Picture supply: Getty Photos

After years of barnstorming development, the S&P 500 has hit one among its occasional sticky patches. Uncertainty round a possible international commerce battle and the path of the US financial system has led to a 7.3% decline within the index in simply over a month.

For long-term traders although, this may merely imply cheaper costs for high-quality shares. Listed here are two that would show to have been bargains a number of years down the highway.

Uber

Talking of roads, I believe ridesharing big Uber Applied sciences (NYSE: UBER) inventory is value contemplating. It’s down 13.3% since mid-October.

Whereas Uber isn’t any spring rooster nowadays, the corporate continues to develop very strongly. In 2024, income jumped 18% yr on yr to $44bn, and the agency ended December with 171m month-to-month lively platform prospects.

Extra importantly, Uber is now very worthwhile, which de-risks the funding case. It reported $2.8bn in working revenue final yr, an enormous enchancment from the cash-incinerating days of yore.

Present projections point out that Uber’s working revenue will surpass $10bn by the top of 2027!

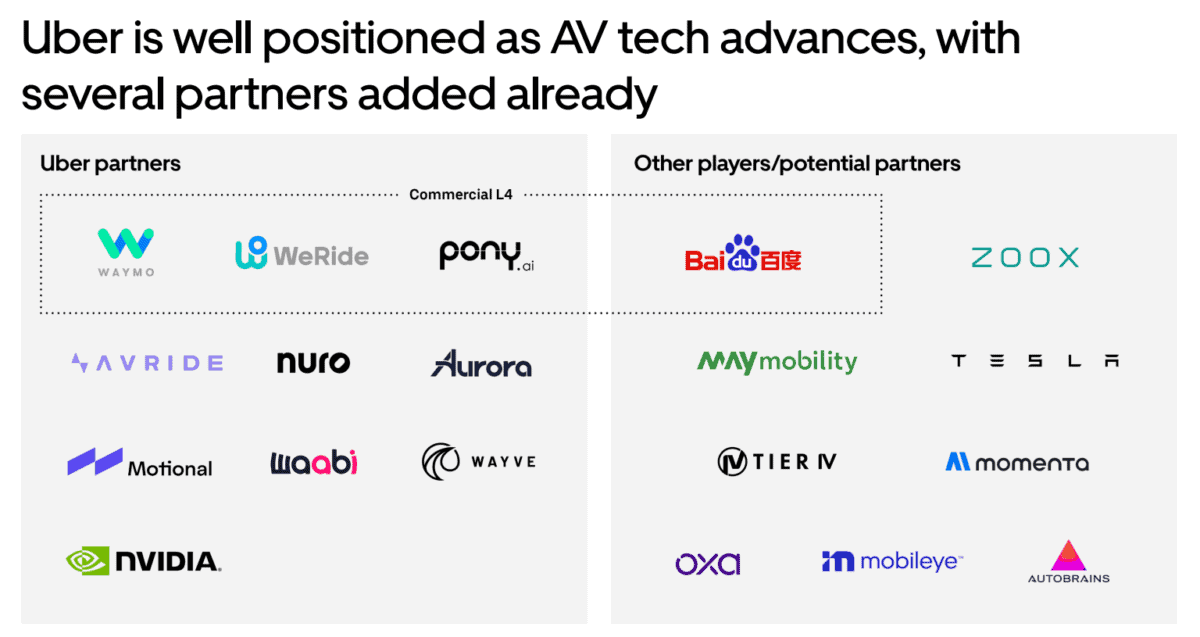

One danger right here although is the rise of robotaxis. If Alphabet‘s Waymo or Tesla manage to scale their own consumer apps, that could hurt Uber’s development trajectory and will even disrupt its enterprise.

That mentioned, there are many companies engaged on autonomy now. I discover it unlikely that customers will need a number of robotaxi apps downloaded. For corporations then, it’ll be a lot simpler to faucet into the community results of the Uber platform than to go it alone.

I believe Uber will in the end change into the accomplice of selection for many, if not all. It already works with many, together with Waymo, whose autonomous automobiles are booked solely by means of the Uber app in Austin, Texas (and shortly Atlanta, Georgia).

If robotaxis begin changing human drivers, then Uber’s labour prices would begin falling dramatically. Margins might broaden meaningfully.

This potential makes the inventory look low-cost at round 18 occasions forecast adjusted EBITDA for 2025.

Low cost tech big

After being unsure about Nvidia (NASDAQ: NVDA) for over a yr, I believe the inventory has reached a price ($111) the place it’s additionally value contemplating.

Down 24% in two months, it’s now buying and selling at simply 24 occasions this monetary yr’s forecast earnings. That a number of rapidly falls beneath 20 subsequent yr, primarily based on present forecasts.

For a quick-growing firm whose chips stay integral to advances in synthetic intelligence (AI), that appears like a possible discount to me.

So what’s the catch? Effectively, one situation is that Nvidia presently will get 13% of its income (round $17bn) from China. However the US is tightening restrictions on chips getting into the world’s second largest financial system.

China can also be actively encouraging home expertise companies to scale back reliance on Nvidia’s AI chips and as a substitute undertake native options. Nvidia is piggy within the center and this might influence gross sales development.

Regardless of this danger, I used to be inspired by the corporate’s long-term imaginative and prescient set out at its current expertise convention. AI is transferring from the coaching stage to inference (being deployed and in a position to ship extra knowledge), which may wish exponentially extra computing energy. Nvidia’s chips have extra competitors on this house, however its choices stay cutting-edge.

In the meantime, the corporate is systemically positioning itself to be on the centre of a number of megatrends, from self-driving automobiles and humanoid robots to AI-driven healthcare and the metaverse.