YEREVAN (CoinChapter.com) — Elon Musk has performed a key position in Dogecoin’s transformation from a parody to a speculative digital asset. His social media exercise and company choices have repeatedly influenced the price and recognition of the meme coin. In 2025, his involvement reached a brand new stage with the launch of a U.S. authorities company named D.O.G.E., brief for the Division of Authorities Effectivity.

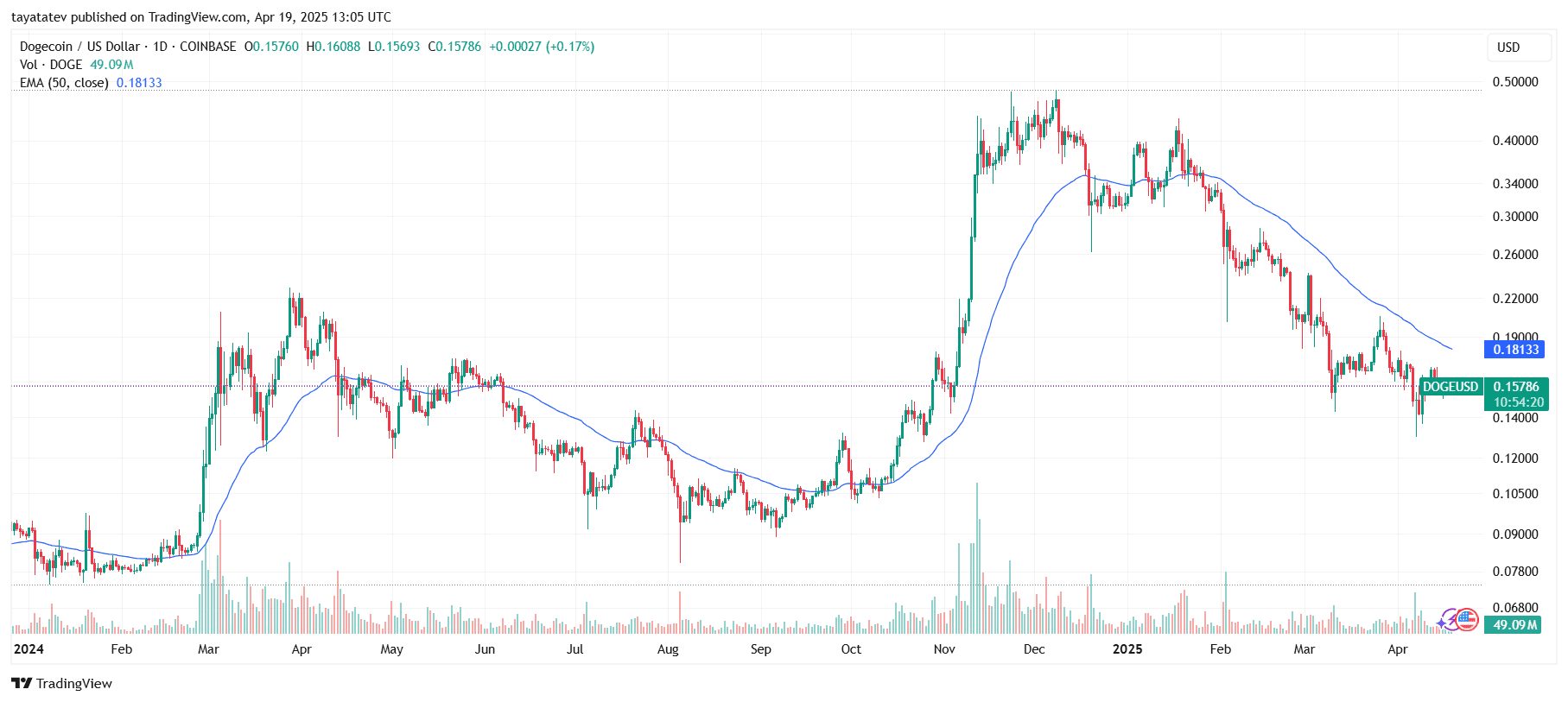

Musk’s announcement of the Division of Authorities Effectivity (D.O.G.E.) triggered an preliminary surge in Dogecoin’s price. Nonetheless, the good points didn’t final. Between January 21 and March 31, addresses holding $1 million to $9.99 million in DOGE dropped by 40.21%. On the similar time, wallets with over $10 million fell from 400 to 212, marking a 47% decline. Total, Dogecoin millionaire addresses fell by 41% in simply over two months, based on Finbold.

Dogecoin Was Constructed as a Joke. Musk Turned It Right into a Speculative Asset

Dogecoin started in December 2013. Software program engineers Billy Markus and Jackson Palmer created it to parody crypto hype. They selected the Shiba Inu meme, generally known as “Doge,” to signify the coin. Their intention was satire, not severe investing.

Regardless of the joke, Dogecoin gained traction on-line. By 2020, Elon Musk had began tweeting about it. His posts ranged from easy mentions to memes, all boosting Dogecoin’s visibility. In April 2019, he tweeted that Dogecoin was his “favorite cryptocurrency.” Inside two days, its price doubled from $0.002 to $0.004.

