Picture supply: Getty Pictures

Ever since ChatGPT was launched into the wilderness in late 2022, there was a component of uncertainty hanging over Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Principally, some inventory market traders fear that AI chatbots will disrupt Google’s search empire, which remains to be the money cow for dad or mum firm Alphabet.

This worry was reignited with a vengeance yesterday (7 Might) when an Apple government revealed some worrying information relating to look. This despatched the Alphabet share price down 7.5%, bringing the three-month decline to 26%

What occurred?

It’s broadly believed that Google pays Apple over $20bn yearly for default standing on iPhones and Safari browsers. However testifying in a federal antitrust case yesterday, Apple government Eddy Cue stated that the iPhone maker is exploring AI-powered various search choices for Safari.

Subsequently, this might see Google being changed because the default search engine. Not superb for Alphabet.

Second, the manager additionally revealed that searches on Safari declined in April for the primary time ever! He attributed this to customers more and more turning to AI bots like ChatGPT and Perplexity to seek for issues.

A altering panorama

So, there are two important issues right here. The primary is a transfer away from Google being the default search engine on iPhones, which appears prone to me on condition that the lawsuits particularly use this as proof that Google is a monopoly. Providing extra selections looks like a simple treatment.

Whether or not or not customers will in the end select to make use of options is one other matter. Personally, I’m fairly completely satisfied utilizing Google on my iPhone for issues like purchasing and inventory market information, whereas utilizing chatbots like ChatGPT and Google’s Gemini for different issues.

For instance, ChatGPT helped me with a DIY downside the opposite day. I uploaded pictures and it talked me by way of what I wanted to do step-by-step. Beforehand I’d have searched Google for that, and doubtless been despatched to a prolonged YouTube video which could not have been very useful.

This hyperlinks to the second concern right here, which is altering client behaviour. Final 12 months, Gartner projected that there shall be a 25% decline in using conventional engines like google by 2026. So this latest drop in web searches reported by Apple may be the tip of the iceberg.

Very low cost tech inventory

The unusual factor right here although is that we’re seeing no proof but of disruption in Alphabet’s financials.

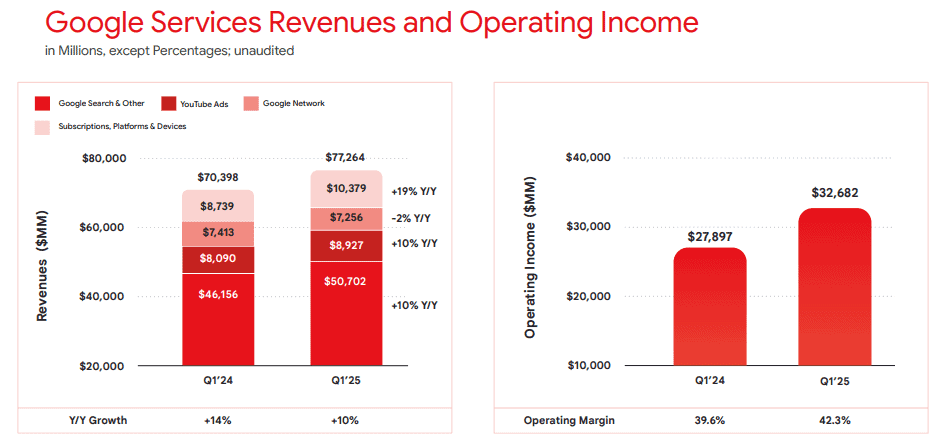

In Q1, complete income rose 12% 12 months on 12 months to $90.2bn, with the Google Search class rising from $46.2bn to $50.7bn. Google has rolled out its AI Overview function, which now has 1.5bn customers per thirty days and is even boosting engagement.

And whereas search was nonetheless liable for roughly 56% of complete income, that determine is way decrease than in earlier years. YouTube advertisements, subscriptions and Google Cloud proceed to develop strongly and supply diversification and optionality.

In the meantime, I count on its Waymo robotaxi enterprise to develop considerably. It’s now doing over 250,000 paid journeys each week, and that determine will in all probability be hundreds of thousands a day in future.

The inventory is buying and selling at simply 15 occasions Alphabet’s anticipated earnings for 2026. Regardless of the continuing dangers from the antitrust probe and a altering search panorama, that appears far too low cost to me.

I feel the inventory is properly value contemplating at $152.