Germany and the US are seemingly competing for who can spook bitcoin markets extra.

Addresses linked to German and US governments have just lately despatched $737.6 million in bitcoin to exchanges together with Coinbase, Bitstamp and Kraken, in addition to some to OTC desk operator-slash-market maker Stream Merchants.

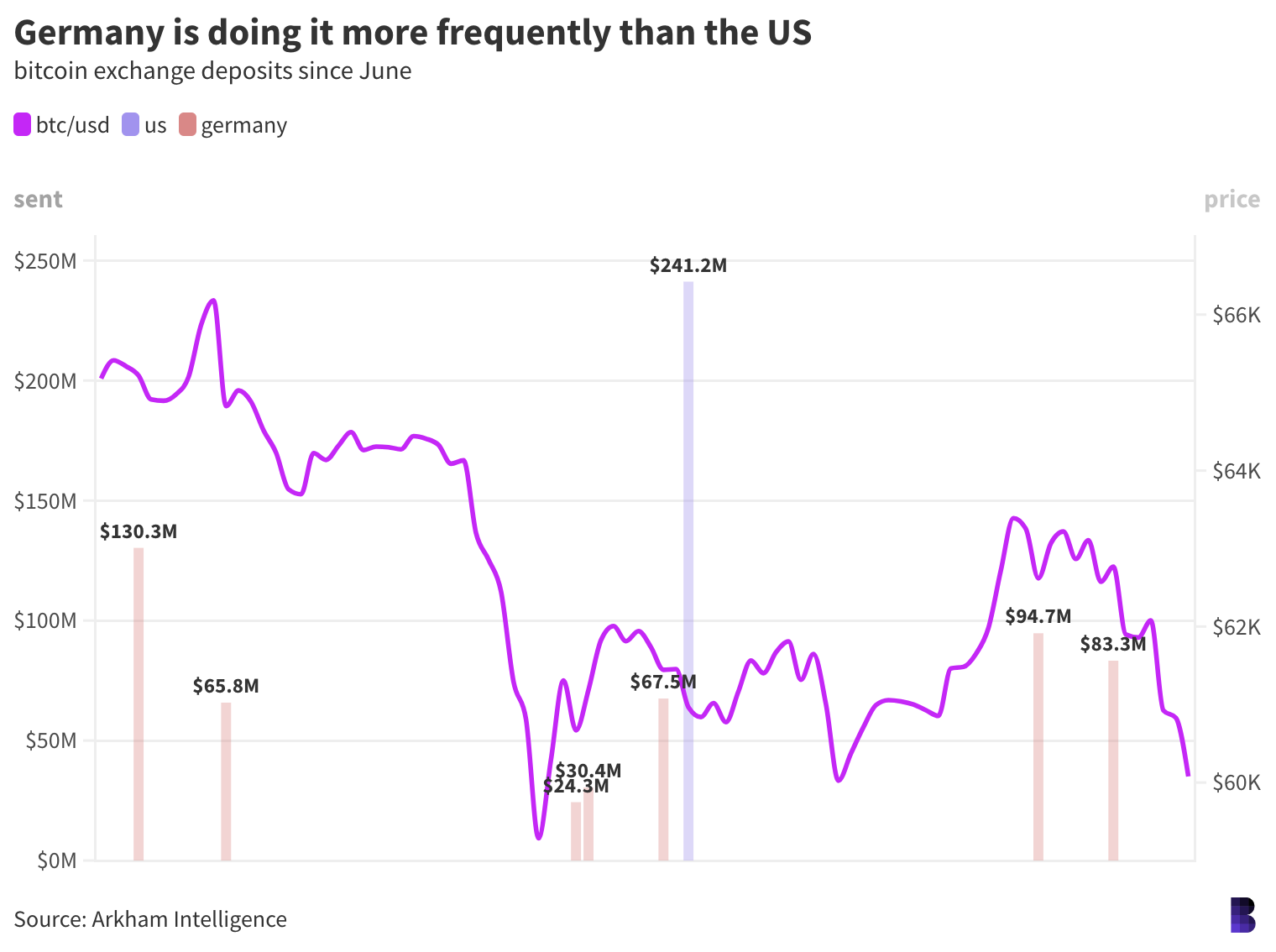

Germany makes up about three-quarters of that complete, with its deposits unfold throughout 30 totally different transactions — normally within the morning round 9 am native time.

