Picture supply: Getty Pictures

The inventory market‘s an awesome place to become profitable, nevertheless it will also be a spot to lose it. Thankfully, traders can put themselves forward of the competitors by simply avoiding one easy mistake.

On the whole, the worst factor traders can do is promote shares when costs are low. This looks like a simple precept, nevertheless it’s stunning how usually it appears to occur.

Promote low?

Warren Buffett‘s instruction to be grasping when others are fearful is well-known. However – as Buffett additionally acknowledges – figuring out when costs are at their lowest is almost unattainable.

Even when shopping for when costs are at their lowest is tough, it ought to not less than be doable to keep away from promoting at these instances. However traders appear to have an uncanny knack for doing precisely this.

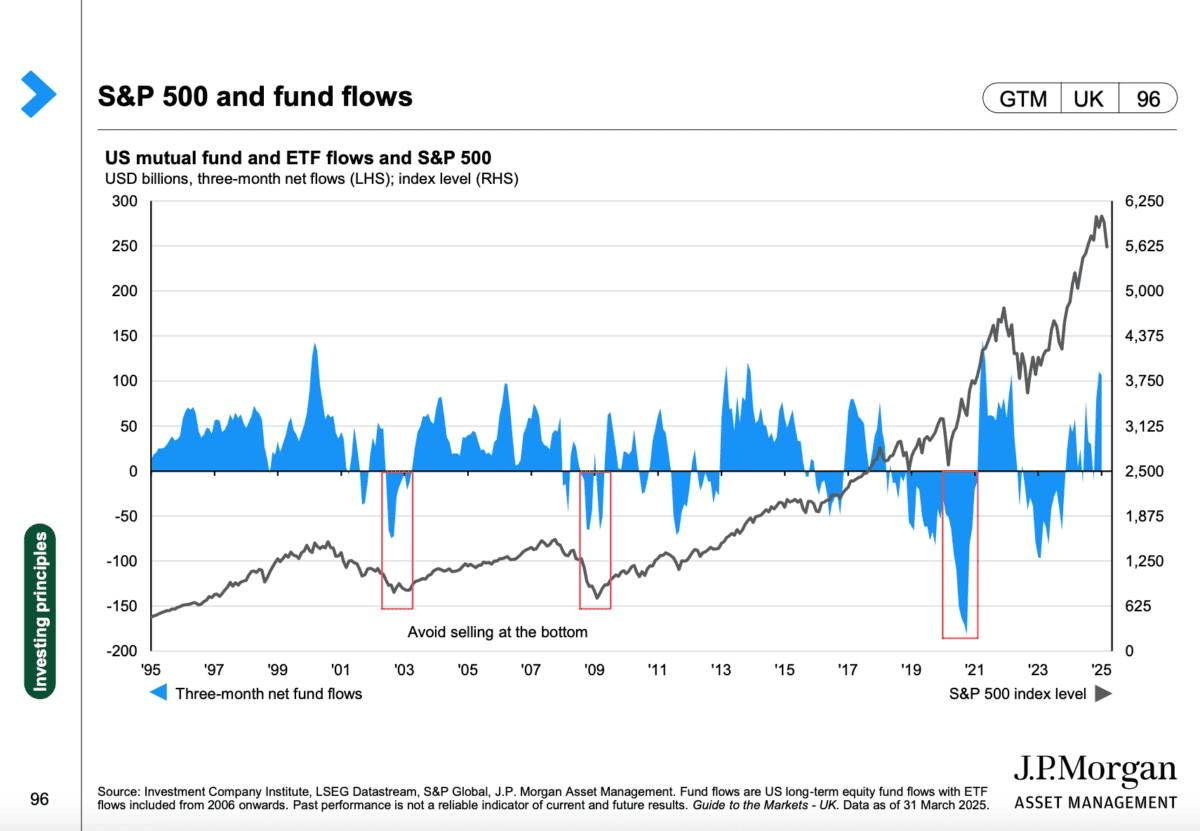

Based on JP Morgan, the most important outflows from US fairness funds within the final 30 years have been at instances the S&P 500 has been falling. In different phrases, traders promote when shares go down.

There are a few classes traders can take from this. One is that following Buffett’s recommendation is simpler mentioned than accomplished, however the different is those that can are at an enormous benefit.

Exceptions

Like all good guidelines nonetheless, there are exceptions. Through the Covid-19 pandemic, Buffett offered Berkshire Hathaway’s stakes within the main US airways after their share costs had fallen.

There was nonetheless, an excellent purpose for this. Journey restrictions meant the companies began shedding cash and needed to tackle vital quantities of debt to remain afloat.

United Airways, for instance, went from having $13bn in long-term debt on the finish of 2019 to $30bn on the finish of 2021. And that made the corporate’s future prospects look very totally different.

A giant change within the underlying enterprise can justify promoting a falling inventory. However when this isn’t the case, traders must be cautious of the temptation to promote when costs are low.

An instance from my portfolio

One of many shares in my portfolio is JD Wetherspoon (LSE:JDW). Since I began shopping for it firstly of 2024, the share price has fallen 25%, however the enterprise has carried out comparatively properly.

Gross sales have grown and earnings have greater than doubled. And the agency has invested closely into proudly owning its pubs outright – relatively than leasing them – to deliver down prices in future.

The inventory’s been falling as a consequence of issues over wage inflation. Offsetting these will possible contain elevating costs and this brings an inevitable danger of placing prospects off.

It is a real concern, however I don’t assume JD Wetherspoon has ever been in a greater place to take care of it. So I’m not trying to promote my funding regardless of the falling share price.

Staying the course

Avoiding promoting when costs are low appears simple, however the market information suggests it’s surprisingly laborious to observe. I feel meaning there’s an enormous potential benefit right here for traders.

JD Wetherspoon is an attention-grabbing instance. Its key strengths – its scale and its repute for low costs – are nonetheless firmly intact and the enterprise is trying to develop by opening new pubs.

I can perceive why there’s worry round, however I feel the corporate’s scenario is healthier than individuals assume. So I feel promoting with the share price falling could be a mistake I’m hoping to keep away from.