VIRTUAL, a local token of Digital Protocol is gaining momentum as one of the crucial promising AI-native tokens, fueled by a revamped staking mannequin and growing demand from on-chain contributors.

Digital Protocol Overview

Virtuals Protocol is a decentralized AI platform constructed on the Base blockchain, enabling customers to create and co-own AI brokers. The VIRTUAL token serves as the bottom foreign money and liquidity pair for all interactions with brokers, appearing because the financial spine of all the ecosystem.

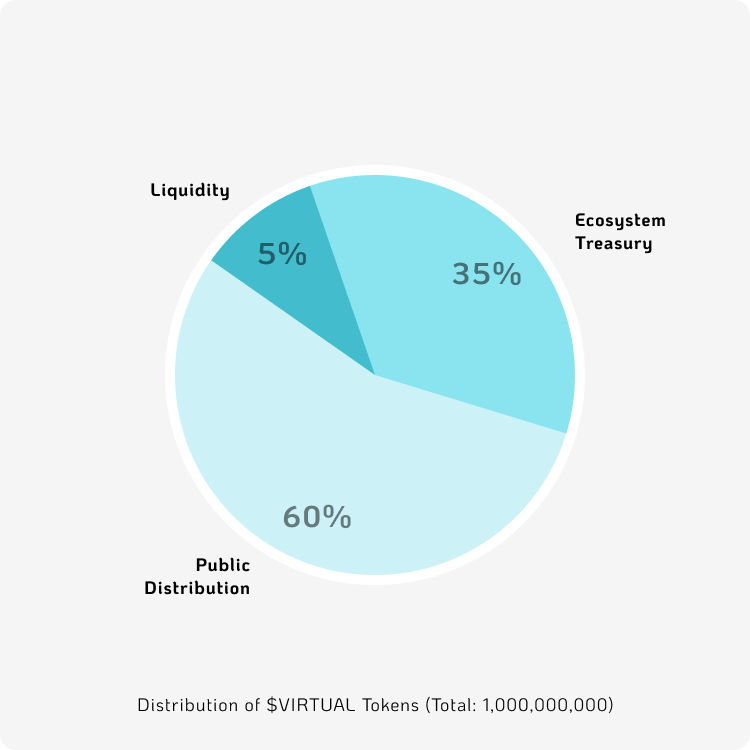

The entire provide of $VIRTUAL is 1 billion tokens (non-inflationary), distributed as follows:

- 60% (600 million) in free circulation,

- 5% (50 million) allotted to liquidity swimming pools,

- 35% (350 million) held within the ecosystem treasury.

Supply: Digital Protocol

Listings on a number of main centralized exchanges (CEXs), the liquidity of $VIRTUAL has considerably improved, making it simpler for buyers to entry and take part.

As well as, Virtuals is actively increasing its strategic partnerships, collaborating with tasks like Illuvium (a Web3 sport) to combine AI into gaming, and partnering with Nillion, Digital Labs, and Aikoi.ai to develop personal information storage, AI brokers, and sport integration.

In March 2025, Virtuals launched the Virtuals Companions Community (VPN) – a community that brings collectively funding funds (resembling Delphi Ventures), trade specialists, and main researchers to assist AI founders constructing tasks on the platform.

