Picture supply: Getty Photographs

In search of the perfect low-cost shares to purchase in the present day? Nice! Buying shares at knock-down costs can result in vital returns over time.

However I consider traders ought to severely contemplate avoiding these low-cost shares in the present day. Right here’s why.

ASOS

Luxurious style shares have lengthy outperformed excessive avenue and on-line retailers. However the development’s flipped extra lately, with eToro knowledge exhibiting a basket of excessive avenue shares rising 11% over the previous yr. The corporate’s luxurious inventory basket has dropped 8% over the timeframe.

Does this make ASOS (LSE:ASC) a inventory to think about in the present day? I don’t suppose so, regardless that its shares look filth low-cost proper now.

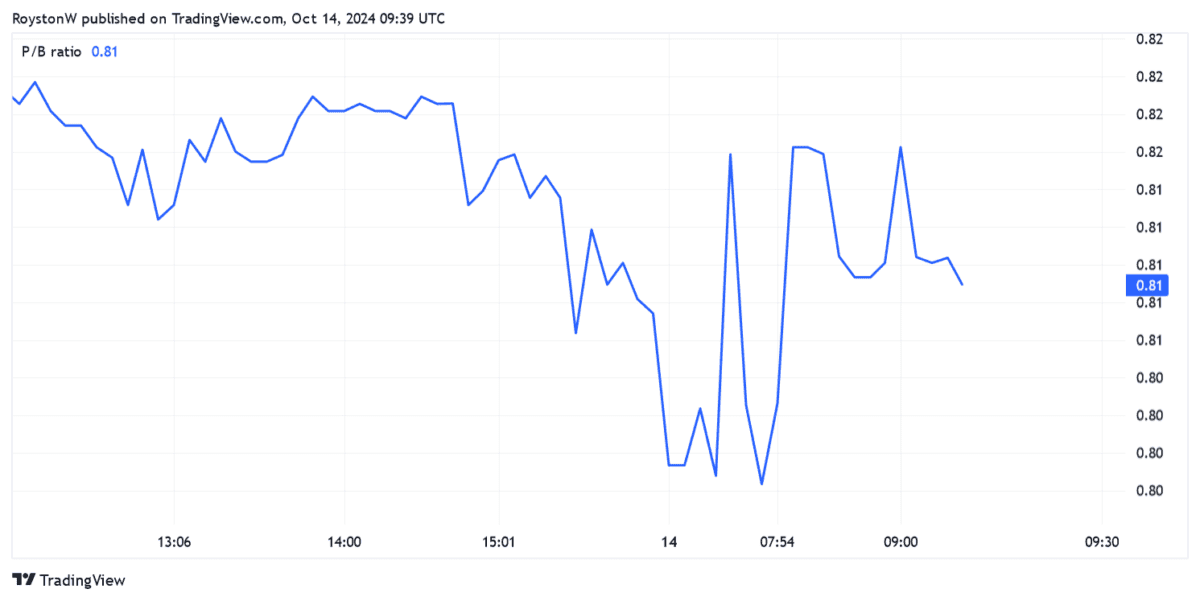

At 421p per share, the retailer trades on a price-to-book (P/B) ratio beneath 1. This means the agency trades at a reduction to the worth of its belongings.

ASOS’s share price has plummeted 87% through the previous 5 years. Metropolis analysts anticipate it to stay loss-making till 2026 at the very least.

I’m not involved about its cheapness. It faces big issues that might proceed to canine it for years. Not solely is ‘fast fashion’ falling out of favour because of shopper considerations over provide chains and the surroundings. Rivals comparable to Shein, Temu and Vinted are rising quickly, including additional strain in what’s already a extremely aggressive business.

Current debt restructuring and the sale of Topshop provides ASOS extra monetary firepower to spice up its turnaround. However although it has extra scope to put money into merchandise, as an example, I believe the chances nonetheless look stacked in opposition to the corporate.

Lloyds Banking Group

FTSE 100 share Lloyds (LSE:LLOY) may additionally look interesting for discount hunters. It trades on a ahead price-to-earnings (P/E) ratio of 9.1 occasions, and carries a big 5.5% dividend yield.

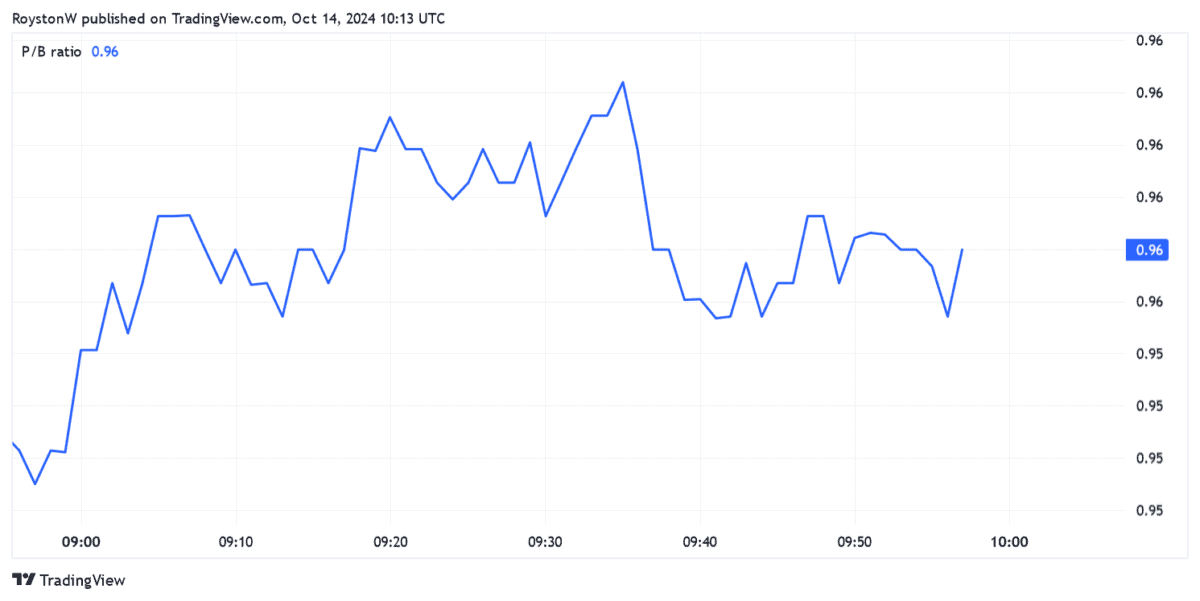

The corporate additionally trades on a sub-1 PEG ratio, though the low cost on this foundation is much narrower right here.

Metropolis analysts suppose earnings right here will slide 13% this yr earlier than rising 12% and 18% in 2025 and 2026 respectively. However Lloyds faces immense challenges to hit these targets, which explains the financial institution’s low valuation at 59.6p per share.

Like ASOS, the financial institution faces a wrestle to win and even maintain on to clients as challengers like Revolut and Monzo flex their muscular tissues. That is removed from its solely downside both.

Margins may very well be set for a sustained drop if the Financial institution of England (as anticipated) steadily cuts charges as inflation eases. With the UK economic system additionally poised for a protracted interval of low progress, it’s robust to see how retail banks like this can develop earnings.

The continued restoration within the housing market’s a superb signal for Lloyds. It’s Britain’s greatest house mortgage supplier, so rebounding purchaser demand will give earnings an enormous increase.

However this alone isn’t sufficient to encourage me to purchase the financial institution. Lloyds’ share price is about 1% decrease than it was 5 years in the past. I anticipate it to proceed struggling for progress.