Because the crypto market quickly evolves, traders are eyeing standout tasks with the very best progress potential. Among the many prime contenders are Ethereum, Chainlink, and fast-emerging names like Aptos, Sui, and LayerZero. These platforms mix robust fundamentals, cutting-edge know-how, and increasing ecosystems, making them doubtless candidates for explosive progress by 2025.

1. Chainlink (LINK) — The Finest Crypto Undertaking to Watch in 2025

Chainlink is a decentralized oracle community designed to attach good contracts with real-world information, APIs, and exterior programs. It serves as a important layer of infrastructure for decentralized finance (DeFi), insurance coverage, gaming, and extra by securely delivering offchain information to onchain functions.

As real-world blockchain adoption accelerates, the demand for dependable exterior information is predicted to develop exponentially. Chainlink, already built-in with a whole lot of platforms, is well-positioned to learn from this pattern. Its widespread utilization and established fame make it a number one contender for long-term progress.

Technically, the LINK/USDT weekly chart reveals Chainlink consolidating inside a broad ascending channel that started in mid-2022. LINK is testing the channel’s decrease trendline help, which has traditionally triggered robust upward rebounds.

The price can also be hovering close to the 200-week EMA (~$13.23), offering extra help, whereas the RSI stays impartial at 45, suggesting room for upside with out being overbought.

If the help holds, LINK might purpose for a breakout towards the higher trendline close to $32–$35, which additionally aligns with the 0.618–0.786 Fibonacci retracement ranges from its all-time excessive. A failure to carry this channel, nevertheless, dangers a drop towards $10 or decrease.

2. Aptos (APT) Eyes 180% Positive factors By 12 months-Finish? Finest Crypto Undertaking

Aptos is a high-performance layer-1 blockchain developed by former Meta engineers, constructed for scalability, safety, and developer accessibility. The community makes use of parallel execution and a brand new good contract language, Transfer, to allow quick, low-cost transactions.

Backed by main enterprise capital and strategic partnerships, Aptos has quickly gained traction throughout the developer neighborhood. Its mixture of technical innovation and institutional help positions it as a possible main participant within the Web3 infrastructure race.

