YEREVAN (CoinChapter.com) — Actual world asset (RWA) backed tokens deliver bodily and intangible property onto the blockchain. These property embody gold, actual property, tremendous artwork, bonds, and even mental property. As soon as tokenized, they are often digitally saved, traded, and transferred like some other blockchain-based asset. Every token represents a selected portion or proper tied to the real-world merchandise.

Via tokenization, individuals can entry investments beforehand out of attain attributable to excessive prices or geographic restrictions. As an alternative of shopping for a complete property or a gold bar, somebody can now maintain a small share of it within the type of a token. Blockchain expertise handles the possession information, making certain that transactions are clear and safe. This strategy not solely will increase liquidity but additionally reduces paperwork, middlemen, and administrative burdens.

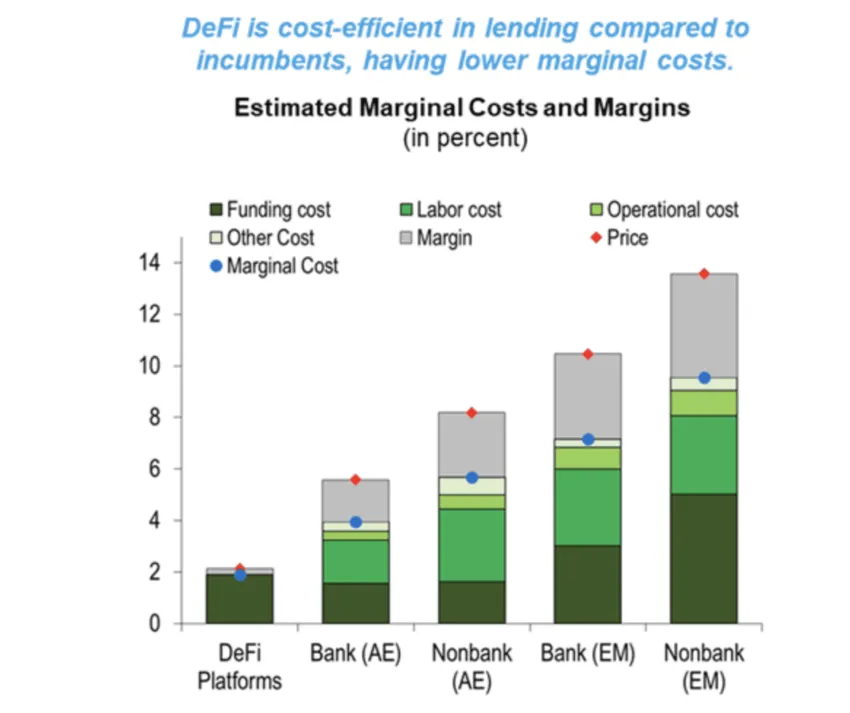

Tokenization has grown rapidly with the rise of decentralized finance (DeFi), which gives blockchain-based alternate options to conventional banking. RWA-backed tokens assist bridge the hole between the bodily world and DeFi, unlocking new markets and making long-standing funding instruments extra accessible.

Tokenization Makes Conventional Property Work on Blockchain

The method of tokenization turns real-world property into blockchain tokens by assigning every token a hard and fast worth tied to an current merchandise or proper. Sensible contracts govern these tokens. These contracts outline guidelines, challenge the tokens, handle transfers, and implement possession.

Digital representations of real-world property usually are not a brand new concept, however blockchain has modified the size and safety of the method. Now, an asset resembling a property, a portray, or a commodity might be was tokens and exchanged throughout the web with out involving banks or brokers. Every transaction is recorded on-chain, which eliminates disputes and makes asset possession simple to confirm.

Even intangible property like debt devices, authorities bonds, and carbon credit are eligible for tokenization. Their digital variations carry the identical rights and obligations as their bodily varieties however include added flexibility and decrease entry prices. Some tokens additionally signify future revenue streams. As an example, a tokenized condominium may generate hire, and sensible contracts can robotically distribute that revenue amongst token holders.

