JPMorgan Chase’s determination to permit shoppers to purchase Bitcoin, regardless of CEO Jamie Dimon’s skepticism, displays a broader wave of institutional adoption in 2025, as monetary giants and governments more and more again the main cryptocurrency.

JPMorgan’s Pivot to Bitcoin Entry

On Could 19, 2025, JPMorgan Chase, the biggest U.S. financial institution, introduced it is going to allow shoppers to buy Bitcoin BTC, although it is not going to present custody companies, as acknowledged by CEO Jamie Dimon on the financial institution’s Investor Day.

JAMIE DIMON: I’m not a fan of Bitcoin, however we are going to will let you purchase it.

I don’t assume you need to smoke, however I defend your proper to smoke.

I defend your proper to purchase Bitcoin. Go at it. pic.twitter.com/nGEGsUEgWu

— Bitcoin Information (@BitcoinNewsCom) Could 19, 2025

This marks a big shift for the financial institution, which holds $1.7 billion in Bitcoin ETFs, together with 263,000 shares of BlackRock’s iShares Bitcoin Belief (IBIT). Regardless of Dimon’s previous criticisms – calling Bitcoin a “Ponzi scheme” and evaluating it to “smoking” in a January 2025 CBS interview – JPMorgan’s transfer aligns with a pro-crypto U.S. regulatory atmosphere underneath the Trump administration. The financial institution’s blockchain platform, Kinexys, processed a tokenized Treasury transaction with Ondo Finance, signaling its rising blockchain engagement.

Institutional adoption is accelerating, with MicroStrategy holding 576,230 BTC and BlackRock’s IBIT managing 633,212 BTC ($66.45 billion) as of Could 2025. U.S. states like New Hampshire and Arizona have added Bitcoin to reserves, whereas Bhutan transferred 374,217 BTC ($34.14 million) to Binance, prone to capitalize on Bitcoin’s all-time excessive of $91,000 in November 2024.

Supply: iShares

Institutional Backing Drives Bitcoin Towards All-Time Excessive

Regardless of some preferring gold as a protected haven, Bitcoin’s institutional momentum is simple. Morgan Stanley’s Bitcoin ETF choices and Financial institution of America’s openness to stablecoins replicate rising acceptance.

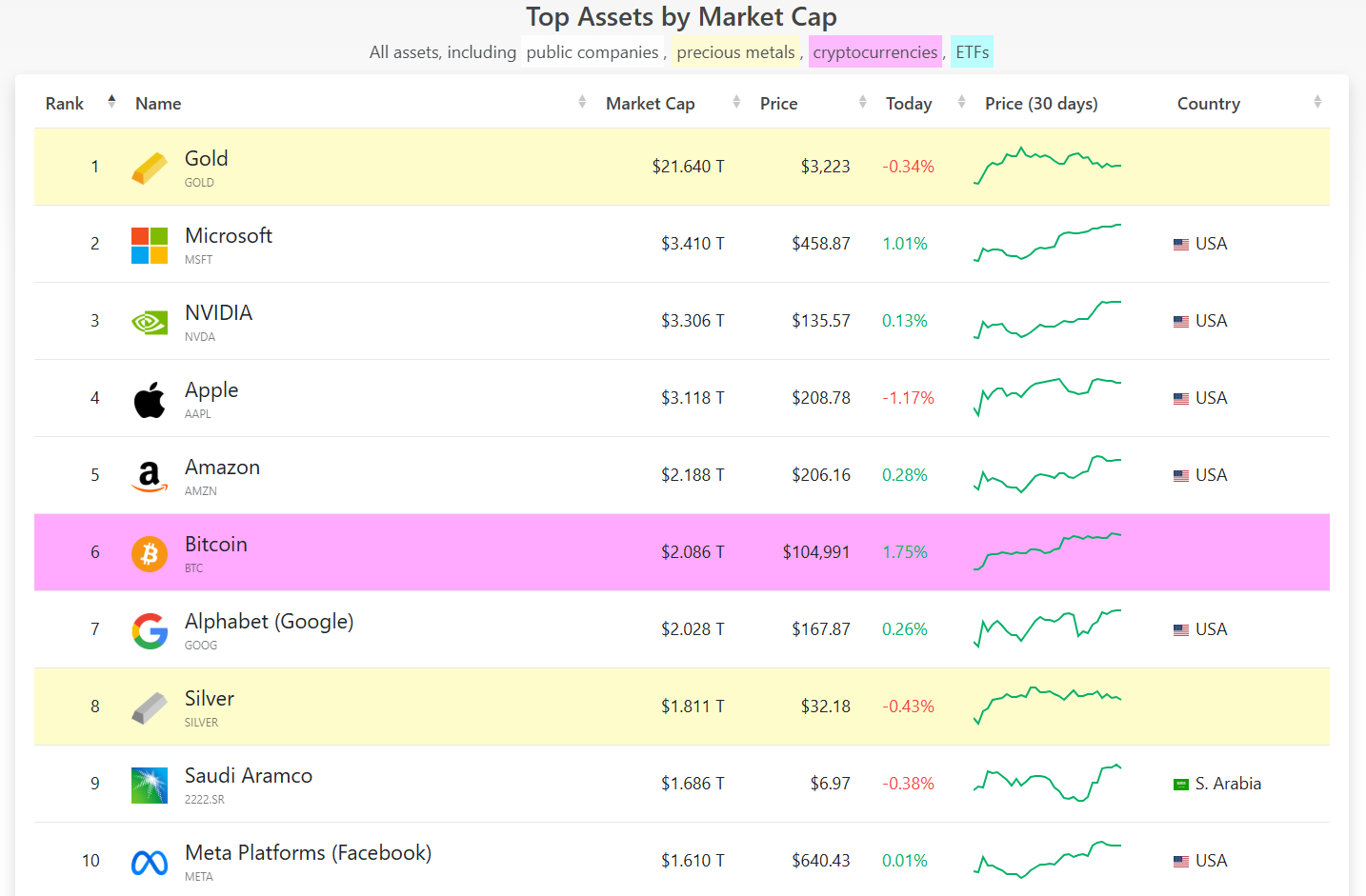

Bitcoin’s market cap hit $2 trillion in 2025, with U.S. spot Bitcoin ETFs holding $125.89 billion, or 5.6% of its 21 million provide. BlackRock’s Larry Fink now champions Bitcoin, a stark distinction to his earlier skepticism, whereas Kevin O’Leary, as soon as a critic, allotted 1.5% of his portfolio to BTC.

Supply: Firms Marketcap

Analysts like Nic Puckrin of The Coin Bureau name Bitcoin’s adoption “unstoppable,” citing JPMorgan’s transfer as a milestone. Nonetheless, challenges persist, together with regulatory scrutiny and market volatility, as seen in a 7.8% Bitcoin price drop to $77,100 in April 2025 amid commerce battle fears. The repeal of SAB 121 has eased financial institution custody restrictions, however Dimon’s reluctance to custody Bitcoin suggests warning. Nonetheless, with pro-crypto insurance policies and institutional backing, Bitcoin’s position as a portfolio asset strengthens.