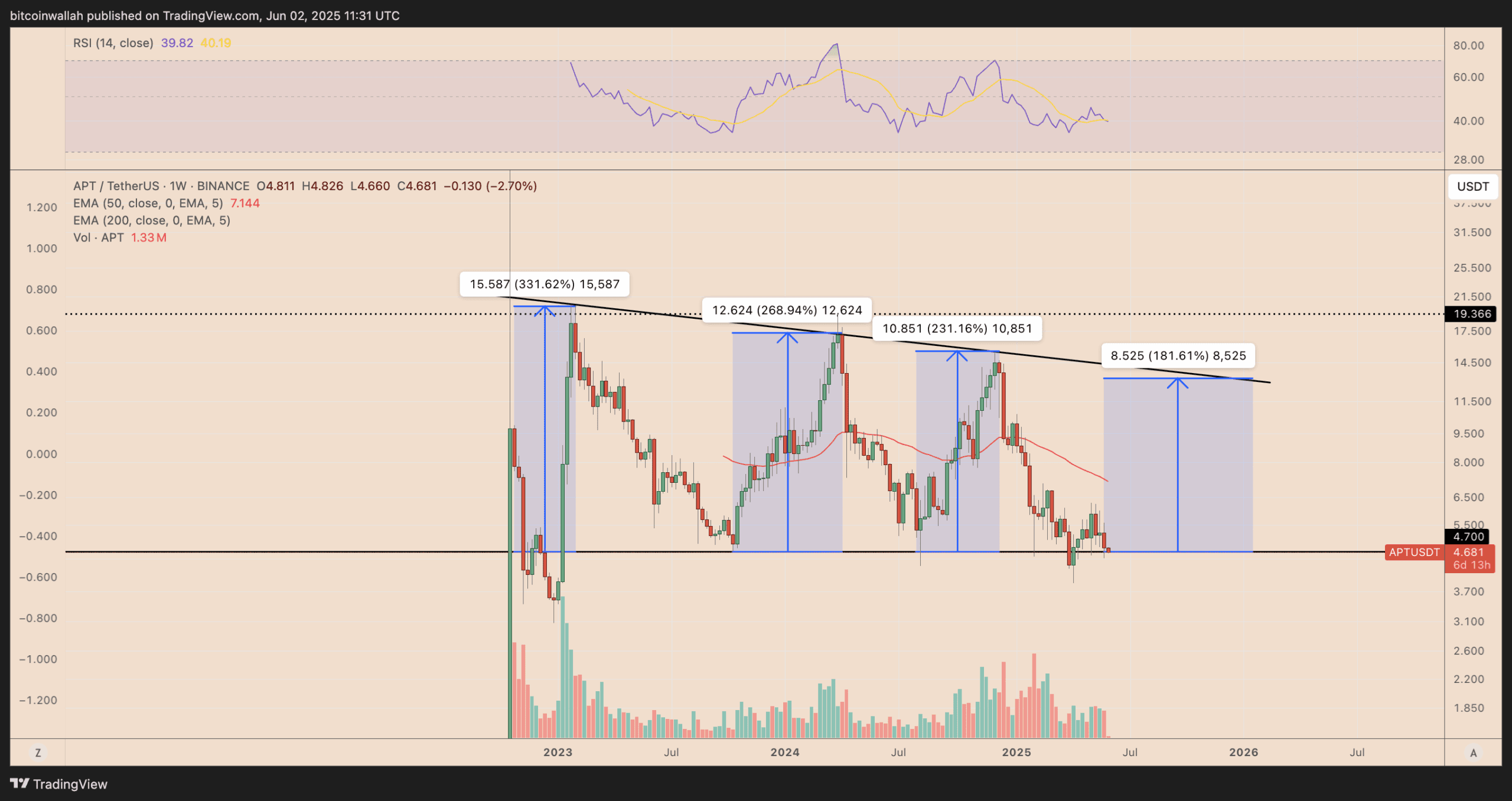

The APT/USDT weekly chart reveals Aptos buying and selling close to a long-term horizontal help round $4.70, which has triggered a number of bullish reversals since early 2023.

Every bounce from this stage has produced diminishing returns, with rallies of 331%, 268%, 231%, and most not too long ago a projected 181%, suggesting weakening bullish momentum.

A descending trendline throughout the swing highs kinds a broad descending triangle sample—a doubtlessly bearish construction if help breaks decisively.

3. Sui (SUI) — Ascending Channel Bounce Underway

Sui is one other next-generation layer-1 blockchain developed by ex-Meta engineers concerned within the Diem (previously Libra) undertaking. It emphasizes efficiency, providing excessive throughput and low latency—qualities that make it interesting for decentralized functions, notably in gaming, NFTs, and finance.

The undertaking has secured backing from distinguished VCs and continues to develop its developer ecosystem. With a user-friendly structure and concentrate on scalability, Sui is considered as some of the promising infrastructure performs within the present market.

