Picture supply: Getty Pictures

I imagine the FTSE 100‘s stuffed full of bargains at the moment. I’ve picked the three I believe presently supply the very best worth.

Out of trend

Shares in JD Sports activities (LSE:JD.) presently (16 August) change arms for 28% lower than the inventory’s 52-week excessive.

It’s been caught within the crossfire following a downgrade in Nike’s gross sales forecast. The American sportswear big is believed to account for 50% of JD Sports activities’ income so this isn’t stunning.

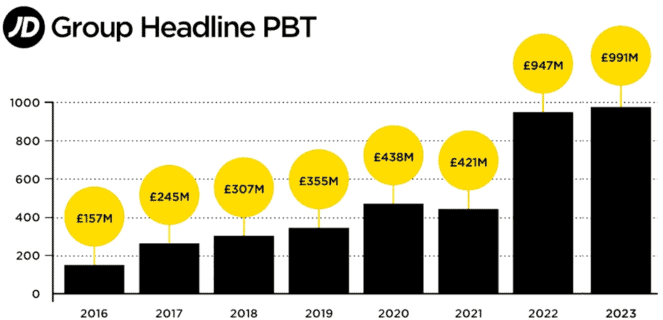

However the retailer sells a number of manufacturers together with some which can be capitalising on Nike’s issues. And the corporate has a formidable observe file of rising its earnings.

With a price-to-earnings (P/E) ratio of round 10 — half its common over the previous decade — I not too long ago determined to purchase some inventory.

Ringing the adjustments

On the again of stagnant income and falling earnings, Vodafone’s (LSE:VOD) shares seem like caught within the 65p-80p vary. I believe that’s why the corporate’s restructuring its operations and promoting its under-performing divisions in Spain and Italy.

There’s no assure its turnaround plan will work — others have failed. And I’ve considerations in regards to the firm’s debt ranges.

However I’ve confidence in its CEO. And the corporate’s latest buying and selling replace — for the primary quarter of its March 2025 monetary 12 months — hinted at a restoration below approach. I imagine now could possibly be entry level.

To contemplate the inventory’s potential, I’ve been taking a look at Deutsche Telekom, Europe’s largest telecoms firm. If the identical earnings a number of (13.7) was utilized to Vodafone, its shares could be 46% larger.

Prepared for take-off

Worldwide Consolidated Airways Group (LSE:IAG) shares are presently buying and selling 9% under their 52-week excessive. Analysts expect earnings per share of 40.97 euro cents (35.18p) in 2024. If appropriate, this suggests a P/E ratio of 4.8.

This appears to be like low cost in comparison with easyJet — the one different airline within the FTSE 100 — which has a ahead earnings a number of of 6.9. If the identical valuation was utilized to IAG, its inventory could be 43% larger (243p).

The pandemic reminded us of the dangers related to the airline trade. Additionally, IAG’s income have been impacted by inflation. Gas prices are largely out of its management. And a decent labour market’s placing stress on salaries. In August final 12 months, British Airways agreed a 13% pay rise (over 18 months) with its 24,000 employees.

Throughout 2023, these two expense headings accounted for precisely 50% of its working expenditure.

However I believe now could possibly be time to think about it. Passenger numbers are growing as soon as extra, internet debt’s falling, its dividend has been reinstated (albeit a modest one) and plenty of expect oil costs to fall over the subsequent 12 months.

Brokers seem to agree with my evaluation. Of the 16 analysts overlaying the inventory, 11 give it a Purchase ranking and 5 are Impartial.

Financial institution of America and RBC Capital Markets each have a price goal of 230p. After all, there’s no assure the share price will attain this stage however it illustrates that some charge the inventory extremely.

League desk

I already personal two of those shares. And if I had some spare money, I’d add IAG to my portfolio. Nevertheless, rating them in ascending order I’d put Vodafone third (low cost), adopted by IAG (cheaper) and JD Sports activities (least expensive).