Picture supply: Getty Photographs

Many traders go for a Self-Invested Private Pension (SIPP) as a result of it provides considerably better management over how their retirement financial savings are managed. Not like conventional pension schemes, which generally restrict people to a slender vary of pre-selected funds, a SIPP permits for a much wider number of funding choices — together with particular person shares, funding trusts, ETFs, business property, and extra.

This flexibility might be significantly interesting to those that are assured in making their very own funding choices or who work with a monetary adviser to construct a tailor-made technique. Importantly, a SIPP additionally gives transparency. It permits traders to see precisely the place their cash goes and the way every element of the portfolio is performing. For a lot of, this visibility interprets into better confidence. It may well additionally imply a stronger sense of possession over their long-term monetary future.

Beginning younger

I opened my daughter’s ISA when she was lower than six months previous. Whereas the utmost contributions are comparatively small, they’re nonetheless topped up by the federal government, and provides her the easiest likelihood of compounding her option to an early retirement. And that’s necessary for me, as a result of I do fear in regards to the future, the job’s market, and the world I’m bringing her into.

The true benefit lies in time. Beginning early provides every pound the possibility to develop time and again, quietly accumulating over time. Even modest annual returns, when stretched over almost 20 years, can flip small deposits into one thing surprisingly substantial. And since beneficial properties throughout the ISA are tax-free, each little bit of progress stays working for her. It’s not about guessing markets or selecting winners — it’s simply letting time and consistency do the heavy lifting. The sooner it begins, the tougher compounding works.

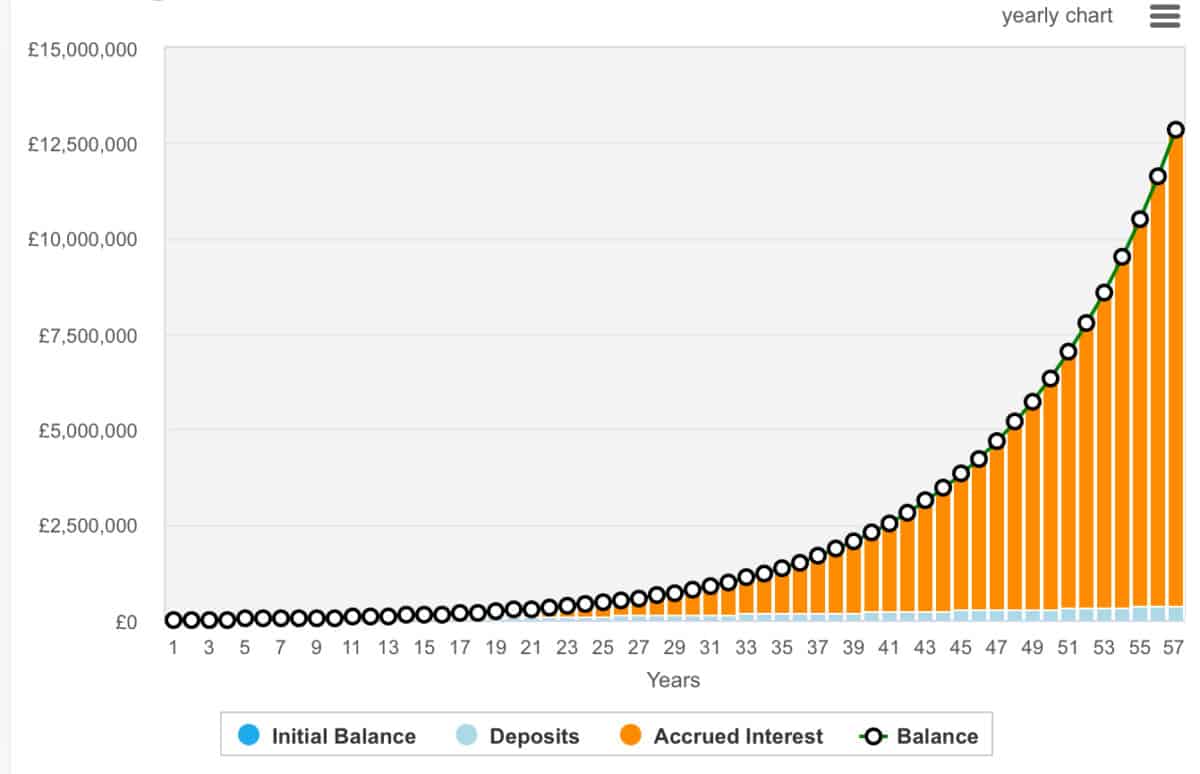

Right here’s a quite simple chart to indicate the way it can develop. I’ve began with £300 of month-to-month contributions — which is the present restrict together with the state contribution — and added a 2% improve to that contribution. Because of this in 50 years, the contribution can be round £800 a month. I’ve additionally assumed a ten% annualised return. That’s a robust return over the long term, however I’m backing myself right here.

The place to speculate?

Scottish Mortgage Funding Belief (LSE:SMT) has lengthy held a spot in lots of UK traders’ portfolios — and for good purpose. Managed by Baillie Gifford, the belief has constructed a popularity for daring, long-term investing in transformational progress firms all over the world.

Its portfolio consists of each private and non-private corporations, together with Nvidia and SpaceX. These investments usually specializing in disruptive applied sciences, healthcare innovation, and rising markets. Buyers are drawn to its international imaginative and prescient and willingness to again conviction bets early. Names like Tesla, Moderna, and ASML have all featured prominently.

Nevertheless, with that ambition comes danger. One key issue is gearing — using debt to doubtlessly amplify returns. Whereas this may improve beneficial properties in a rising market, it will possibly additionally deepen losses throughout downturns. The belief’s progress focus additionally means efficiency can lag in additional defensive or value-driven environments.

Nevertheless, for these traders comfy with volatility and pondering long run, although, Scottish Mortgage stays an ever-appealing choice. It’s one I regularly prime up on.