Picture supply: Getty Photographs

Shares in FTSE 250 actual property funding belief (REIT) Nice Portland Estates (LSE:GPE) look low-cost in the intervening time. The inventory presently trades at round 66% of its ebook worth.

I feel this raises a lot of attention-grabbing prospects for buyers. And at a 43% low cost to the place it was 5 years in the past, it might nicely be value nearer consideration.

Please notice that tax therapy will depend on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

London actual property

Like all REITs, Nice Portland Estates leases properties and returns the money to shareholders as dividends. Its portfolio consists of round 40 office-type buildings situated in Central London.

It’s no secret that demand for workplace area has been weak because the Covid-19 pandemic. And this has been mirrored in each the agency’s operational efficiency and its monetary returns.

Emptiness charges have elevated from under 2% to round 9% during the last 5 years. Consequently, the corporate hasn’t elevated its dividend since 2020.

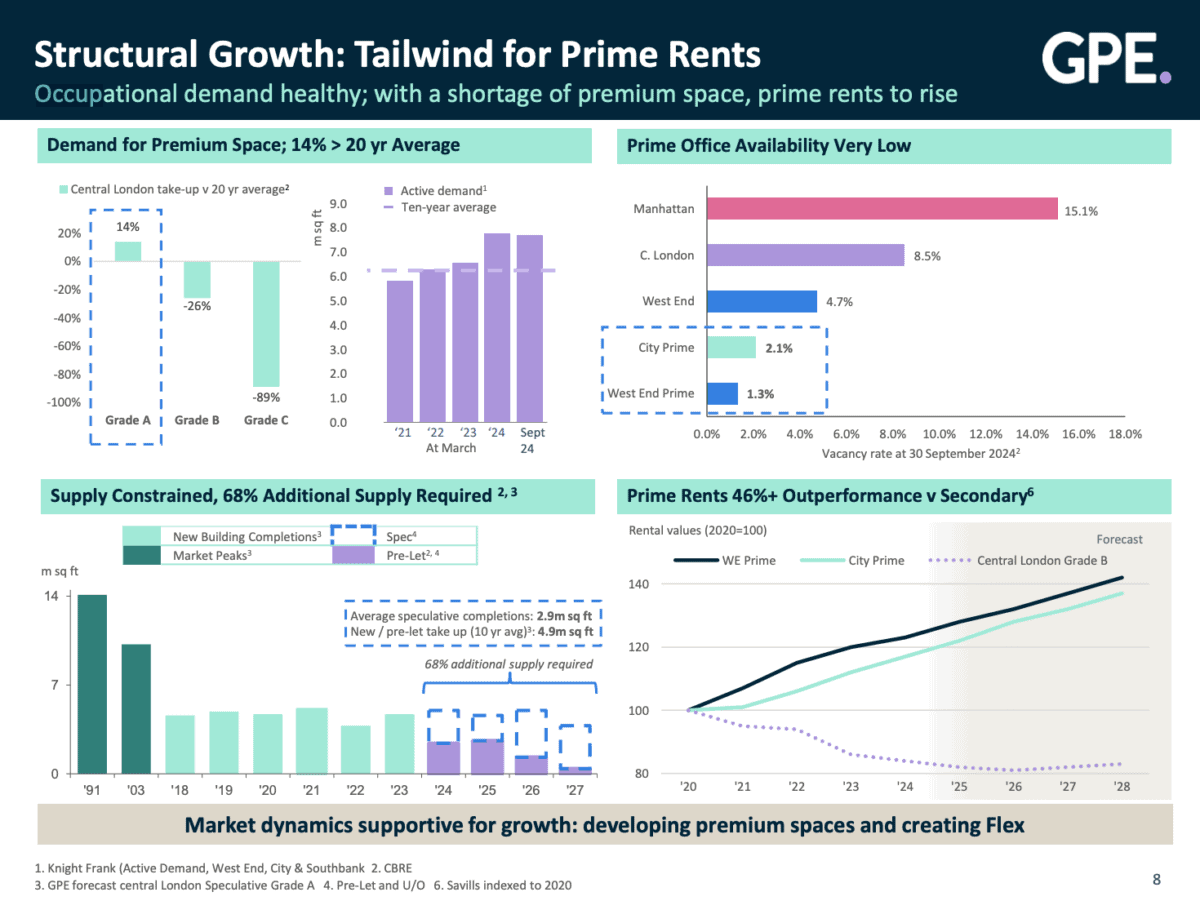

Neither of those is a optimistic signal, however there are causes for optimism. One is the very fact the imbalance between provide and demand appears to be bettering, from the agency’s perspective.

Supply: Firm presentation

That’s partly a characteristic of the corporate’s give attention to properties in fascinating Central London places. However there’s another excuse the inventory has been catching my eye currently.

I don’t usually view a inventory buying and selling at a giant low cost to the online worth of its property as notably important. However on this case, issues are a bit totally different.

