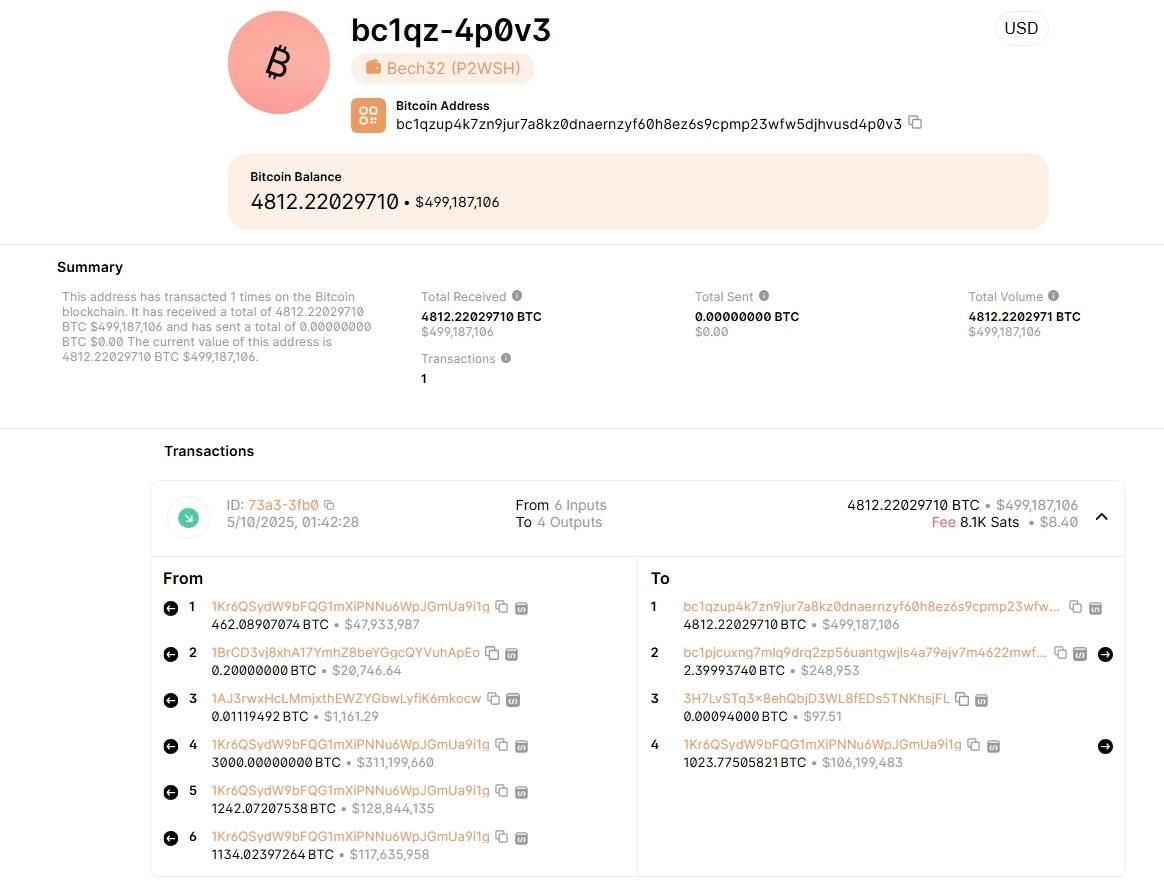

On Could 14, 2025, Twenty One Capital, a Bitcoin-native monetary agency backed by heavyweights like Tether, SoftBank, and Bitfinex, made headlines by buying 4,812 BTC for $458.7 million at a median price of $95,300 per Bitcoin.

JUST IN: Jack Mallers Twenty One Capital and Tether buys 4,812 #Bitcoin for $458,700,000 🤯 pic.twitter.com/SZFMZcDBAa

— Bitcoin Journal (@BitcoinMagazine) Could 13, 2025

A Large Bitcoin Buy Indicators Strategic Ambition

The Bitcoin BTC buy, executed via Tether, has propelled the agency to grow to be the third-largest public Bitcoin holder, with over 42,000 BTC in its treasury.

Supply: X

Led by CEO Jack Mallers, Twenty One Capital goals to maximise Bitcoin per share, positioning itself as a pure-play Bitcoin alternative in capital markets. This transfer isn’t just a monetary flex however a strategic assertion, difficult established gamers like Technique (previously MicroStrategy) within the race to build up Bitcoin as a core asset.

Twenty One Capital’s technique suggests confidence in Bitcoin’s long-term worth, leveraging its institutional backing to capitalize on market fluctuations. In contrast to Technique, which has confronted challenges with inventory issuance inefficiencies (e.g., solely $10.7 million in Bitcoin bought on March 17, 2025), Twenty One Capital’s streamlined strategy via Tether’s liquidity alerts a nimble but highly effective technique. Mallers emphasised this distinction in a current interview, noting that his agency presents a purer Bitcoin funding automobile in comparison with Technique’s broader monetary maneuvers. This buy underscores Twenty One Capital’s ambition to redefine company Bitcoin adoption, mixing fintech innovation with conventional finance.

