1 Introduction

Blockchain, emerged because the underlying supporting know-how for Bitcoin [1], is a distributed ledger system offering non-tampering and traceability functionalities. Ethereum [2], also referred to as the blockchain 2.0 platform, additional provides helps for sensible contracts, that are applications that may be saved and executed on the blockchain system [3]. Builders can use sensible contracts to create varied decentralized purposes, particularly video games.

Blockchain video games are thought-about to have distinctive benefits over conventional on-line video games in that their gaming information and logic are transparently saved and executed on blockchains [4]. These benefits notably go well with video games with in-game cost and probability mechanisms, e.g., playing, which frequently suffered from belief points in conventional on-line setting. Consequently, present designs of blockchain video games primarily revolve across the technology, possession, and buying and selling of digital property [5].

Cryptokitties is a blockchain sport launched on Ethereum in late November 2017. Gamers can personal, commerce, and create digital kitties, represented by non-fungible tokens assembly the ERC-721 token customary within the sport. The attributes and transactions of kitties are recorded within the Ethereum blockchain. As soon as launched, CryptoKitties quickly gained large recognition that its transactions accounted for greater than 10% of the complete Ethereum visitors in early December 2017 [6].

Nonetheless, Min et al. [4] claimed that a lot of the present blockchain video games lack playability. Potential causes embrace that present blockchain platforms limit builders from implementing advanced sport features, present builders are paying inadequate consideration to the gamers’ gaming expertise, and lack a aggressive market within the blockchain sport business. Not surprisingly, the recognition of CryptoKitties solely lasted for a brief interval, too.

On this research, we goal to totally unveil the collective consumer behaviors within the sport and the explanations resulting in the sport’s speedy rise and fall by analyzing blockchain transaction data. Particularly, we first assemble a kitty possession switch community and examine the community structural modifications over time. Then, we conjecture and confirm the doable causes for the speedy modifications in gaming recognition from 4 views: the provision and demand of kitties, the profitability within the sport, the inequality of gamers’ wealth, and the constraints of blockchain programs. Based mostly on our observations, we pinpoint the deficiencies within the design of CryptoKitties and supply ideas for additional improvement of blockchain video games.

Community analysis strategies have been utilized to cryptocurrency transaction data in lots of earlier works. Chen et al. [7] constructed three graphs with ether switch, contract creation, and contract invocation, discovered a power-law diploma distribution, and revealed anomalies in these graphs. Somin et al. [8] additionally discovered a power-law diploma distribution within the ERC20 token switch community. Guo et al. [9] additional revealed a bow-tie construction within the Ethereum transaction community. Aside from the Ethereum blockchain, comparable strategies have additionally been used to investigate transactions on different blockchains, resembling EOSIO [10].

The remainder of this paper is organized as follows. CryptoKitties’ gaming guidelines are launched in Part 2. In Part 3, we assemble the kitty possession switch community and outline community structural properties. In Part 4, we divide the progress of the sport into 4 phases and look at the modifications of community parameters in numerous phases. We’ll talk about the explanations for the speedy change within the recognition of CryptoKitties in Part 5. Part 6 concludes the research and offers ideas for the additional improvement of blockchain video games.

2 Gaming Guidelines

As proven in Desk 1, the CryptoKitties sport has 5 sensible contracts: the Core contract, GeneScience contract, Gives contract, SalesAuction contract, and SiringAuction contract. The names of those contracts may very well be discovered on Etherscan [11]. Based mostly on these contracts, gamers can commerce or switch kitties with different gamers and breed new kitties.

TABLE 1. CryptoKitties’s sensible contracts.

There are 3 ways to commerce or switch a kitty. (1) Utilizing the SalesAuction contract. The vendor lists a kitty on the market with an preliminary price, a remaining price, and a price change interval to the SalesAuction contract. The preliminary price is normally greater than the ultimate price. After the public sale begins, the kitty price will change linearly from the preliminary price to the ultimate price at a relentless charge through the price change interval. The price won’t change after this era. Except bid by a purchaser or canceled by the vendor, the kitty will stay within the SalesAuction contract. Upon receiving a bid, the SalesAuction contract will ship the kitty to the customer and switch the cost to the vendor. The sport writer additionally sells 0-generation kitties to gamers on this approach. (2) Utilizing the Core contract. A participant can both name the switch operate to switch his kitty to a different participant or the approve operate to permit different gamers to switch his kitty. Approved gamers can name switch from operate to switch different gamers’ kitties. Transferring a kitty on this approach doesn’t essentially imply that the participant is buying and selling the kitty however may also be sending a kitty as a present to a buddy. (3) Utilizing the Gives contract. On this approach, the customer initiates a request to the vendor and sends the acquisition payment to the Gives contract. If the vendor accepts the request, the Gives contract will switch the kitty to the customer’s handle and ship the acquisition payment to the vendor.

When buying and selling kitties by the SalesAuction, the sport writer costs the sellers for 3.75% of the dealing price as a dealing with payment. Identical charge of dealing price can be charged to the patrons utilizing the Gives contracts. When calling any operate in every contract, the gamers additionally have to pay gasoline charges to Ethereum miners by their Ethereum pockets. The gasoline payment is normally between 0.0001eth and 0.01eth.

