Picture supply: Getty Photos

There’s no ‘right’ or ‘wrong’ strategy to go about constructing a Shares and Shares ISA. However proudly owning a diversified portfolio of shares from the FTSE 100, FTSE 250 and elsewhere may help traders generate a robust and steady return over time.

One efficient strategy to diversify is by buying a number of worth, progress and dividend shares that present a easy return throughout all phases of the financial cycle.

With this in thoughts, listed here are three nice Footsie shares for brand new and current Shares and Shares ISA traders to think about in the present day.

Worth

Rising markets financial institution Commonplace Chartered appears low-cost throughout a wide range of metrics. When it comes to income, it trades on a ahead price-to-earnings (P/E) ratio of simply 8.3 occasions. In the meantime, its price-to-earnings progress (PEG) worth — at 0.6 — sits comfortably inside worth territory of 1 and under.

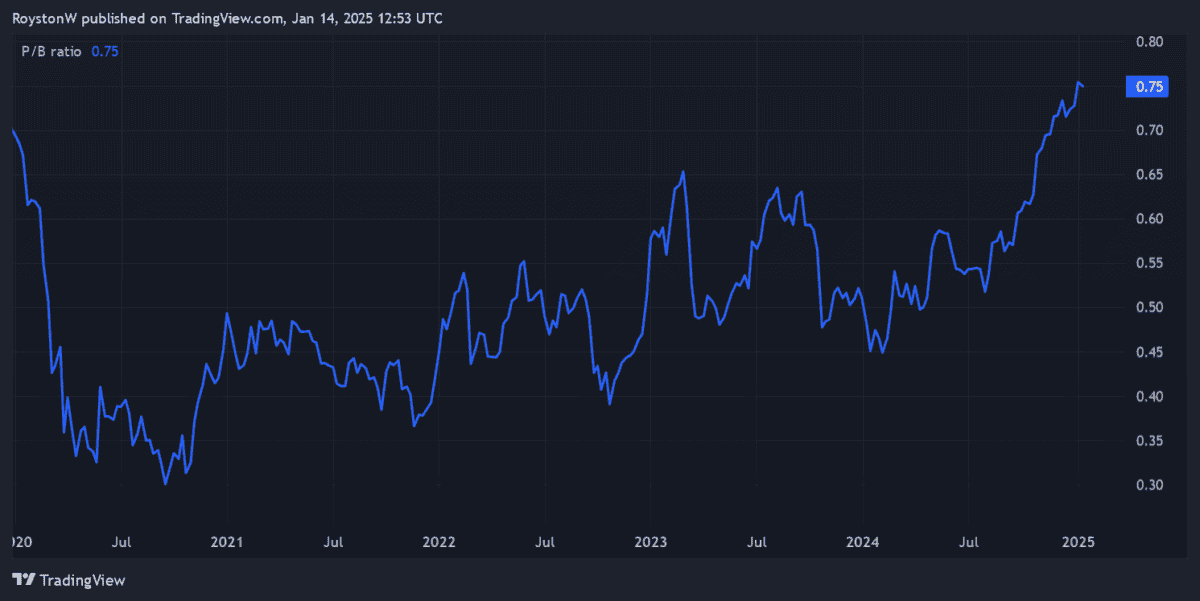

Commonplace Chartered shares additionally look low-cost relative to the worth of the financial institution’s property. At round 0.8, that is additionally under the worth threshold of 1.

It’s true that Asia-focused StanChart faces uncertainty as China’s economic system splutters. Nevertheless, it additionally has appreciable long-term progress potential as rising regional wealth and inhabitants progress drive banking companies progress.

The agency additionally has appreciable publicity to Africa to assist offset momentary bother in China.

