Torsten Asmus

Virtu Monetary Overview

Virtu Monetary (NASDAQ:VIRT) had an overperformance reported yesterday. Volatility and volumes are down, so there was some decline to be anticipated, however they managed development. Particularly, some outperformance got here from the truth that VIRT is levered to volumes and commerce in crypto that are up YoY because the risk-on setting got here again in addition to the launch of institutionally supported crypto exchange-traded merchandise. That is possible additionally the place among the quick curiosity comes from, as we get round 10% of internet every day buying and selling revenue in these merchandise based mostly on per-day figures. The buyback on the again of the overperformance in outcomes continues which markets should like at round 1% buyback yield this quarter, therefore the rising price on earnings launch, and likewise the information that the approaching Ethereum (ETH-USD) would possibly make a distinction to outcomes. We predict that Virtu appears to be like just a little discounted, taking a crude method to writing off the crypto enterprise, but it surely comes from that crypto publicity.

Virtu Monetary Earnings

Let’s perhaps begin with the Ethereum angle. There are a number of factors to be made right here.

So, we’re sitting right here immediately. In the event you had stated to me three years in the past, like, hey, you are going to have $600,000 plus of adjusted internet buying and selling and practically $700,000 from these three classes, which successfully offered zero P&L three years in the past.

Douglas Cifu, CEO of Virtu, in reference to varied crypto merchandise and choices to date and their every day buying and selling internet revenue figures.

What’s to notice right here is that company-wide run charges are round $6 million in every day internet buying and selling revenue. So crypto merchandise are already up to 10%.

Ethereum merchandise have been permitted to come back to market in power with accessible spot merchandise, and Virtu might be making markets for these merchandise. These merchandise are coming to market on the twenty third of July. Critically, a lot of the infrastructure that’s at the moment getting used to distribute block merchandise and make the markets for these are going to be the identical for Ethereum merchandise. Analysts on the decision tried to pinpoint the relative recognition of Ethereum merchandise to the opposite block merchandise based mostly on launch figures, hoping for round half as widespread, however with cannibalisation results on volumes and the speed at which issuers are getting accepted, it is most likely nearer to a 3rd. No matter exercise ranges it ends up reaching, it is going to be monetised at basically 100% internet margin since these {dollars} on the margin are just about costless on present mounted infrastructure and community.

So whether or not it is half in dimension, or a 3rd in dimension, I feel it is most likely nearer to a 3rd than a half is what’s how I might form of scope it out. So, look, it is, and the marginal {dollars} on that successfully flowing to the underside line of Virtu after we pay trade charges and the SEC charges and all that different form of stuff is actually 100%.

– Douglas Cifu

Traders can hope that this may in the end result in a terminal improve of round 30-50% within the exercise in crypto-related merchandise, which ought to mirror in internet buying and selling revenue as a development of that magnitude. On the underside line, there can be the expectation of main working leverage results that would see EBITDAs improve by as a lot as a strong 12% from simply that impact, taking one other $200,000 internet buying and selling per day and placing it proper on the working revenue line. Maybe this might take some three years, which is how lengthy it took for the present suite of block merchandise to scale, presuming after all crypto would not once more collapse, which it simply may.

Snapshot (8-Ok)

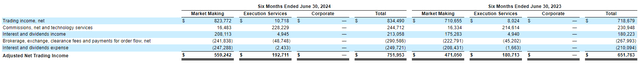

By way of the newest outcomes, not essentially wanting ahead, efficiency was positively forward of friends. Most volumes have been down in most markets, together with mounted revenue and equities, each sequentially and YoY. In crypto, volumes have been down sequentially within the general market by 30%. Normally, each institutional and retail exercise was combined to down. That is per the brokerage outcomes we’re seeing in different monetary picks. Market maker and dealer companies, that are each Virtu money-makers, need quantity and volatility with a view to maximise spreads and commissions and maximise. Regardless of poor business fundamentals, they managed a good sequential efficiency of round 4%, rising in internet buying and selling revenue, they usually managed a great YoY efficiency in internet buying and selling revenue of round 39%.

Backside Line

Valuation is a problem. A brokerage enterprise can be round an 18x PE, based mostly on US friends. Market makers can be across the identical presumably, and Virtu anyway has a mixture. Nonetheless, the working leverage and 10% reliance (and rising) on crypto merchandise are possible the place buyers are taking pause, as ahead PEs are round 10x, with LTM PEs at round 19x. Crypto coming on-line isn’t one thing that may be trusted by an inexpensive market participant to remain round sustainably, since it is a market that routinely crashes. Crudely, we might say that discounting the crypto enterprise, a 14x PE is what comes out on forwards, eradicating round $600k per day in internet buying and selling revenue from the working line. 14x is a reduced a number of in comparison with round 18x which you get on brokerage companies. Additionally, it’s ignoring the income that may come from making markets for crypto merchandise, even when it ends up being nothing greater than a windfall. It is not a nasty proposition. It is discounted, however the causes are absolutely crypto, so it is to not our style.