As of Might 7, 2025, three fiat currencies—the Swiss franc (CHF), Japanese yen (JPY), and euro (EUR)—are exhibiting stronger safe-haven traits than Bitcoin. This shift displays investor responses to international financial uncertainties, together with U.S. fiscal instability and geopolitical tensions.

Swiss Franc vs Bitcoin: Secure-Haven Currencies’ Demand Surges in Might 2025

The Swiss franc (CHF) continues to outperform Bitcoin (BTC) as a safe-haven asset, with Might 2025 knowledge reinforcing investor desire for conventional stability. The CHF index not too long ago surged to 121.59, marking a brand new multi-year excessive. On the identical chart, the 50-week exponential transferring common (EMA) stood at 114.40, confirming the franc’s robust upward momentum. This rally got here as international traders fled riskier property in response to rising commerce tensions beneath Trump’s renewed tariff insurance policies, detailed in a EU Report.

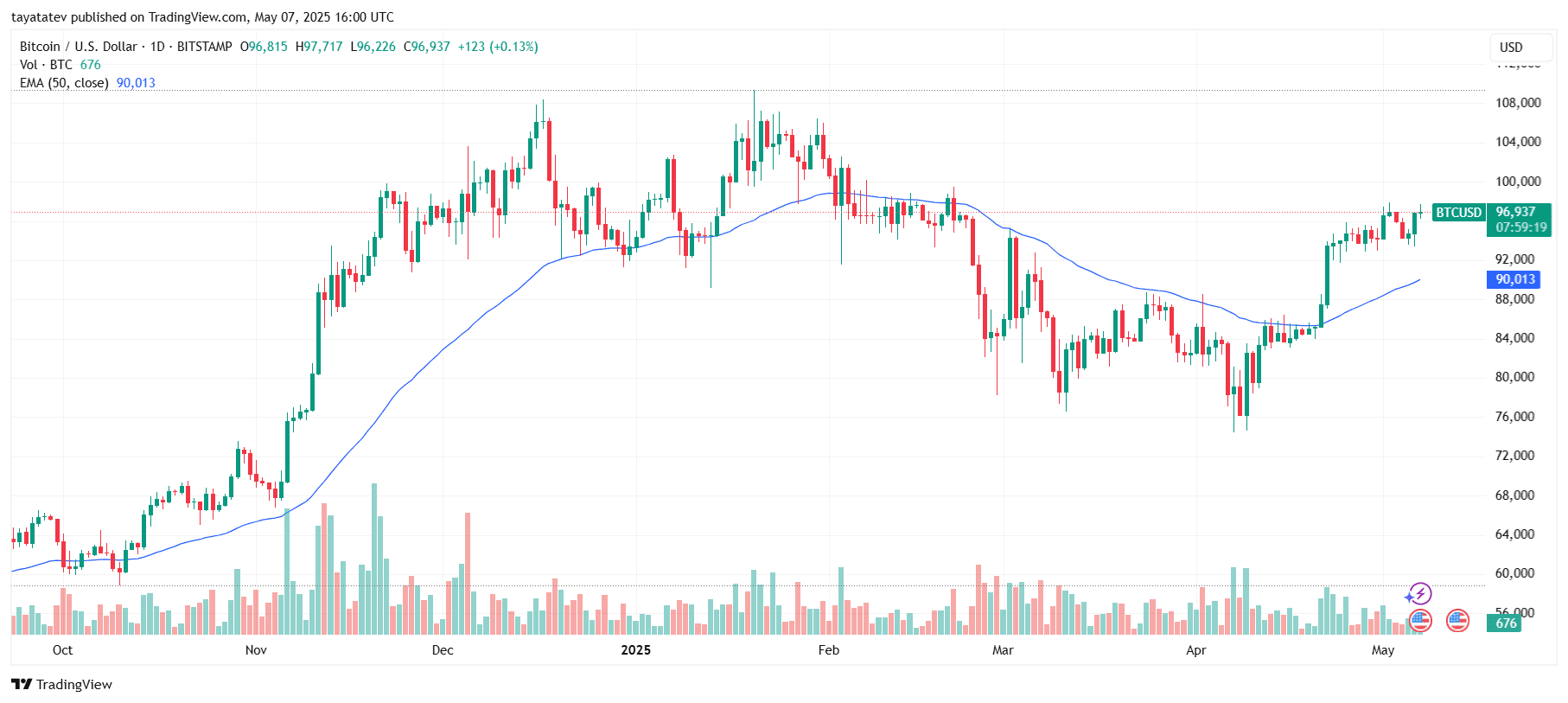

On the similar time, Bitcoin traded round $96,901—recovering barely however nonetheless down from its March peak close to $107,000. The distinction between these two property is placing when positioned side-by-side. The second chart exhibits Bitcoin’s historic volatility. Sharp spikes and drawdowns dominate its path, whereas the CHF/USD line stays regular, anchored round 1.2153. Traders in search of capital preservation amid inflation issues and geopolitical stress selected CHF over BTC all through April and early Might.

This shift doesn’t depend on hypothesis. In April alone, the franc gained over 9% towards the U.S. greenback—the strongest month-to-month rise because the 2008 monetary disaster. The appreciation adopted Trump‘s unpredictable trade decisions, which redirected capital away from U.S. assets and into neutral currencies. Switzerland’s low nationwide debt, strict monetary insurance policies, and credible central financial institution help the franc’s energy. Even because the Swiss Nationwide Financial institution weighs rate of interest cuts to guard exports, the franc continues to draw safe-haven demand.

On the similar time, Bitcoin’s picture as “digital gold” continues to weaken. Its excessive correlation with tech shares and different risk-sensitive property challenges its repute as a retailer of worth. Regardless of regular institutional curiosity, Bitcoin has not proven the identical price stability as gold or the Swiss franc. Ongoing regulatory uncertainty in each the U.S. and EU additional limits its attraction amongst cautious traders.

