Binance – the world’s largest cryptocurrency trade, is usually thought-about the “golden stamp” for a token as soon as it will get listed on the spot market. Nevertheless, in latest months, the rising development of token delistings has raised severe questions concerning the sustainability of its itemizing ecosystem.

This text analyzes the ratio between tokens listed on the spot market and people delisted from Binance over the previous three years, providing key insights for buyers.

Spot Itemizing vs. Delisting Ratio

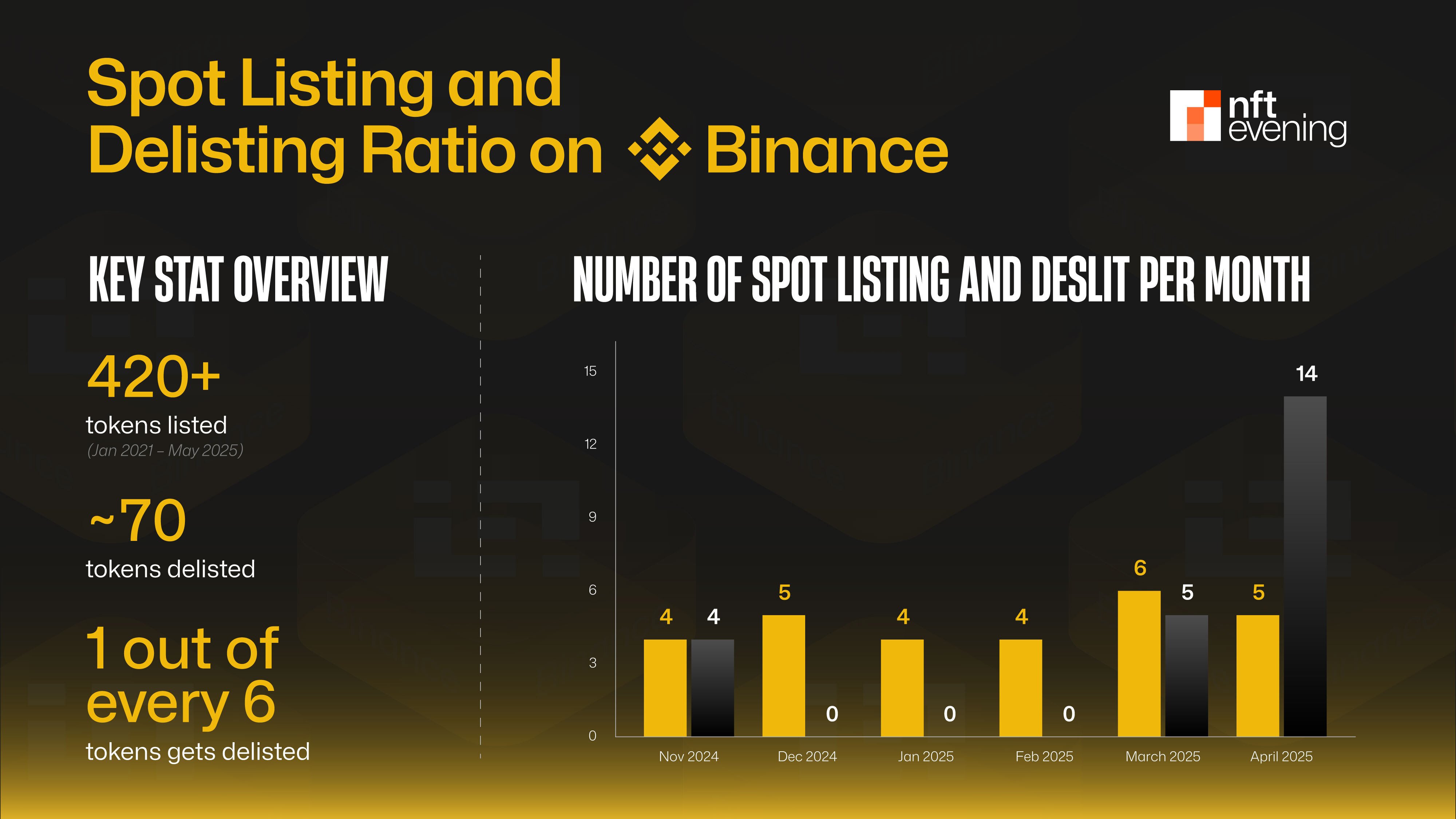

In response to knowledge compiled from CoinGecko and Dune Analytics, from early 2021 to Could 2025, Binance listed over 420 tokens on its spot market. Throughout the identical interval, almost 70 tokens have been delisted, equal to a delisting price of roughly 16.6%.

On common, for each 6 tokens listed, 1 token is delisted inside the following 1 to 2 years. It is a notable statistic, particularly on condition that many buyers nonetheless view a Binance itemizing as a mark of security and credibility.

Nevertheless, one noteworthy development is the shift in how Binance handles delistings. As an alternative of delisting tokens sporadically, Binance has moved towards a extra cyclical and clear analysis course of. That is evident in large-scale delisting batches in November 2024 and April 2025.

Learn extra: Binance Delist 14 Tokens in First “Vote to Delist” Batch

In these rounds, for each 10–15 tokens listed, a batch of 5–10 tokens was eliminated directly, signaling that Binance is adopting a cluster-based cleanup technique, particularly throughout market downturns or when itemizing requirements are tightened.

This mannequin displays a stricter high quality management coverage, shifting away from relying solely on particular person token efficiency. It aligns with a broader push for improved regulatory compliance and better venture requirements in a extra mature market surroundings.

Learn extra: Trading with Free Crypto Alerts in Night Dealer Channel

Causes for Delisting and the Periodic Evaluate Course of

Binance enforces a strict analysis course of earlier than itemizing any new token. Key standards embrace the event staff, liquidity, authorized compliance, and technological worth.

These similar standards are additionally utilized periodically to reassess listed tokens. If a token now not meets the required requirements, Binance could resolve to delist it.