There are two methods to breed a brand new kitty. (1) A participant selects two of his personal kitties as parameters and name the breed With Auto operate within the Core contract with a breeding payment. After this operation, the mom kitties (might be arbitrarily chosen between the 2) will turn into pregnant for a interval. After this era, a participant, additionally referred to as the midwife, will name the give delivery operate within the Core contract to present delivery to the brand new kitty. The new child kitty can be transferred to the proprietor of the mom kitty. The breeding payment can be compensated to the midwife for his or her Ethereum gasoline charges paid. (2) A participant breeds with certainly one of his personal kitties and one other rented from the Siring Public sale contract, which lists quite a few kitties owned by the lenders. A midwife can also be wanted on this case. When a kitty is rented out by the Siring Public sale contract, the sport writer will cost the lender 3.75% of the hire as a dealing with payment.

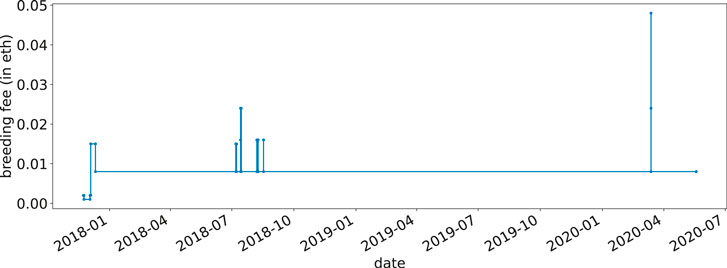

The breeding payment various over time (see Determine 1). It was set to 0.002eth on the sport’s launch. Nonetheless, because of the congestion of the Ethereum community ensuing from the gaming transactions, the gasoline payment was raised. The sport writer elevated the breeding payment to 0.015eth and later adjusted it to 0.008eth. Such adjustment occurred a number of instances afterward, however regardless of that, the breeding payment has been secure at 0.008eth.

FIGURE 1. Modifications of the breeding payment.

3 Information and Strategies

3.1 Blockchain Transactions

We synchronized an Ethereum parity shopper in full mode and used the eth_getLogs methodology to extract the transactions in CryptoKitties. The transactions span from November 23, 2017, to Might 19, 2020. The info concerned 1,923,901 kitties, 104,517 addresses, and 5,173,521 switch data. There are 9 sorts of transactions (see Desk 2) associated to the actions of kitties, together with the buying and selling, transferring, and the brand new delivery of kitties. Take into account participation charge because the ratio of the variety of addresses that participate in a particular exercise to the variety of all addresses in CryptoKitties, shopping for kitties by the SalesAuction contract has the best participation charge (84.6%), indicating that almost all gamers would purchase no less than one kitty from the official market. Participation charges are additionally excessive for breeding kitty (64.9%) and promoting kitty by the SalesAuction contract (51.8%). Gamers confirmed low curiosity in lending (38.1%) and renting kitties (26.6%). Solely a really small variety of gamers (lower than 1%) traded kitties by the Gives contract.

TABLE 2. 9 sorts of transactions associated to the actions of kitties.

3.2 Establishing Possession Switch Community of Kitties

The precise possession of the kitties solely modifications when (1) the gross sales public sale on the SalesAuction contract is fulfilled, (2) the buying and selling by the Gives contract is fulfilled, and (3) kitties are transferred straight utilizing features within the Core contract. Due to this fact, We assemble the kitty possession switch community

3.3 Community Structural Properties

We use the common diploma, non-zero in-/out-degree ratio, Gini coefficient of in-, out-, and whole levels, common clustering coefficient, density, reciprocity, and assortativity to explain the structural properties of the community.

The common diploma

The non-zero in-/out-degree ratio

The Gini coefficient

the place

The common clustering coefficient c is used to measure the clustering diploma of the community, which is outlined as

the place

Community density

The reciprocity

The diploma assortativity coefficient r measures the similarity of connections within the community with respect to the node diploma:

the place

4 Collective Behaviors of CryptoKitties Gamers

4.1 The 4 Phases of Sport Progress

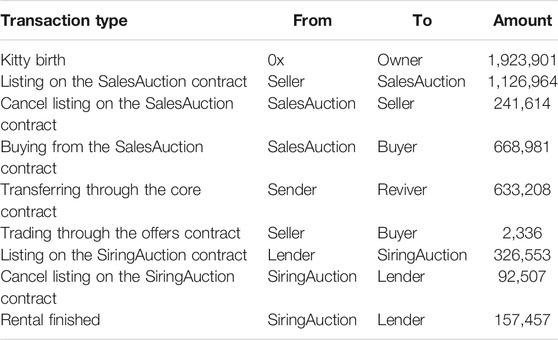

Utilizing the numbers of each day addresses associated to CryptoKitties transactions, the sport might be divided into 4 phases: the primer, the rise, the autumn, and the serenity, as proven in Determine 2.

1. The primer: The sport was launched on November 23, 2017. There weren’t many gamers earlier than December 2, 2017.

2. The rise: A lot of gamers entered the sport since December 2, 2017. The sport recognition quickly elevated earlier than reaching a peak on December 10.

3. The autumn: Since then, the recognition has dropped sharply. Initially of 2018, the sport’s recognition is lower than 10% of its peak.

