Share this text

Bitcoin (BTC) dropped by 4.4% final week pressured by long-term holders (LTH), whales, and miners promoting their holdings, in response to the most recent version of the “Bitfinex Alpha” report. The actions occurred primarily by alternate gross sales and over-the-counter (OTC) transactions.

These teams, traditionally recognized to divest throughout bull markets and consolidation phases, are demonstrating their market affect as soon as once more. The latest promoting, although much less intense than earlier situations, underscores the numerous influence LTHs and whales have on liquidity and price fluctuations.

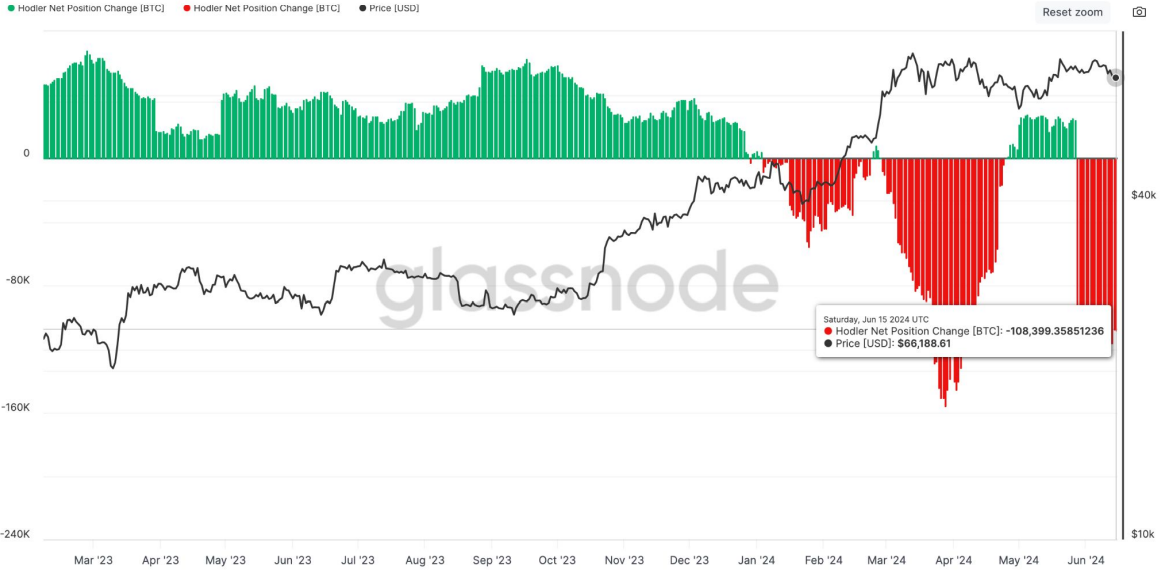

Notably, on-chain metrics reveal that LTHs had been the principle contributors to the latest sell-off, overshadowing exchange-traded funds (ETF) outflows. This exercise aligns with the unwinding of the idea arbitrage commerce highlighted within the earlier week’s Bitfinex Alpha report. The “Hodler Net Position Change” metric, which tracks the month-to-month place adjustments of LTHs, has registered unfavorable exercise, indicating a promoting development amongst this cohort.

Moreover, the highest 10 inflows into exchanges have risen as a proportion of complete inflows, signaling heightened whale exercise. This development usually precedes a price drop, though the previous three months have seen Bitcoin’s price stay comparatively steady, probably on account of strong spot ETF demand. Nonetheless, the continuing promoting is seemingly capping Bitcoin’s potential price positive aspects.

The Coinbase Premium Index, one other indicator of whale conduct, suggests sturdy promoting strain from US traders on Coinbase Professional, as evidenced by a constant unfavorable proportion distinction in comparison with different main exchanges.

Moreover, an inverse relationship between Bitcoin’s price and miner reserves has been noticed, with a notable decline in miner reserves coinciding with the height in Bitcoin’s price round March 2024, indicating miners had been promoting to capitalize on excessive costs and put together for the halving occasion.

As miner reserves method four-year lows, it means that promoting strain from this group could also be nearing a essential level, probably impacting future market dynamics.

Share this text

![]()