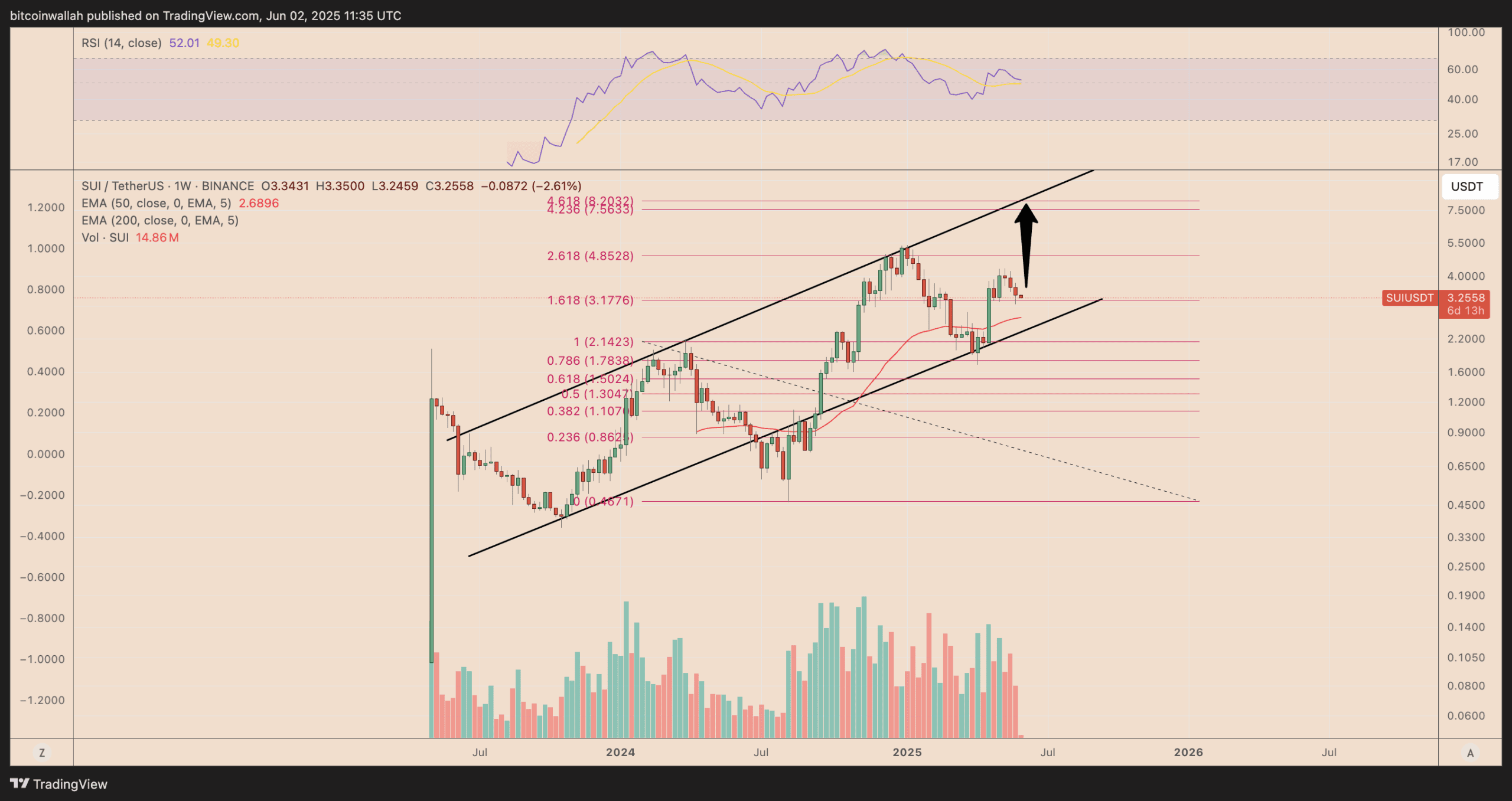

The SUI/USDT weekly chart reveals Sui buying and selling inside a well-defined ascending channel, at present consolidating simply above the 1.618 Fibonacci extension stage close to $3.18.

If SUI maintains its present pattern, a transfer towards $5–$6 seems possible. Nevertheless, a breakdown under $3.18 might sign a retest of decrease help ranges close to $2.14 or the 50-week EMA at $2.68.

4. LayerZero (ZRO) — A 200% Rally Setup is Making This One of many Finest Crypto Tasks in 2025

LayerZero is a blockchain interoperability protocol aimed toward enabling seamless crosschain communication. Because the crypto trade continues to fragment throughout a number of chains, options that may unify ecosystems have gained consideration from each builders and traders.

LayerZero’s structure helps omnichain functions, permitting builders to construct DApps that span a number of blockchains. With backing from main gamers within the house, together with partnerships with main DeFi platforms, LayerZero is more and more seen as important infrastructure for a multichain future.