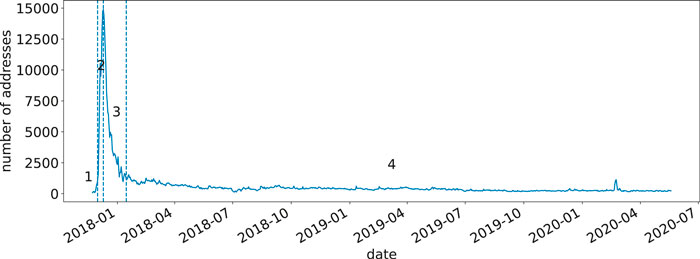

4. The serenity: After January 15, 2018, the recognition stabilized right into a long-term gradual downward development. Determine 3 reveals 4 snapshots of the community in every of the phases. The community measurement shrinks apparently over time.

FIGURE 2. 4 phases of the sport. The three dotted strains correspond to December 1, 2017, December 10, 2017, and January 15, 2018, respectively.

FIGURE 3. Visualizations of typical networks in each stage. Nodes within the community are filtered by out-degree. (A) There aren’t many early gamers in stage 1. (B) The community accommodates a lot of nodes in stage 2. (C) The community shrinks in stage 3. (D) Solely long-term gamers are left in stage 4.

4.2 Evolution of the Community Construction

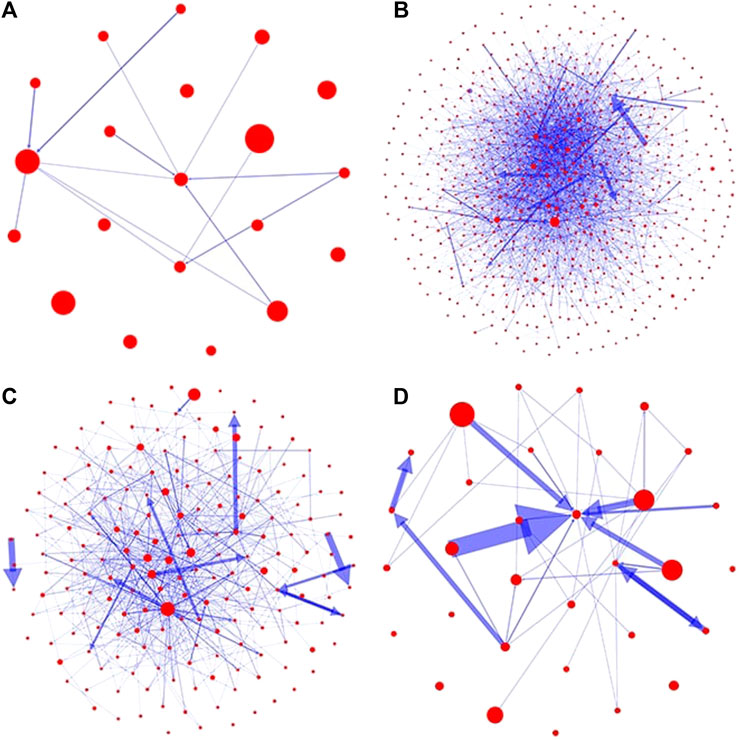

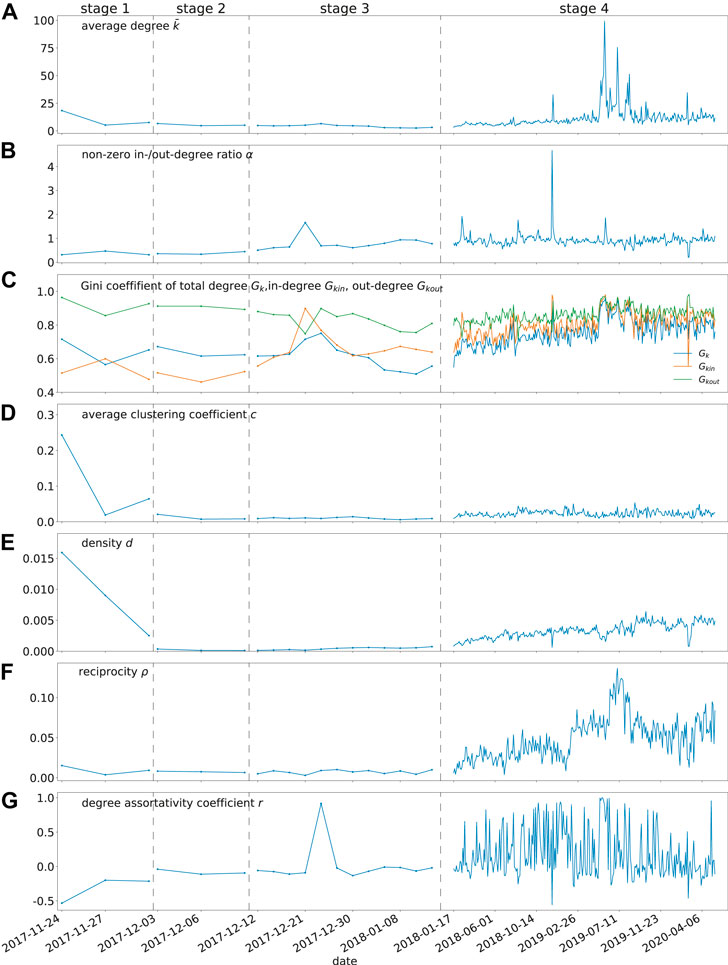

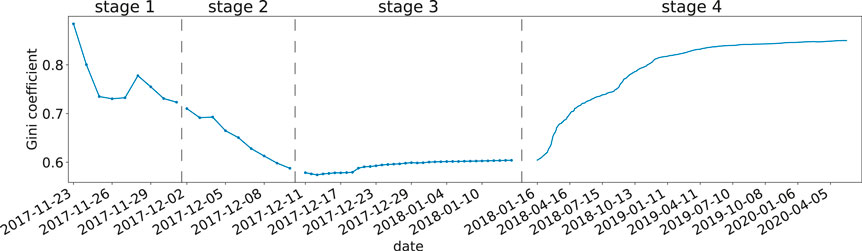

The evolution of community structural properties within the 4 phases are proven in Determine 4. Within the first stage, the Gini coefficient of out-degrees decreased all of the sudden. It is because virtually all 0-generation kitties had been transferred from the sport writer’s addresses to the gamers within the first few days. Quickly after that, gamers started to breed new kitties and promote them to one another. The decreases in common diploma, community density, and common clustering coefficient consequence from early gamers coming into the sport and increasing the community. In the meantime, the assortativity coefficient stayed adverse as a result of low-degree gamers tended to commerce with high-degree gamers, who’re the sport writer.

FIGURE 4. Evolution of the community structural properties over time. (A) The common diploma, (B) the non-zero in-/out-degree ratio, (C) the Gini coefficients of in-, out-, and whole levels, (D) the common clustering coefficient, (E) community density, (F) reciprocity, and (G) assortativity. Dotted strains separates the 4 phases. The labels on the x-axis characterize the center date of time home windows. The x-axis are re-scaled to raised illustrate the parameter dynamics in phases 1, 2 and three.

Within the second stage, the community density stayed low because of the massive variety of gamers coming into the sport. The diploma assortativity coefficient elevated to zero, which means that low-activity gamers tended to switch kitties amongst themselves moderately than buying and selling with high-activity gamers.

