Dogecoin (DOGE) not too long ago obtained a optimistic replace: the U.S. Securities and Change Fee (SEC) formally acknowledged Nasdaq’s submitting to checklist and commerce shares of the 21Shares Dogecoin ETF. This marks the start of the regulatory assessment course of for the ETF.

The announcement didn’t trigger a lot motion in Dogecoin’s price. The price solely reached round $0.24—nicely inside its current buying and selling vary. ETF-related bulletins usually gasoline sturdy rallies, particularly in extremely speculative property like DOGE. But on this case, the response was muted in comparison with what was anticipated.

It looks as if the ETF information could have already been priced in. The authentic ETF submitting by 21Shares was made again in April, and DOGE had already surged over 50% in early Could. In different phrases, the ETF replace acted extra as a affirmation than a catalyst.

Dogecoin Lively Addresses Drop from 650K to 347K

On-chain information from Santiment exhibits that DOGE’s lively 24-hour addresses spiked to over 650,000 through the ETF announcement however shortly dropped to 347,000. This sharp fall signifies a decline in speedy community exercise following the price correction. An increase in lively addresses usually displays rising person curiosity or buying and selling exercise.

Sustained community development requires constant person exercise—not brief bursts tied to information occasions. A wholesome rally is often supported by a regularly growing variety of lively addresses, which isn’t the case right here.

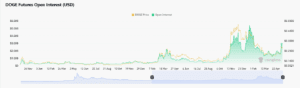

Futures Open Curiosity (OI) has additionally risen together with the price, indicating recent cash getting into the market. Nonetheless, the OI-weighted funding charge stays optimistic, implying that the majority of that cash is betting lengthy. This creates an imbalance: if the price doesn’t rise, these lengthy positions could start to unwind, triggering a cascade of liquidations—a basic “long squeeze.”

Funding charge information additional helps this. DOGE’s funding charges stay optimistic, indicating extra lengthy positions than brief ones. When funding charges keep excessive whereas the price stops shifting up, it can lead to a flush as over-leveraged longs are pressured to exit.

From a threat administration standpoint, this setup is fragile. There must be a breakout supported by spot quantity, not simply derivatives hypothesis.

You Could Additionally Like: Dogecoin Holders Mark ‘Dogeday’ as SEC ETF Selections Close to Key Deadlines

Technical Indicators Sign Weak point

Dogecoin’s current price motion exhibits clear indicators of exhaustion after failing to interrupt above the $0.24 resistance. The 4-hour chart reveals that DOGE is buying and selling under the 20 EMA ($0.23042), with the 50 EMA ($0.21889) appearing as near-term help. The 100 EMA at $0.20410 represents the subsequent key degree if the price fails to carry above present help.

The Relative Power Index (RSI) has dropped to 46.60, slipping under the impartial 50 mark. This means that purchasing strain has weakened, and bears could also be gaining management within the brief time period. Moreover, the MACD histogram is flattening, suggesting a doable bearish crossover if momentum doesn’t return quickly.

Quantity has additionally declined for the reason that ETF acknowledgment rally, signaling diminished participation. With no surge in spot shopping for curiosity, DOGE could proceed to consolidate or face additional draw back strain.

If DOGE closes above $0.24 with sturdy quantity, it might try a transfer towards the subsequent resistance at $0.265. Nonetheless, if it breaks under the $0.218 degree, the price could fall towards $0.20—a psychologically vital help zone. An additional breakdown under $0.20 would expose DOGE to a drop towards the $0.182 space, the place the 200 EMA presently resides.