In the present day, roughly $8.12 billion value of Bitcoin (BTC) and Ethereum (ETH) choices are because of expire.

Market watchers are significantly attentive to this occasion because of its potential to affect short-term tendencies by way of the quantity of contracts and their notional worth. Analyzing the put-to-call ratios and most ache factors can present insights into merchants’ expectations and attainable market instructions.

Insights on In the present day’s Expiring Bitcoin and Ethereum Choices

The notional worth of as we speak’s expiring BTC choices is $4.65 billion. In accordance with Deribit’s information, these 261,390 expiring Bitcoin choices have a put-to-call ratio 0.6. This ratio suggests a prevalence of buy choices (calls) over gross sales choices (places).

The info additionally reveals that the utmost ache level for these expiring choices is $65,000. The utmost ache level is the price at which the asset will trigger the best variety of holders’ monetary losses.

Learn extra: An Introduction to Crypto Choices Trading

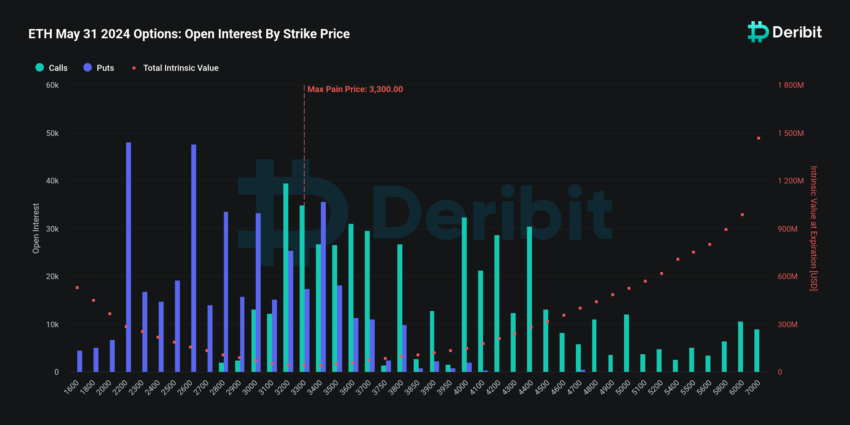

Along with Bitcoin choices, 2,750,922 Ethereum choices contracts are set to run out as we speak. These expiring choices have a notional worth of $3.47 billion, a put-to-call ratio of 0.85, and a most ache level of $3,300.

The variety of as we speak’s expiring Ethereum choices was considerably greater than final week. BeInCrypto reported that final week’s expired ETH choices have been 352,861 contracts, with a notional worth of $1.33 billion.

Forward of the expiration, choices buying and selling instrument supplier Greeks.stay shared its insights into the choices market. It prompt that market volatility is anticipated to stay low, making present circumstances favorable for choices buying and selling with decrease implied volatility.

“There are fewer macro events this week, and they don’t affect the macro market. The crypto world is dominated by the approval of ETH [exchange-traded funds] ETFs, but it’s unlikely that they will go straight through to listing, and less volatility is expected. Volatility in the crypto market has been dropping fast recently. [Implied Volatility] IV is dropping fast, and ETF funding and Block data is still worth watching,” it mentioned.

Learn extra: 9 Greatest Crypto Choices Trading Platforms

Whereas choice expirations may cause sharp price actions, the influence is normally non permanent. The market usually stabilizes the following day, offsetting preliminary fluctuations. Merchants ought to fastidiously analyze technical indicators and market sentiment earlier than investing on this risky atmosphere.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.