In response to Binance Academy and Binance Help, frequent causes for delisting embrace low buying and selling quantity, lack of technological progress, regulatory or safety points, and in some circumstances, delisting is requested by the venture staff itself.

As well as, Binance has not too long ago launched a “Community Delisting Vote” mechanism – permitting customers to suggest the removing of underperforming tokens from the platform.

Past technical and regulatory elements, delisting can be a strategic transfer to stop liquidity fragmentation throughout too many tokens. When numerous belongings are listed, buying and selling quantity and capital can develop into diluted, decreasing market depth and consumer expertise.

By eradicating underperforming or inactive tokens, Binance can focus liquidity on higher-potential belongings – together with exchange-backed cash, newly listed tokens, and main ecosystem initiatives. This strategy enhances buying and selling effectivity and helps the expansion of prioritized buying and selling pairs on the platform.

Some Notable Case Research

ALPACA (ALPACA) is a notable instance. Though the token was introduced for delisting in late This fall 2025, it unexpectedly surged by over 600% shortly afterward resulting from a sudden shopping for spree when liquidity reopened on decentralized exchanges (DEXs).

This highlights how “short squeezes” or speculative buying and selling habits can happen even after unfavorable information, particularly when the market senses low liquidity and potential provide shortage throughout different platforms. Nevertheless, this price rally didn’t replicate any elementary restoration or long-term worth of the token.

Learn extra: ALPACA Token’s Surprising Journey: Quick Squeeze, Issuance Freeze, and Looming Delisting

The case of MITH (Mithril) additionally drew consideration when the token was delisted in late 2022. The venture later sued Binance, alleging a scarcity of transparency within the delisting course of.

This set a authorized precedent, underscoring the regulatory dangers exchanges could face if delisting procedures are opaque. Being listed means little long-term until a venture stays clear and retains its group engaged.

TUSD, as soon as backed by Binance, was delisted in March 2024 with its liquidity eliminated unexpectedly.

Even tokens linked to the trade danger delisting in the event that they lack transparency or face regulatory points.

