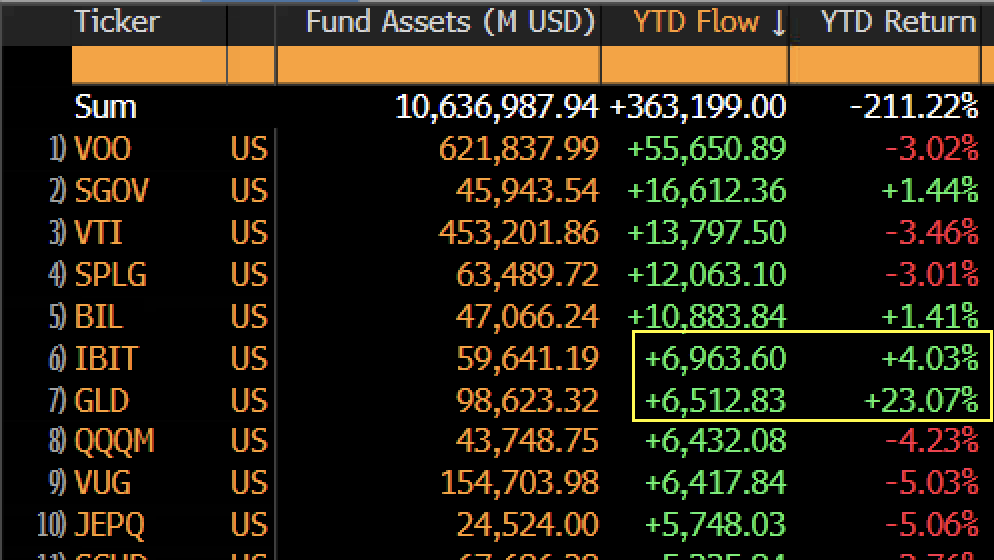

On Could 8, 2025, traders poured new capital into these funds, pushing the entire to this record-breaking determine. BlackRock’s iShares Bitcoin Belief (IBIT), the most important spot Bitcoin ETF, alone has attracted $6.96 billion in year-to-date inflows, outpacing even the world’s largest gold ETF, SPDR Gold Belief (GLD), which recorded $6.5 billion.

Supply: X

This outperformance highlights institutional traders’ rising confidence in Bitcoin BTC as a long-term retailer of worth, regardless of its modest 3.8% price achieve in comparison with gold’s 29% surge this 12 months.

Lengthy-term shopping for strain from Bitcoin whales factors to a possible continuation of the bullish pattern.

Supply: CryptoQuant

Ethereum ETFs Acquire Momentum

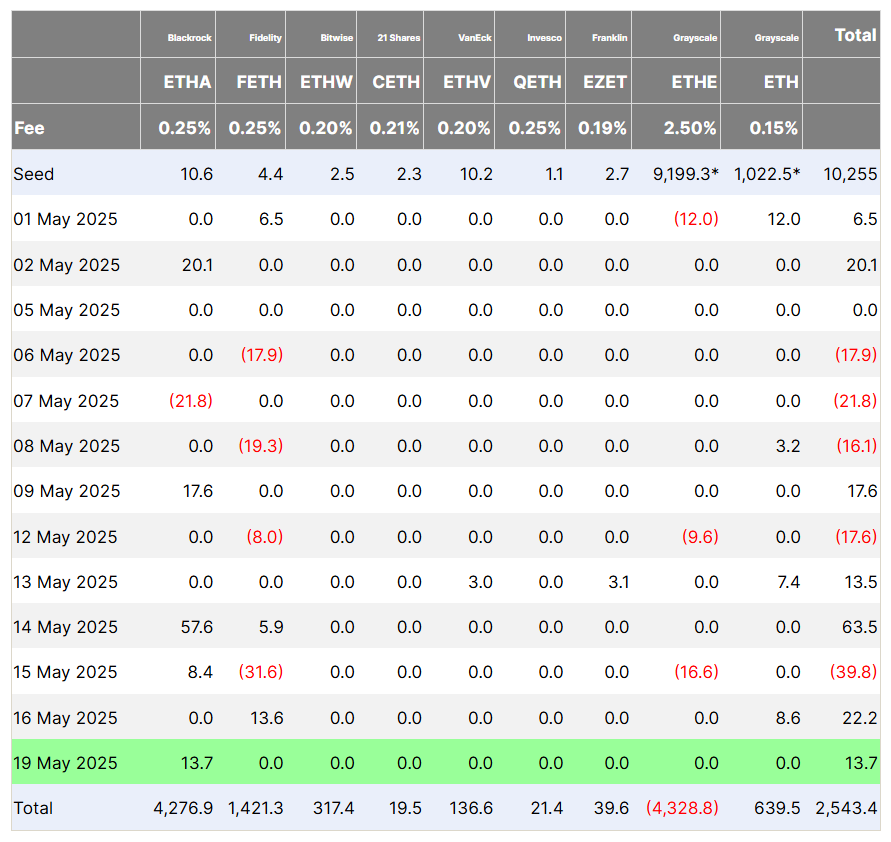

Whereas Bitcoin ETFs proceed to dominate headlines, spot Ethereum ETFs are steadily carving out their very own success.

In early Could 2025, Ethereum ETFs recorded important web inflows, ending an eight-week streak of outflows, pushed by a broader cryptocurrency market rally. This marked their first constructive weekly inflows since February 2025, reflecting renewed investor confidence.

Supply: Farside Traders

BlackRock’s Ethereum ETF (ETHA) has been a standout, attracting substantial capital and contributing to the fund’s rising AUM, which now reaches billions.

Regardless of earlier challenges, together with notable outflows in March, the current surge underscores Ethereum’s enchantment as an institutional funding, fueled by its sturdy ecosystem and Pectra upgrades.

Analysts observe that whereas Ethereum ETFs nonetheless path Bitcoin in scale, their current efficiency alerts a shift, with establishments more and more recognizing Ethereum’s potential as a cornerstone of the crypto market.

Rising Institutional Belief Powers ETF Inflows

Whereas Bitcoin advantages from its established narrative as digital gold, Ethereum ETFs stay a “sidekick” to their Bitcoin counterparts, with inflows considerably decrease.

The file inflows into each Bitcoin and Ethereum ETFs sign a structural shift within the monetary panorama, with establishments more and more viewing cryptocurrencies as viable portfolio belongings. Analysts attribute this pattern to macroeconomic components, together with persistent inflation, a weakening U.S. greenback, and expectations of renewed quantitative easing by the Federal Reserve.

Rachael Lucas from BTC Markets famous that these inflows mirror a “maturing role” for Bitcoin and Ethereum ETH in diversified portfolios. Moreover, world adoption is gaining traction, with nations just like the UAE, Singapore, and Hong Kong launching their spot Bitcoin and Ethereum ETFs, additional legitimizing cryptocurrencies as an asset class. Regardless of short-term volatility, comparable to Bitcoin’s 12% price drop in Q1 2025, the sustained inflows display unwavering institutional optimism.