Learn extra: Trading with Free Crypto Indicators in Night Dealer Channel

$VIRTUAL Staking Mechanism & Comparability to Binance Alpha

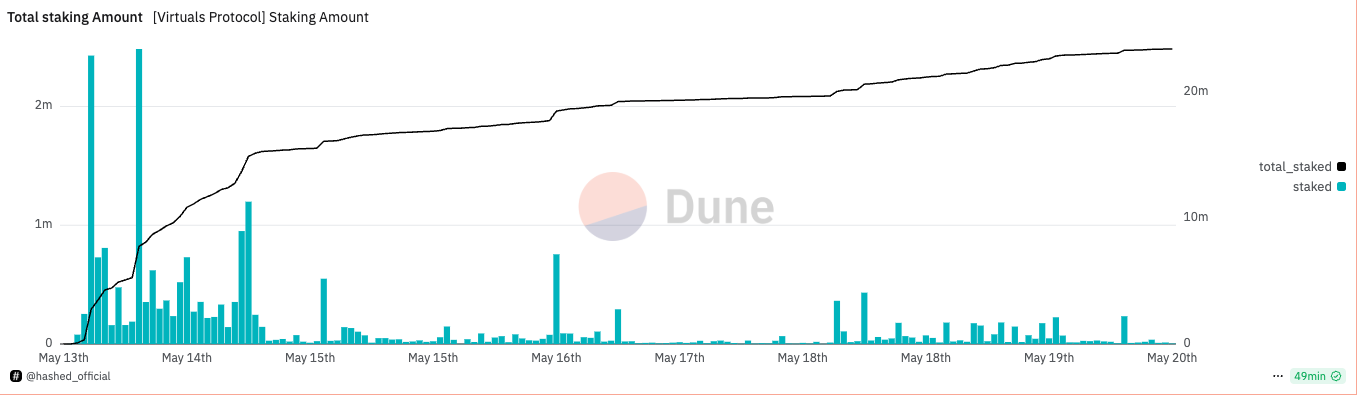

Virtuals Protocol has launched a vote-escrow (ve) staking mannequin designed to incentivize long-term holding and reward lively contributors.

When customers stake their $VIRTUAL tokens (with a lock-up interval of up to 2 years), they obtain veVIRTUAL – an escrowed governance token representing long-term dedication and ecosystem privileges. Notably, 20% of the entire reward factors (Virgen Factors) within the system are allotted to veVIRTUAL holders.

Supply: Digital Protocol

Beforehand, merely holding $VIRTUAL in a pockets was sufficient to build up factors. Now, solely customers who stake and maintain veVIRTUAL are eligible to earn factors, which means tokens have to be actively locked to completely take part in airdrop campaigns.

The veVIRTUAL mannequin transforms $VIRTUAL from a passive asset into an lively participation software: stakers not solely acquire future governance rights (voting) but in addition precedence entry to rewards and airdrops from new tasks.

Particularly, veVIRTUAL holders are eligible to obtain parts of the “Genesis Airdrop” — free token distributions from new tasks launching on Virtuals. Distributing rewards by means of veVIRTUAL ensures that solely long-term, dedicated customers profit, making the system fairer than earlier fashions.

