Picture supply: Getty Pictures

It may be fairly daunting when first contemplating the inventory market as a approach to generate a second revenue. There’s a variety of jargon to get one’s head round. However it’s not fairly as complicated as it would first appear.

With this in thoughts, listed below are just a few easy steps a brand new investor may observe to focus on sizeable dividend revenue.

Select the correct account

To start out, there clearly must be an account to purchase shares in. This can be opened by way of a brokerage, which is an organization that acts as an middleman to facilitate the shopping for and promoting of shares.

There are a good few about. Some legacy platforms like Hargreaves Lansdown nonetheless cost prospects per commerce. Nevertheless, there are various new apps that enable free buying and selling. To be truthful, Hargreaves Lansdown has a wealth of sources for brand new traders, whereas the no-frills free-trade apps are very a lot DIY. It depends upon desire.

The investing account somebody would typically begin with within the UK is a Shares and Shares ISA. This marvellous car allows a portfolio to develop extra quickly as a result of there are not any tax liabilities on revenue and returns (the annual contribution restrict is £20,000).

Please notice that tax remedy depends upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Contemplate high quality high-yield dividend shares

Because the intention is to start out incomes a second revenue, the following focus can be on in search of shares that pay dividends. These are semi-regular funds made by corporations to shareholders, normally from income. They’re largely paid twice or 4 occasions a 12 months.

The inventory’s dividend yield will decide how a lot passive revenue is on supply. For instance, insurance coverage and asset administration agency Authorized & Normal (LSE: LGEN) at present carries a mighty 8.9% yield.

In different phrases, an investor may put £2,000 into this FTSE 100 inventory and hope to obtain £178 again annually in dividends. Nevertheless it might be lower than this (if the agency cuts the payout, which is at all times potential) or ideally extra.

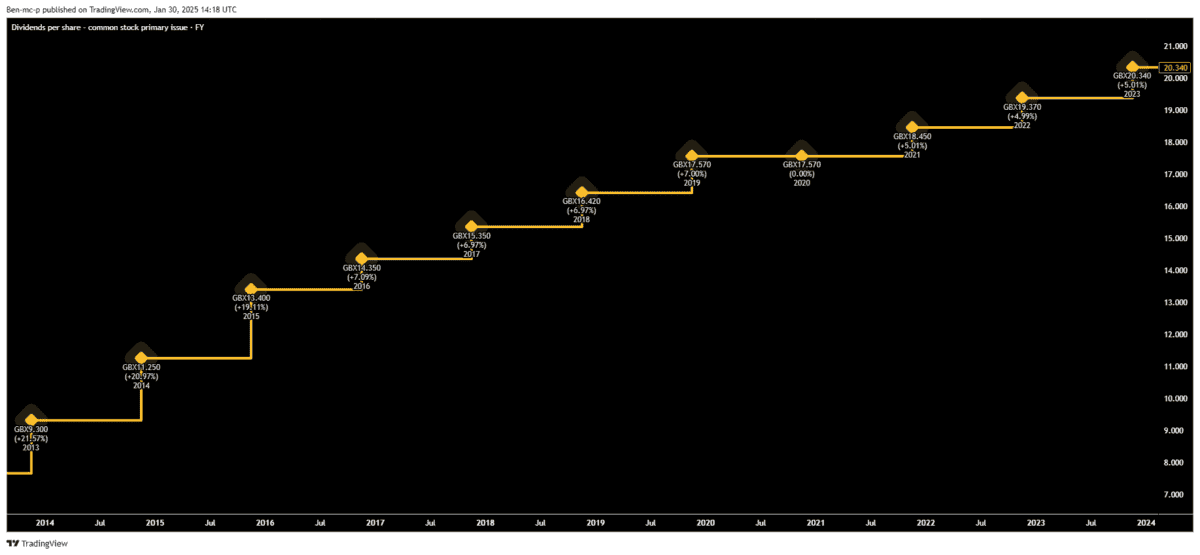

Personally, I feel Authorized & Normal is among the greatest revenue shares round, which is why I personal it in my very own portfolio. The corporate has a robust model, giant buyer base, and wonderful observe report of accelerating its payout.

A effectively as alternatives although, dangers can come up from the group’s huge $1trn+ belongings beneath administration. It’s uncovered to inventory market downturns, which may shortly cut back the worth of its funding portfolios, in addition to shifting rates of interest that drive fluctuations in bond costs. Financial downturns also can negatively impression earnings.

Nevertheless, for traders in search of high-yield revenue, I feel Authorized & Normal is price contemplating for inclusion in a diversified portfolio of high quality shares.

Make investments repeatedly

The keys to constructing up a sizeable passive revenue portfolio are time and consistency.

Had been somebody to speculate £750 a month, reaching an 8% common return, they’d finish up with roughly £275,000 after 15 years. This assumes dividends are reinvested over this time reasonably than spent.

At this level within the journey, the ISA portfolio can be producing annual revenue of roughly £20,000. It may then be loved or reinvested for longer to focus on a good better determine.