What are the primary takeaways?

Binance has listed many tokens tied to traits like GameFi, AI, meme cash, and RWA prior to now yr. Many tokens commerce below $1M every day, with poor liquidity and vast bid-ask spreads.

Supply: Dune

Many initiatives go inactive 3–6 months post-listing, risking delist if they’ll’t maintain progress or help.

For instance, meme cash like XAI and BOME have been listed throughout waves of social media-driven FOMO. Nevertheless, they quickly skilled sharp declines in buying and selling quantity. Low updates and fading communities increase delisting dangers if initiatives fail to ship lasting worth.

GameFi tokens like DAR and TLM now face low exercise and weak help, risking delisting with out strategic adjustments.

Supply: TradingView

Conclusion

Roughly 1 in 6 listed tokens will get delisted — itemizing doesn’t assure long-term security.

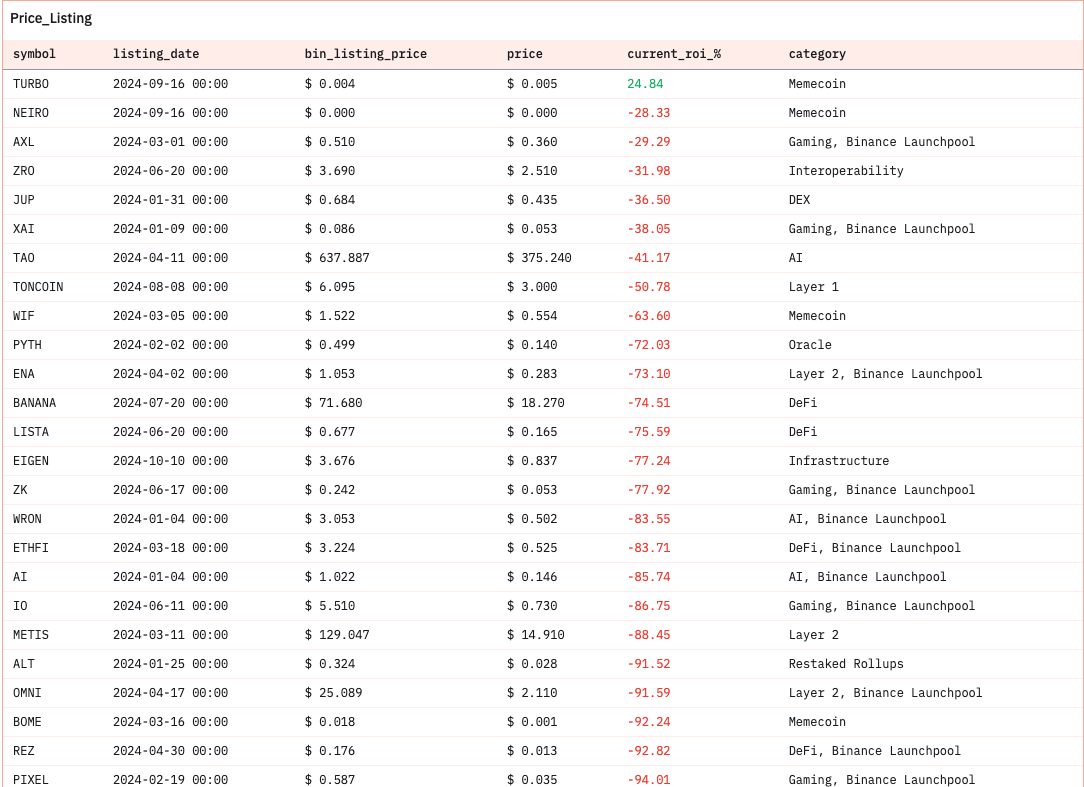

A token’s itemizing on Binance doesn’t guarantee long-term price appreciation. Many tokens jumped 10–20x at itemizing, then dropped 99% inside a yr.

Excessive-FDV tokens with lengthy vesting typically face staff abandonment or liquidity manipulation.