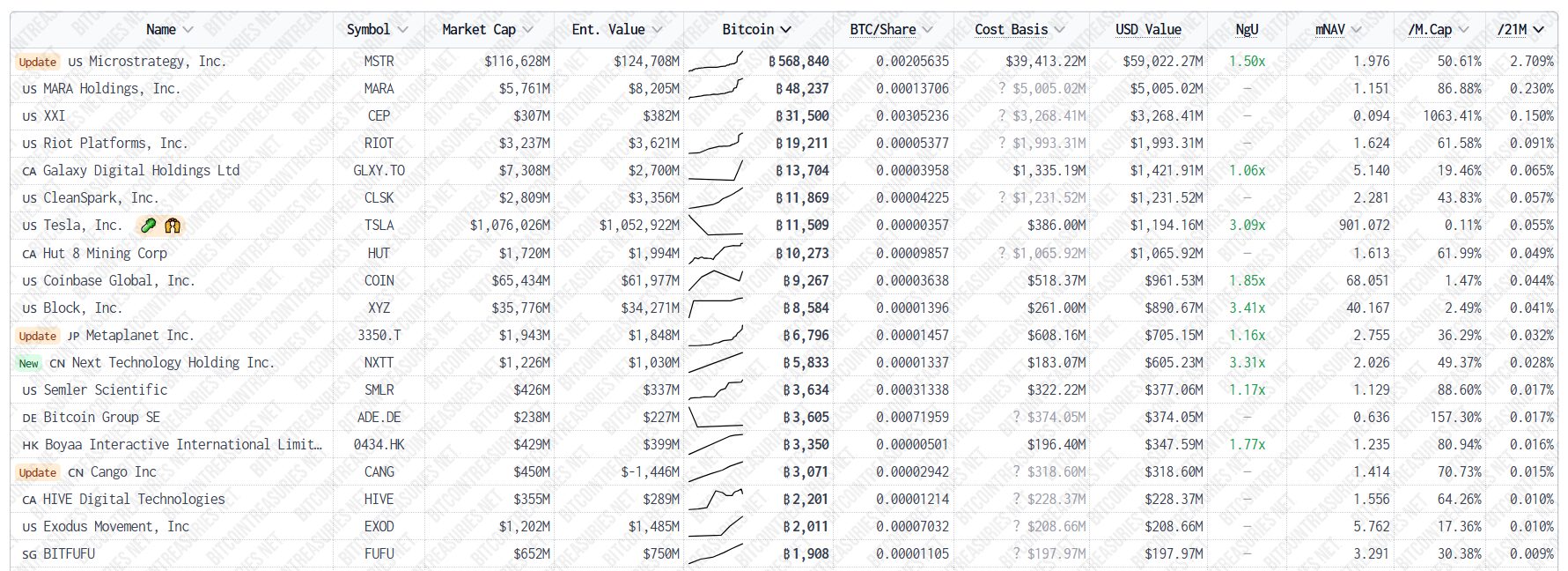

Supply: Bitcoin Treasuries

Different Establishments Using the Bitcoin Wave

Twenty One Capital will not be alone in its Bitcoin fervor.

Technique, underneath Michael Saylor’s management, stays the poster little one for company Bitcoin adoption, holding 568,840 BTC, value $39.41 billion as of Could 11, 2025. Technique’s “21/21” plan goals to lift $42 billion to additional bolster its Bitcoin reserves, although current hiccups in inventory gross sales have slowed its tempo.

Learn extra: Technique Bolsters Bitcoin Holdings with $1.34 Billion Buy

Metaplanet, dubbed “Strategy of Asia,” has additionally embraced Bitcoin, holding 6,796 BTC, already surpassing El Salvador’s holdings.

Learn extra: Metaplanet Provides 1,241 BTC, Surpasses El Salvador’s Holdings

Semler Scientific, a medical gadget firm, has joined the fray, holding a complete of three,634 BTC price $342 million by Could 2025.

These establishments view Bitcoin as “digital gold,” a hedge towards inflation and a retailer of worth in an unsure financial panorama. Their methods usually contain issuing bonds or shares to fund Bitcoin purchases, as seen with Technique’s $21 billion inventory providing and MicroStrategy’s earlier $561 million bond sale.

Considerably, this development displays a rising acceptance of Bitcoin amongst public corporations, with corporations like MARA, Tesla, and Tether additionally sustaining periodic Bitcoin acquisitions. Nonetheless, dangers stay, as evidenced by Technique’s $670.8 million This fall 2024 loss, pushed by its heavy Bitcoin wager. Twenty One Capital’s entry intensifies this high-stakes sport, doubtlessly setting a brand new benchmark for company crypto funding.