KEY POINTS

- CRYPTO INTEREST PEAKS: A report 43% of respondents are prone to spend money on cryptocurrency inside the subsequent 12 months.

- DEMOGRAPHIC DIVIDE: Cryptocurrency funding and curiosity stay highest amongst younger males, with skepticism prevalent in older and feminine demographics.

- REGULATION RECEPTION: Bitcoin ETFs and potential crypto integration into banking and bank cards present combined potential to draw new buyers.

Key findings are powered by ChatGPT and based mostly solely off the content material from this text. They’re reviewed by Jack Caporal, our research director. The creator and editors take final accountability for the content material.

Cryptocurrency is again on the rise, propelled by approval of the primary Bitcoin exchange-traded funds (ETFs), however The Motley Idiot Ascent’s 2024 Cryptocurrency Investor Traits Survey reveals that crypto continues to be struggling to draw buyers past Gen Z and millennial males.

Regardless of 23% of respondents — a better share than another 12 months — stating they’re “very likely” to purchase cryptocurrency, respondents with essentially the most curiosity and belief in cryptocurrency stay younger males, lots of whom have already invested in crypto.

The introduction of recent, regulated Bitcoin ETFs could not do a lot to convey new demographics into crypto.

- The Motley Idiot Ascent’s cryptocurrency survey reveals that teams most excited in regards to the means to realize publicity to Bitcoin by way of these ETFs are these probably to already be invested or : younger males.

- Those that are least prone to be swayed by the brand new Bitcoin ETFs — older respondents and ladies — are already skeptical about crypto.

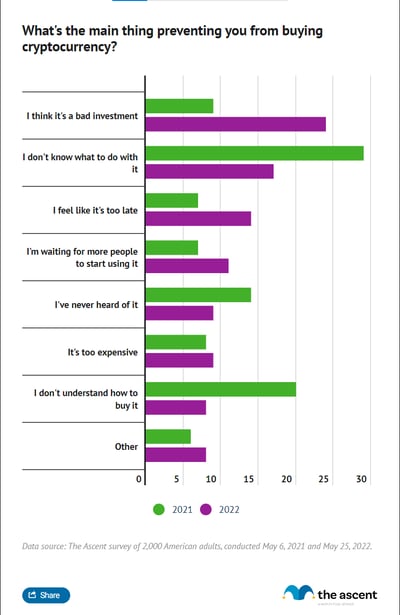

The highest causes for crypto skepticism are the beliefs that it is a unhealthy funding, it is too late to speculate, and that it is too costly to spend money on.

Learn on to grasp crucial traits within the crypto house, because the trade enters a pivotal second.

43% say they’re probably to purchase crypto within the subsequent 12 months

Forty-three p.c of respondents to the The Motley Idiot Ascent’s Cryptocurrency Investor Traits Survey mentioned they’re considerably probably or very probably to purchase cryptocurrency within the subsequent 12 months. That is a report excessive.

Twenty-three p.c — one other report excessive and up 20% from 2021 — mentioned they’re very probably, whereas 20% mentioned they’re considerably probably.

The vast majority of these probably to purchase crypto have already invested

Whereas curiosity in cryptocurrency amongst respondents is at a report stage, most of it’s coming from respondents who already personal cryptocurrency or have publicity to Bitcoin by way of an ETF. These respondents had been more likely to say that they are prone to spend money on crypto within the coming 12 months.

Amongst respondents who’ve by no means owned cryptocurrency, simply 3% mentioned they’re very probably to purchase subsequent 12 months and solely 13% mentioned they’re considerably probably. Eighty-three p.c mentioned they’re unlikely to buy crypto within the coming 12 months.

However, 62% of respondents who presently personal crypto and 48% who’ve invested in a Bitcoin ETF mentioned they’re very probably to purchase extra this 12 months.

Respondents who beforehand owned cryptocurrency however do not maintain any proper now are most on the fence about shopping for this 12 months. Eleven p.c of that group say they’re very prone to make investments this 12 months, 40% are considerably probably, 27% are considerably unlikely, and 22% are impossible.

Males and youthful respondents usually tend to purchase crypto than girls and older respondents

Male respondents, significantly Gen Z and millennials, are more likely than girls to personal cryptocurrency and be excited about investing in it sooner or later.

That demographic pattern has been repeatedly noticed, together with by Pew, JPMorgan Chase, and Morning Seek the advice of.

As Bitcoin has rallied to a brand new excessive, the trade’s means to broaden past the younger male demographic shall be instructive as as to whether its progress is sustainable and if volatility will be reined in.

File excessive 75% of crypto homeowners view it as funding

A report excessive 75% of respondents who personal cryptocurrency view crypto as an funding. Most respondents do not personal crypto to make safe funds, to purchase NFTs, or as a result of they assume it is going to exchange currencies — regardless of these being among the many most hyped alleged use circumstances for cryptocurrencies.

Whether or not the shift in crypto homeowners’ attitudes is a boon or dampener for the trade stays to be seen. A lot of the preliminary attraction to crypto was pushed by the concept it might turn into a world forex and car for safe funds. These concepts have been gradual to take maintain whereas retail buyers and now monetary establishments more and more see cryptocurrencies as simply one other funding class.

The highest the reason why crypto skeptics will not make investments

Probably the most-cited the reason why respondents who do not personal cryptocurrency have not invested are safety considerations (36%), not figuring out what to do with it (35%), and never understanding how to purchase crypto (33%).

Twenty-nine p.c of respondents who do not personal cryptocurrency have not invested as a result of they do not assume it is going to generate return. That is regardless of Bitcoin hitting report highs. Eleven p.c assume crypto is just too costly to purchase.

