Picture supply: Getty Photos

Historical past reveals that, with the appropriate technique, investing in UK shares could be an efficient method to make one million kilos or extra by retirement.

WIth this in thoughts, are three steps for buyers concentrating on a seven-figure portfolio to contemplate.

1. Attempt to eradicate tax

The very first thing to consider is opening an funding account that may cut back or eradicate one’s tax liabilities. Within the UK, we’re speaking concerning the Particular person Financial savings Account (ISA) and the Self-Invested Private Pension (SIPP).

The great thing about these tax wrappers is twofold. Not solely can they save buyers a boatload of money from the clutches of HMRC. The cash that’s shielded can be reinvested, giving people an opportunity to supercharge portfolio progress by way of the miracle of compounding.

Shares and Shares ISA buyers can make investments £20k a yr, whereas SIPP customers can deposit a sum equal to their annual wage (up to a most of £60k).

Please notice that tax remedy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

2. Make investments as early as potential

‘Time in the market beats timing the market’, because the outdated saying goes. Slightly than ready for the perfect alternative to purchase, investing as quickly as potential — after which holding one’s cash locked up within the markets — is confirmed the simplest method to construct long-term wealth.

Contemporary proof from Hargreaves Lansdown underlines the effectiveness of such a technique. It says that greater than a 3rd (34%) of the Shares and Shares ISA millionaires on its books topped up their portfolio within the first two weeks of the 2024/25 tax yr.

By comparability, simply 2% of its millionaires invested within the remaining two weeks of the interval.

3. Construct a diversified portfolio

The ultimate factor to contemplate is creating an ISA and SIPP that’s properly diversified throughout plenty of traces (reminiscent of sector and geography). This gives buyers with publicity to a number of investing alternatives, in addition to danger mitigation that limits the influence of 1 or two underperforming property.

This may be achieved by shopping for a variety of particular person shares. Investing in trusts or funds that maintain quite a lot of property works, too. I personally use a mixture of each methods, and the iShares S&P 500 ETF (LSE:CSPX) is an exchange-traded fund (ETF) I at the moment personal.

In reality, it’s at the moment one in every of my largest holdings. With an beautiful common annual return of 13.2% since 2010, I don’t assume it’s tough to see why.

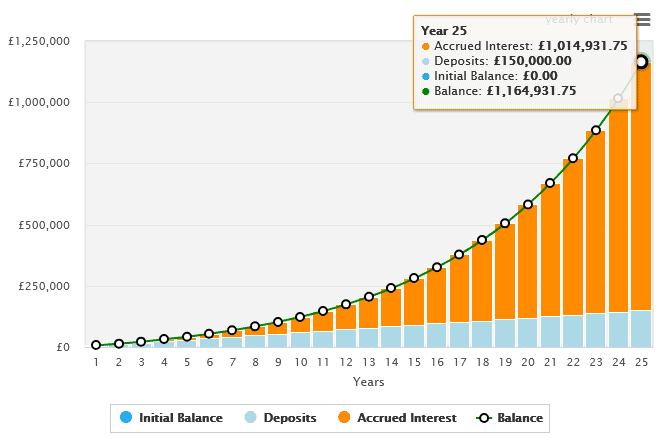

Previous efficiency isn’t at all times a dependable information to future returns. But when this ETF’s sturdy file continues, somebody who invested £500 right here a month would — after 25 years — have constructed an ISA or SIPP portfolio of £1.16m (excluding buying and selling charges).

With holdings in roughly 500 large-cap corporations, this one fund might facilitate a properly diversified portfolio simply by itself. With multinationals like Nvidia, Visa, Coca-Cola, and Amazon in its ranks, it achieves broad publicity by geography. And as that checklist reveals, it’s additionally successfully diversified by business.

Its efficiency extra just lately has been dented by the specter of growth-sapping commerce wars. Whereas this stays a risk going forwards, I consider S&P 500-based funds like this could stay highly effective long-term investments.