Picture supply: Getty Photos

There’s little doubt that Nvidia‘s (NASDAQ:NVDA) monetary outcomes over the previous 12 months have been one thing particular. Earnings have soared as chip demand for the substitute intelligence (AI) revolution has boomed. However as an investor, I really feel that its spectacular buying and selling is now baked into its elevated share price.

At $122.60 per share, Nvidia trades on an enormous price-to-earnings (P/E) ratio of 45.5 instances for 2024.

Tech shares normally command massive premiums due to their vital progress potential. Nonetheless, the chipmaker seems massively costly in comparison with nearly all its sector rivals.

Fellow tech giants and AI shares Microsoft and Alphabet, as an illustration, commerce on ahead P/E ratios of 37.5 instances and 24 instances, respectively.

This heady valuation leaves little room for scope for dangerous information. A world financial slowdown, product improvement points, or issues with assembly orders are a couple of dangers that — in the event that they grew to become actuality — might trigger Nvidia’s share price to sink.

Early days

There’s one other downside that I’ve with shopping for Nvidia shares at present costs.

The microchip maker has been one of many AI pacesetters to this point. However at this early stage of the race, it’s tough to inform who would be the eventual winners from this new tech frontier.

Every of ‘The Magnificent Seven’ shares — which incorporates Nvidia, Microsoft and Meta, alongside Amazon, Apple, Alphabet, and Tesla — are all spending huge sums in generative AI and machine studying. We could look again and baulk at Nvidia’s huge valuation a couple of years from now.

Higher AI shares?

One option to get round this may very well be to purchase AI-related shares quite than the know-how corporations themselves. This method will give me the prospect to hedge my bets in addition to keep away from the huge premiums these progress corporations appeal to.

With this in thoughts, listed here are some I believe may very well be nice methods to revenue from the AI revolution.

Energy surge

A considerable quantity of computational energy is required for AI functions, particularly these involving deep studying and large-scale information processing. This in flip is resulting in fast enlargement of information centres that maintain the required {hardware}, and with it a pointy rise in electrical energy demand.

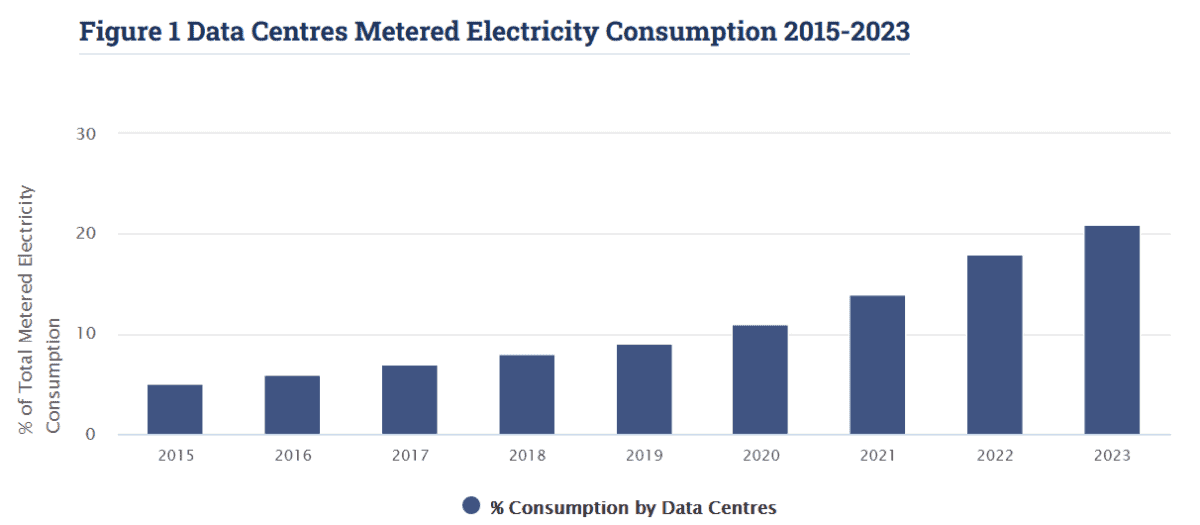

Power utilization information from Eire this week underlines simply how a lot juice it takes to run these hubs. Electrical energy consumption by the nation’s information centres soared by a fifth between 2022 and 2023. The sector now accounts for 21% of all Eire’s energy, greater than all of city households within the nation mixed.

With AI quickly rising, international locations are in extreme hazard of lacking their web zero insurance policies. The end result may very well be a ramping up of renewable vitality creation throughout the globe.

Greencoat Renewables is one such enterprise that would profit from Eire’s energy drain. It owns and operates primarily onshore and offshore wind farms throughout Europe, nearly all of that are positioned on the Emerald Isle.

Different sturdy renewable vitality shares embody The Renewable Infrastructure Group — a share I personal in my very own portfolio — and FTSE 100 wind vitality large SSE. There are in reality dozens of such shares for traders to select from at present.

Unfavourable climate durations can play havoc with vitality technology and income at corporations like these. However like Nvidia, additionally they carry appreciable progress potential because the battle towards local weather change intensifies.