Japanese Yen vs BTC: JPY Rallies as Merchants Flee Threat Belongings

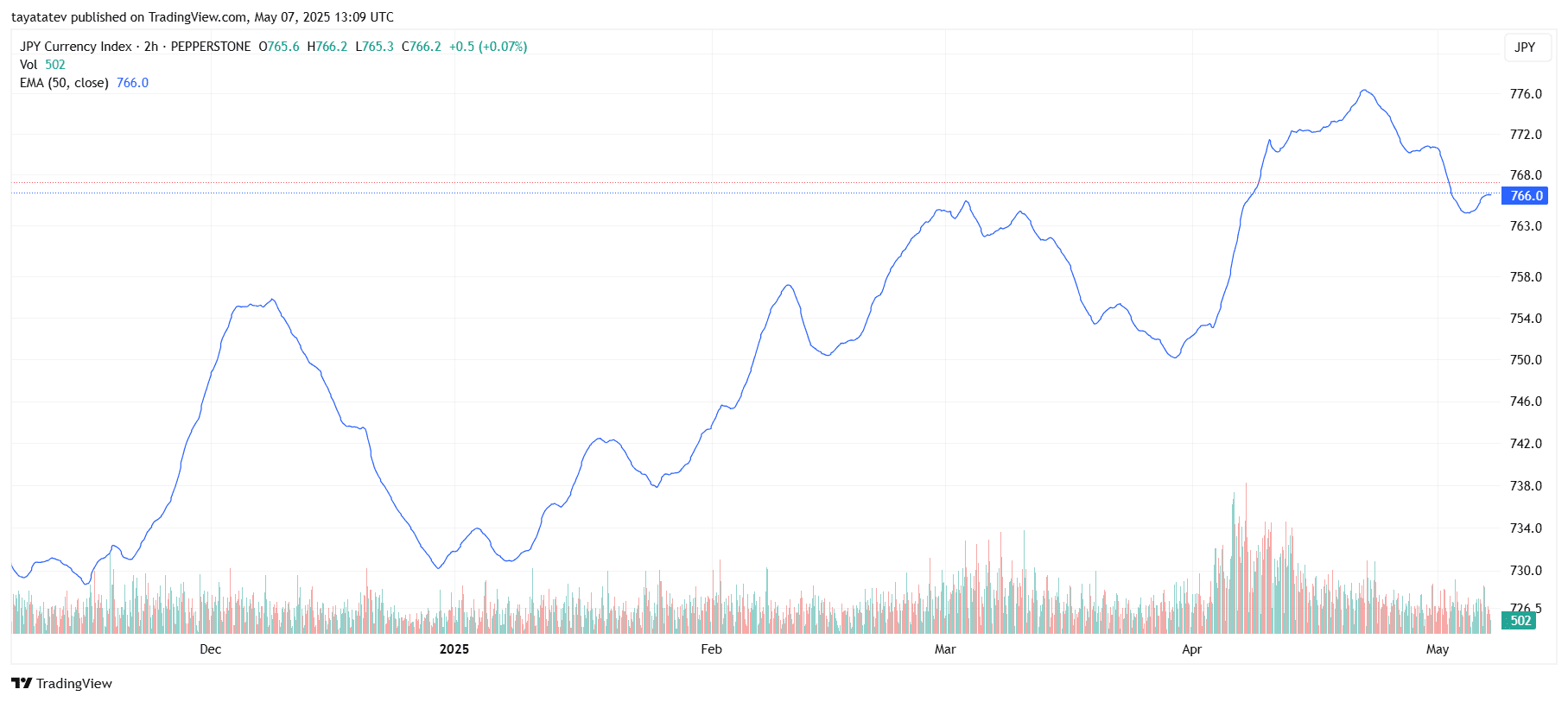

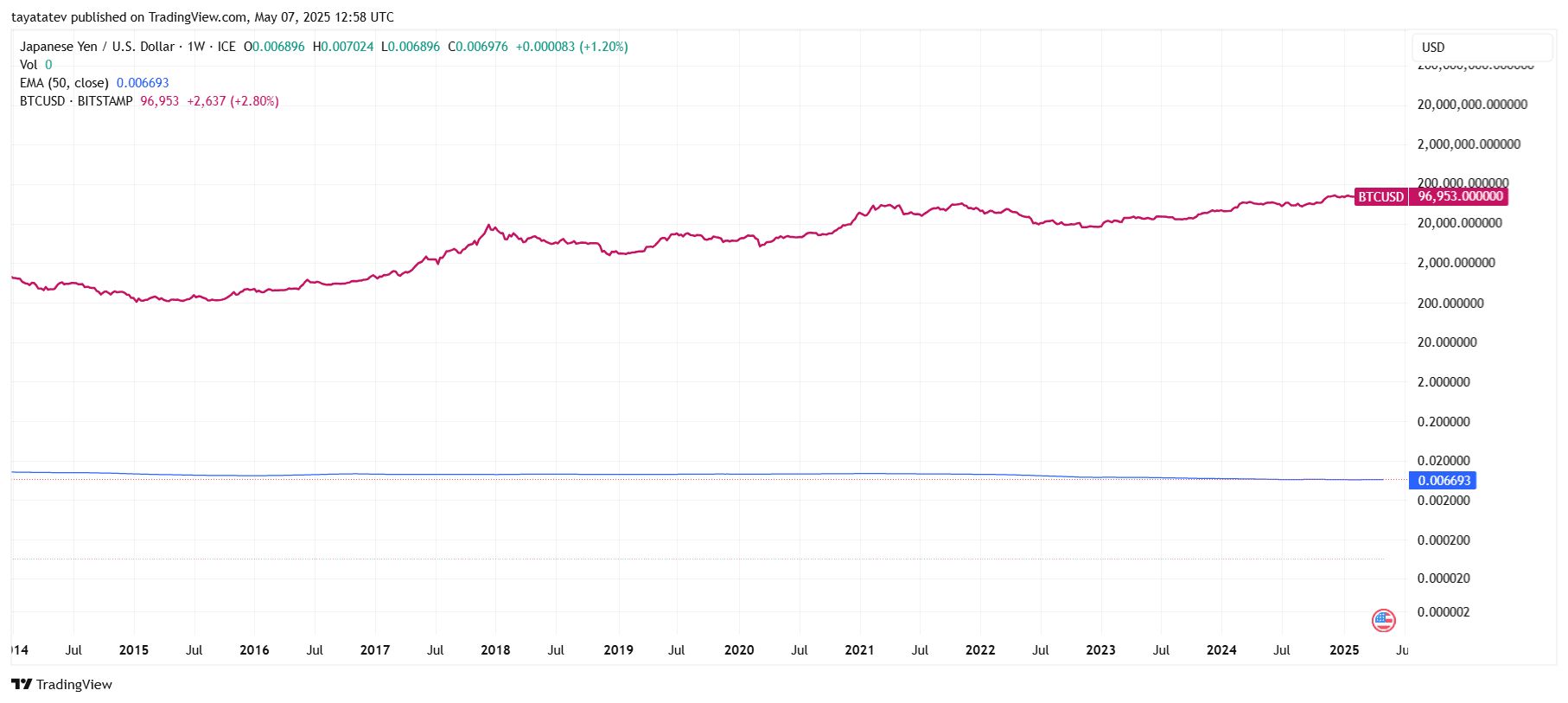

The Japanese yen (JPY) strengthened in 2025 as international markets confronted rising uncertainty. On Might 7, the JPY Foreign money Index hit 765.8, climbing 0.71% for the week. The USD/JPY pair traded at 0.006896, up 1.2% from the earlier week. The 50-week exponential transferring common stood at 0.006693, displaying that the yen had damaged above key resistance ranges.

Again in March 2025, throughout a tech-sector sell-off, USD/JPY dropped from 152 to 145. The transfer mirrored a direct shift into the yen as merchants exited dangerous positions. Japan’s near-zero rates of interest continued to make the yen engaging in international carry trades. When volatility rises, traders unwind these trades, boosting demand for JPY.

The Financial institution of Japan has stored coverage unchanged, avoiding price hikes. This has maintained the yen’s function as a funding forex. On the similar time, geopolitical rigidity and Trump’s 2025 tariff measures pushed extra capital into defensive property. Traders moved funds into JPY-denominated markets in search of forex stability.

On the identical day, Bitcoin traded at $96,953. Whereas BTC posted a 2.8% acquire, it confirmed no clear hyperlink to broader safe-haven flows. Bitcoin’s price motion remained extremely unstable, reacting to speculative strikes reasonably than macroeconomic stress.

The yen’s regular rise adopted direct capital inflows and low-yield positioning. Bitcoin, in distinction, delivered unstable price swings that failed to supply safety throughout current fairness drawdowns. This divergence confirms that JPY continues to behave as a sensible hedge when market danger intensifies.

Euro vs Bitcoin: EUR Emerges as a Secure-Haven Foreign money Amid Greenback Weak spot

