Picture supply: Getty Pictures

The US presents an unlimited collection of shares that traders can purchase to construct a five-star diversified portfolio. By concentrating primarily or wholly on firms listed on Wall Avenue, traders can strategically handle threat whereas aiming for substantial returns.

Progress shares are usually on the forefront of innovation and may capitalise on new developments and shopper habits, resulting in substantial income and consequently share price development.

Dividend shares, in the meantime, have much less capital positive factors potential. However they’re are sometimes much less risky, and may present a gradual return throughout all factors of the financial cycle.

With this in thoughts, listed here are two of my favorite US shares from every class.

Progress

Dell Applied sciences (NYSE:DELL) has been offering pc {hardware} and software program for 40 years. And now it’s seeking to synthetic intelligence (AI) to take gross sales to the following stage.

To seize this, it’s investing huge sums to supply full-stack AI options overlaying the fields of shopper units, servers, storage, information safety, and networking.

As a part of this drive, it just lately launched Dell Manufacturing unit with Nvidia, which makes use of the latter’s applied sciences to supply bespoke or full-fat services and products to hurry up firm adoption of AI.

It’s also offering servers for xAI’s deliberate supercomputer, in keeping with the startup’s founder, Elon Musk.

I like Dell shares due to their cheapness in contrast with many different AI shares. It trades on a ahead price-to-earnings (P/E) ratio of round 16 instances, even after current positive factors. This compares favourably with most different tech shares (Nvidia, as an example, trades on a a number of of 43.4 instances).

It’s early days, so predicting the eventual winner(s) of the AI wars is a troublesome job. However the formidable steps Dell is making might make it one of many sector’s main lights.

Dividends

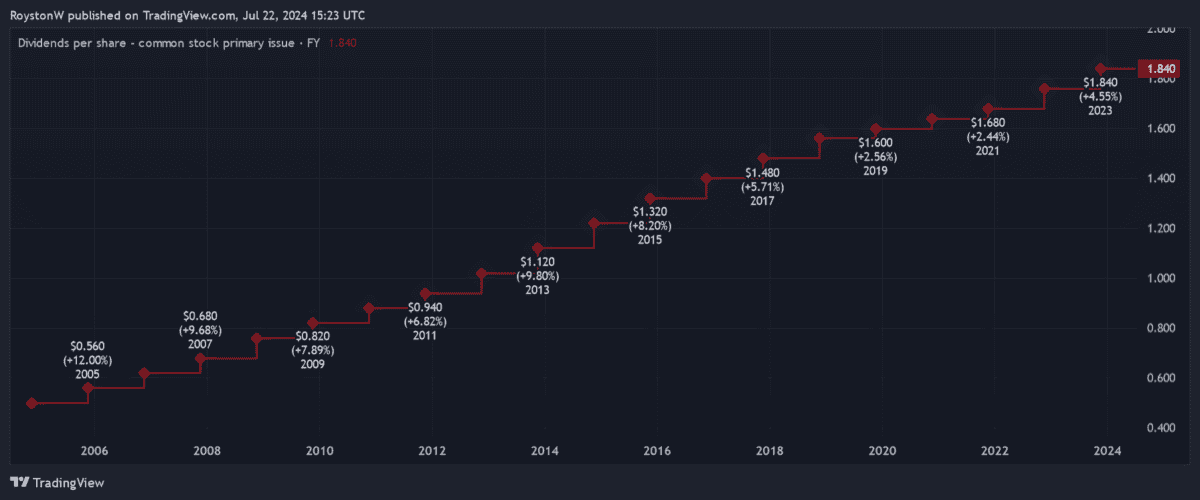

Drinks large The Coca-Cola Firm (NYSE:KO) is among the world’s true Dividend Aristocrats. Shareholder payouts right here have risen yearly for a staggering 62 years.

That is because of the distinctive model energy of Coke and its many different tender drinks labels. They keep in excessive demand in any respect factors of the financial cycle. Even throughout robust instances, costs on these items may be hiked to assist the corporate offset prices and develop earnings.

Intense competitors throughout all its classes is a menace. Nevertheless, the large funding Coca-Cola makes in advertising and marketing and product innovation means it at the moment stays one step forward of the pack.

This yr it launched Coca-Cola Spiced within the US and Canada to use surging shopper demand for spicier meals and drinks.

Metropolis analysts count on dividends right here to proceed rising throughout to 2026 a minimum of. It means for this yr the agency carries a wholesome 3% dividend yield, supported by an anticipated 14% earnings rise.

And for 2025 and 2026, the yield on Coca-Cola shares strikes to three.1% and three.3% respectively. All three ahead yields beat the S&P 500 common of 1.3% by a wholesome distance.