Understanding What Can Be Tokenized

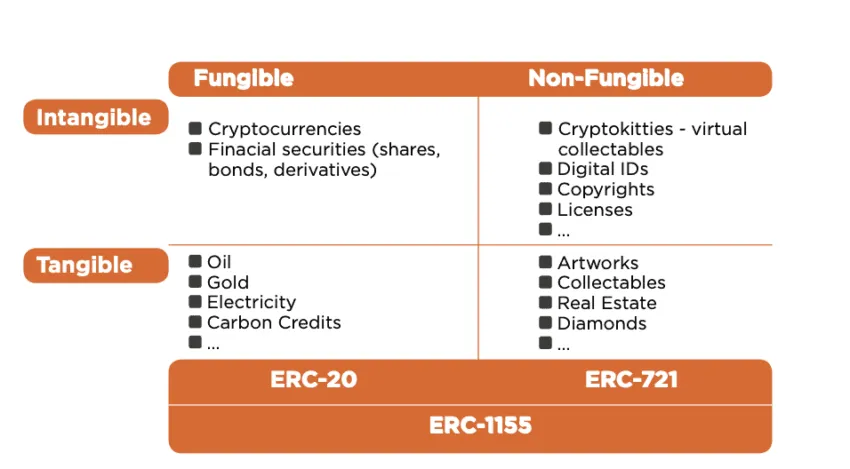

Actual world property usually are not restricted to 1 class. Tokenization applies to tangible and intangible objects alike. Tangible objects resembling houses, land, metals, and art work might be tokenized. Intangible objects, together with equities, debt, patents, or copyrights, may also be was blockchain property. The principle requirement is that the merchandise holds worth and might be legally verified.

Tokenizing property permits individuals to carry small parts of high-priced objects. For instance, a luxurious property in New York price thousands and thousands might be break up into digital tokens. A single token may cost a little just a few {dollars}. This makes high-value property out there to retail traders with out the necessity for full possession or direct management over the asset.

How the Tokenization Course of Works in Follow

Tokenization begins by selecting the asset. After deciding on the merchandise, the subsequent step is to make clear authorized possession, establish any restrictions, and outline what rights the token holders will obtain. An expert appraisal follows, figuring out the asset’s market worth and what number of tokens must be created.

As soon as the groundwork is full, builders construct a wise contract that governs the tokens. This contract units the token provide, controls how transfers work, and defines revenue distribution if the asset produces returns. After writing and auditing the contract, the issuer can launch the tokens on a blockchain community. Generally, the issuer additionally ensures the providing meets authorized necessities tied to securities and investor safety.

Totally different requirements govern the kind of token issued. If the asset is fungible, resembling gold or oil, the token could observe the ERC-20 customary on Ethereum. For distinctive property like artwork or particular person properties, the ERC-721 customary applies. There’s additionally ERC-1155, which helps a mixture of each sorts. Some newer requirements like ERC-1400 or ERC-3643 embody built-in compliance instruments, making it simpler to fulfill regulatory wants.

How RWA Tokens Match Into the Blockchain Ecosystem

Tokenized property use sensible contracts to outline how they work together with customers. These contracts deal with income sharing, buying and selling guidelines, vesting schedules, and extra. For instance, if the tokenized asset earns hire, the sensible contract may break up the earnings robotically amongst token holders and deposit funds into their wallets. All the course of runs with out handbook intervention, making transactions sooner and cheaper.

RWA tokens additionally make monetary merchandise programmable. A contract may limit how tokens are transferred, who can maintain them, or once they expire. This flexibility helps align the token with real-world laws and enterprise logic.

The tokenization course of connects the bodily world to blockchain by three key steps. First, the asset is verified and documented off-chain. Subsequent, builders encode possession and rights into the sensible contract. Lastly, the tokens are issued and traded on blockchain platforms, the place they observe the principles outlined by the issuer and regulator.

Advantages That Make RWA Tokens Helpful

Actual world asset tokens scale back entry limitations for brand new traders. As an alternative of needing giant capital, somebody can maintain a small proportion of a high-value merchandise. This democratizes investing and makes once-exclusive markets accessible to extra individuals.

The liquidity of tokenized property is increased than conventional property. They are often traded across the clock on international platforms while not having intermediaries. Transactions are quick, clear, and ultimate. Since all exercise is logged on the blockchain, token possession is safe and tamper-proof.

The authorized options of those tokens may also be coded instantly into sensible contracts. This ensures that compliance is automated and environment friendly. Traders profit from clearer guidelines and fewer disputes. Programmable revenue, resembling dividend funds or hire distribution, may also be managed instantly by the contract.

Actual World Property Join DeFi and Conventional Finance

DeFi platforms are already integrating RWA tokens to broaden the vary of providers they provide. One of many main examples is MakerDAO, which accepts tokenized actual property as collateral. Because of this as an alternative of locking up crypto like ETH or USDC, customers can now use digital representations of real-world property—resembling property—as a assure to mint DAI, MakerDAO’s stablecoin.

This growth introduces exterior, non-crypto worth into decentralized finance. Conventional property like actual property are sometimes extra steady than risky cryptocurrencies. By bringing them into the DeFi house, platforms can scale back the danger related to excessive price fluctuations. This not solely provides a extra predictable basis for monetary operations but additionally makes the system much less depending on crypto market swings.