Twenty-four p.c of non-investors will not purchase crypto as a result of they assume it is a rip-off and 28% have not invested because of the lack of a transparent regulatory framework for crypto. These considerations are probably fueled by crypto’s scandal-filled 2023.

No single cause drives crypto skepticism, which means that the trade must overcome a number of limitations to draw new retail buyers. Probably the most-cited obstacles are basic and sign that there is a belief hole that may should be bridged for brand spanking new buyers to enter the market.

Bitcoin ETFs could not pull in lots of new retail crypto buyers

The SEC’s approval of Bitcoin ETFs spurred the cryptocurrency to report highs, however it might not entice many new buyers.

The respondents that had been probably to say that the brand new Bitcoin ETFs make them extra prone to spend money on crypto are these probably to be already invested: those that personal crypto, male respondents, and millennials.

These probably to say the ETFs could have no impression on their willingness to spend money on crypto — or make it much less probably that they will make investments — are those that have by no means owned crypto: girls, Gen X, and boomers.

There’s a small group of crypto homeowners (11%) who’re much less prone to make investments because of the approval of Bitcoin ETFs. These buyers could also be turned off by the brand new authorities oversight of Bitcoin.

44% would take into account investing in crypto by way of their retirement account

Forty-four p.c of respondents would take into account investing in cryptocurrency by way of their retirement account, down from 52% in 2022 regardless of Bitcoin hitting report ranges.

The decline in curiosity could also be attributable to crypto’s volatility and the slew of scams, scandals, and safety considerations that rocked the trade — essentially the most notable being the collapse of FTX and revelations of fraud perpetrated by its founder Sam Bankman-Fried.

The respondents most excited about including crypto to their 401(ok)s and IRAs are present and former crypto buyers, with millennials, Gen Z, and males most prepared to think about. Non-owners, girls, and older generations are least prone to be excited about placing crypto of their retirement funds.

With the ability to retailer crypto in a checking account could encourage some to speculate

Fifty-seven p.c of respondents, together with 40% of those that have by no means owned crypto, mentioned that having the ability to retailer crypto of their checking account would make them take into account investing. That implies that security, safety, and regulation are keys to bringing new buyers into the crypto house.

Nonetheless, the share of respondents who would take into account shopping for crypto if they might put it of their checking account is down from 62% in 2022 and 70% in 2021, indicating that crypto’s integration with extra secure monetary establishments is not a golden ticket to including buyers.

81% of crypto homeowners would take into account a bank card with crypto rewards

Crypto bank cards unsurprisingly draw severe curiosity from crypto buyers and a few curiosity from those that have by no means invested. Twenty-eight p.c of that group would take into account a bank card that gives crypto rewards.

That implies that crypto bank cards might be an entry level for some crypto skeptics.

There are a restricted variety of crypto bank cards and they’re distinctive in that rewards could also be taxable if a acquire is realized from them.

Confidence in crypto understanding is on the decline

Eighteen p.c of respondents declare to grasp how cryptocurrency works “very well,” down from 24% in 2022 and 22% in 2021. A report excessive 33% mentioned they do not perceive how crypto works in any respect, up from 19% in 2022 and 24% in 2021.

Crypto homeowners, males, and millennials are most assured about their crypto data whereas girls and older respondents had been extra prone to say they haven’t any or little understanding. It will seem that these teams are following the knowledge of solely investing in what they perceive.

Crypto homeowners and millennials are the one teams who imagine the federal government has completed sufficient to control

Authorities regulation of crypto is a sizzling button matter that divides crypto holders, 65% of whom imagine there’s sufficient regulation now, and 82% of non-owners imagine that there is not sufficient authorities regulation.

Respondents who beforehand owned crypto however do not presently maintain any could really feel as if they had been spurned by inadequate regulation. Sixty p.c of these respondents do not assume there’s sufficient regulation. This is without doubt one of the few matters for which that group breaks with present crypto buyers.

The controversy over cryptocurrency regulation in the US facilities on whether or not crypto property will be thought of securities, which might topic them to the identical laws as shares and different securities. In a blow to proponents of regulation, a district court docket of appeals in 2023 dominated that cryptocurrency functioned as a safety when offered to establishments, however not when traded on exchanges.

Curiosity in crypto stays, however the largest boosters are already invested

Retail buyers surveyed by The Motley Idiot Ascent confirmed report curiosity in crypto, however there are indicators that the trade is struggling to develop its pool of buyers past Gen Z and millennial males.

The Motley Idiot Ascent’s 2024 Cryptocurrency Investor Traits Survey reveals that Gen Z and millennial males stay most enthusiastic in the direction of crypto whereas girls, Gen X, and child boomers are nonetheless skeptical of investing.

The introduction of Bitcoin ETFs has drawn some curiosity from girls and older People, however present buyers are the biggest proponents of them.

Integrating cryptocurrency with present, trusted monetary establishments and merchandise like banks and bank cards might assist some overcome their crypto skepticism, however is not a silver bullet for mass adoption.

Sustainable, long-term, and fewer risky progress within the crypto trade could depend upon whether or not it will possibly right its demographic imbalance and present would-be buyers that crypto is safe, straightforward to purchase, and has actual worth past hypothesis.

Sources

Methodology

The Motley Idiot Ascent distributed surveys by way of Pollfish on March 6, 2024, Could 25, 2022, and Could 6, 2021. Outcomes had been post-stratified to generate nationally consultant information based mostly on age and gender. Pollfish employs natural random machine engagement sampling. Every survey was composed of two,000 grownup People.