2023 was a 12 months of restoration for cryptocurrency, because the trade rebounded from the scandals, blowups, and price declines of 2022. With crypto property rebounding and market exercise rising over the course of 2023, many consider that crypto winter is ending, and a brand new progress part could quickly be upon us.

However what did all of that imply for crypto crime? Let’s take a look at the high-level developments.

2023 noticed a major drop in worth acquired by illicit cryptocurrency addresses, to a complete of $24.2 billion. As all the time, we now have to caveat by saying that these figures are decrease certain estimates based mostly on inflows to the illicit addresses we’ve recognized right now. One 12 months from now, these totals will virtually actually be larger, as we establish extra illicit addresses and incorporate their historic exercise into our estimates. As an illustration, after we revealed our Crypto Crime Report final 12 months, we estimated $20.6 billion price of illicit transaction quantity for 2022. One 12 months later, our up to date estimate for 2022 is $39.6 billion. A lot of that progress got here from the identification of beforehand unknown, extremely lively addresses hosted by sanctioned companies, in addition to our addition of transaction quantity related to companies in sanctioned jurisdictions to our illicit totals.

One other key motive the brand new whole is a lot larger, in addition to the identification of recent illicit addresses: We’re now counting the $8.7 billion in creditor claims in opposition to FTX in our 2022 figures. In final 12 months’s report, we stated that we might maintain off on together with transaction volumes related to FTX and different corporations that collapsed that 12 months beneath allegedly fraudulent circumstances in our illicit totals till authorized processes performed out. Since then, a jury has convicted FTX’s former CEO of fraud.

Usually, we solely embody measurable on-chain exercise in our estimates for illicit exercise. Within the case of FTX, it’s inconceivable to make use of on-chain information alone to measure the scope of the fraudulent exercise, as there’s no method to isolate illegitimate actions of consumer funds. As such, we consider the $8.7 billion in creditor claims in opposition to FTX is the perfect estimate to incorporate. Given the scale and affect of the FTX scenario, we’re treating it as an exception to our regular on-chain methodology. If courts convict in related, ongoing instances, we plan to incorporate their exercise in our illicit transaction information as nicely sooner or later.

All different totals exclude income from non-crypto native crime, reminiscent of standard drug trafficking through which crypto is used as a way of fee. Such transactions are just about indistinguishable from licit transactions in on-chain information. After all, legislation enforcement with off-chain context can nonetheless examine these flows utilizing Chainalysis options. In instances the place we’re in a position to verify such data, we rely the transactions as illicit in our information, however there are virtually actually many cases the place that isn’t the case, and subsequently the numbers wouldn’t be mirrored in our totals.

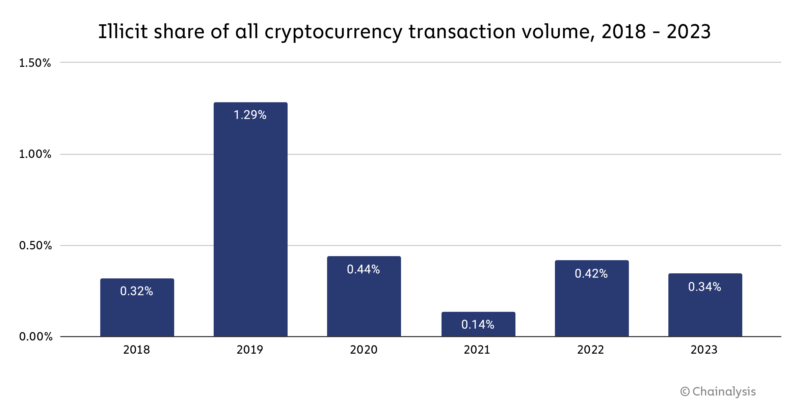

Along with the discount in absolute worth of illicit exercise, our estimate for the share of all crypto transaction quantity related to illicit exercise additionally fell, to 0.34% from 0.42% in 2022. [1]

