Picture supply: Getty Photographs

Thousands and thousands of Britons make investments for a second earnings. We make investments, ideally via a Shares and Shares ISA, over a protracted time frame with the intention of constructing a portfolio that’s massive sufficient to sustainably generate an earnings. It doesn’t occur in a single day, however in the long run, it’s value it.

So, why £27,500? Effectively, primarily based on knowledge from the Annual Survey for Hours and Earnings (ASHE) by the Workplace for Nationwide Statistics (ONS), the online common month-to-month earnings (that is after tax) are £2,297 (or £27,573) within the UK.

Right here’s the way it may be achieved by investing.

Taking part in the lengthy sport

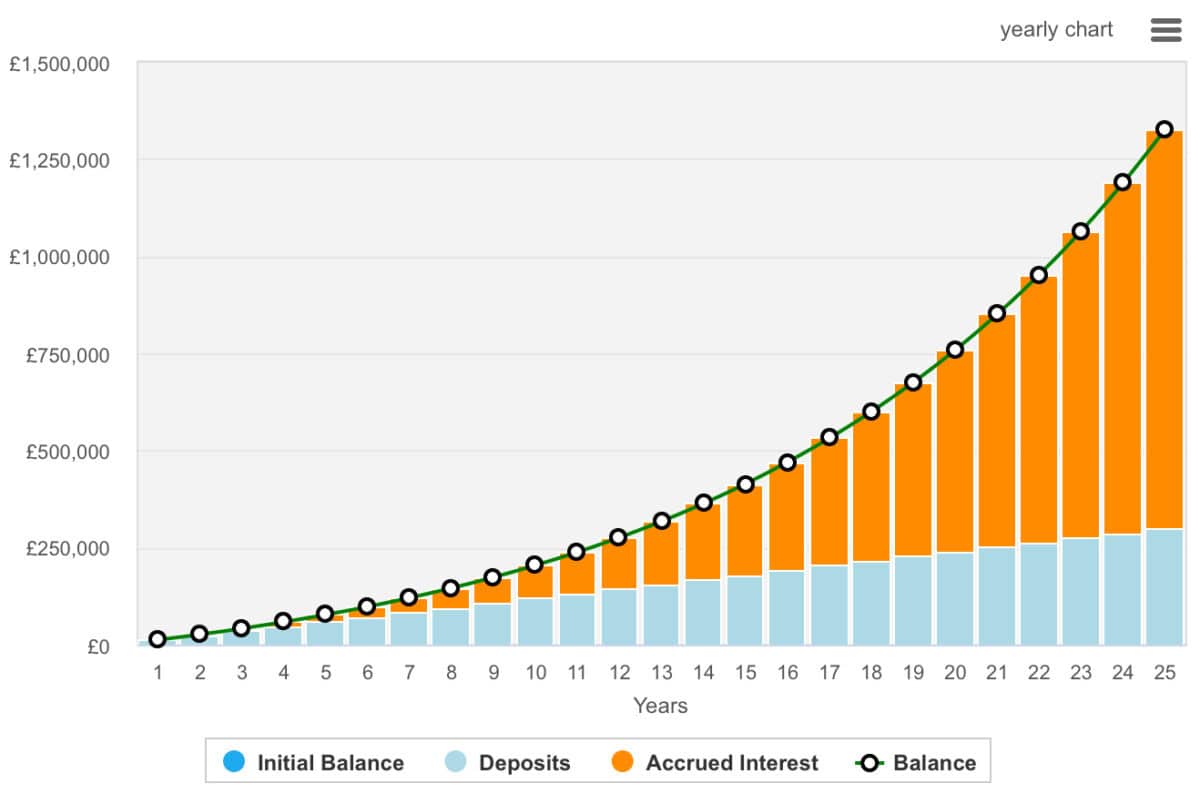

With a purpose to generate £27,500 a yr from a Shares and Shares ISA, somebody wants £550,000 invested and to realize a 5% annualised dividend yield. Now, this would possibly sound a like a tough ask, particularly if we’re ranging from nothing. However I guarantee you, it’s solely possible.

There are many hypothetical or mathematical methods of attending to £550,000. Nonetheless, all of those equations require traders to make constant contributions and to reinvest the proceeds of capital good points and dividends.

On this instance, a £550,000 portfolio could possibly be achieved by investing £1,000 per thirty days whereas reaching an annualised return of 10% over 17.5 years. At this level, an investor might transfer to a dividend-focused portfolio, or bonds, to be able to take a tax-free second earnings.

Nonetheless, we must always bear in mind the facility of compounding. If an investor continues with the technique for an extended time frame, the speed of progress would increase.

Please be aware that tax therapy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Investments to think about

After all, there’s a caveat. Make investments poorly and folks will lose cash. With this in thoughts, novice traders are usually suggested to take a diversified method. This usually means investing in an index tracker — a fund that goals to copy the efficiency of an index.

Nonetheless, some actively managed funds or trusts might give traders a greater probability of beating the market. One choice to think about could possibly be Berkshire Hathaway (NYSE:BRK.B). It’s neither a fund nor belief, however a conglomerate with companies in railroads and insurance coverage, and inventory holdings in corporations like Apple, American Specific, and Visa. Briefly, it invests within the spine of the American economic system.

Whereas we’re at the moment seeing turmoil in US markets amid Trumpian uncertainty and recession fears, Berkshire Hathaway inventory hasn’t been offered off. That may sound unusual for a corporation that’s so tightly linked to the US economic system. However there’s a very good purpose. The enterprise has been slowly promoting positions in its holdings over the previous 18 months. Amazingly, it now has $334bn in money.

Traders have been questioning why the Warren Buffett-controlled firm has been turning to money. Nonetheless, with a recession changing into extra seemingly and on account of an enormous selloff in US shares, Buffett could also be properly positioned to make strategic acquisitions or provoke new positions in shares.

After all, there’s a threat with Berkshire, as there may be with each funding. The danger is that Berkshire’s portfolio is extremely targeting the US economic system. Throughout Buffett’s profession, the US economic system has outperformed, however there’s no assure that may proceed eternally. Nonetheless, I’ve not too long ago change into a Berkshire shareholder myself.