Progress

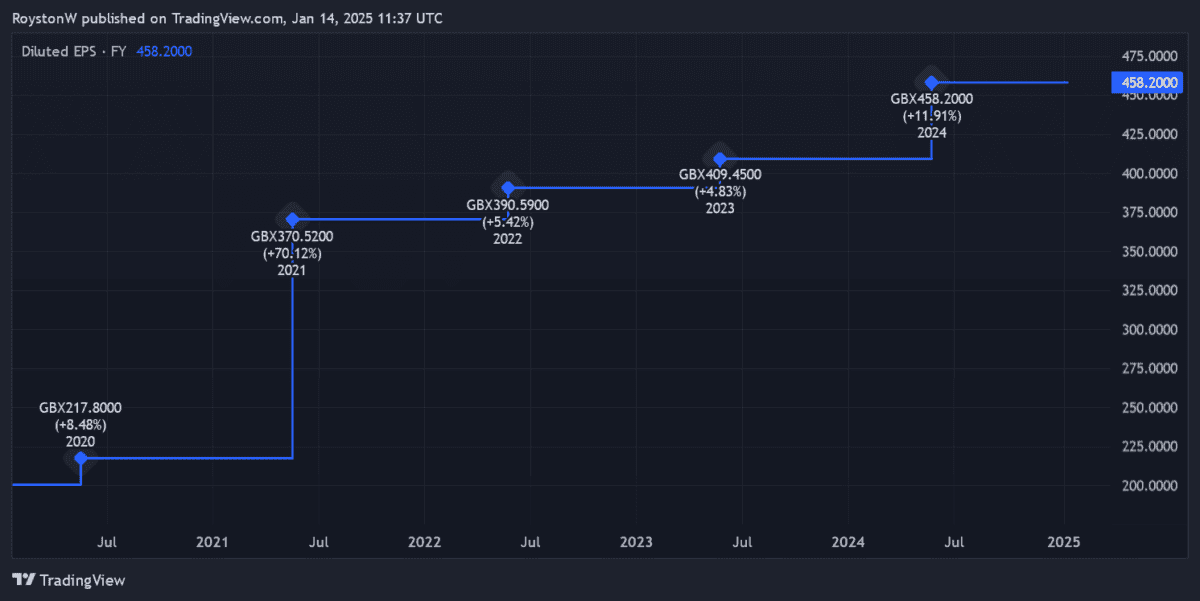

Tabletop gaming’s changing into more and more mainstream, pushed by market chief Video games Workshop (LSE:GAW). Its miniatures and video games techniques are thought of the gold customary of the business. Because the chart under reveals, it continues to get pleasure from fast earnings progress.

Video games Workshop — which solely entered the FTSE 100 final month — is finest identified for its Warhammer line of merchandise. Hobbyists construct, paint, after which do battle with their miniatures inside a group of fellow fans.

It’s a distinct segment but extremely profitable enterprise. Revenues totalled £299.5m within the six months to 1 December, up 14% 12 months on 12 months. With Video games Workshop additionally having fun with sky-high margins, working revenue elevated 33% to £126.1m.

Whereas weak client spending stays a menace, Metropolis analysts assume earnings right here will rise 7% on this monetary 12 months (to Might), and one other 4% the next 12 months. Over the long run, I believe income may rise considerably because the agency ramps up licencing of its IP to TV, movie and online game producers.

Revenue

I believe Authorized & Common‘s one of the Footsie’s hottest dividend shares in the present day. It’s why — together with Video games Workshop — I maintain its shares in my very own portfolio.

It’s raised dividends yearly for greater than a decade, and has pledged to maintain elevating them till 2027 a minimum of.

What’s extra, the dividend yield on Authorized & Common shares is a gigantic 9.9% for 2025 and 10% for 2026. To place this in context, the index common is manner again at 3.6%.

Dividends are by no means, ever assured. And shareholder payouts right here may come beneath stress if client spending weakens and/or aggressive pressures rise.

However in my opinion, the agency’s rock-solid stability sheet leaves it in fine condition to maintain delivering massive and rising dividends. As of final June, its Solvency II capital ratio was greater than twice the regulatory minimal, at 223%.