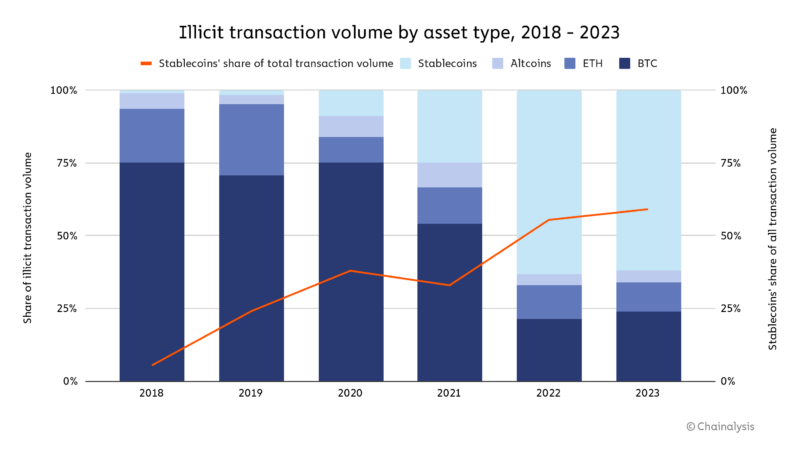

We’re additionally seeing a shift within the kinds of property concerned in cryptocurrency-based crime.

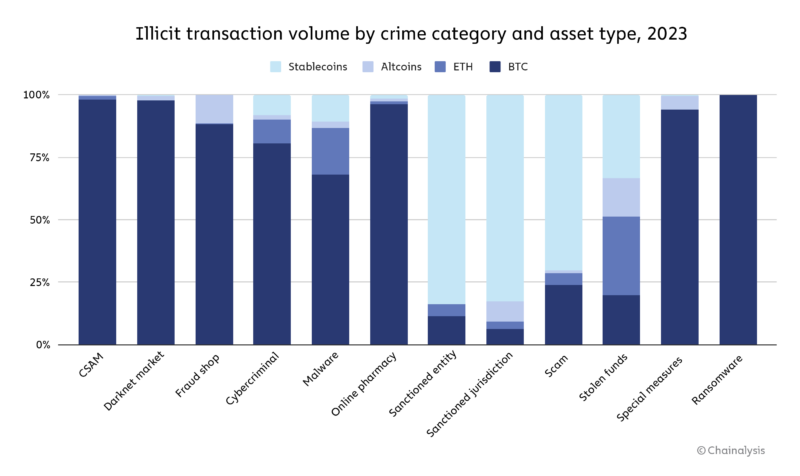

Via 2021, Bitcoin reigned supreme because the cryptocurrency of alternative amongst cybercriminals, possible on account of its excessive liquidity. However that’s modified over the past two years, with stablecoins now accounting for almost all of all illicit transaction quantity. This variation additionally comes alongside current progress in stablecoins’ share of all crypto exercise general, together with reputable exercise. Nevertheless, stablecoin dominance isn’t the case for all types of cryptocurrency-based crime.

Some types of illicit cryptocurrency exercise, reminiscent of darknet market gross sales and ransomware extortion, nonetheless happen predominantly in Bitcoin. [2] Others, like scamming and transactions related to sanctioned entities, have shifted to stablecoins. These additionally occur to be the most important types of crypto crime by transaction quantity, thereby driving the bigger development. Sanctioned entities, in addition to these working in sanctioned jurisdictions or concerned with terrorism financing, even have a higher incentive to make use of stablecoins, as they could face extra challenges accessing the U.S. greenback via conventional means, however nonetheless need to profit from the soundness it gives. Nevertheless, stablecoin issuers can freeze funds after they turn out to be conscious of their illicit use, as Tether not too long ago did with addresses linked to terrorism and warfare in Israel and Ukraine.

Under, we’ll take a look at three key developments that outlined crypto crime in 2023 and shall be necessary to look at transferring ahead.

Scamming and Stolen Funds down huge

Crypto scamming and hacking income each fell considerably in 2023, with whole illicit income for every down 29.2% and 54.3% respectively.

As we focus on later in our scams part, many crypto scammers have now adopted romance rip-off ways, focusing on people and constructing relationships with them to be able to pitch them on fraudulent investing alternatives, quite than promoting them far and broad, which regularly makes them harder to uncover. Though the FBI has revealed information exhibiting that reviews of crypto funding scams within the U.S. has been rising 12 months over 12 months via 2022, our on-chain metrics recommend scamming revenues globally have been trending down since 2021. We consider this aligns with the long-standing development that scamming is most profitable when markets are up, exuberance is excessive, and folks really feel like they’re lacking out on a possibility to get wealthy shortly. After all, the affect of romance scams on particular person victims is devastating and shouldn’t be understated. And whereas elevated reporting – at the very least within the U.S. – is an effective signal, we nonetheless consider insights into romance scams particularly endure from underreporting. We hypothesize that the true injury of scamming is larger than what reporting to the FBI and our on-chain metrics present, however general, scamming is down, given broader market dynamics.

