Aave TVL doubles to a report $40.3 billion, signaling renewed power in Ethereum’s DeFi ecosystem as institutional and retail curiosity drives unprecedented progress in 2025.

New week, new all-time excessive.

$40.3 billion web deposits 👻

The best TVL ever reached by a DeFi protocol. pic.twitter.com/XBRnruemQz

— Aave (@aave) Might 12, 2025

Aave TVL Doubles in 2025

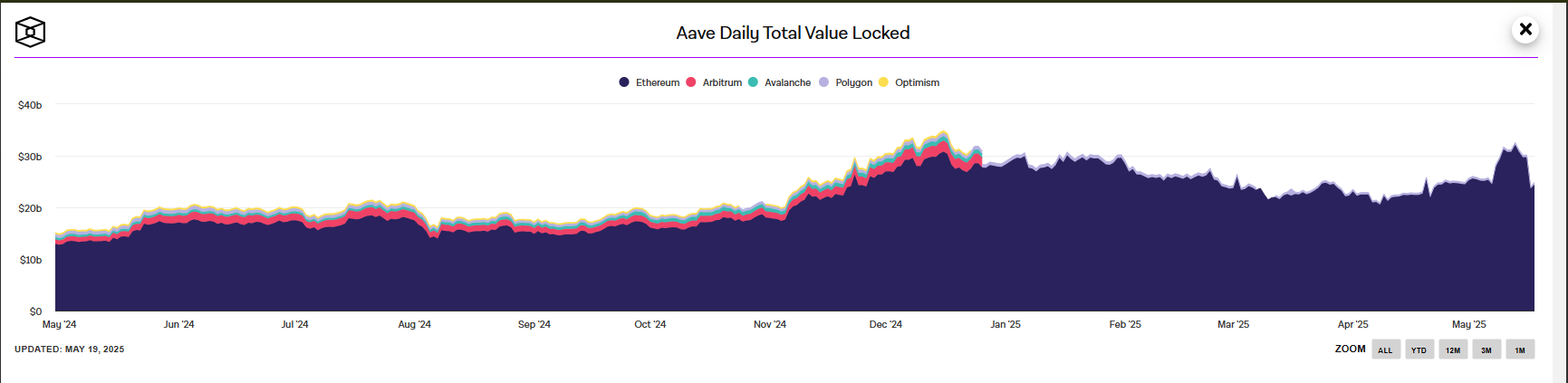

AAVE, Ethereum’s main decentralized finance (DeFi) lending protocol, has reached an all-time excessive complete worth locked (TVL) of $40.3 billion as of Might 12, 2025, a 50% improve from its year-to-date low of $20 billion.

Supply: The Block

This milestone positions it as the highest DeFi protocol by TVL, surpassing opponents like Lido DAO, which holds $33.8 billion. The surge displays rising confidence in Ethereum’s ecosystem, fueled by improved market circumstances and Ether’s price rally from $1,500 to $2,500 previously month. Aave’s excellent debt has risen to $10 billion, sustaining a wholesome 33% debt-to-TVL ratio, indicating strong utilization and liquidity.

Study extra: Aave vs Jupiter: Ethereum vs Solana Struggle in DeFi Sector

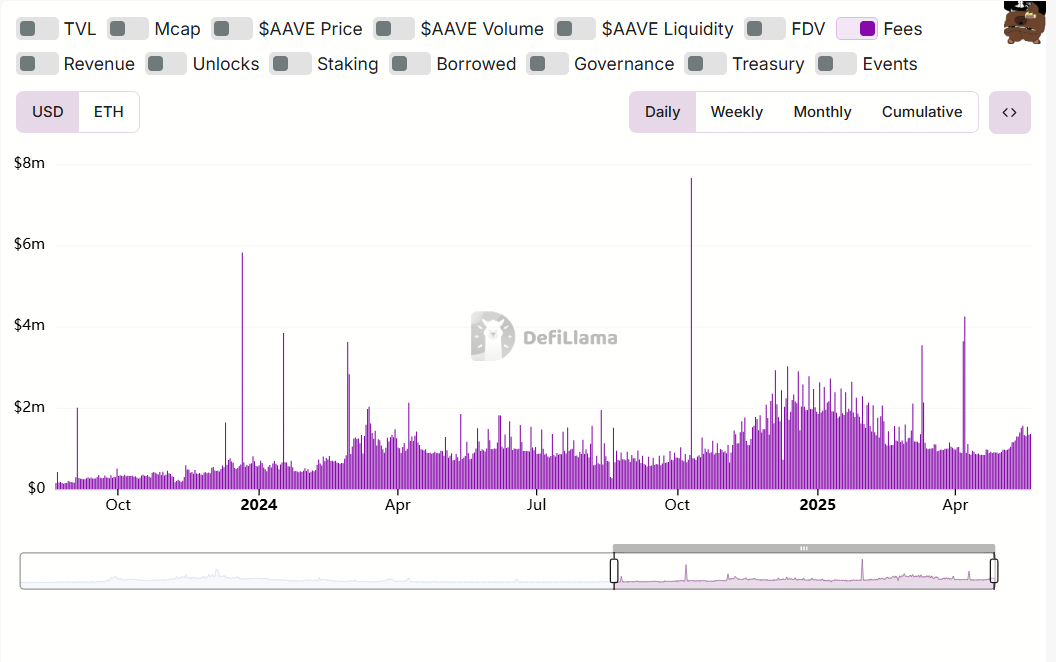

Aave’s every day charges have reached $1 million, and its lending markets throughout Ethereum and Layer 2 options like Arbitrum and Optimism have attracted $500 million in collateral netflows in a single week. The combination of Chainlink’s SVR, overlaying 27% of Aave’s TVL, enhances safety and scalability, additional boosting investor belief.

Supply: DefiLlama

Ethereum’s DeFi Power Persists Regardless of Competitors

Ethereum ETH stays the spine of DeFi, with a TVL of $77.15 billion, accounting for 51.24% of the sector’s complete, regardless of fierce competitors from Solana and L2 options like Arbitrum and Optimism.

Aave’s 19.63% share of DeFi TVL is bolstered by its strong ecosystem, internet hosting practically 5,000 dApps, together with Uniswap and MakerDAO, and over 290 million lively addresses.

Solana’s DeFi ecosystem, that includes initiatives like Raydium and Jupiter, excels in high-frequency buying and selling and memecoin surge, with 400+ DeFi and NFT initiatives and $1.8 billion in Raydium’s TVL alone.

Solana’s Proof-of-Historical past (PoH) and low-cost transactions ($0.00025 per transaction) appeal to builders for scalable dApps, significantly in gaming and memecoins, however its 2,000 validators elevate centralization issues in comparison with Ethereum’s 800,000+.

L2 options like Arbitrum, with $8 billion in stablecoin quantity, and Optimism problem Ethereum’s mainnet by providing quicker, cheaper transactions, diverting some liquidity. Regardless of this, Ethereum’s first-mover benefit, mature developer neighborhood, and Pectra improve guarantee its DeFi dominance, whereas Aave’s cross-chain technique counters Solana’s pace benefit.

Regardless of these hurdles, Aave’s progressive options, similar to permissioned RWA collateral and the GHO stablecoin, bridge conventional finance and DeFi, attracting institutional curiosity.