Whereas it’s unclear whether or not all of the bitcoin was truly offered (a portion has since been returned to the unique addresses), Germany’s transfers to exchanges are believed to be the primary ever, no less than going by Arkham Intelligence information.

Native authorities had beforehand seized bitcoin by way of numerous legal circumstances, together with pirate portal Movie2k.

Over the previous two weeks, Germany has despatched 7,828 BTC in transfers that seem like a part of liquidation efforts.

That bitcoin was altogether valued at $496.4 million on the respective transaction occasions, implying a median price of $63,400. Bitcoin at the moment trades for $60,200, though a direct causal hyperlink between Germany’s transfers and falling costs is hard to attract.

As for the US, the Feds used to promote bitcoin at public sale. Now, it sells on Coinbase.

The US despatched a single 3,940 BTC deposit to Coinbase Prime at 11 am ET on June 26. The bitcoin, which as soon as belonged to drug vendor Banmeet Singh, was price $241.22 million on the time, whereas the identical haul would fetch $237.35 million proper now.

Except for the bitcoin offered at public sale in years prior, placing a precise worth on how a lot the US authorities has offloaded over time is troublesome.

Some transactions are apparent, just like the Coinbase deposits. Others solely finish up on exchanges after being despatched via a number of single-use addresses. (For the sake of this analysis, crypto that was first despatched to an in-between deal with earlier than being forwarded to an change additionally counted in the direction of the totals.)

After combing via the chain for change deposits, and different transfers which have all of the hallmarks of gross sales, it appears to be like just like the US authorities could have now both liquidated or moved to liquidate virtually $590 million in bitcoin since November 2020 (valued on the time of switch). Which is about 20% greater than Germany’s latest strikes.

The information means that:

- The US offered 15,903 BTC for about $37,000 on common since 2020.

- Had the US held all that bitcoin till now, it may’ve netted $958.7 million.

- The US missed out on an estimated $370 million by promoting too quickly, and that’s not counting the billions missed by promoting at public sale during the last decade.

World governments transferring round their bitcoin are inclined to make quite a lot of noise. However the onchain information signifies that the US has been promoting seized ETH for so long as BTC.

Cut up between Coinbase and Kraken, addresses tagged because the US authorities have despatched $49.1 million in ETH to buying and selling platforms since September 2020. A further $2.6 million in DAI and a small quantity of USDC was additionally despatched to an deal with that forwarded it onto Kraken.

All up, utilizing the identical analysis because the bitcoin train above, the US authorities seems to have liquidated 108,673 ETH for a median price of $452 (present price: $3,300). Had it held all that and offered at the moment, it might’ve scored over $358 million — lacking out on practically $310 million.

The ETH got here from wallets designated to seizures from circumstances involving defunct crypto debit card ploy Centra Tech and Gary Harmon, who, sarcastically, stole bitcoin seized by the US authorities, amongst others.

Combining it altogether exhibits the US and Germany have directed near $1.14 billion in seized bitcoin, ether and stablecoins to exchanges and different buying and selling platforms over the previous 4 years.

The US continues to be sitting on about $13.3 billion in crypto, largely bitcoin, in addition to a mixed $300 million in ether and tether. Germany in any other case continues to carry 43,549 BTC ($2.6 billion).

Begin your day with prime crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire publication.

Discover the rising intersection between crypto, macroeconomics, coverage and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin publication.

The Lightspeed publication is all issues Solana, in your inbox, each day. Subscribe to every day Solana information from Jack Kubinec and Jeff Albus.