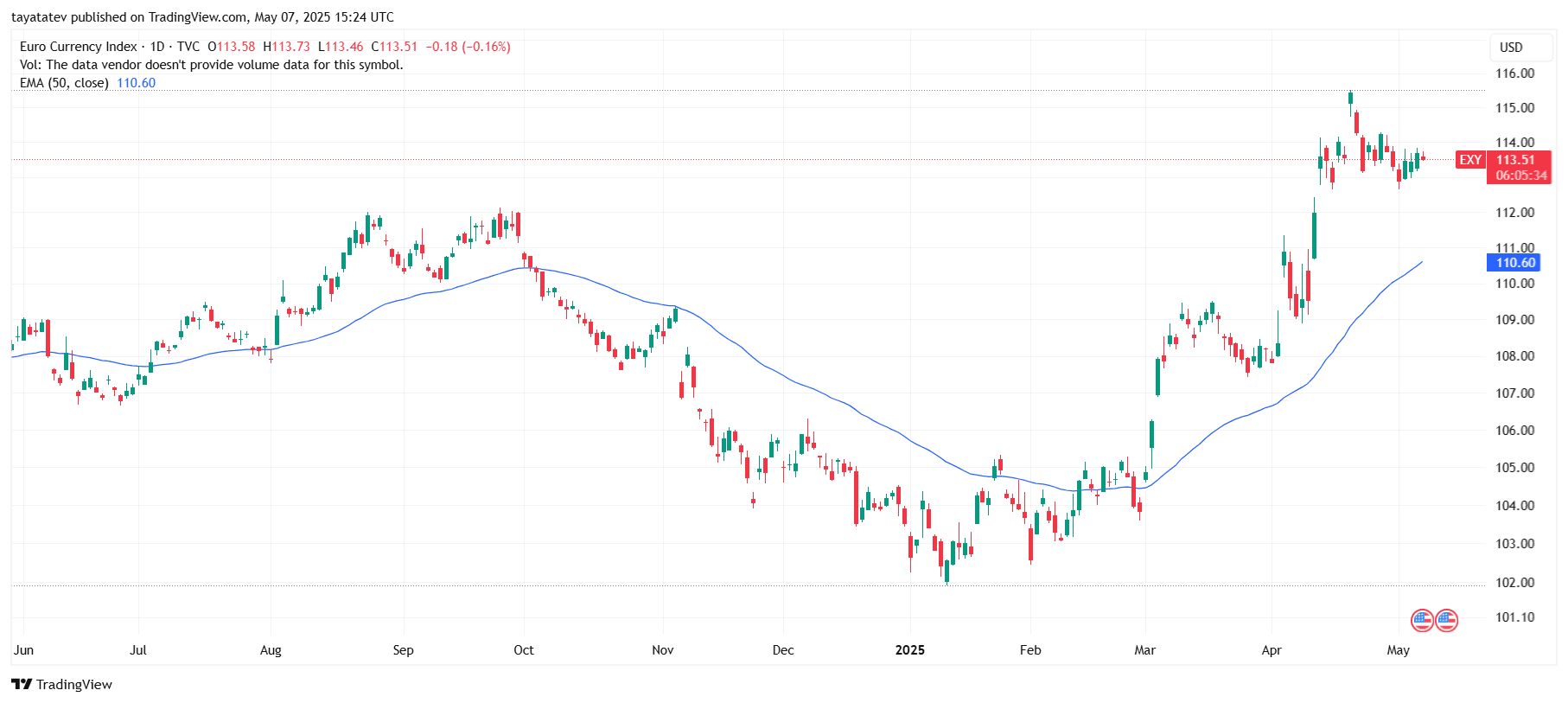

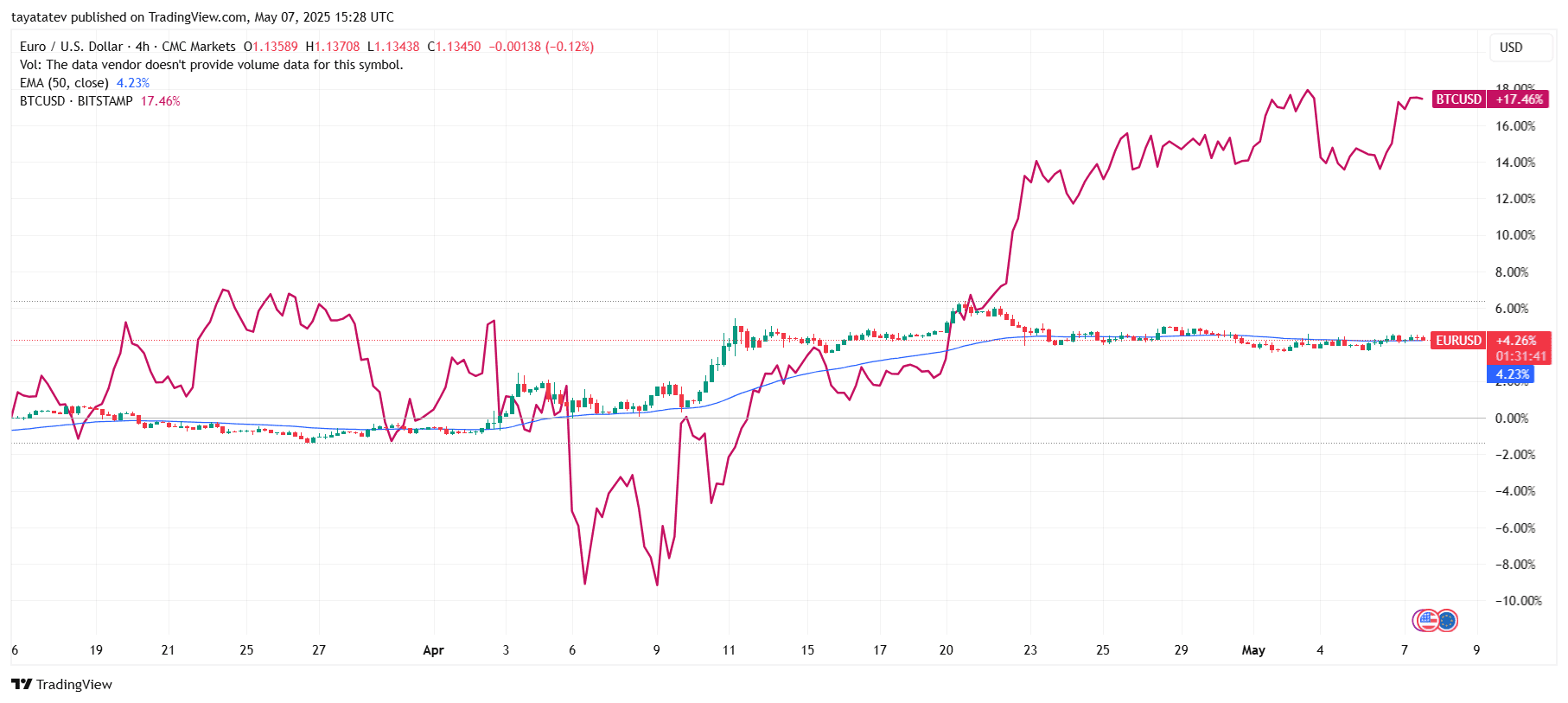

The euro (EUR) additionally gained energy in 2025 as institutional traders shifted away from the U.S. greenback amid rising fiscal instability in the USA. The EUR/USD alternate price reached 1.1345 on Might 7, up 4.26% over the previous month. In the meantime, the Euro Foreign money Index (EXY) rose to 113.51, buying and selling properly above its 50-day exponential transferring common of 110.60.

This efficiency follows a collection of warnings about U.S. debt sustainability. Based on the Monetary Instances, traders are more and more apprehensive about Washington’s incapability to move price range reforms, particularly after the April 2025 standoff over the debt ceiling. This led to a downgrade watch on U.S. creditworthiness and diminished demand for dollar-denominated property.

On the similar time, the European Central Financial institution (ECB) coordinated capital movement controls and finalized the mixing of a digital euro framework in early 2025. These strikes diminished Europe’s publicity to U.S. monetary infrastructure and boosted confidence in euro liquidity throughout exterior shocks.

Furthermore, current EU banking reforms tightened capital buffers and established joint fiscal backing mechanisms. This added authorized and monetary ensures behind the eurozone’s unified financial coverage. In consequence, traders in search of lower-risk alternate options rotated into the euro.

Bitcoin gained 17.46% over the identical interval however confirmed erratic swings. Its efficiency remained disconnected from macro shifts, signaling speculative buying and selling reasonably than capital preservation.

Whereas BTC outperformed in uncooked returns, the euro’s motion adopted clear macroeconomic catalysts, together with forex diversification and central financial institution coordination.

BTC: Volatility Undermines Secure-Haven Standing

In early 2025, Bitcoin (BTC) skilled vital price fluctuations, dropping roughly 20% from $109,000 to $88,000. This volatility challenges its function as a steady retailer of worth, particularly when in comparison with conventional safe-haven property.

Regardless of institutional adoption and the approval of Bitcoin ETFs, BTC’s price actions stay extremely delicate to market dynamics. As an example, in periods of market stress, Bitcoin’s correlation with equities has elevated, undermining its place as an unbiased hedge.

Whereas Bitcoin’s long-term potential as a digital asset stays, its present volatility and correlation with danger property counsel it has but to determine itself as a dependable safe-haven akin to conventional forex choices.