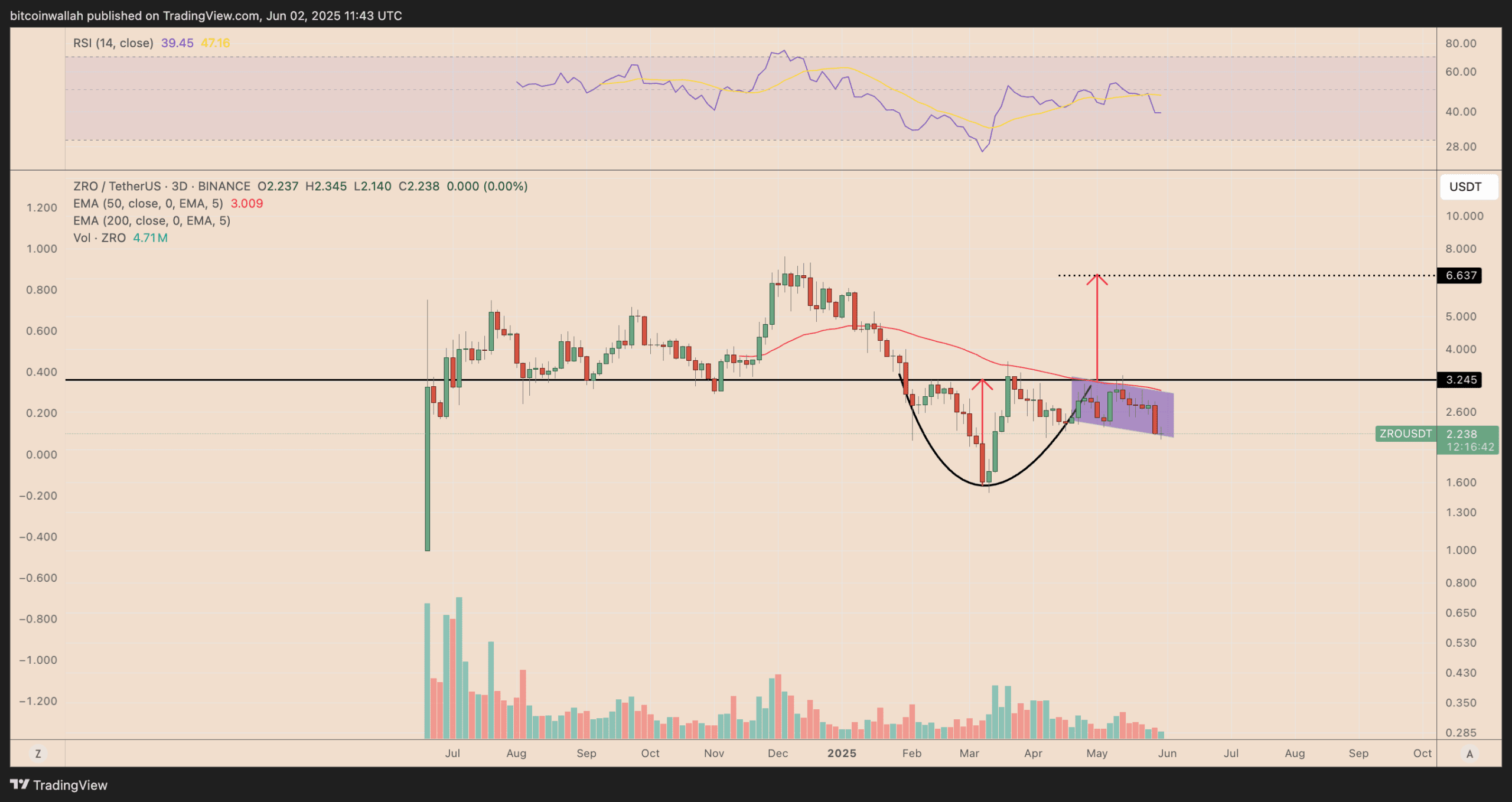

The ZRO/USDT 3-day chart shows a basic cup-and-handle formation, with the cup’s base round $1.60 and neckline resistance close to $3.25. After forming the cup, the price entered a deal with consolidation section—a downward-sloping channel—suggesting a possible breakout setup.

A profitable breakout above $3.25 would affirm the sample and activate a technical upside goal close to $6.63, calculated by including the cup’s depth to the breakout stage.

5. Ethereum (ETH) — Sensible Contract King Eyes

Ethereum stays the dominant good contract platform within the crypto trade, powering a variety of decentralized functions, together with DeFi, NFTs, and DAOs. Regardless of rising competitors, Ethereum continues to steer due to its robust developer neighborhood and dedication to scalability enhancements.

The Ethereum 2.0 improve—that includes a transition to proof-of-stake, rollup integrations, and eventual sharding—is predicted to enhance transaction velocity, decrease charges, and scale back vitality utilization. These upgrades might improve Ethereum’s competitiveness and adoption at each institutional and retail ranges.

