Picture supply: Getty Pictures

Scottish Mortgage Funding Belief (LSE: SMT) shares took a pasting after President Trump’s ‘Liberation Day’ speech on 2 April. They dropped 13.5% in simply three buying and selling days!

Since then although, they’ve bounced again to 930p and absolutely recovered. Due to this fact, an investor who’d purchased £5,000 price of shares at 815p on 7 April would now have roughly £5,700.

Volatility is the norm

That stated, this whipsawing demonstrates how unstable the FTSE 100 funding belief is. It tends to essentially fly when the Nasdaq Composite heads greater, and vice versa.

There are additionally Asian, Latin American and European shares within the portfolio, making up almost 40%. However for higher or worse (fortuitously the previous over the long term), Scottish Mortgage strikes with US-listed shares.

Due to this fact, a possible US recession is a danger to corporations’ earnings and valuations. That’s why it’s essential to take a long-term view with this growth-focused belief.

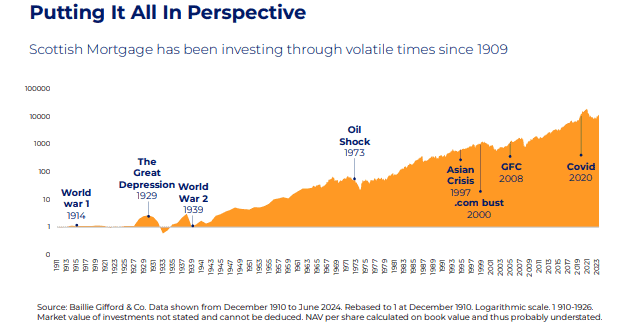

For perspective although, Scottish Mortgage has survived varied crises over the previous century, together with two world wars, world pandemics, and 15 separate US recessions. It’ll survive one other downturn then preserve transferring greater, in my opinion.

Portfolio progress

We’re at the moment in the midst of Q1 earnings season. So we will assess the progress of among the belief’s high holdings which have already reported earnings.

Let’s begin with Amazon, the third-largest holding. Q1 income rose 9% 12 months on 12 months to $155.7bn, with AWS gross sales leaping 17% to $29.3bn. Amazon’s promoting income, which elevated 17.7%, is now turning into a significant contributor to earnings. Total working revenue surged 20% to $18.4bn.

The fourth-largest holding — Meta Platforms — additionally reported sturdy progress. Income elevated 16% to $42.3bn, whereas the working margin expanded from 38% to 41%.

Elsewhere, Spotify‘s free money circulation continues to blow up greater, rising almost tenfold in simply two years. The Spotify share price has greater than doubled prior to now 12 months.

In the meantime, Chinese language electrical automobile agency BYD has simply reported a doubling of earnings because it aggressively expands worldwide. Scottish Mortgage just lately wrote: “If BYD is subject to the tariffs on China, it could still one day sell 10m cars or more a year outside the US, including autonomous and rapid charge technology.”

Yesterday (6 Could), Ferrari reported a really strong 18% rise in earnings per share.

These are all wonderful companies rising strongly. Finally, will probably be a few of these that may assist drive Scottish Mortgage’s long-term efficiency.

Roblox

One other fascinating holding that continues to impress me is Roblox (NYSE: RBLX). Shares of the gaming platform are up 75% over the previous 12 months.

In Q1, income surged 29% to only over $1bn, whereas bookings grew quicker at 31%. Bookings principally replicate the entire worth of digital foreign money Robux bought on the platform.

Common each day energetic customers (DAUs) jumped 26% to 97.8m, whereas hours engaged rose 30% to 21.7bn. Progress was sturdy in all areas, together with the huge progress market of India (DAUs up 77%).

One concern with Roblox is that it stays unprofitable on a internet revenue foundation, which provides danger. It reported a quarterly internet lack of $216m.

I believe the corporate’s profitability ought to enhance because it scales its promoting enterprise over the following few years. But it surely stays dear and excessive danger, for my part. I really feel Scottish Mortgage is the safer long-term wager to contemplate.