Market veteran Ali Martinez analyzes Ethereum market dynamics within the wake of the spot ETF approval, seeing an increase to $5,000 if a important stage holds.

Ethereum has just lately skilled vital price actions following the approval of a number of spot Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Trade Fee (SEC).

This milestone has sparked renewed curiosity and discussions amongst merchants and analysts. Market veteran Ali Martinez took to X to supply an in-depth analysis of the potential influence of the latest improvement on Ethereum’s market dynamics, calling consideration to a shift in market traits.

🧵Was the #Ethereum ETF a “sell the news” occasion? How low can $ETH go? Let’s dive in! 👇

— Ali (@ali_charts) Might 24, 2024

Elevated ETH Deposits on Exchanges

Martinez highlighted a surge in Ethereum transfers to cryptocurrency exchanges, noting that such actions usually sign elevated buying and selling exercise. Up to now two weeks, greater than 242,000 ETH have been moved to alternate wallets.

On account of this substantial inflow of tokens, exchanges now maintain 13.69 million ETH as steadiness, representing 11% of Ethereum’s circulating provide. This elevated inflow might sign an intent from whales to rebalance their portfolio, take earnings or interact in speculative buying and selling.

Considered one of Ethereum’s co-founders, Jeffrey Wilke, is one whale concerned in these transfers. Martinez discovered that he moved 10,000 ETH ($37.38 million) to the Kraken alternate. This transfer has added to the hypothesis that vital stakeholders is likely to be making ready to take earnings or modify their holdings in response to the ETF approval.

– Commercial –

Martinez additionally known as consideration to the feelings from trade pundits surrounding the Ethereum market. For example, Anthony Pompliano, a distinguished trade determine, views the approval of the Ethereum ETF as a major milestone, doubtlessly marking a broader acceptance of the cryptocurrency trade.

In the event that they approve the Ethereum ETF, they’re approving the complete trade.

That is the final dam to be damaged.

— Pomp 🌪 (@APompliano) Might 21, 2024

Nonetheless, Martinez urges warning, suggesting that the elevated deposits to alternate wallets might point out an impending sell-off or heightened profit-taking actions. Regardless of the uncertainty, a CryptoQuant report at this time confirmed that everlasting ETH holders just lately procured over 100,000 ETH.

Ethereum Assist and Resistance Ranges

Additional, Martinez referenced the TD Sequential. This software has offered a promote sign on the every day chart, that includes a inexperienced 9 candlestick. This sign suggests a possible retracement. Martinez explains that this might result in a decline presumably extending to 4 days or provoke a brand new downward part earlier than a resurgence of the uptrend.

