Picture supply: Getty Pictures

Brokers and fund managers usually love progress shares, however the extra savvy amongst them know a very good dividend share after they see one. The next three UK shares have had a troublesome few years — however are on the lists of execs within the know. I made a decision to see what all of the fuss is about.

GSK

GSK (LSE: GSK) is among the largest pharmaceutical corporations within the UK, at the moment sporting a dividend yield of three.9%. It had a very good begin to the yr. On 15 Could, the share price was up 22% yr thus far (YTD) — however issues have gone downhill since.

A lift early within the yr got here after a constructive FY 2023 earnings report, outlining progress throughout a number of metrics. Income and earnings grew 3.4% and 11%, respectively, from 2022. However the Q1 report in Could was much less constructive, with earnings per share (EPS) lacking analysts’ expectations by 19%.

Two months later, the price is again down to £15, the place it began the yr. However a minimum of one dealer doesn’t assume it’ll fall any additional. Main US financial institution Citi put in a ‘buy’ score on the inventory on 5 July. Does it know one thing we don’t? Probably. Based mostly on money stream forecasts, I can see the present price is estimated to be undervalued by 64%. Feels like progress potential to me.

Diageo

Diageo (LSE: DGE) is part of world-famous investor Warren Buffett’s Berkshire Hathaway portfolio, though it holds the US-listed model. It’s one in every of few worldwide corporations the fund is invested in. Different notable ones embrace the Japanese conglomerate Mitsubishi Corp and the Chinese language EV producer BYD.

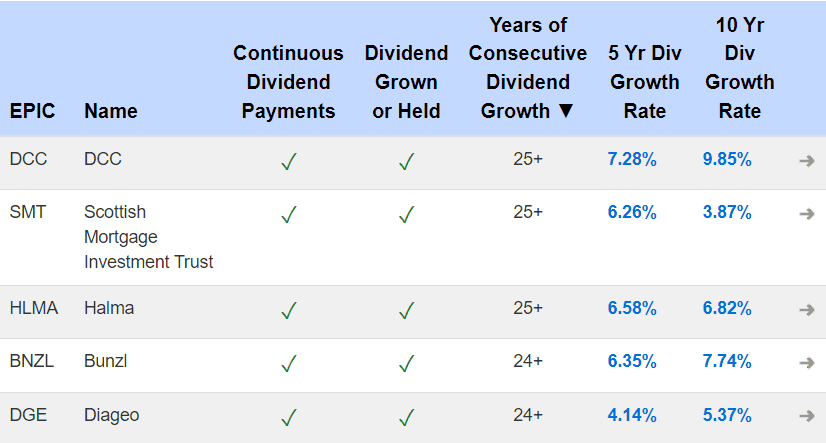

Trying on the share price at this time, one may query the Oracle of Omaha’s sanity — it’s down 24% previously yr! However it is a long-term funding and a strong dividend payer at that. With a 3.2% yield, it’s the fifth-most constant dividend payer on the FTSE 100, with 24+ years of consecutive progress at a charge of 5.37% over 10 years.

Nevertheless, its most important product is alcohol, which can clarify latest declines. Not solely are youthful individuals consuming much less however financial strife has restricted shopper spending on luxurious gadgets. Diageo might have to introduce extra low-cost, non-alcoholic choices to its model portfolio if it hopes to stay related.

Unilever

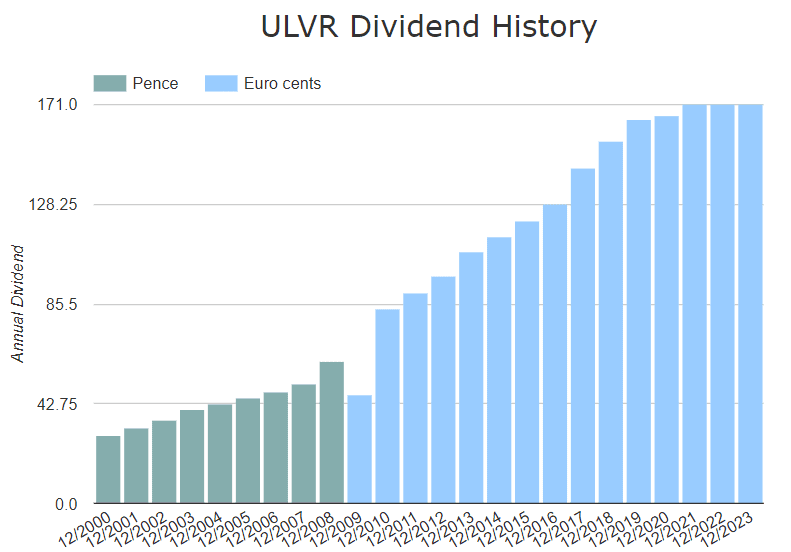

Unilever (LSE: ULVR) is a dividend stalwart within the UK market, with near-uninterrupted progress between 2000 and 2020. In recent times, funds have been capped at 170c however nonetheless characterize good worth with a 3.4% yield.

The price traded round £39 for many of Q1 however not too long ago jumped above £42 after a constructive Q1 earnings report. Underlying gross sales grew 4.4% with turnover up 1.4%. Based mostly on revenue margins and earnings forecasts, analysts estimate a good price-to-earnings (P/E) ratio of 30, but it’s at the moment 19.7. This implies the price is affordable and could also be one purpose main dealer JPMorgan put in an ‘overweight’ score on the inventory this week.

However like many fashionable model retailers, Unilever is dealing with stress from excessive rates of interest. Shoppers are more and more turning to low-cost alternate options as belts tighten. With solely 6% progress previously yr, it underperformed the FTSE 100. The dividends might decide up a few of that slack but when issues don’t enhance, shareholders might begin trying elsewhere.