Picture supply: Getty Pictures

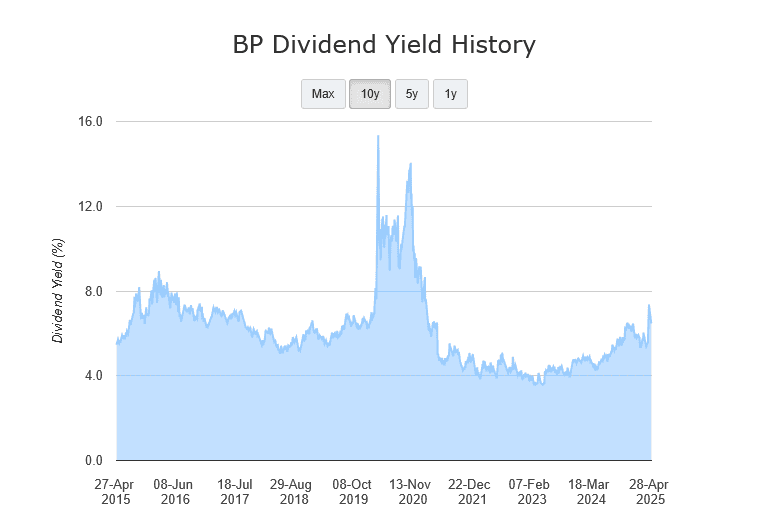

A risky oil price has created a equally uneven setting for vitality sector income. However as with most of the world’s oil majors, the dividends on BP (LSE:BP.) shares have continued flowing.

Because of its monumental money flows, dividends from the FTSE 100 firm have lengthy outstripped what the broader index has supplied within the final decade. That’s even accounting for swingeing payout cuts, and particularly across the time of the pandemic:

When financial downturns soften vitality demand, the dividend for oil shares have been recognized to topple, as BP’s latest file exhibits. And this stays a danger going forwards as commerce wars intensify.

The excellent news is that Metropolis analysts anticipate money rewards to proceed rising over the subsequent few years. However how sensible are these forecasts, and will I take into account shopping for BP shares immediately?

7%+ dividend yields

| Yr | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2025 | 24.43p | 1% | 6.9% |

| 2026 | 25.52p | 4.5% | 7.3% |

| 2027 | 26.91p | 5.4% | 7.7% |

As you’ll be able to see, dividends are tipped to rise modestly this 12 months earlier than development actually takes off from 2026. This — mixed with latest weak spot within the BP share price — means yields sit round 7% and above for the subsequent few years.

However whereas these projections are spectacular, I consider they stand on extraordinarily shaky foundations. Firstly, predicted dividends by means of the interval aren’t particularly effectively lined by estimated earnings.

That is particularly harmful for economically delicate shares like oil shares, as we’ve seen with BP earlier than.

As an investor, I’m looking for a studying of two instances and above for a large margin of security. Sadly, dividend cowl right here sits at 1.6 and 1.7 instances for 2025 and 2026, respectively. This improves to 1.8 instances for 2027 however remains to be on the skinny aspect.

Debt climbs

Dividend cowl isn’t the be-all-and-end-all when contemplating a share’s dividend prospects, nonetheless. A powerful stability sheet can nonetheless assist companies see out momentary income issues and pay nice dividends.

But BP doesn’t have the strong monetary foundations that might assist it experience out oil market weak spot. Underlying substitute price revenue dropped to $1.4bn from $2.7bn within the first quarter, knowledge final week confirmed. This in flip prompted web debt to soar $3bn over the 12 months to March, to $27bn.

In an alarming sign of its harassed stability sheet, BP mentioned it could repurchase ‘just’ $750m value of shares this quarter. That’s down from the $1.75bn it beforehand purchased.

On the plus aspect, the enterprise has focused $3bn-$4bn value of asset gross sales, together with additional price slicing to fix its funds. However this will finish up hardly making a dent if oil costs proceed sinking.

Are BP shares a purchase?

And the probabilities of additional crude price weak spot are substantial, in my view. Rising recessionary dangers within the US and China pose a considerable risk to vitality demand. On the similar time, manufacturing from each OPEC+ and non-cartel nations is ratcheting larger, placing Brent crude values underneath a extreme squeeze.

This bodes badly for BP’s dividends and share price within the close to time period. And the corporate’s outlook over an extended time horizon is plagued with uncertainty, too, as the recognition of renewable vitality takes off.

Plans to lift oil manufacturing may raise the enterprise if vitality costs recuperate. However on stability, I feel buyers ought to take into account giving BP shares a large berth.