Within the third stage, the non-zero in-/out-degree ratio maintained an upward development, indicating that the ratio of sellers to patrons was rising, and market competitors was intensifying. The Gini coefficient of out-degrees decreased gently, indicating that even the vendor/purchaser ratio elevated, the hole between gross sales quantity amongst sellers was narrowing. Nonetheless, in-degrees’ Gini coefficient went up all of the sudden. The anomalous information level round December 23, 2017, was brought on by an exceptionally massive variety of transactions made by a handful of addresses.

Within the fourth stage, the rising common diploma and reciprocity point out that the gamers left within the video games had been actively buying and selling with one another. The Gini coefficients all maintained an upward development, indicating a big hole forming in these gamers: some large gamers had been progressively dominating the sport.

Observe that the common diploma, Gini coefficients, and reciprocity all of the sudden elevated in June 2019. We discovered that they had been brought on by the launch of Wrapped Cryptokitties (WCK), which is an ERC-20 token contract, enabling gamers to change undesirable ERC-721 kitties for WCK and use WCK to change different kitties. The alternative of a lot of ERC-721 kitties with WCK resulted in a sudden fluctuation within the community construction.

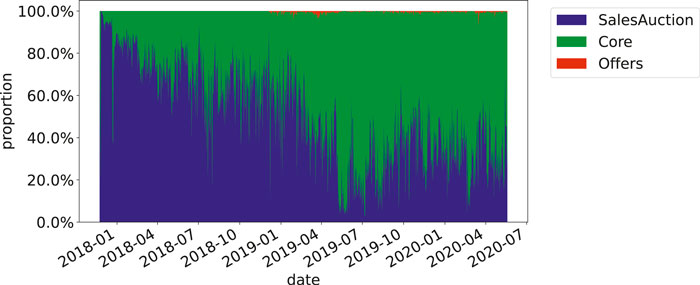

4.3 Modifications within the Kitty Possession Transferring Strategies

There are 3 ways to switch the possession of kitties: by the SalesAuction, Gives, or Core contracts. The modifications within the proportions of the three strategies over time are proven in Determine 5. Within the early days of the sport, the possession switch of kitties was primarily realized by the SalesAuction contract. Later, the proportion of transferring kitties with the tactic in Core contract progressively elevated. After April 2019, this methodology had turn into the principle approach of transferring kitty ownerships. The variety of kitties transferred by the Gives contract was at all times small.

FIGURE 5. The change in proportion of three strategies to switch the kitties.

Price was the principle purpose for this variation. Gamers are likely to switch kitties at a decrease price. When shopping for and promoting kitties by the SalesAuction and Gives contracts, gamers have to pay a transaction payment to the sport writer, normally 3.75% of the transaction quantity. Utilizing the switch methodology within the Core contract, in distinction, solely requires a gasoline payment cost. Due to this fact, some third-party buying and selling platforms emerged to assist gamers commerce kitties, charging fewer transaction charges. For instance, the transaction payment charged by the OpenSea buying and selling platform is barely 2.5%.

