Picture supply: Getty Pictures

For greater than a decade, Authorized & Normal (LSE:LGEN) shares have confirmed a reliable supply of passive revenue. No matter challenges have come alongside to knock earnings, the FTSE 100 firm has nonetheless managed to ship a big and (largely) rising dividend to shareholders.

Excluding 2020, when the enterprise froze money rewards because the pandemic rolled on, Authorized & Normal has constantly raised money rewards for the final 12 years.

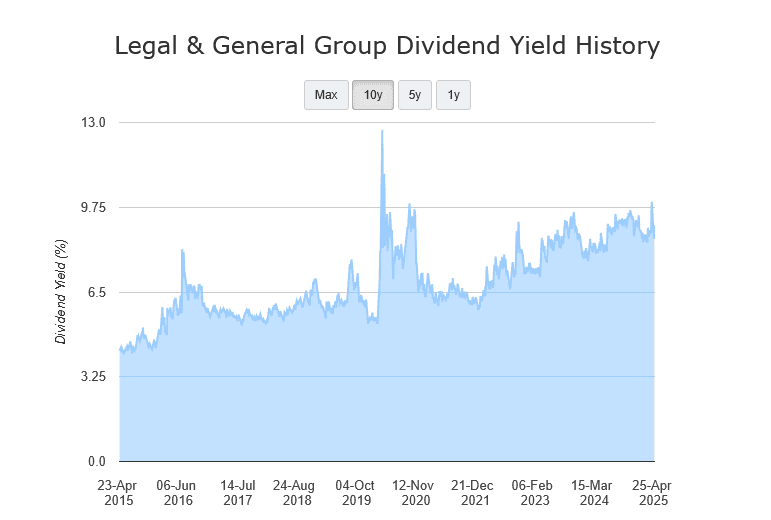

This, in flip, has meant the corporate’s dividend yields have lengthy towered over the broader FTSE 100 common:

Nevertheless, previous efficiency isn’t all the time a dependable information to future returns. And with threats to the worldwide economic system looming, can Authorized & Normal stay one of many London inventory market’s biggest dividend shares?

Big dividend yields

Dividends are by no means assured. And as we noticed through the Covid-19, even Footsie shares with distinguished payout information can minimize, postpone or cancel dividends.

However except for one other once-in-a-generation disaster, I believe Authorized & Normal shares are in good condition to maintain delivering a rising dividend. My optimism is shared by Metropolis brokers, whose forecasts might be seen beneath:

| Yr | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2025 | 21.82p | 2% | 9.1% |

| 2026 | 22.29p | 2% | 9.3% |

| 2027 | 22.65p | 2% | 9.5% |

These predictions are consistent with the agency’s pledge to lift annual dividends by 2% over the interval. And it means the agency’s dividend yields sail additional above the FTSE 100 long-term common of 3-4%.

But it’s essential to notice that dividend estimates look greater than slightly fragile primarily based on one well-liked security metric. Over the following few years, anticipated payouts are lined between 1.1 occasions and 1.2 occasions by anticipated earnings.

As an investor, I’m in search of a studying of two occasions and above to supply a margin of security. This may be particularly essential for companies that function in cyclical industries like this, and significantly right this moment given the powerful financial outlook.

Earnings and dividends may disappoint if client spending weakens and demand for discretionary merchandise (like life insurance coverage insurance policies) suffers. A deteriorating economic system may additionally dampen returns at Authorized & Normal’s asset administration division.

Why I really like Authorized & Normal shares

Nevertheless, its place as a highly-cash-generative enterprise helps to cut back (if not remove) this downside. On the finish of 2024 its Solvency II capital ratio was 232%, up 8% 12 months on 12 months, and miles forward of the 100% degree required by regulators.

These sturdy monetary foundations are additionally permitting Authorized & Normal to interact in substantial share buybacks alongside paying market-leading dividends. The enterprise repurchased £200m value of shares final 12 months, and plans to bump this up to £500m in 2025.

The query for long-term traders like me is can it hold this document up past the medium time period? I believe it might, which is why I personal Authorized & Normal shares in my portfolio.

Helped by its great model energy, I believe income and money flows will growth as demographic modifications drive demand for its asset administration and retirement merchandise. This in flip may ship important dividend revenue in addition to capital positive factors. I believe the FTSE agency’s value critical consideration right this moment.