Picture supply: NatWest Group plc

It has been an excellent 12 months to personal shares in excessive road financial institution NatWest (LSE: NWG). The share price has surged 65% throughout the previous 12 months. Not solely that, it yields 4.9% even after that price enhance.

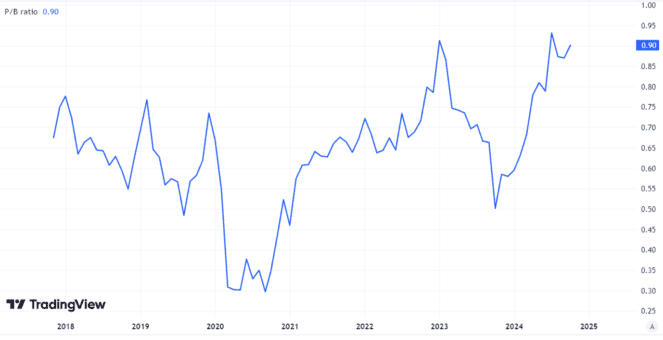

However with a price-to-earnings ratio of seven, the NatWest share price nonetheless appears to be like low cost on that measure. As earnings should not at all times the easiest way to worth financial institution shares, I additionally contemplate price-to-book worth when weighing whether or not so as to add them to my portfolio.

On that foundation too, NatWest shares seem pretty low cost given its robust manufacturers, massive buyer base and confirmed profitability. They arrive in at round 0.9, which is cheaper than the honest worth of 1.

Created utilizing TradingView

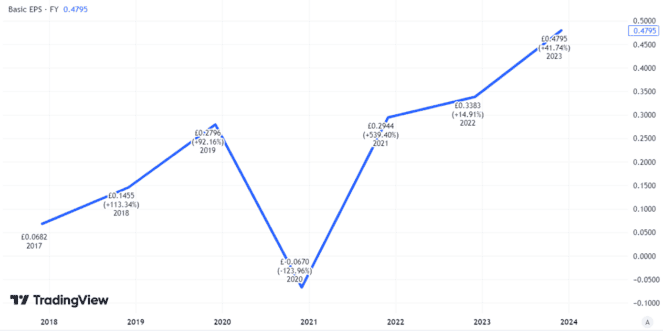

Financial institution earnings can transfer round loads

The problem with e-book worth or earnings as a valuation metric when assessing financial institution shares is that each can change, typically in a short time.

If the property market abruptly crashes or family earnings contracts sharply, the variety of debtors that fall behind on their repayments can enhance. That may result in decrease earnings or perhaps a transfer from revenue into the crimson.

Created utilizing TradingView

If property costs fall, a financial institution’s e-book worth will possible additionally fall. In spite of everything, that worth is predicated on the property (akin to mortgaged buildings) that it carried on its books. So decrease property costs can imply a decrease e-book worth.

For now, there isn’t a speedy signal that both is about to occur on a big scale. However on a longer-term timeframe, I really feel much less assured. The economic system stays lacklustre, whereas property costs stay excessive by long-term historic affordability measures.

Restricted provide and robust demand may also help assist costs, however even when demand outstrips provide, property costs can fall if householders wrestle to pay for them.

The place issues may go from right here

That could be a danger that weighs on my thoughts proper now on the subject of the share price of British banks, together with NatWest. Certainly, it’s a key cause that I don’t personal the share for the time being and haven’t any plans so as to add it into my portfolio.

The federal government promoting down its stake within the financial institution (a legacy of a monetary disaster period bailout) appears to not have damage the NatWest share price and from a valuation perspective the financial institution nonetheless appears to be like pretty low cost.

In the meantime, the longer the enterprise continues to carry out nicely, the extra assured I reckon some buyers will really feel {that a} exhausting financial touchdown is a falling danger. On that foundation, I feel that even after their latest run, NatWest shares may maintain transferring up from right here.

I might not be shocked to see them at a better price a 12 months from now, though I don’t suppose the enterprise efficiency justifies something like one other 65% rise in share price within the coming 12 months.

Regardless of that optimism although, I’ll stay on the bench till there’s clearer proof of ongoing robust efficiency within the world economic system and the UK.