5 Causes for the Rise and Fall of CryptoKitties

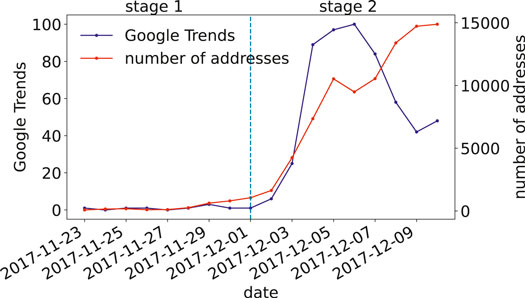

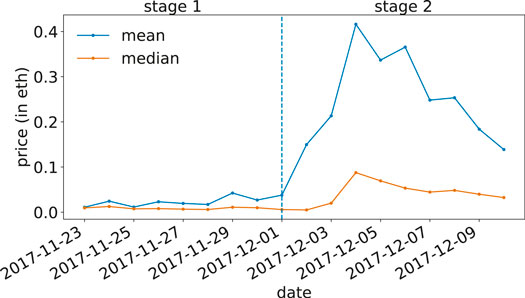

5.1 Causes for the Explosive Progress of Sport Recognition

On December 2, 2017, the kitty with ID 1 was bought for 247eth, i.e., greater than US $100,000 [12]. This message unfold rapidly on the Web, producing a considerable amount of attentions. Determine 6 reveals the Google development index of CryptoKitties and variety of each day addresses associated to CryptoKitties transactions. Kitties traded at extraordinarily excessive costs will undoubtedly appeal to media consideration and produce many new gamers to the sport. The elevated consideration from Web customers finally led to the explosive development of the sport’s recognition. We can’t rule out the chance that the sport writer intentionally made the information {that a} particular kitty has being bought at a particularly excessive price. In reality, virtually all transactions with an quantity higher than 100eth occurred in early December 2017, which corresponds exactly to the rise stage of the sport. Nonetheless, regardless of of the trigger, media publicity had certainly elevated the sport recognition considerably.

FIGURE 6. Google Tendencies of CryptoKitties and the numbers of each day lively addresses.

Cryptocurrencies, resembling Bitcoin, present a constructive correlation between their costs and the sizes of the consumer teams [13–15]. The kitties within the sport are ERC-721 token, and subsequently, the identical rule applies. On the one hand, the enlargement of the participant neighborhood has elevated the demand for kitty tokens and promoted the rise of kitty price. Alternatively, the rise in kitty price attracted extra gamers to hitch the neighborhood. Ultimately, the entry of a lot of gamers into the sport has led to a surge in demand for kitties, therefore the kitty price (see Determine 7). The imply price of kitties in every day is considerably greater than the median price as a result of a small variety of kitties had been bought at considerably greater costs than common.

FIGURE 7. Imply and median costs of the kitties bought in every day.

5.2 Causes for the Speedy Fading of Sport Recognition

The speedy development of sport recognition solely lasted lower than ten days. Since then, the variety of gamers has dropped sharply. Lee et al. [16] famous that customers’ taking part in behaviors in CryptoKitties are affected by speculative and gratifying components. Right here, we suggest 4 particular causes that might account for the speedy decline in sport recognition: the out-of-balance of the provision and demand of kitties; the lack of revenue in kitty buying and selling; the rising hole between the wealthy and poor gamers, and the constraints of blockchain programs.

5.2.1 The out of Provide and Demand Steadiness

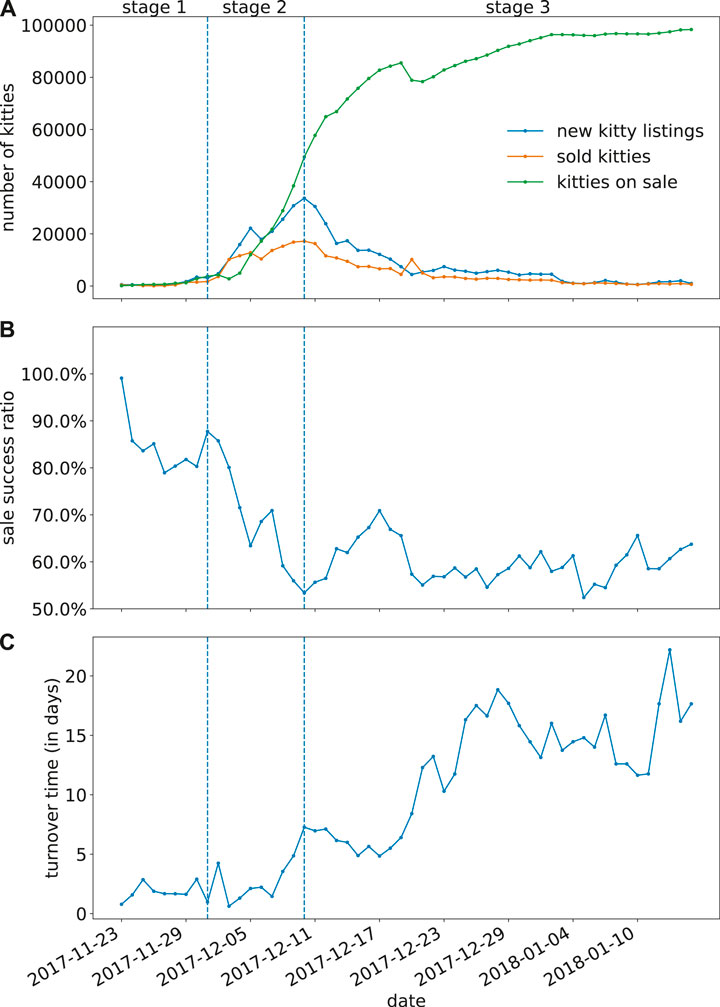

The big variety of gamers poured in through the explosive development stage bred a lot of kitties in a really brief time. Since December 4, 2017, the variety of new kitty listings has considerably exceeded the variety of kitties bought day-after-day, leading to a speedy enhance within the variety of kitties left on sale, i.e., inventory stock (see Determine 8A). The kitty market has turn into a purchaser’s market, and the competitors has intensified. The ratio of a profitable sale for kitties listed on every day additionally decreased (see Determine 8B), and the turnover time, i.e., the common time interval between kitty itemizing and commerce closing turns into longer (see Determine 8C).

