UniSwap (UNI) is witnessing a major change in market dynamics, fueled by whale exercise and main on-chain indicators. Right now, crypto analyst Onchain Lens noticed a whale who withdrew 947,557 UNI tokens value $5.61 million from Binance.

Whale turns bullish on UniSwap

This withdrawal motion reveals that the whale seems to be a long-term purchaser who’s positioning himself within the UniSwap marketplace for potential future price development.

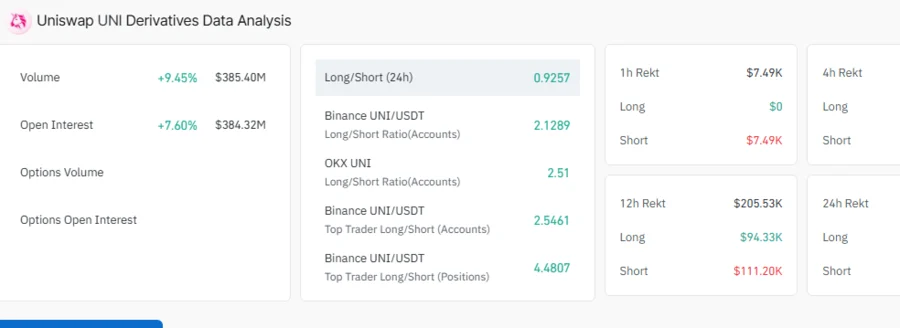

On the second notice, this investor’s exercise means that whales and savvy merchants are shopping for UNI tokens, attracted by the asset’s potential. Right now, the token’s transaction quantity rose by 9.45% from yesterday (as per Coinglass information), suggesting a latest improve in market exercise. That is an indicator of an elevated variety of consumers withdrawing UNI tokens from exchanges, transferring them to personal wallets for holding functions.

A sustained withdraw exercise usually ignites optimistic impacts on crypto costs like UNI. This sometimes occurs this fashion as a result of such exercise tends to lower the availability of tokens on exchanges and subsequently prompts a possible improve of an asset’s price.

Key indicators pushing UniSwap ahead

A number of on-chain indicators present that UNI is poised to see an uptrend. First, UniSwap is a robust platform whose development is supported by a number of protocols, together with Unichain, working inside its ecosystem. Simply to say just a few, UniSwap is the most important participant within the decentralized alternate sector. Regardless of robust competitors from different DEXs, it nonetheless retains its robust market share.

Over the previous 30 days, it processed transactions valued at greater than $64 billion, outperforming its rivals, together with PancakeSwap, Raydium, and Meteora, which processed transactions value $51.1 billion, $26 billion, and $17.8 billion, respectively. This development is presumably as a result of UniSwap operates in a number of blockchains, together with Avalanche, Base, Arbitrum, Polygon, and Ethereum.

Secondly, the whale’s withdrawal from Binance has attracted substantial consideration within the UniSwap group. Whale actions like this usually affect liquidity and may set off potential upward motion. At press time right this moment, the asset’s price is standing at $6.24, up 6.5% over the previous 24 hours. This soar signifies that the market is getting ready to expertise upswing within the coming days.

On the third level, whereas the whale withdrawal highlights rising market participation, Open Curiosity additional confirms this bullishness. As per metrics from Coinglass, UniSwap’s Open Curiosity (IO) has elevated by 7.60% right this moment, suggesting rising curiosity amongst merchants within the derivatives market. This reveals that an elevated variety of futures merchants are putting lengthy premiums, optimistic a few potential future price hike.

In one other essential indicator, UniSwap is at present buying and selling in a double-bottom sample. This can be a bullish reversal sample displaying that the present downward motion is ending and an upside would possibly emerge. This implies that the asset is prone to break the resistance ranges of $6.613 and $6.739 quickly.