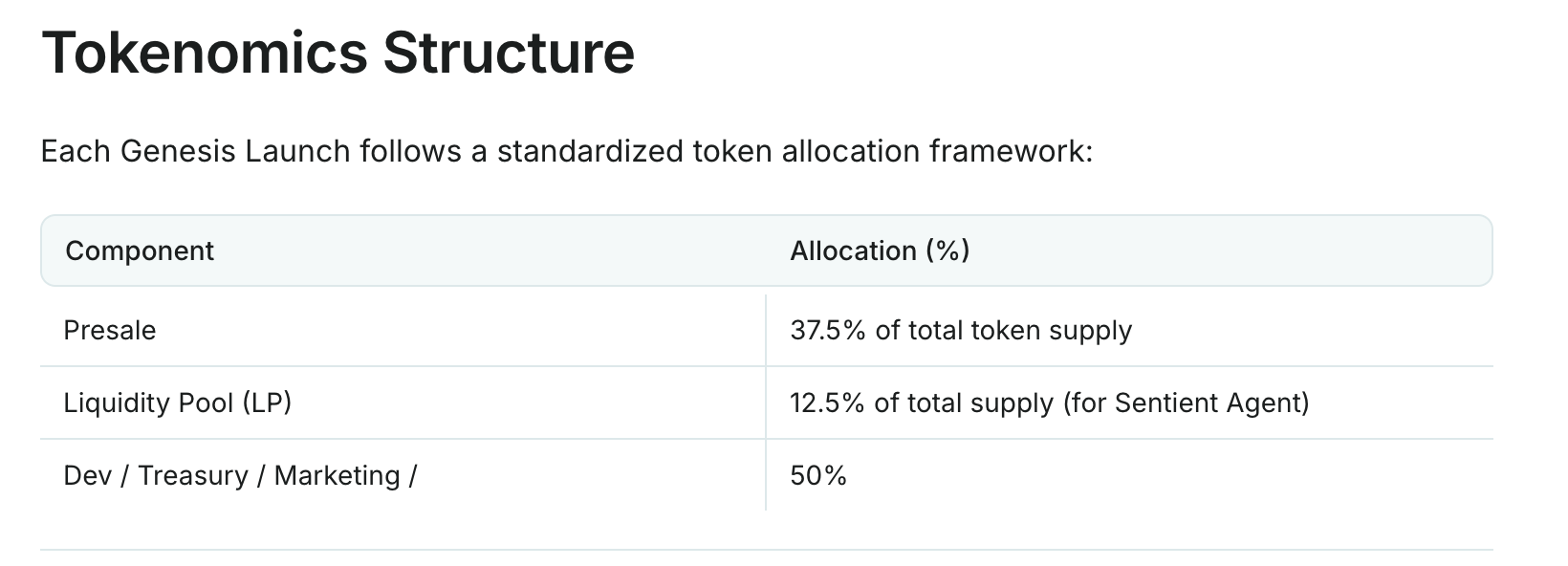

Genesis Launch is the identify for preliminary token choices on the Virtuals platform. Every Genesis Launch runs for twenty-four hours, throughout which customers stake $VIRTUAL together with their Virgen Factors to register for a brand new token sale.

The system calculates allocation primarily based on every person’s contribution ratio (factors + staked tokens) relative to the entire. If the entire staked $VIRTUAL falls under a required threshold, all contributions will likely be refunded.

How $VIRTUAL Is Being Used

Inside the Virtuals ecosystem, $VIRTUAL is greater than only a governance or cost token – it’s a necessary asset for incomes Virgen Factors, which perform as allocation tickets for Genesis Launches. These factors can considerably enhance a person’s probability of receiving early entry to new token gross sales at discounted costs.

Key use instances for $VIRTUAL embrace:

- Holding $VIRTUAL long-term: Wallets that maintain $VIRTUAL earn each day Virgen Factors primarily based on holding length and quantity.

- Trading $VIRTUAL: Shopping for and promoting additionally generate factors, though at decrease charges.

- Staking ecosystem tokens: Customers can stake associated tokens resembling $VADER, $AIXBT, $SHEKEL, and $ALCOLYTE to earn factors. Notably, $VADER affords the best level multiplier (5% of each day allocation).

- Digital Trenches participation: A particular occasion that enables staking of Sentient or Prototype brokers for each day factors.

- Holding Genesis Launch tokens: Customers who maintain bought tokens for greater than 24 hours are eligible for bonus factors.

- Content material creation: Publishing or sharing high quality posts about Virtuals on X (previously Twitter) and linking them to the platform can even earn factors primarily based on engagement metrics.

This reward mannequin amplifies demand for $VIRTUAL, because the token turns into a prerequisite for maximizing allocations and rewards. As a substitute of being passively held, $VIRTUAL is actively used throughout a number of verticals – a habits that reduces provide stress and helps price stability.

Supply: Dune

We’ve seen comparable token demand dynamics work properly prior to now:

- INJ (Injective) skilled fast development after introducing staking rewards and ecosystem incentives.

- SUI benefited from its Sui Quest program and airdrop ecosystem.

- BERA gained over 300% in three weeks following a combo of airdrops and staking campaigns.

These examples spotlight a sample: well-designed incentive loops typically precede bullish token momentum.

Comparability with Binance Alpha

The token distribution method of Virtuals Protocol shares a number of similarities and variations with Binance Alpha, Binance’s early-stage venture assist platform. Each methods are designed to incentivize person participation and reward long-term contributors by means of staking and point-based mechanisms.