FIGURE 8. The provision and demand of kitties out there. (A) The numbers of latest kitty listings, kitties bought, and kitties on sale out there day-after-day. (B) The ratio of profitable sale for kitties listed on every day. (C) Turnover time, i.e., the common time interval between kitty itemizing and commerce closing for kitties listed on every day. Dotted strains separates the stage 1, 2 and three.

5.2.2 The Lack of Revenue in Kitty Trading

Buchholz et al. [17] identified that the worth of cryptocurrencies has no benchmark however purely rely upon the provision and demand out there. As the provision of kitties considerably overwhelmed the demand, the price of kitties dropped considerably. Revenue is a crucial motivation to encourage the gamers to remain within the sport. If their income from promoting kitties turns into decrease than the prices, the gamers’ enthusiasm will decline and even disappear.

Teoretically, suppose a participant makes use of two of his personal kitties to breed a brand new kitty and promote it on the median kitty price (excluding the 0-generation kitties) by the SalesAuction contract on the identical day. The common price of breeding and promoting a kitty in in the future might be written as

the place

the place

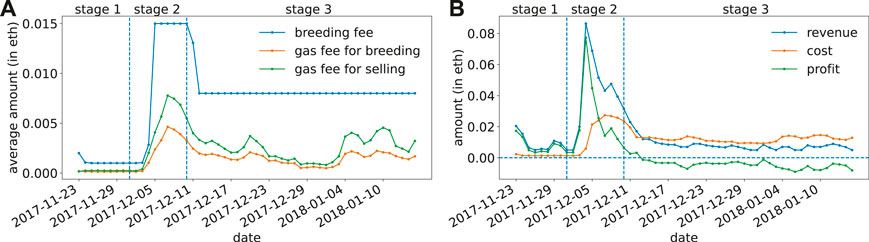

Determine 9A reveals that the price break-down for breeding and promoting elevated sharply in stage 2. Amongst all the prices, the breeding payment is the best, adopted by the miner’s payment for the promoting operation, and the miner’s payment for the breeding operation is the bottom. Determine 9B reveals that ranging from December 13, 2017, the common revenue for a participant to breed and promote a kitty grew to become adverse, indicating that the participant might lose cash when taking part in the sport.

FIGURE 9. The lack of revenue in kitty gross sales. (A) The common breeding payment, gasoline payment for breeding, and gasoline payment for promoting a kitty by SalesAuction contract on every day. (B) The income (median price of kitties), price, and revenue for breeding and promoting a kitty on every day. Dotted strains separates the stage 1, 2 and three.

The precise in-game breeding and sale might not occur on the identical day. For each kitty bought, the vendor’s precise revenue might be evaluated by the distinction between the breeding or acquisition price and promoting income. Right here, we additionally estimate the precise revenue of kitties bought every day. For the kitty bought for the primary time, the vendor’s revenue might be written as

the place v is the price at which the kitty is bought,

the place

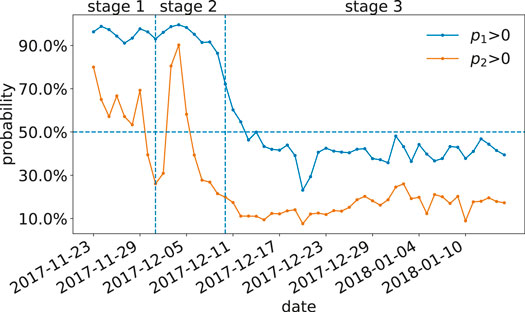

Determine 10 reveals the likelihood of producing a constructive revenue by promoting kitties every day. After December 6, 2017, this likelihood for kitty resales grew to become lower than 50%. After December 13, 2017, this likelihood for promoting self-bred kitties grew to become lower than 50%. Whether or not the participant sells kitties bred by self or beforehand bought, there’s a nice probability of shedding cash.

FIGURE 10. The likelihood of producing constructive revenue in promoting a kitty every day. Dotted strains separates the stage 1, 2 and three.

5.2.3 The Growing Hole Between the Wealthy and Poor

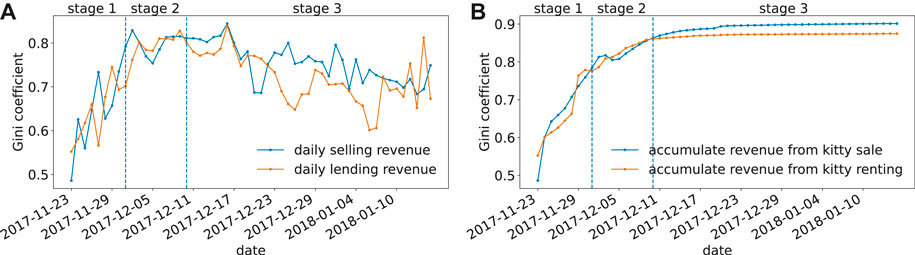

Gamers obtain income from promoting and lending kitties. Within the first stage of the sport, the Gini coefficient of each day income from promoting and leasing elevated considerably (see Determine 11A), and that of the cumulative income for all of the addresses additionally elevated considerably (see Determine 11B). After coming into the third stage, though the Gini coefficient of the income earned by gamers from promoting and renting fluctuated, all of them remained at a comparatively excessive stage (higher than 0.6). The Gini coefficient of accrued income stayed at a excessive stage (higher than 0.8). Since 0-generation kitties had been primarily bought by sport writer, these gross sales weren’t thought-about when counting the income of gamers. Our outcomes present that the hole between the wealthy and poor within the sport expanded. A couple of gamers earned a lot of the cash from the sport, whereas most can solely get little or no revenue, if any. The rising hole within the income has triggered most gamers’ gaming expertise to deteriorate, they usually progressively withdrew from the sport.