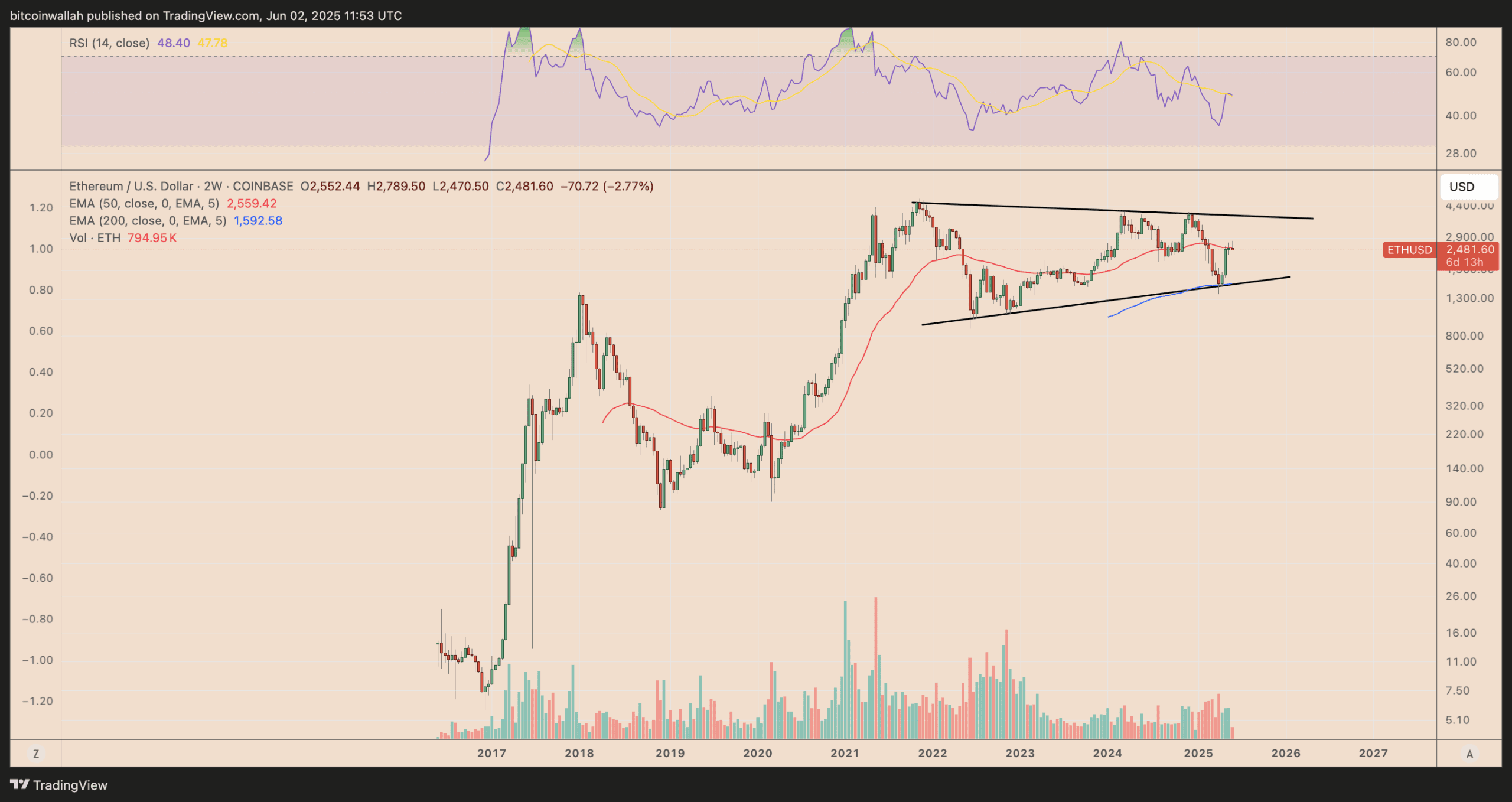

The ETH/USD 2-week chart reveals Ethereum buying and selling inside a big symmetrical triangle sample that has endured since late 2021.

The present construction is outlined by a sequence of decrease highs and better lows, with price now rebounding off the triangle’s ascending help close to $1,600 and focusing on the higher resistance trendline close to $4,000.