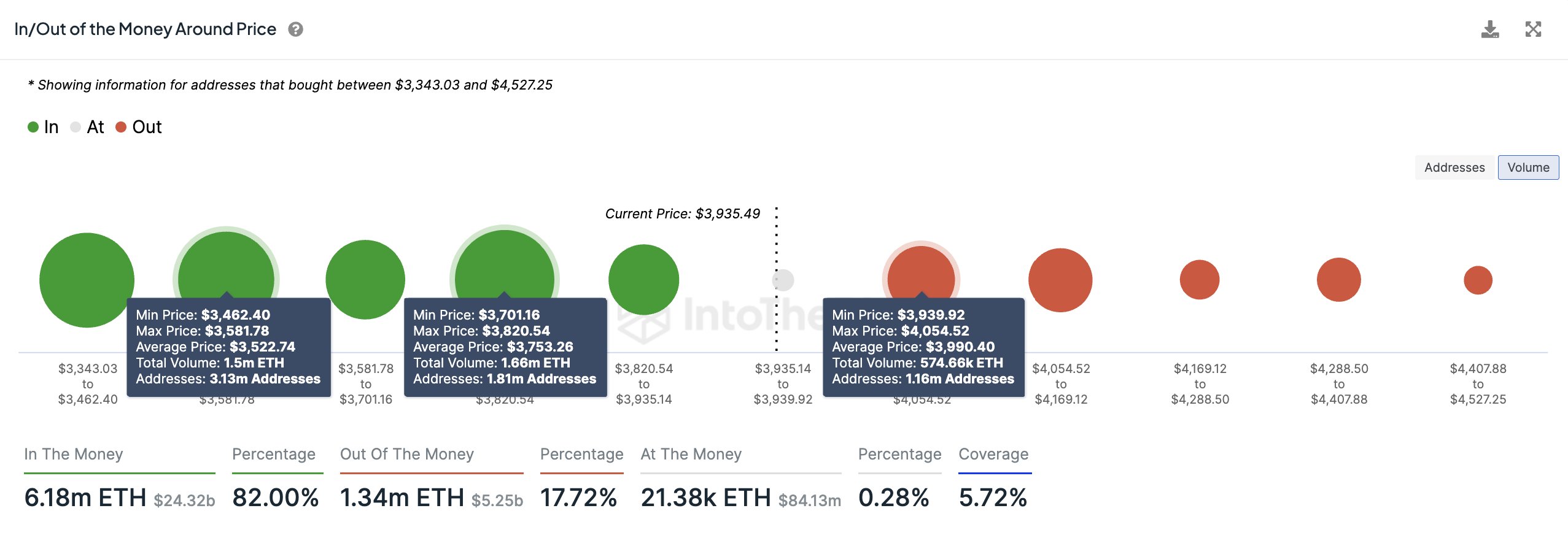

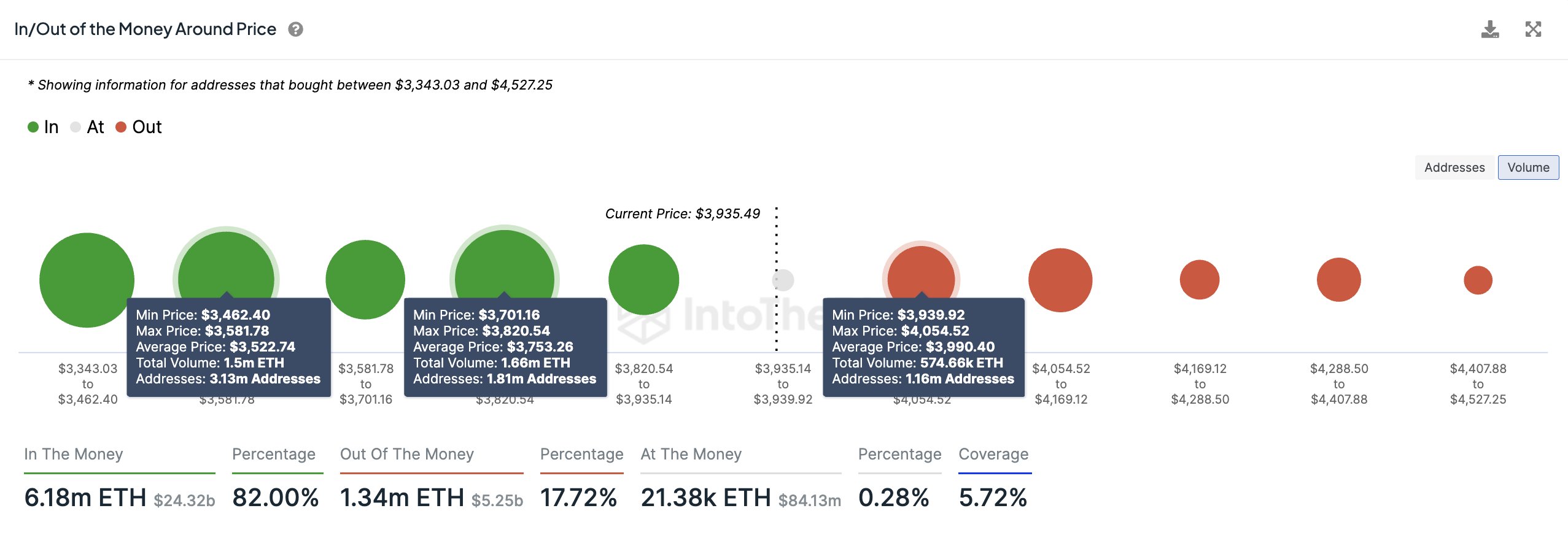

As well as, assist and resistance ranges play an important function in figuring out Ethereum’s price actions. In keeping with the In/Out of the Cash Round Worth (IOMAP) metric, a major demand zone exists between $3,820 and $3,700.

On this vary, over 1.81 million addresses maintain 1.66 million ETH. This space might act as a robust assist stage, doubtlessly stopping a extreme price drop amid promoting stress. Nonetheless, if ETH fails to carry this stage, the following assist zone lies between $3,580 and $3,462, the place 3.13 million addresses purchased 1.50 million ETH.

A Attainable Ethereum Push to $5,000

On the upside, Ethereum faces an important resistance barrier between $3,940 and $4,054, the place about 1.16 million addresses beforehand purchased 574,660 ETH. Overcoming this resistance may very well be difficult, but when Ethereum manages to report a every day shut above $4,170, it might invalidate the bearish momentum.

In keeping with Ali Martinez, such a transfer may set off a brand new upward part, doubtlessly pushing Ethereum’s price towards the $5,000 mark. ETH at the moment trades for $3,720, down 1.56% at this time however retains a 20% acquire over the previous week. Its every day RSI stays beneath 70, at the moment at 67 regardless of the most recent uptick.

Disclaimer: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article might embrace the creator’s private opinions and don’t mirror The Crypto Fundamental’s opinion. Readers are inspired to do thorough research earlier than making any funding selections. The Crypto Fundamental will not be chargeable for any monetary losses.

-Commercial-