FIGURE 11. Gini coefficients of (A) each day promoting and lending income and (B) the accumulate income from kitty sale and renting for all of the addresses. Dotted strains separates the stage 1, 2 and three.

Not solely the revenues, kitty ownerships had been additionally progressively concentrated to some gamers. The Gini coefficient of the variety of kitties owned by all addresses at every stage is proven in Determine 12. When counting the variety of kitties belong to an handle, unsold kitties within the SalesAuction contract belong to the vendor, and unrented kitties within the SiringAuction contract belong to the lender. Within the first and second phases, many new gamers entered the sport, all making buying, and the Gini coefficient progressively decreased. Nonetheless, because the variety of new gamers decreased and current gamers give up, the Gini coefficient rose within the third stage and stored rising within the fourth stage. As of April 2020, the Gini coefficient of kitties with addresses has exceeded 0.8. At the moment, the assets in CryptoKitties grew to become extremely concentrated.

FIGURE 12. The Gini coefficient of kitties owned by all addresses. Dotted strains separates the 4 phases. The x-axis are re-scaled to raised illustrate the parameter dynamics in phases 1, 2 and three.

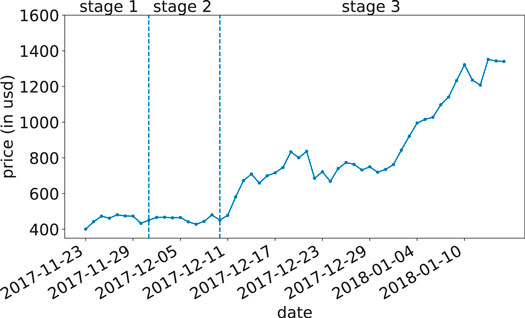

5.2.4 Limitations of Blockchain Techniques

The price of performing operations on a public blockchain system is very unstable because of the unstable price of cryptocurrencies, leading to it tough to manage the price of the purposes deployed on the blockchain. As CryptoKitties was deployed on Ethereum, the price of taking part in the sport (together with the prices of shopping for, breeding, and renting kitties, in addition to the charges paid to Ethereum miners) has risen considerably because of the speedy rise of Ether price within the third stage. Ether price elevated from US $451 on December 10, 2017, to US $1,322 on January 10, 2018 (see Determine 13), leading to a big enhance in the price of taking part in the sport, elevating the bars for brand new gamers coming into the sport.

FIGURE 13. The Ether price. Dotted strains separates the stage 1, 2 and three.

Along with the cryptocurrency price, different potential limitations of blockchain programs embrace the pointless gasoline price by poorly designed sensible contracts and the low system throughput (measured in transaction per second, TPS). Underneath-optimized sensible contracts will eat extra gasoline than essential [18], making it costlier for customers to play video games. Chen et al. [19, 20] studied the gasoline price mechanism of Ethereum and proposed a solution to optimize sensible contracts by analyzing bytecodes, probably lowering the gaming prices. The low throughput of Ethereum [21] has rendered that concurrent operations by many customers are usually not possible. As soon as too many gamers have joined the sport, the time wanted to validate operations within the sport takes too lengthy, subsequently sabotaging the gamers’ gaming experiences.

6 Conclusion

This paper is the primary to totally unveil the consumer actions within the as soon as hottest blockchain sport CryptoKitties and establish the explanations for its rise and fall. Based mostly on the variety of addresses related to the sport day-after-day, we divide the method of CryptoKitties into 4 phases: the primer, the rise, the autumn, and the serenity. We extracted all of the 5 million kitty transactions from the Ethereum blockchain and constructed the kitty possession switch community for characterizing the consumer behaviors. We discovered that a lot of gamers flooded within the sport within the early days however rapidly withdrew later, and some large gamers progressively took management of the sport.

We discovered that the general public consideration drew by the message {that a} particular kitty was bought at a particularly excessive price finally led to the explosive development of sport recognition. For the speedy decline of the recognition, causes together with 1) the oversupply of sport props, i.e., the kitties, 2) the lack of revenue within the sport prop buying and selling, 3) the rising hole between the wealth distribution among the many gamers, and 4) the constraints of blockchain are accounted for.

Drawing from these observations, we advise on the designing of future blockchain video games as follows.

1. Design an affordable prop output mechanism to maintain a stability between provide and demand.

2. Present a mechanism for adjusting participant revenue to forestall gamers shedding cash in prop buying and selling with a excessive likelihood.

3. Design a mechanism to slim down the hole between the wealthy and poor and forestall the income from being gained by only some gamers.

4. To totally contemplate the constraints of blockchain programs within the sport design.

Information Availability Assertion

Publicly out there datasets had been analyzed on this research. This information might be discovered right here: https://github.com/jiangxjcn/Cryptokitties-analysis.git.