Promoting alternatives

The rationale I don’t normally take note of ebook worth is that it’s unlikely to be realised. Except an organization begins promoting its property, their market worth doesn’t actually matter.

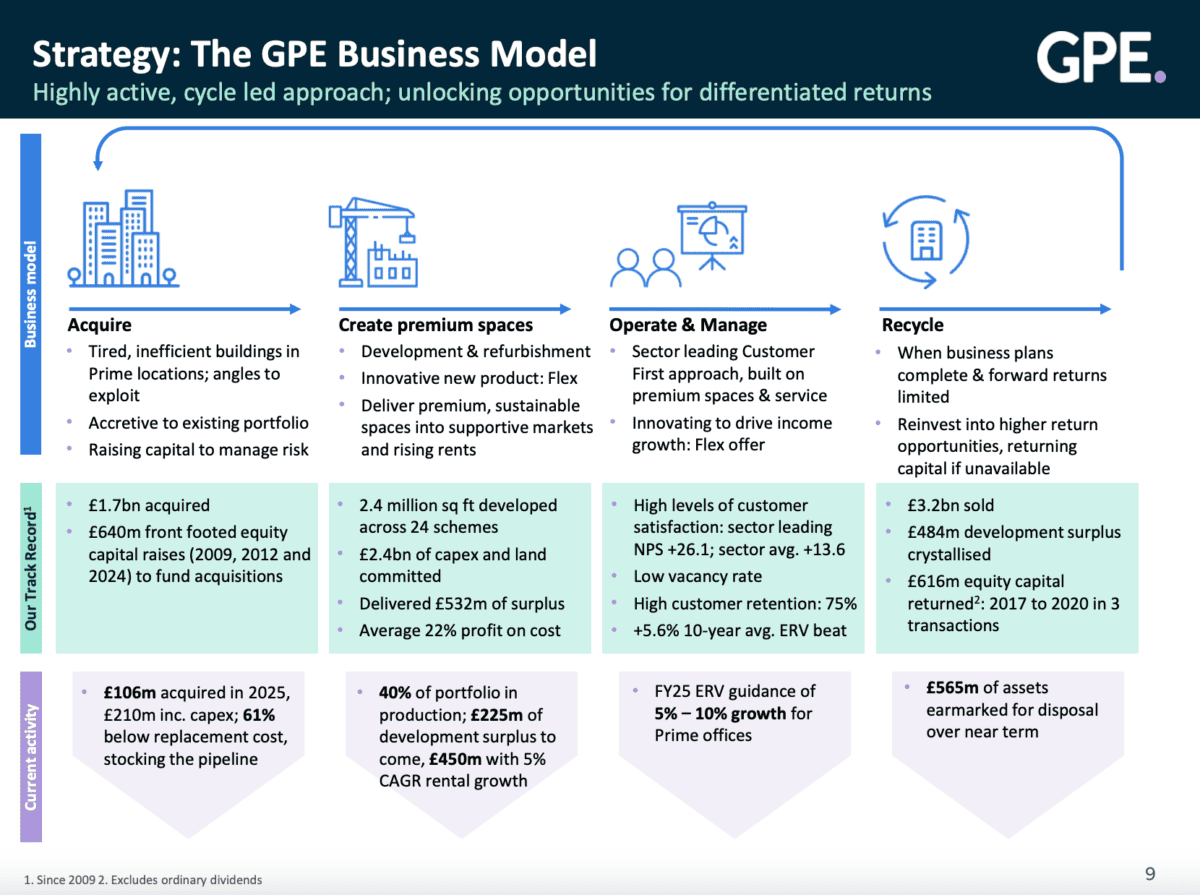

With Nice Portland Estates, nevertheless, promoting property is a key a part of the enterprise. The agency’s technique entails buying, growing, leasing, and in the end disposing of properties.

Supply: Firm presentation

In truth, the corporate presently has plans to eliminate round £565m value of properties. That’s the equal of virtually 45% of its market worth.

This implies shareholders might nicely profit from the FTSE 250 agency promoting a few of its property. And there’s one very last thing to notice as nicely.

UK REITs have been attracting a variety of consideration lately from institutional buyers. Plenty of actual property shares buying and selling at reductions to ebook worth have been takeover targets.

The potential for being purchased out at a premium to the present share price isn’t the first cause to think about shopping for the inventory. However I do assume it’s one thing buyers shouldn’t ignore.

A inventory to think about

I feel buyers have a lot of methods to get an excellent outcome from shares in Nice Portland Estates. One is from the corporate’s operations and the opposite is from promoting its property.

An bettering stability between provide and demand (albeit from a low base) might increase occupancy charges and rental earnings. And this might lead to a return to dividend progress.

Equally, the agency’s scope for promoting property – both as a part of its technique or in an acquisition is one other risk. And that is particularly believable with the inventory buying and selling under ebook worth.

Having a number of routes to an excellent return is one thing that makes the inventory enticing. And I feel it’s value contemplating at at present’s costs.