Shiba Inu’s (SHIB) alternate reserves have fallen to their lowest degree in years. The present reserve steadiness throughout all main exchanges sits close to 96 trillion SHIB, a pointy drop from the 180 trillion seen in early 2024. This drastic discount indicators that fewer tokens at the moment are obtainable for fast buying and selling, which may tighten provide and probably push costs greater if demand picks up.

Alternate reserves observe the quantity of cryptocurrency held on centralized exchanges. These tokens are usually obtainable for rapid shopping for or promoting. A drop in reserves often means extra tokens are being moved to personal wallets, suggesting that holders choose to maintain SHIB off exchanges. This will point out long-term holding habits or preparation for staking, burning, or different utility-driven exercise.

All through 2025, the decline in Shiba Inu alternate reserves has been regular. However in latest weeks, the drop has accelerated. This coincides with elevated market curiosity, as costs briefly rose to $0.000017 earlier in Might earlier than pulling again to the $0.000015 vary.

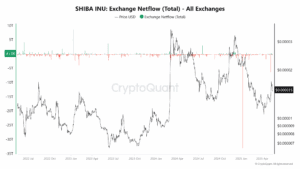

This discount in provide is supported by SHIB’s netflow information, which reveals persistent detrimental move—extra tokens leaving exchanges than getting into.

One main spike confirmed greater than 20 trillion SHIB leaving exchanges in a single transfer. These outflows are often seen as bullish, as they take away tokens from the open market.

Is a Provide Shock Coming?

A provide shock happens when obtainable provide instantly turns into restricted whereas demand stays the identical or will increase. With SHIB’s alternate balances dropping and no important rise in new provide, the stage is being set for such a state of affairs. If demand will increase—maybe triggered by a burn occasion, main information, or broader altcoin rally—costs may rise rapidly as a result of restricted sell-side liquidity.

Nonetheless, for now, on-chain exercise doesn’t present a surge in demand. Energetic addresses and transaction counts stay flat, suggesting that retail engagement is low. With out sturdy demand, low provide alone will not be sufficient to set off a pointy rally.

You Might Additionally Like: Bitcoin (BTC) Reversal To $60K? $74K Hole and Bearish Cues Elevate Purple Flags

Derivatives and Sentiment: What Do They Say About Shiba Inu?

Futures information gives a combined image. SHIB’s open curiosity stays regular, and funding charges are close to impartial. This reveals that leverage merchants are cautious and never closely betting in both path. Moreover, latest liquidations had been minor, which implies no main quick squeeze or panic shopping for has occurred but.

This cautious stance amongst merchants aligns with the flat RSI and weakening momentum on the 4-hour chart. The Relative Energy Index is hovering round 44, under the 50 impartial mark, signaling gentle bearish momentum.

Shiba Inu’s Market Worth to Realized Worth (MVRV) ratio stands at 0.81, based mostly on information from IntoTheBlock. This implies most holders are nonetheless in a loss. Traditionally, an MVRV under 1 typically signifies undervaluation. If sentiment shifts and demand picks up, this might give bulls a cause to purchase, particularly with provide drying up on exchanges.

Technical Indicators Sign Brief-Time period Weak spot

SHIB is at present buying and selling inside a descending triangle sample, which usually indicators bearish continuation except damaged to the upside.

On the time of writing, SHIB is buying and selling just under the 20 EMA ($0.00001535) and 50 EMA ($0.00001516), each of that are sloping downward. This alignment displays short-term bearish stress. Nonetheless, the token nonetheless holds above its 100 EMA ($0.00001459) and 200 EMA ($0.00001395), indicating that the broader bullish development has not but been damaged.

The Relative Energy Index (RSI) sits at 44.50, exhibiting a scarcity of sturdy momentum. It stays under the impartial 50 degree, indicating that sellers at present have a slight edge. Nonetheless, RSI is making an attempt to stabilize, and a transfer above 50 would sign a doable shift in development.

This setup creates a decent squeeze between declining resistance and flat help. A break under $0.00001500 may push SHIB towards the 100 EMA round $0.00001460, and probably towards $0.00001400 close to the 200 EMA. Conversely, if bulls handle to reclaim the 20 EMA and push above the descending trendline, SHIB may try a breakout towards $0.00001600 and above.