Creator Contributions

Each authors designed the research and wrote the paper. XJJ performed information analysis.

Funding

This work is supported by CityU Begin-up Grant for New College (No. 7200649) and CityU Strategic Analysis Grant (No. 11503620).

Battle of Curiosity

The authors declare that the research was performed within the absence of any business or monetary relationships that may very well be construed as a possible battle of curiosity.

Acknowledgments

We thank Si-Hao Liu and Ying-Hao Zhang for his or her ideas on the revision of this text.

References

1. Nakamoto S. Bitcoin: A peer-to-peer digital money system (2008).

2. Buterin V. Ethereum white paper: a subsequent technology sensible contract & decentralized software platform (2014).

3. Mohanta BK, Panda SS, Jena D. An summary of sensible contract and use instances in blockchain know-how. In: 2018 ninth Worldwide convention on computing, communication and networking applied sciences (INCCCNT); 2018 July 10–12; Bangalore, India. NEW YORK: IEEE (2018), 1–4.

Google Scholar

4. Min T, Wang H, Guo Y, Cai W. Blockchain video games: a survey. In: 2019 IEEE Convention on Video games (CoG); 2019 August 20–23; London, United Kingdom. NEW YORK: IEEE (2019). p. 1–8.

Google Scholar

5. Scholten OJ, Hughes NGJ, Deterding S, Drachen A, Walker JA, Zendle D. Ethereum crypto-games: mechanics, prevalence, and playing similarities. In: Chi Play’19: Proceedings of the Annual Symposium on Pc-Human Interplay in Play; 2019 October 17; Barcelona, Spain. New York: ACM (2019) 379–89.

Google Scholar

7. Chen T, Zhu Y, Li Z, Chen J, Li X, Luo X, et al. Understanding ethereum through graph analysis. In: IEEE INFOCOM ’18 convention on pc communications; 2018 April 16–19; Honolulu, HI, USA. NEW YORK: IEEE (2018a). p. 1484–92.

Google Scholar

9. Guo D, Dong J, Wang Ok. Graph construction and statistical properties of ethereum transaction relationships. Inf Sci (2019) 492:58–71. doi:10.1016/j.ins.2019.04.013

CrossRef Full Textual content | Google Scholar

10. Huang Y, Wang H, Wu L, Tyson G, Luo X, Zhang R, et al. Understanding (Mis)Conduct on the EOSIO blockchain. Proc ACM Meas Anal Comput Syst (2020) 4(2):1–28. doi:10.1145/3392155

CrossRef Full Textual content | Google Scholar

11.Etherscan. The ethereum block explorer (2017). Accessible from: https://etherscan.io/ (Accessed Might 19, 2020).

13. Baumann A, Fabian B, Lischke M. Exploring the bitcoin community. In: tenth Worldwide Convention on Internet Data Techniques and Applied sciences quantity 2: WEBIST ’14; 2014 Apr 3–5; Barcelona, Spain. Setúbal, Portugal: SciTePress (2014), 369–74.

Google Scholar

15. Szücs I, Kiss A. Quantitative analysis of bitcoin change charge and transactional community properties. In: ninth Worldwide Convention on Utilized Informatics; 2014 Jan 29–Feb 1; Eger, Hungary. (2015), vol. 1, 201–11.

Google Scholar

16. Lee J, Yoo B, Jang M. Is a blockchain-based sport a sport for enjoyable, or is it a instrument for hypothesis? an empirical analysis of participant habits in crypokitties. In: Xu JJ, Zhu B, Liu X, Shaw MJ, Zhang H, and Fan M, editors. The ecosystem of e-business: applied sciences, stakeholders, and connections. WEB 2018. Lecture Notes in Enterprise Data Processing. vol. 357. Cham, Switzerland: Springer Worldwide Publishing (2018). p. 141–8.

Google Scholar

18. Chen T, Li X, Luo X, Zhang X. Underneath-optimized sensible contracts devour your cash. In: 2017 IEEE twenty fourth worldwide convention on software program analysis, evolution and reengineering (SANER); 2017 Feb 20–24; Klagenfurt, Austria. NEW YORK: IEEE (2017). p. 442–6.

Google Scholar

19. Chen T, Li Z, Zhou H, Chen J, Luo X, Li X, et al. ving cash in In direction of saving cash in utilizing sensible contracts. In: 2018 IEEE/ACM fortieth worldwide convention on software program engineering: new concepts and rising applied sciences outcomes (ICSE-NIER); 2018 Might 27–June 3; Gothenburg, Sweden. NEW YORK: IEEE (2018b). p. 81–4.

Google Scholar

20. Chen T, Li X, Wang Y, Chen J, Li Z, Luo X, et al. An adaptive gasoline price mechanism for ethereum to defend towards under-priced DoS assaults. In: Liu J, , and Samarati P, editors. Worldwide convention on info safety apply and expertise; 2017 December 13–15; Melbourne, Australia. Cham, Switzerland: Springer (2017b). p. 3–24.

CrossRef Full Textual content | Google Scholar

21. Tang H, Shi Y, Dong P. Public blockchain analysis utilizing entropy and topsis. Professional Syst Appl (2019) 117:204–10. doi:10.1016/j.eswa.2018.09.048

CrossRef Full Textual content | Google Scholar