Picture supply: Getty Photographs

Penny shares are typically dangerous investments. However they’ll generate spectacular returns at instances, to allow them to be price together with in a diversified portfolio.

Right here, I’m going to focus on two thrilling penny shares that I consider are price a better look immediately. At the moment, each are buying and selling for lower than 20p.

Excessive-risk, high-return

First up, we have now Poolbeg Pharma (LSE: POLB). It’s an under-the-radar biopharmaceutical firm that’s growing medicine (with the assistance of synthetic intelligence) to handle unmet medical wants.

Now, this can be a traditional penny inventory in that it’s a excessive danger, excessive reward play. You see, this firm doesn’t have any revenues or earnings in any respect immediately so it’s a really speculative funding.

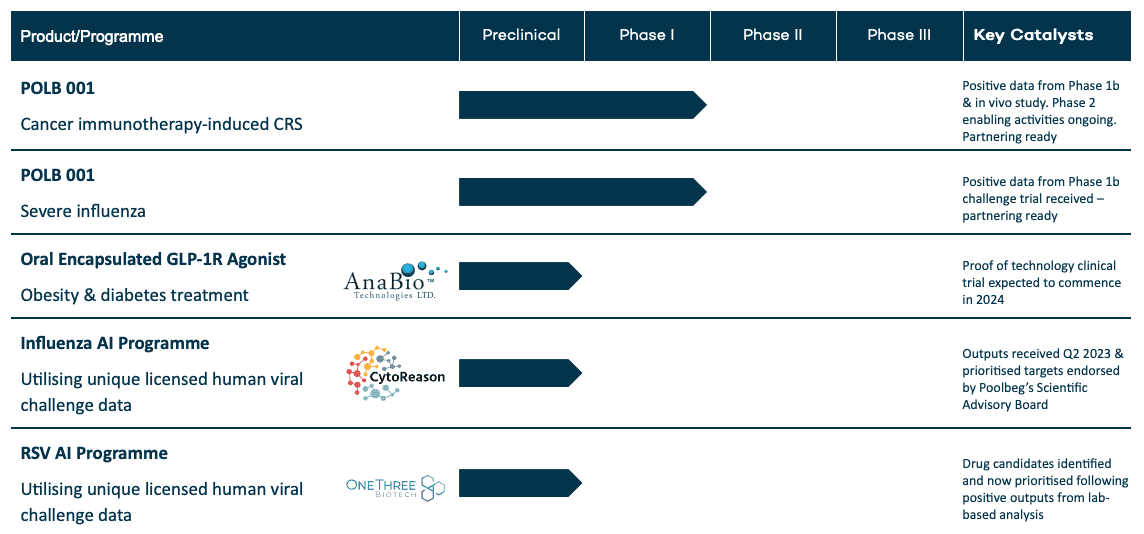

However issues might change. At the moment, the corporate’s engaged on a variety of medicine together with merchandise to deal with most cancers immunotherapy-induced Cytokine Launch Syndrome (a situation that develops when an immune system responds too aggressively to an infection) and weight problems (it’s engaged on an oral weight-loss product).

If it was in a position to deliver any of those medicine to the market, its revenues might explode. And so might its share price.

After all, buyers shouldn’t assume profitable market launches will occur. Drug growth’s a notoriously difficult business by which main setbacks are the norm.

I see a variety of potential right here although. I feel Poolbeg Pharma’s price contemplating as a speculative funding.

A high-growth business

The opposite penny inventory I need to spotlight immediately is Corero Community Safety (LSE: CNS). It’s a small cybersecurity firm that specialises in Distributed Denial of Service (DDoS) safety options.

I see this inventory as rather less dangerous than Poolbeg Pharma. That’s as a result of the corporate already has revenues. Final 12 months, these got here in at $22.3m. This 12 months, analysts anticipate $28m (development of a powerful 26%).

That mentioned, it’s nonetheless a really dangerous inventory as the corporate’s earnings are small. For 2024, web revenue and earnings per share are solely anticipated to return in at round $375,000 and 0.1 cents respectively.

Once more although, I’m excited in regards to the potential right here. Cybersecurity’s a quickly rising business and this firm’s having a variety of success at current, having not too long ago signed numerous contacts with companies of various sizes and shapes.

If it could proceed to do that and develop its revenues and earnings within the years forward, I feel it might transform an honest funding. It’s price noting that in July, the corporate mentioned that it continues to expertise excessive demand for its SmartWall ONETM DDoS safety options and that its pipeline is at file ranges.

After all, cybercrime’s at all times evolving. So there’s assure this firm will proceed to achieve success going ahead.

As a speculative funding nonetheless, I consider it’s price a glance.