“Musk’s involvement transformed Dogecoin from a satirical internet token into a speculative asset class by bestowing it with perceived legitimacy and entertainment value,” Voloder stated. He added that Musk made Dogecoin a “cultural product with real economic consequences.”

Dogecoin Turned a Meme Coin With Actual Worth Actions

By early 2021, Dogecoin’s market response to Musk’s posts intensified. When Musk tweeted “Dogecoin is the people’s crypto,” its buying and selling quantity rose by greater than 50% in a single day. However his affect additionally made Dogecoin extremely risky.

On Might 8, 2021, Musk appeared on Saturday Night time Stay. When he referred to as Dogecoin “a hustle,” the price dropped by greater than 33% inside hours.

Musk Named a Authorities Division After Dogecoin

On January 20, 2025, the U.S. Division of Authorities Effectivity (DOGE) launched its official web site, prominently that includes the Dogecoin emblem. This transfer led to a 13% surge in Dogecoin’s price inside quarter-hour, rising from $0.33 to $0.40, reversing earlier losses and marking a 20% rebound from its intraday low.

The division, established by President Donald Trump and led by Elon Musk, goals to cut back federal spending and paperwork. The acronym DOGE, mirroring the cryptocurrency’s title, and the inclusion of its emblem on the federal government website, sparked discussions concerning the mixing of web tradition with official authorities initiatives .

On January 20, when the D.O.G.E. web site went dwell, Dogecoin’s price jumped 13% inside quarter-hour. It briefly reversed a previous downtrend, peaking at $0.36.

That rally was short-lived. From January 20 to April 12, Dogecoin’s price fell to $0.15—a 58% drop.

D.O.G.E. Hype Might Have Reversed Its Worth Momentum

The price drop following Musk’s D.O.G.E. appointment indicators a transparent shift in market sentiment. Though the timing coincides with the announcement, broader financial situations additionally influenced Dogecoin’s decline.

Since 2022, central banks—led by the U.S. Federal Reserve—have repeatedly raised rates of interest to fight inflation. These will increase pulled capital away from danger property like cryptocurrencies by making conventional choices corresponding to bonds extra enticing. Consequently, investor urge for food for speculative cash, together with Dogecoin, has weakened.

On the similar time, regulatory stress has grown. Within the U.S., the SEC has stepped up enforcement, concentrating on main crypto platforms and tokens. The heightened scrutiny has added authorized and compliance dangers, particularly for institutional buyers, prompting a extra cautious method towards giant crypto holdings.

The retail panorama has additionally modified. The 2021 surge introduced thousands and thousands of recent customers into crypto, many drawn by viral memes and celeb endorsements. However after the market cooled, many left. Trading exercise slowed, on-line curiosity pale, and meme coin inflows dropped. This decline in grassroots engagement has made it tough for Dogecoin to get better misplaced momentum.

Whereas these situations present crucial context, the steep drop in high-value DOGE wallets after the D.O.G.E. web site launch means that Musk’s involvement could have influenced investor conduct. The overlap between the 2 occasions factors to a response formed by sentiment however bolstered by tightening monetary and regulatory environments.

Moral Issues Round Musk’s Dogecoin Exercise

Musk’s continued promotion of Dogecoin has sparked renewed scrutiny over the dangers tied to “parasocial investing.” This time period refers to conduct the place people depend on celeb figures for monetary cues with out conducting unbiased research.

Retail buyers—notably these with restricted monetary expertise—usually act on public endorsements with out totally greedy the potential downsides. This surroundings creates area for each monetary losses and misplaced belief, particularly in risky and frivolously regulated markets like crypto.

Whereas Musk has the correct to share private views, his public statements can spark vital price actions, triggering both sharp rallies or declines. His affect, amplified by thousands and thousands of followers and excessive visibility, raises issues concerning the moral tasks of public figures in monetary discourse.

Underneath U.S. legislation, market manipulation sometimes includes deliberate makes an attempt to distort costs or mislead market individuals. The Securities and Change Fee (SEC) investigates such exercise in securities markets, however Dogecoin doesn’t fall underneath its jurisdiction. The Commodity Futures Trading Fee (CFTC), which oversees commodities, might probably study Musk’s affect underneath its broader authority.

The authorized boundaries stay unclear. Nonetheless, the affect of Musk’s social media posts is difficult to disregard. Even when framed as private commentary, his tweets usually end in rapid price shifts. These repeated results could function oblique market indicators, no matter intent.

$258 Billion Lawsuit Targets Musk Over Dogecoin

In June 2022, buyers filed a $258 billion lawsuit towards Elon Musk, accusing him of operating a Dogecoin pyramid scheme. The grievance alleged that Musk used tweets and media appearances to artificially increase the coin’s worth, benefiting from the surge whereas others suffered losses as costs later collapsed.

The case highlights rising scrutiny of celeb affect in monetary markets. Though the SEC has not labeled Dogecoin as a safety, the authorized course of might grow to be difficult because of the coin’s regulatory grey space. If courts decide that Musk knowingly manipulated the market or misled buyers, he might face civil penalties or be required to settle.

This lawsuit follows a sample. In 2018, the SEC took motion towards Musk over deceptive tweets associated to Tesla. That case ended with a consent decree, signaling that regulators are keen to intervene when public statements have an effect on investor conduct.