21Shares filed a Type S-1 with the U.S. Securities and Change Fee (SEC) on April 30, 2025, to launch a spot Sui ETF. The product, named 21Shares Sui ETF, goals to trace the market price of Sui (SUI) via direct token holdings.

The ETF construction doesn’t contain leverage, derivatives, or speculative buying and selling methods. As a substitute, it should maintain SUI tokens instantly, in line with the 128-page submitting. The ETF would subject frequent shares of useful curiosity and function beneath 21Shares’ U.S. subsidiary.

The spot Sui ETF submitting marks a continuation of the agency’s enlargement into the U.S. market. In July 2024, 21Shares launched the Sui Staking ETP in Europe, with listings on Euronext Paris and Euronext Amsterdam.

Spot Sui ETF Lacks Ticker and U.S. Change Itemizing

The 21Shares Sui ETF submitting doesn’t embrace a ticker image. It additionally doesn’t establish the U.S. change the place the ETF would commerce. The doc cautions that share costs could not match internet asset worth (NAV) always.

“There is no certainty that there will be liquidity available on the exchange or that the market price will be in line with the NAV [net asset value] or the principal market NAV at any given time,”

the submitting states.

The proposed ETF will present publicity to the Sui token price with out utilizing any artificial or oblique devices. It focuses solely on bodily SUI token custody held by the fund.

No official launch date or itemizing venue has been disclosed by 21Shares as of Could 1, 2025.

Canary Capital Filed First Spot Sui ETF within the U.S.

Canary Capital filed its Type S-1 registration for a spot Sui ETF on March 17, 2025. The agency grew to become the primary within the U.S. to hunt approval for a spot Sui ETF. In early April, the Cboe BZX Change filed a separate request with the SEC to checklist Canary Capital’s product.

21Shares is now the second applicant for a spot Sui ETF within the U.S., coming into a rising discipline of digital asset ETF proposals. Whereas Canary Capital’s submitting got here first, 21Shares has beforehand launched Sui-based ETPs within the European market.

Each Canary Capital and 21Shares search to supply regulated entry to the Sui token via direct publicity, utilizing related submitting codecs.

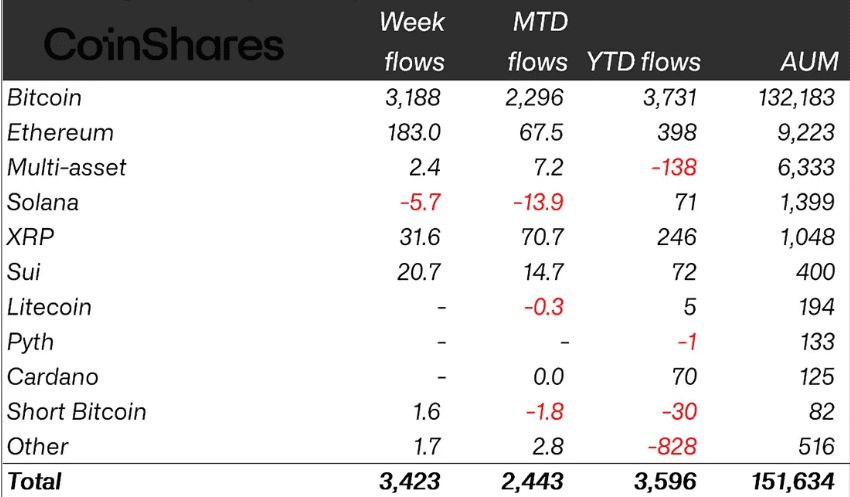

$400M in Sui ETP Property Underneath Administration

Knowledge from CoinShares reveals that Sui-based exchange-traded merchandise (ETPs) held $400 million in property beneath administration (AUM) as of April 25, 2025. The inflows mirror rising institutional consideration to Sui-related funding autos.

Sui ETPs added $72 million in internet inflows because the starting of 2025. Within the week main up to April 25, they attracted $20.7 million, in line with the report.

The AUM consists of 21Shares’ Sui Staking ETP and VanEck’s Sui ETP, each of which commerce in Europe. These merchandise enable buyers to realize price publicity to SUI via listed securities, with holdings backed by precise token reserves.

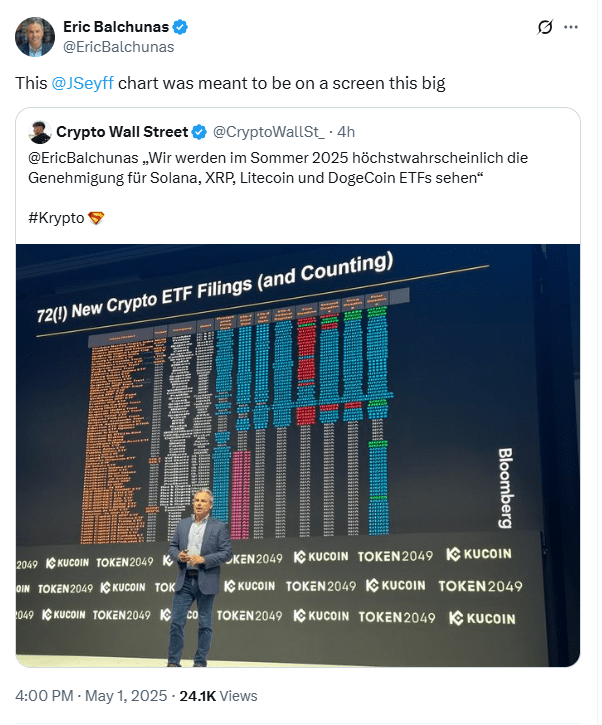

SEC Reviewing Over 70 Pending Crypto ETF Filings

The 21Shares Sui ETF submitting is considered one of greater than 70 crypto ETF proposals awaiting SEC assessment. Bloomberg ETF analysts Eric Balchunas and James Seyffart confirmed the variety of pending filings as of Could 1, 2025.

Purposes embrace spot and futures ETFs for main tokens similar to Bitcoin, Ethereum, Solana, and now Sui. Whereas the SEC has permitted some crypto-related futures ETFs, it has not but cleared any spot Sui ETF for U.S. buying and selling.

Furthermore, Spot Sui ETF proposals from each Canary Capital and 21Shares now await the SEC’s determination. Nonetheless, the company has not offered a timeline for approval or denial of both software.