Crypto hacking, alternatively, is way more tough for criminals to cover, as trade observers can shortly spot the weird outflows from a given service or protocol when a hack happens. As we’ll focus on later, the decline in stolen funds is pushed largely by a pointy dropoff in DeFi hacking. That dropoff might signify the reversal of a disturbing, long-term development, and will signify that DeFi protocols are enhancing their safety practices. That stated, stolen funds metrics are closely outlier-driven, and one massive hack might once more shift the development.

Ransomware and darknet market exercise on the rise

Ransomware and darknet markets, alternatively, are two of essentially the most distinguished types of crypto crime that noticed revenues rise in 2023, in distinction with general developments. The expansion of ransomware income is disappointing following the sharp declines we coated final 12 months, and means that maybe ransomware attackers have adjusted to organizations’ cybersecurity enhancements, a development we first reported earlier this 12 months.

Equally, this 12 months’s progress in darknet market income additionally comes after a 2022 decline in income. That decline was pushed largely by the shutdown of Hydra, which was as soon as the world’s most dominant market by far, capturing over 90% of all darknet market income at its peak. Whereas no single market has but emerged to take its place, the sector as an entire is rebounding, with whole income climbing again in direction of its 2021 highs.

Transactions with sanctioned entities drive the overwhelming majority of illicit exercise

Maybe the obvious development that emerges when illicit transaction quantity is the prominence of sanctions-related transactions. Sanctioned entities and jurisdictions collectively accounted for a mixed $14.9 billion price of transaction quantity in 2023, which represents 61.5% of all illicit transaction quantity we measured on the 12 months. Most of this whole is pushed by cryptocurrency companies that have been sanctioned by the U.S. Division of the Treasury’s Workplace of Overseas Property Management (OFAC), or are situated in sanctioned jurisdictions, and may proceed to function as a result of they’re in jurisdictions the place U.S. sanctions will not be enforced.

Whereas these companies can and have been used for nefarious functions, it additionally signifies that a few of that $14.9 billion in sanctions-related transaction quantity consists of exercise from common crypto customers who occur to reside in these jurisdictions. For instance, Russia-based trade Garantex, which was sanctioned by OFAC and OFSI within the U.Okay. for its facilitation of cash laundering on behalf of ransomware attackers and different cybercriminals, was one of many largest drivers of transaction quantity related to sanctioned entities in 2023. Garantex continues to function as a result of Russia doesn’t implement U.S. sanctions. So, does that imply all of Garantex’s transaction quantity is related to ransomware and cash laundering? No. Nonetheless, publicity to Garantex introduces critical sanctions threat for crypto platforms topic to U.S. or U.Okay. jurisdiction, which implies these platforms should stay ever-more vigilant and display for publicity to Garantex to be able to be compliant.

Extra crypto crime insights to come back

Keep looking out for extra research into cryptocurrency-based crime, as we proceed to roll out insights on ransomware, hacking, crypto cash laundering, and extra. You too can click on right here to get the complete 2024 Crypto Crime Report delivered to your inbox as quickly because it’s revealed.

Finish notes:

[1] Transaction quantity is a measure of all financial exercise, a proxy for funds altering palms. We take away peel chains, inside service transactions, change, and some other sort of transaction that may not rely as an financial transaction between distinct financial actors.

[2] These estimates don’t embody privateness cash like Monero.

This materials is for informational functions solely, and isn’t meant to offer authorized, tax, monetary, funding, regulatory or different skilled recommendation, neither is it to be relied upon as an expert opinion. Recipients ought to seek the advice of their very own advisors earlier than making some of these selections. Chainalysis doesn’t assure or warrant the accuracy, completeness, timeliness, suitability or validity of the knowledge herein. Chainalysis has no duty or legal responsibility for any resolution made or some other acts or omissions in reference to Recipient’s use of this materials.