Permitting tokenized real-world property to function collateral has one other profit. It makes DeFi extra enticing to traders who’re accustomed to conventional finance however hesitant to have interaction with crypto volatility. These customers can take part through the use of tokenized variations of property they already perceive, resembling houses, business buildings, or authorities bonds. This expands the consumer base of DeFi platforms and creates new pathways for liquidity.

When extra customers contribute tokenized property, the full worth locked (TVL) in DeFi protocols will increase. Increased TVL improves the general well being of lending and borrowing ecosystems, permitting platforms to supply extra aggressive returns and providers. On the similar time, the provision of numerous, asset-backed collateral reduces systemic danger and helps a extra balanced, resilient monetary surroundings.

Present Challenges Slowing Wider Adoption

Regardless of the advantages, tokenizing real-world property stays advanced. Authorized and regulatory guidelines fluctuate by nation and asset sort. Many areas nonetheless lack clear frameworks for tokenized securities, making it laborious for issuers to function throughout borders.

One other challenge is asset verification. Off-chain property require cautious documentation, and disputes over possession can nonetheless come up. Custody providers should handle the bodily merchandise and guarantee it stays intact whereas tokens flow into. Managing these relationships is expensive and time-consuming.

Standardization is one other hurdle. Totally different platforms use totally different token fashions, making it tough to check choices or transfer tokens between methods. Adoption has additionally been slower than anticipated, with many establishments nonetheless testing tokenization moderately than utilizing it at scale.

Key Platforms Powering the RWA Ecosystem

A number of blockchain platforms now help tokenization. MakerDAO makes use of sensible contracts to simply accept real-world property as collateral. Centrifuge lets customers put money into actual property, invoices, and different yield-generating property utilizing crypto. Goldfinch helps companies get loans with out crypto collateral. Maple gives uncollateralized lending by credit score swimming pools and authorised delegates. Ondo Finance gives tokenized authorities bonds and company funds to be used in DeFi.

Every platform brings a singular construction for managing token issuance, liquidity, and compliance. Their function is to deal with the technical, authorized, and monetary complexity behind asset tokenization.

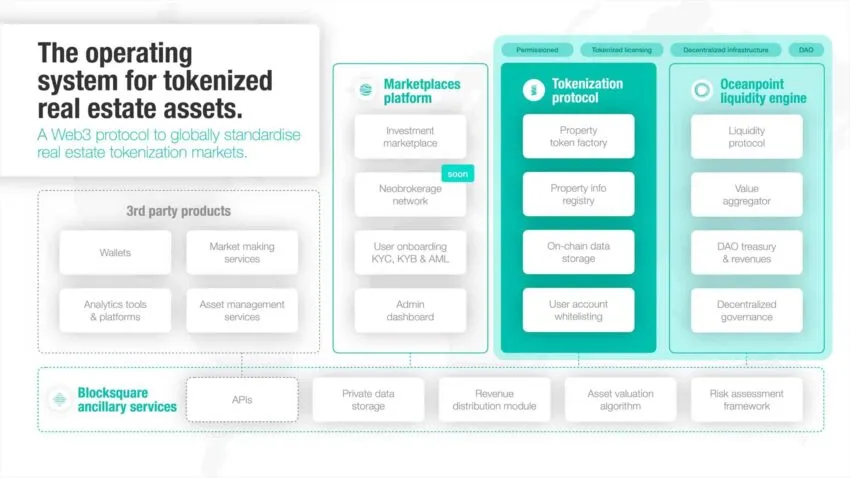

Platforms like RealT, STASIS, and Blocksquare additionally contribute by providing tokenized actual property, fiat currencies, and different property. Some give attention to fractional possession, whereas others intention to supply institutional-grade investmFent merchandise.

The Evolving RWA Token Market

The RWA token market consists of totally different segments. Fairness-based tokens cowl shares and firm possession. Asset-based tokens signify bodily objects like gold or actual property. Mounted-income tokens give attention to bonds, loans, and different yield-generating devices. Every sort performs a job in bringing real-world worth into decentralized finance.

The development is rising. New tasks now discover tokenizing whisky, patents, and even renewable power credit. Customized blockchain options are being constructed to help these tokens with built-in KYC and compliance instruments.

Whereas many platforms run on public chains, permissioned blockchains are gaining curiosity. These provide a stability between openness and regulatory management. Over time, authorized buildings, id verification, and information safety instruments are anticipated to enhance, driving broader adoption.