Binance Alpha is a centralized platform throughout the Binance Pockets ecosystem, centered on introducing and supporting early-stage crypto tasks. Participation in airdrops and TGE occasions depends upon Alpha Factors, that are gathered primarily based on asset balances and buying and selling quantity of Alpha tokens during the last 15 days.

Alpha Factors are calculated each day and embrace:

- Steadiness Factors: awarded primarily based on pockets holdings (starting from 1 to three factors/day)

- Quantity Factors: growing exponentially with buying and selling exercise.

Customers should preserve a minimal Alpha Level threshold to qualify for participation in airdrops or TGEs. In particular instances like WIO, customers are required to build up sufficient Alpha Factors, and every participation consumes a portion of their factors.

The important thing distinction lies within the participation mechanism:

- Virtuals Protocol requires customers to stake tokens and interact instantly throughout the ecosystem.

- Binance Alpha, against this, is predicated on pockets balances and buying and selling exercise, with out requiring staking.

Virtuals Protocol runs a decentralized, on-chain mannequin on Base, in contrast to the centralized, custodial setup of Binance Alpha.

| Digital Protocol | Binance Alpha | |

| Airdrop Mechanism | Staking VIRTUAL → veVIRTUAL → Genesis Airdrops | Steadiness + Quantity → declare airdrop |

| Reward Factors | From staking and on-chain exercise | Based mostly on asset stability and token purchases |

| Launchpad/WIO Participation | Requires veVIRTUAL/Virgen Factors | Preserve $1,000+ belongings & commerce Alpha tokens |

| Minimal Asset | No fastened minimal; factors scale with staking length and quantity | ~$1,000 belongings + ~0.1–0.3% buying and selling payment per Alpha token buy |

| Dangers | $VIRTUAL price volatility | Token price fluctuations, excessive buying and selling frequency necessities (excessive payment) |

Binance Alpha leverages Binance’s person base, whereas Virtuals affords a decentralized launchpad pushed by actual on-chain contributions.

Virtuals builds a stronger group by rewarding staking, content material creation, and lively participation over passive pockets balances.

Protocol might evolve into a number one various to centralized launchpads, providing fairer entry and stronger token efficiency for early supporters.

VIRTUAL Value Prediction: Brief-term Outlook

Based mostly on technical analysis and present market information, the short-term price vary for $VIRTUAL is projected to be between $2.40 and $3.50.

Constructive information circulate and the general restoration within the crypto market, $VIRTUAL has surged roughly +270% prior to now 30 days, reclaiming the $2.00 mark by mid-Might 2025.

Nonetheless, technical indicators counsel that the $1.80–$2.00 zone is a vital resistance degree. $VIRTUAL wants to interrupt by means of this vary to substantiate a sustained bullish development. Buyers ought to monitor assist ranges ($1.30 and deeper at $1.00) and resistance zones ($2.00, $3.00) intently.

It stays the highest narrative in crypto proper now, and Virtuals Protocol sits squarely on the intersection of DeFi and AI-driven on-chain brokers.

As one of many foremost AI-centric ecosystems, $VIRTUAL goals to seize the primary wave of latest capital flowing into this area. If these developments persist, we might very properly see $VIRTUAL decisively break its all-time excessive and even take a look at ranges within the $4–$5 vary within the coming weeks.

Conclusion

The price of $VIRTUAL is prone to commerce between $2.40 and $3.50. Elementary analysis signifies that Virtuals Protocol has a powerful basis, with wholesome tokenomics, a crew actively increasing the ecosystem, and a steadily rising person base pushed by staking incentives and on-chain engagement.

Potential catalysts for additional price restoration embrace profitable Genesis Launch occasions which have delivered excessive returns to individuals, in addition to the potential of listings on main centralized exchanges.

In the long run, $VIRTUAL might grow to be a high token within the AI Agent narrative. This depends upon attracting high quality AI tasks and sustaining sturdy ecosystem development.

Learn extra: High 10 AI Agent Tokens: The Strongest Narrative within the Web3 Market