Picture supply: Getty Pictures

Investing inside a tax-efficient account similar to a Shares and Shares ISA or Self-Invested Private Pension (SIPP) is among the greatest methods to acquire monetary safety. By placing cash into monetary property similar to shares and funds, traders can develop their wealth considerably over time.

In search of funding concepts for 2025? Listed here are three to contemplate.

Please observe that tax remedy will depend on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Dividend shares for revenue

Dividend shares are standard with British traders and it’s straightforward to see why. These shares pay traders money distributions (dividends) out of firm income regularly and the yields could be very enticing.

For instance, throughout the FTSE 350 index, there are over 30 shares which have forward-looking dividend yields of greater than 7%. With these sorts of yields on supply, it isn’t laborious to construct a passive revenue portfolio.

It’s price mentioning that not all dividend shares are created equal. Some have unbelievable long-term dividend observe information whereas others don’t. The important thing with such a investing is to hunt out firms with robust financials and wholesome development prospects. These sorts of firms are much less prone to reduce their dividends.

Development shares for positive factors

Development shares have generated robust returns for traders lately and I consider they’ll proceed to take action in 2025. The rationale I say that is that there’s an unbelievable quantity of technological innovation occurring internationally right this moment (particularly within the US).

One theme I reckon will proceed to do properly is synthetic intelligence (AI). This theme has been scorching for almost two years now however it’s exhibiting no indicators of slowing.

One other theme that would do properly is cybersecurity. This trade has large development potential and a few analysts consider that it is going to be greater than AI.

Thematic funds and ETFs is usually a good approach to play these sorts of themes. For AI publicity, I’m invested within the Sanlam International Synthetic Intelligence fund. Prime holdings right here embody Nvidia, Amazon, Alphabet and Tesla. So I see it as a good way to play the theme.

High quality shares for excellent long-term returns

My remaining thought for 2025 is ‘quality’ shares. These are the shares of high-quality companies which have robust aggressive benefits, constant revenues and earnings, excessive ranges of profitability, and loads of development potential.

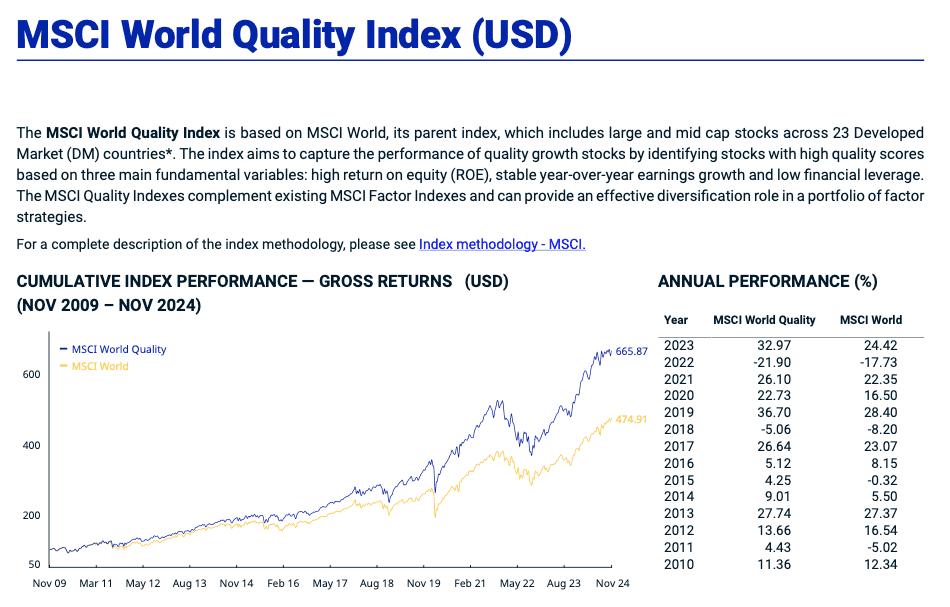

I’m a giant fan of high quality shares as historical past exhibits they have a tendency to outperform the market over the long term. For instance, if we have a look at the MSCI World High quality Index, it’s smashed the common MSCI World Index during the last 15 years.

These searching for broad publicity to this space of the market might need to contemplate an ETF such because the iShares Edge MSCI World High quality Issue UCITS ETF (LSE: IWQU).

This ETF permits publicity to round 300 firms that display up as high-quality. Prime holdings at the moment embody Apple, Microsoft and Nvidia.

Ongoing charges are simply 0.25%. So the product’s very cost-effective.

It’s price noting that high quality shares don’t at all times outperform. There can be occasions within the financial cycle when low-quality shares have their second so there are not any ensures that this ETF will do properly in 2025.

In the long term although, high quality shares have a tendency to supply nice returns for traders. So I believe publicity to this space of the market in 2025’s price contemplating.