Picture supply: Getty Photographs

One of the vital thrilling holdings in my Shares and Shares ISA is Joby Aviation (NYSE: JOBY). This can be a chief in creating electrical vertical take-off and touchdown (eVTOL) plane. Or electrical air taxis, in plain phrases.

At $7.50 as I write, the inventory is up 49% over the previous 12 months. That’s a really stable return by any stretch of the creativeness.

So, why do I believe I may need backed the improper horse? Let me clarify.

Revolutionising short-distance journey

Joby’s eVTOLs can take off vertically like a helicopter and fly like a drone. They transport a pilot and 4 passengers in near-silence at speeds of up to 200mph. A flight can substitute a one-to-two-hour drive with a journey that takes 10-20 minutes, probably saving hours sitting in site visitors.

The agency’s first industrial service is on observe to launch later this 12 months in Dubai, the place building of a vertiport on the worldwide airport is underway.

However Joby isn’t the one recreation on the town. One other eVTOL firm known as Archer Aviation (NYSE: ACHR) can be racing to commercialise an air taxi service. The inventory jumped 22% on 13 Might, bringing its one-year achieve to 253%!

Reassessment

Symbolically, which means that Archer’s market cap of $7.3bn has overtaken that of Joby ($5.7bn) for the primary time. A 12 months in the past, Joby’s was greater than twice Archer’s — the clear chief. So traders have reassessed the aggressive dynamics right here.

Like Joby, Archer is about to launch a industrial service within the Center East on the finish of this 12 months (in Abu Dhabi). Each have related quantities of money on the steadiness sheet and are progressing properly in the direction of securing plane certification with the US Federal Aviation Administration (FAA).

So, what’s the distinction? Nicely, in its current Q1 outcomes, Archer mentioned it was partnering with Palantir to “construct synthetic intelligence (AI) for the way forward for next-gen aviation applied sciences“. It’s already partnered with defence start-up Anduril to leverage cutting-edge AI expertise to make a army eVTOL.

Due to this fact, the corporate is shifting shortly to safe progressive defence partnerships. There is likely to be early proof rising that bold Archer is extra forward-thinking than Joby.

None of this may have bothered me a 12 months in the past. Again then, I owned each shares. Nevertheless, I made a decision to get off the fence and go together with one over the opposite. With Archer inventory up over 200% since I offered it, that’s wanting like a mistake.

| Archer Aviation | Joby Aviation | |

| Market cap | $7.3bn | $5.7bn |

| Money | $1bn | $813m |

| Q1 internet loss | $93.4m | $82.4m |

| Backers | Boeing, Stellantis, and United Airways | Toyota, Uber, and Delta Air Strains |

Excessive-risk, high-reward inventory

Some analysts envision a $1trn marketplace for eVTOLS over the subsequent decade. However there are many operational and regulatory dangers to navigate for each corporations. There might be delays or a security incident that units the entire business again.

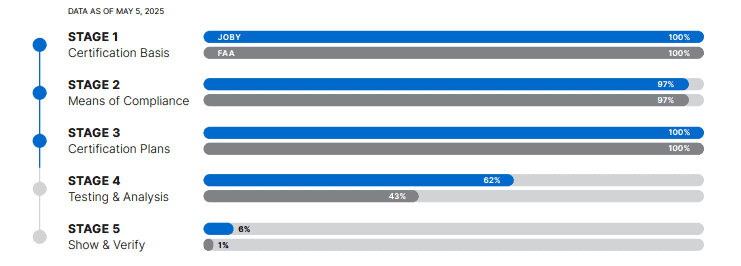

In Q1, Joby had accomplished 62% of the fourth stage of plane certification (of 5). It had $813m in money, plus an extra $500m dedication from backer Toyota. It additionally introduced a partnership with Virgin Atlantic to launch air taxis within the UK.

It’s too early to say if I backed the improper horse. However the truth one is outperforming the opposite by a large margin is a little bit disappointing.

Long run, I’m nonetheless bullish on Joby, as eVTOLs ought to be an enormous development market. Reality is although, we don’t know what margins will seem like, that means this inventory is just appropriate for traders with a abdomen for top danger.